Unternehmensprofil

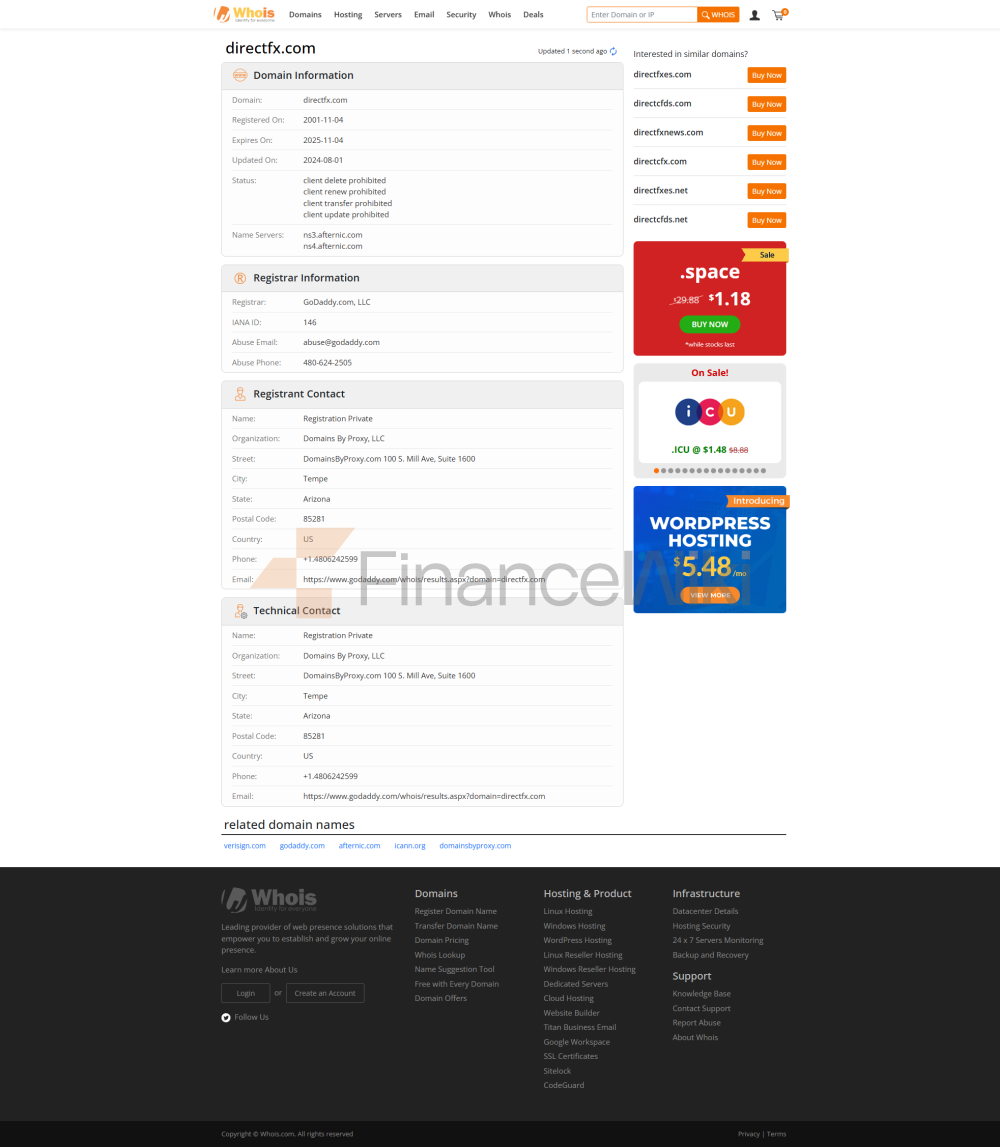

DirectFX (im Folgenden als "Unternehmen" bezeichnet) ist ein Finanzdienstleister mit Hauptsitz in Australien , der derzeit hauptsächlich Online-Handelsdienste für globale Händler anbietet. Das Unternehmen betreibt über seine offizielle Website https://directfx.com/en , aber aus technischen Gründen ist diese Website derzeit nicht zugänglich, so dass wir seine Dienstleistungen nur auf der Grundlage von Daten Dritter beschreiben können. Die Hauptgeschäftsrichtung von DirectFX besteht darin, Handelsdienstleistungen für Finanzinstrumente wie Forex, Edelmetalle, Rohöl und Differenzkontrakte (CFDs) anzubieten. Das Unternehmen behauptet, dass es sein Ziel ist, Händlern vielfältige Anlagemöglichkeiten zu bieten und ihnen bei der Teilnahme an globalen Finanzgeschäften zu helfen. DirectFX behauptet, dass es von der Australian Securities and Investments Commission (ASIC) reguliert wird und besitzt eine ASIC-Lizenznummer 305539 . Bei der Überprüfung stellt sich jedoch heraus, dass es sich bei der Lizenz um einen zweifelhaften Klon von handelt, was ernsthafte Bedenken hinsichtlich der Legalität und Compliance-Probleme von DirectFX aufkommen lässt. Anmerkungen Als Investor sollten Sie bei den aufsichtsrechtlichen Qualifikationen von DirectFX vorsichtig sein. Klonlizenzen sind eine gängige Taktik betrügerischer Finanzunternehmen, um Anleger in den Glauben zu bringen, dass sie die Vorschriften einhalten. In diesem Fall kann ein Compliance-Risiko für DirectFX bestehen. Darüber hinaus wurden bisher keine aufsichtsrechtlichen Aufzeichnungen von DirectFX in anderen Ländern oder Regionen gefunden. DirectFX bietet die folgenden Haupthandelsprodukte an: Forex (Forex) Direkter Handel mit mehreren Währungspaaren, wie EUR / USD (EUR / USD), GBP / USD (GBP / USD), etc. Edelmetalle bietet Handelsdienstleistungen für Edelmetalle wie Gold (XAU), Silber (XAG) und Platin (XPT). Crude Oil bietet Handel mit Rohöl (Crude Oil), was die Preisschwankungen auf dem internationalen Rohölmarkt widerspiegelt. Contracts for Difference (CFDs) ermöglicht es Händlern, auf die Preisschwankungen von Finanzinstrumenten wie Aktienindizes und Rohstoffen zu spekulieren, ohne tatsächlich Vermögenswerte zu halten. DirectFX verfügt über eine Vielzahl von Handelsprodukten, die Händlern eine Vielzahl von Anlageoptionen bieten. DirectFX bietet Händlern Dienstleistungen über die folgenden Plattformen: Web Trading Platform unterstützt den Handel direkt über das Web, ohne Software herunterzuladen. Die Plattform ist voll funktionsfähig und bietet Echtzeit-Marktdaten, Nachrichten-Updates und Handelstools. Mobile Trading Platform bietet mobile Handelsanwendungen für Android und iOS Geräte, die es Händlern ermöglichen, jederzeit