تأسس البنك الإسلامي الأردني والبنك الإسلامي الأردني والبنك الإسلامي للتمويل والاستثمار الأردني في عام 1978 (كشركة عامة محدودة) لمزاولة عمليات التمويل والمصارف والاستثمار وفق أحكام الشريعة الإسلامية ، بموجب قانون الصيرفة الإسلامية الأردني رقم 13 لسنة 1978 الذي ألغي وحل محله الفصل الخاص بالصيرفة الإسلامية في قانون المصارف رقم 28 لسنة 2000 والذي دخل حيز التنفيذ في 2 آب 2000 ، باشر الفرع الأول للبنك عملياته في 22 أيلول 1979 برأس مال مدفوع لا يتجاوز 2 مليون دينار من رأسماله ، المبلغ المصرح به هو 4 ملايين دينار ورأس مال البنك هو (200) 200 مليون دينار أردني.

نشط

Jordan Islamic Bank

شهادة رسمية الأردن .

الأردن .20 سنة

الموقع الرسمي

تحديث على 2025-04-10 12:02:31

سجل الأعمال الحالية

5.00

تصنيف الصناعة

معلومات أساسية

اسم المؤسسة

Jordan Islamic Bank

البلد

الأردن .

تصنيف الشركات

وقت التسجيل

1978

حالة التشغيل

نشط

المعلومات التنظيمية

تقييم المشاريع/التعرض

كتابة التعليقات/التعرض

5.00

0تقييم/

0التعرض

كتابة التعليقات/التعرض

Jordan Islamic Bank عرض الأعمال

Jordan Islamic Bank أمن المؤسسة

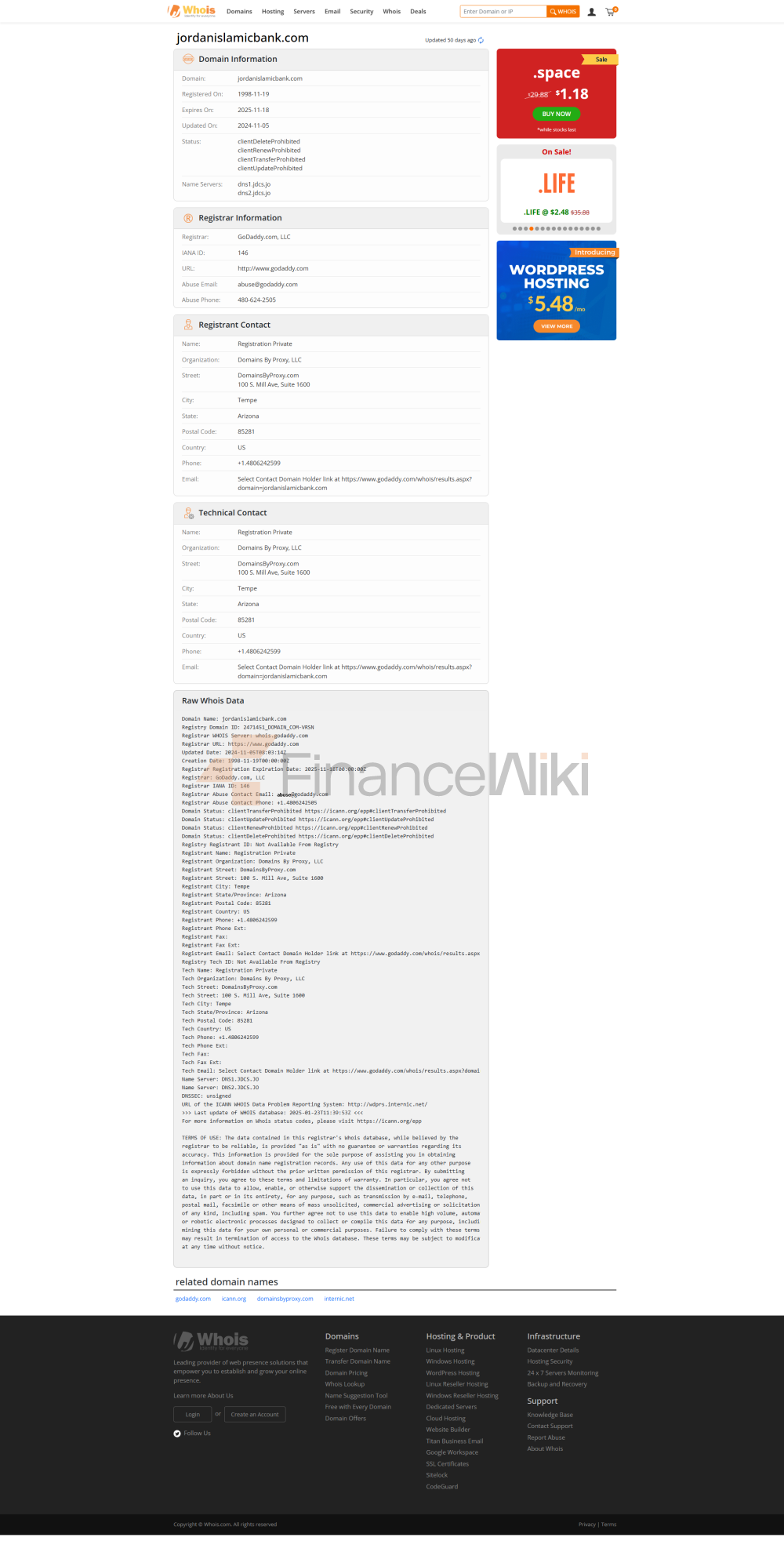

https://www.jordanislamicbank.com/

Jordan Islamic Bank سؤال وجواب

طرح سؤال

وسائل الاعلام الاجتماعية

معلومات الأخبار

خطر موجه

يذكرك موقع Finance.Wiki بأن البيانات الواردة في هذا الموقع قد لا تكون في الوقت الفعلي أو دقيقة. البيانات والأسعار الموجودة على هذا الموقع لا يتم توفيرها بالضرورة من قبل السوق أو البورصة، ولكن قد يتم توفيرها من قبل صناع السوق، لذلك قد لا تكون الأسعار دقيقة وقد تختلف عن اتجاهات أسعار السوق الفعلية. وهذا يعني أن السعر هو مجرد سعر إرشادي، يعكس اتجاه السوق، ولا ينبغي استخدامه لأغراض التداول. لا يتحمل موقع Finance.Wiki ومزود البيانات الواردة في هذا الموقع مسؤولية أي خسائر ناجمة عن سلوكك التجاري أو اعتمادك على المعلومات الواردة في هذا الموقع