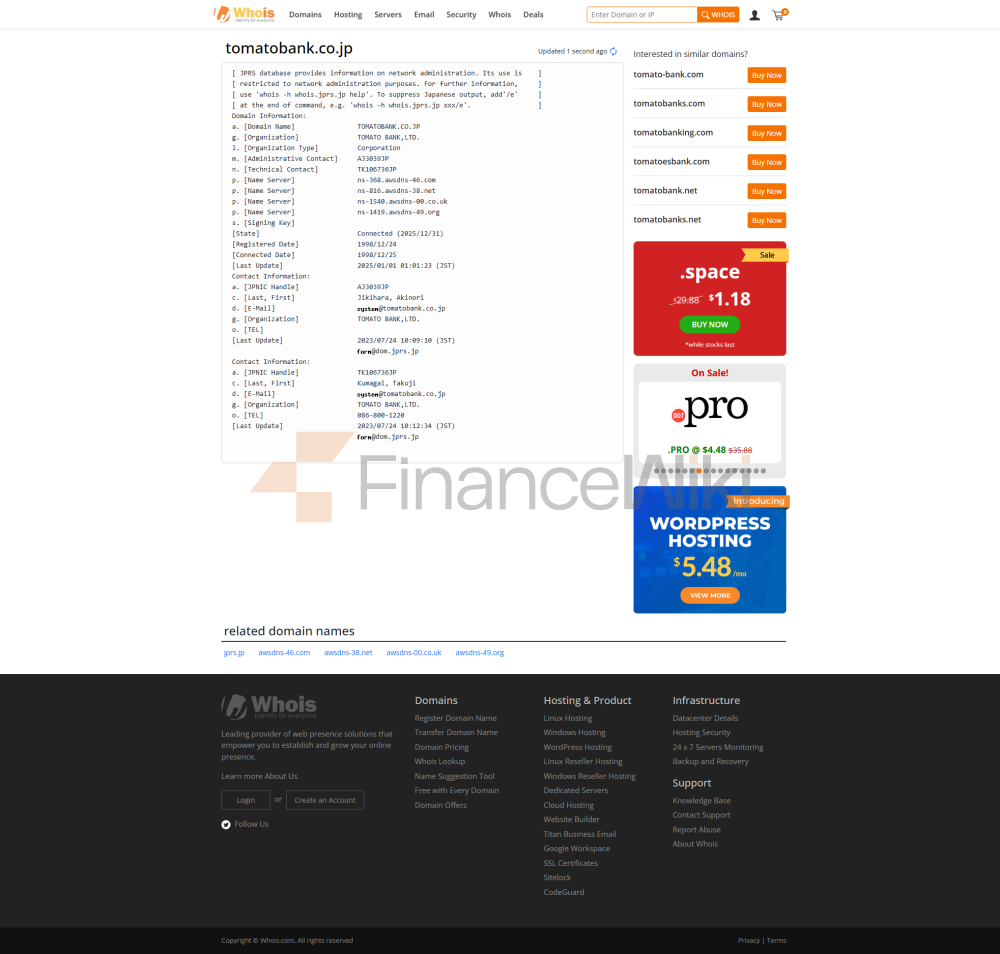

Tomato Bank (Japanese: Japan Corporation, Japan, Japan, Japan, Japan, Japan, Japan, Japan, Japan, Japan, Japan, Japan, Japan.

Corporate Status - Firm, Corporation

- Kapitalbasis 13,4 Milliarden Yen

- Gesamtvermögen 885,929 Milliarden Yen

- Anzahl der Mitarbeiter 871

- Tokyo Stock Exchange Osaka Securities Exchange Market Part 1

History - November 1931 (Showa 6) - Kurashiki Endless, gegründet.

- März 1941 (Showa 16) - Übernahme und Fusion, Xingguo Endless, Biesuo Endless, umbenannt in Sanhe Endless.

- September 1943 (Showa Endless) 18) - Annahme der von China übertragenen Geschäftsrechte Endless.

- Oktober 1951 (Showa 26) - Mutual Bank Law trat in Kraft, umbenannt in Sanhe Mutual Bank.

- April 1969 (Showa 44) - Umbenannt in "Shanyang Mutual Bank".

- April 1989 (das erste Jahr von Heisei) - Umwandlung in eine gewöhnliche Bank, umbenannt in "Tomato Bank". Der Name wurde zu einem Thema der nationalen Nachrichten.

- Juli 2002 (Heisei 14) - Erhielt Kreditportfolio der Präfektur Okayama.

History - November 1931 (Showa 6) - Kurashiki Endless, gegründet.

- März 1941 (Showa 16) - Übernahme und Fusion, Xingguo Endless, Biesuo Endless, umbenannt in Sanhe Endless.

- September 1943 (Showa Endless) 18) - Annahme der von China übertragenen Geschäftsrechte Endless.

- Oktober 1951 (Showa 26) - Mutual Bank Law trat in Kraft, umbenannt in Sanhe Mutual Bank.

- April 1969 (Showa 44) - Umbenannt in "Shanyang Mutual Bank".

- April 1989 (das erste Jahr von Heisei) - Umwandlung in eine gewöhnliche Bank, umbenannt in "Tomato Bank". Der Name wurde zu einem Thema der nationalen Nachrichten.

- Juli 2002 (Heisei 14) - Erhielt Kreditportfolio der Präfektur Okayama.