Grundlagen des Bankwesens

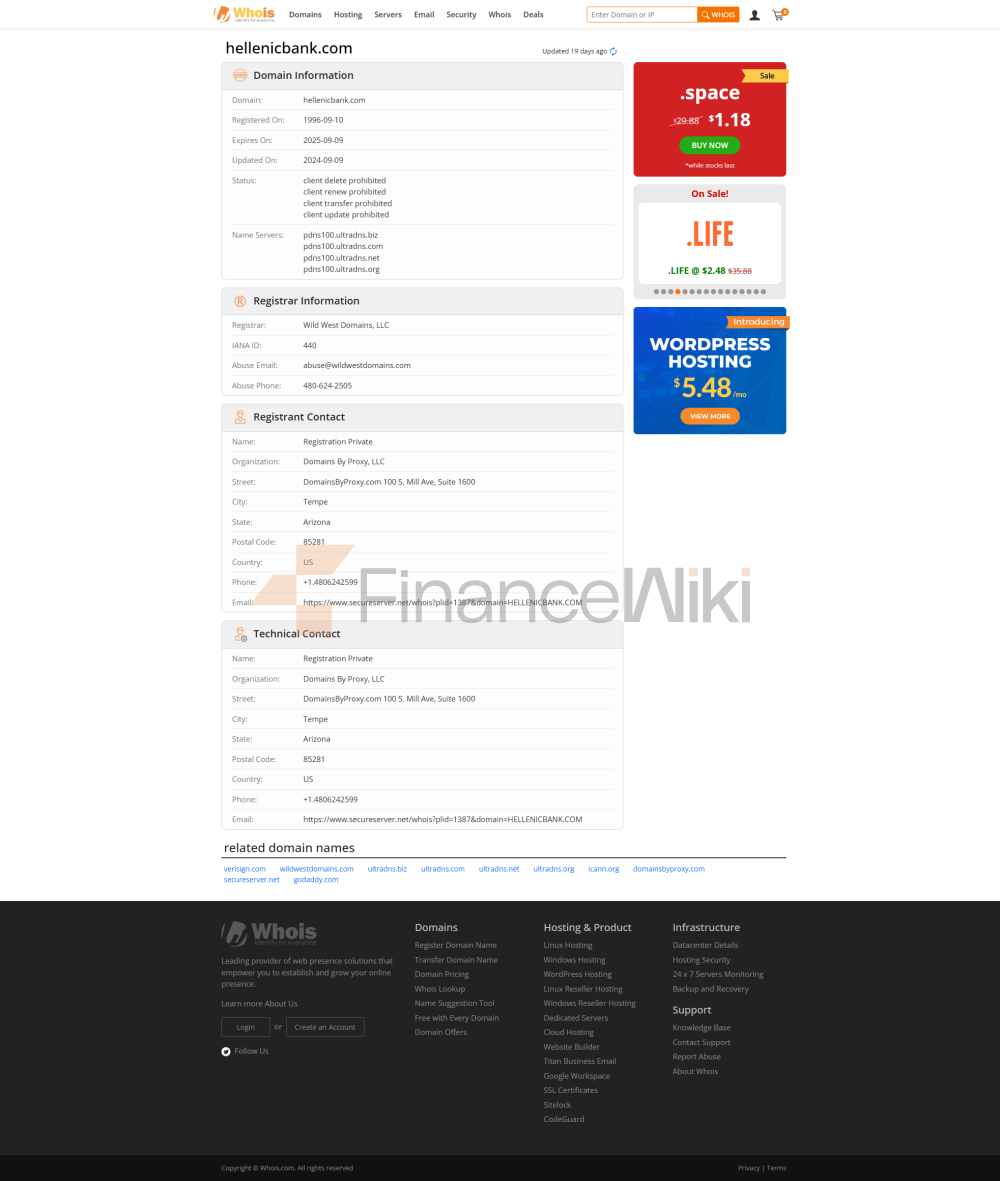

Die Hellenic Bank Public Company Ltd ist die zweitgrößte Bank in Zypern, die 1976 gegründet wurde und ihren Hauptsitz in Nikosia hat. Die Bank ist an der zyprischen Börse notiert und zu ihren Hauptaktionären gehört die Eurobank mit einem Anteil von 93,47 % (Stand 2025). Als Geschäftsbank deckt sie das gesamte Territorium Zyperns ab und verfügt über Repräsentanzen in Russland, Griechenland und anderen Orten.

