Nouvobanq ist eine lokale Bank, die am 19. Juli 1991 auf den Seychellen gegründet und von der Zentralbank der Seychellen zugelassen wurde. Ihre Hauptfiliale befindet sich im Zentrum von Victoria und ist als eine der drei größten Banken der Seychellen bekannt. Als starke und stabile Bank bietet sie die folgenden Produkte und Dienstleistungen an: Retail Banking, Corporate Banking, Forex / Markets

Aktiv

Nouvobanq

Offizielle Bescheinigung Seychellen

Seychellen20 Jahr

Offizielle Website

Aktualisiert am 2025-04-10 14:08:57

Aktuelles Unternehmensrating

5.00

Branchenbewertung

Grundlegende Informationen

Vollständiger Name des Unternehmens

Nouvobanq

Land

Seychellen

Unternehmensklassifizierung

Anmeldezeit

1991

Status des Unternehmens

Aktiv

Regulierungsinformationen

( Seychellen )

Unter Aufsicht

aktueller Zustand

Unter Aufsicht

Regulierungsstaat

Seychellen

Regulierungsnummer

--

Typ des Kennzeichens

--

Lizenzierte Einrichtung

Nouvobanq

Anschrift des zugelassenen Instituts

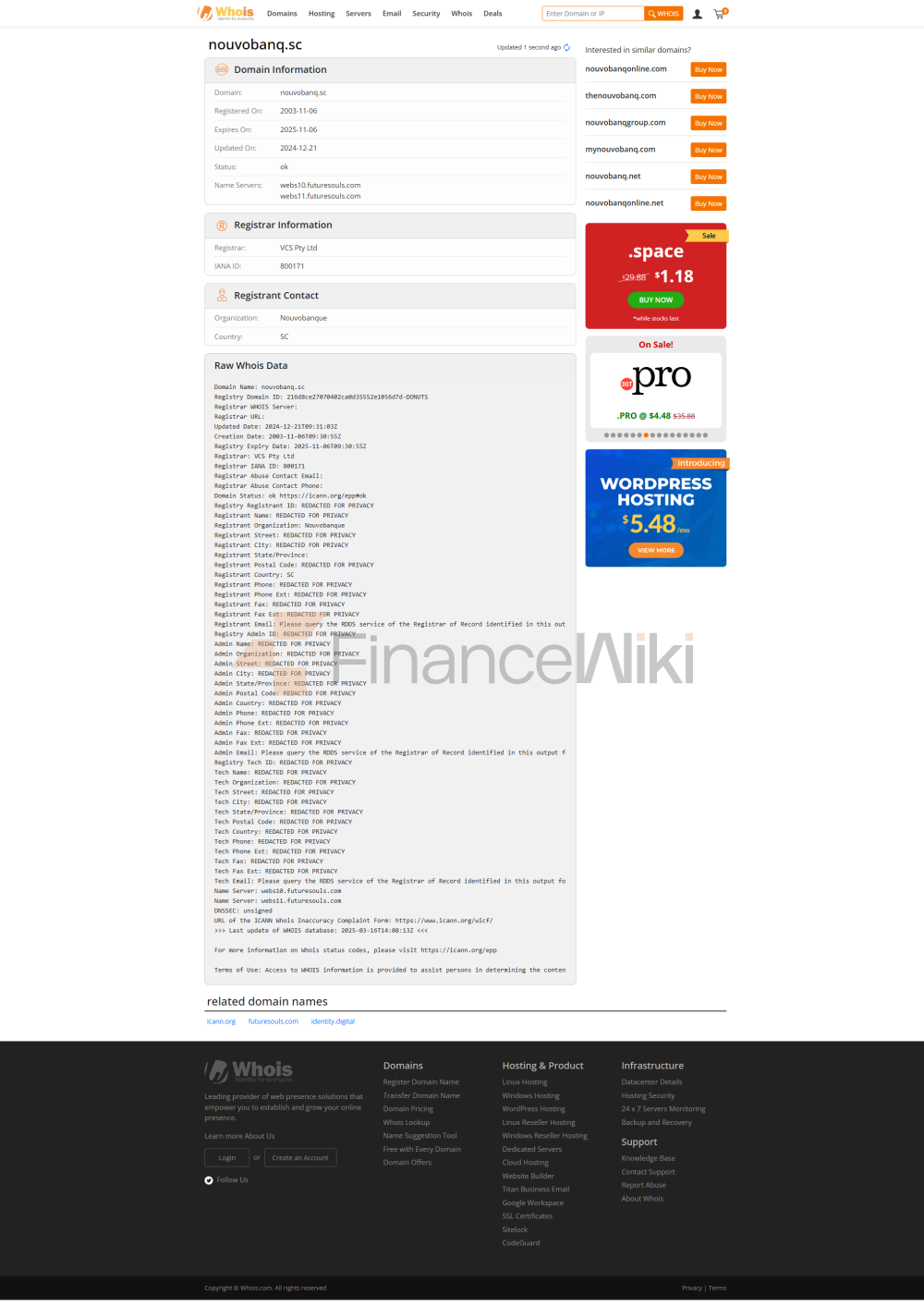

P. O. Box 241 Victoria Mahé Seychelles

E-Mail der lizenzierten Institution

nvb@nouvobanq.sc

Website der lizenzierten Institution

http://www.nouvobanq.sc/

Lizenzierte Institution Telefon

+248 4293000

Zertifikatstyp

Gemeinsame Nutzung der Gruppe

Zeitpunkt des Inkrafttretens

--

Ablaufzeit

--

Unternehmensbewertung/Belichtung

Kommentare schreiben/Belichtung

5.00

0bewerten/

0Belichtung

Kommentare schreiben/Belichtung

Nouvobanq Einführung in Unternehmen

Nouvobanq Unternehmenssicherheit

https://www.nouvobanq.sc/

Nouvobanq Q & A

Stellen Sie eine Frage

Soziale Medien

Nachrichten und Informationen

Risikoerklärung

Finance.Wiki weist Sie darauf hin, dass die auf dieser Website enthaltenen Daten möglicherweise nicht in Echtzeit vorliegen oder nicht korrekt sind. Die Daten und Preise auf dieser Website werden nicht unbedingt vom Markt oder der Börse bereitgestellt, sondern können von Market Makern bereitgestellt werden, sodass die Preise möglicherweise nicht korrekt sind und von den tatsächlichen Marktpreistrends abweichen können. Das heißt, der Preis ist nur ein Richtpreis, der die Marktentwicklung widerspiegelt, und sollte nicht für Handelszwecke verwendet werden. Finance.Wiki und der Anbieter der auf dieser Website enthaltenen Daten haften nicht für Verluste, die durch Ihr Handelsverhalten oder Ihr Vertrauen auf die auf dieser Website enthaltenen Informationen entstehen.