Leistungsumfang

Die Dienstleistungen der Hellenic Bank konzentrieren sich hauptsächlich auf Zypern und bieten ein umfangreiches Netz von Offline-Filialen und Geldautomaten, die Innovationen im bargeldlosen Zahlungsverkehr wie das wasserdichte NFC-Zahlungsarmband "PayBand" unterstützen. Die digitalen Dienstleistungen werden nach und nach ausgebaut, aber die internationale Präsenz ist relativ begrenzt.

Regulierung & Einhaltung

Die Bank wird von der Zentralbank von Zypern und der Cyprus Securities and Exchange Commission (CySEC) reguliert. Im Jahr 2017 wurde der Investmentgesellschaft Hellenic Bank Investments Ltd die CIF-Lizenz entzogen, das Bankgeschäft war jedoch nicht direkt betroffen. Ob das Unternehmen dem EU-Einlagenversicherungssystem (DGS) beitreten wird, ist derzeit nicht öffentlich bekannt.

Finanzielle Gesundheit

Wichtige Kennzahlen: Im Februar 2025 hatte die Bank von Griechenland eine Eigenkapitalquote von 32 %, eine Liquiditätsdeckungsquote von 519 % und eine Quote notleidender Kredite von 2,4 %.

Einlagenklasse: Die Zinssätze für Festeinlagen variieren je nach Einzahlungszeitraum und -betrag. Bei einer 18-monatigen Festgeldanlage beträgt der Zinssatz für Einlagen zwischen 20.000 € und 49.999 € beispielsweise 0,40 %, während der Zinssatz für 50.000 € und mehr 0,65 % beträgt.

Kredite: Bieten Sie Produkte wie Wohnungsbaudarlehen, Autokredite und Privatkredite an. So bieten Autofinanzierungsprodukte die Wahl zwischen festen oder variablen Zinssätzen.

Liste der allgemeinen Gebühren: Einzelheiten zu Gebühren wie Kontoführungsgebühren, Überweisungsgebühren, Überziehungsgebühren und Interbankenabhebungsgebühren an Geldautomaten finden Sie auf der offiziellen Website.

Digital Service Experience

APP und Online-Banking: Griechische Banken bieten Mobile-Banking-Anwendungen an, die Funktionen wie biometrische Anmeldung, Echtzeit-Überweisungen und Rechnungsverwaltung unterstützen. Über die Funktion "Contact Pay" können Nutzer mit ihren Mobiltelefonkontakten sofort bezahlen.

Technologische Innovation: Die Bank investiert weiterhin in die digitale Transformation, um das Kundenerlebnis zu verbessern. Zum Beispiel bietet es einen nahtlosen Überweisungsgenehmigungsprozess, der es den Nutzern ermöglicht, ihre Überweisungen per Fingerabdruck oder Gesichtserkennung zu bestätigen, wodurch die Notwendigkeit herkömmlicher 8-stelliger SMS-Verifizierungscodes entfällt.

Kundenservice-Qualität

Servicekanäle: Bieten Sie Servicekanäle wie 24/7-Telefonsupport, Live-Chat und Social-Media-Antworten an. Kunden können weitere Kontaktinformationen über ihre offizielle Website erhalten.

Beschwerdebearbeitung: Spezifische Daten zu Beschwerdequoten, durchschnittlichen Lösungszeiten und Benutzerzufriedenheit sind auf der offiziellen Website verfügbar.

Mehrsprachiger Support: Als eine der größten Banken in Zypern bietet die Greek Bank mehrsprachige Dienstleistungen an, um unterschiedlichen Kundenbedürfnissen gerecht zu werden.

Sicherheitsmaßnahmen

Fondssicherheit: Einlagen sind durch das zyprische Einlagensicherungssystem geschützt, das die Sicherheit der Kundengelder gewährleistet.

Datensicherheit: Griechische Banken haben die Zertifizierung nach ISO/IEC 27001:2022 bestanden, um die Wirksamkeit ihrer Informationssicherheitsmanagementsysteme zu gewährleisten.

Featured Services & Differentiation

Segmente: Bieten Sie Morphosis-Darlehensprodukte für Studenten an, um Studenten bei der Bezahlung von Studiengebühren, Lebenshaltungskosten und Unterkunft zu helfen.

High-Net-Worth Services: Bieten Sie Private-Banking-Dienstleistungen an, um die persönlichen Bedürfnisse von vermögenden Kunden zu erfüllen.