und überall zu handeln. Die Handelssoftware von DirectFX ist im Allgemeinen benutzerfreundlich gestaltet, aber Händlern wird empfohlen, sie aufgrund von Compliance-Problemen mit Unternehmen mit Vorsicht zu verwenden. DirectFX bietet die folgenden Einzahlungs- und Auszahlungsmethoden: DirectFX wurde nicht gefunden, um detaillierte Anweisungen zum Einzahlungs- und Auszahlungsprozess zu geben. DirectFX bietet die folgenden Kundenunterstützungsmethoden: Die Kundensupport-Kanäle von DirectFX sind vielfältig, aber ihre Compliance-Probleme können die Servicequalität beeinträchtigen. Das Kerngeschäft von DirectFX umfasst Folgendes: High Leverage Trading DirectFX bietet Händlern eine Hebelwirkung von bis zu 400: 1 , die es Händlern ermöglicht, größere Handelspositionen mit geringeren Kapitalbeträgen zu kontrollieren. Hohe Hebelwirkung bringt jedoch auch höhere Risiken mit sich, die potenzielle Verluste verstärken können. Demo Trading Accounts Das Unternehmen bietet Demo-Handelskonten, bei denen Händler virtuelle Fonds nutzen können, um in einer realen Marktumgebung zu operieren, um sich mit der Plattform und den Handelsstrategien vertraut zu machen. Multi-Market Tools DirectFX bietet eine Vielzahl von Handelstools wie Forex, Edelmetalle, Rohöl und CFD, die mehrere Marktsegmente abdecken. News and Market Analysis DirectFX bietet Echtzeit-Marktnachrichten, einen Wirtschaftskalender und technische Analysetools über seine Plattform, um Händlern bei der Entwicklung von Handelsstrategien zu helfen. > Die technische Infrastruktur von DirectFX umfasst die folgenden Aspekte: Trading Platform DirectFX bietet eine webbasierte und mobile Geräte-Handelsplattform, die Multi-Device-Operationen unterstützt. Trading Tools DirectFX bietet eine Vielzahl von Handelstools, einschließlich Charttypen wie candlestick Charts, Line Charts, Pip Charts, Renko Charts , sowie Indikatoren der technischen Analyse (wie MACD, RSI, stochastische Indikatoren, etc.). News & Data DirectFX bietet Echtzeit-Marktnachrichten, Wirtschaftskalender und Forschungsdaten, um Händlern zu helfen, über die Marktdynamik auf dem Laufenden zu bleiben. Hauptprobleme mit DirectFX 's Compliance and Risk Management System: Compliance Problems DirectFX behauptet, von ASIC reguliert zu werden, aber seine Lizenz ist ein zweifelhafter Klon, der auf mögliche Compliance-Risiken für seinen Betrieb hinweist. li> Risk Control Das Unternehmen bietet eine Vielzahl von Risikokontrollinstrumenten an, darunter Stop Loss / Take Profit Orders , aber ihre tatsächliche Wirkung kann durch die Compliance-Probleme des Unternehmens beeinflusst werden. Die Marktpositionierung und der Wettbewerbsvorteil von DirectFX spiegeln sich hauptsächlich in den folgenden Aspekten wider: Multi-Market-Tools DirectFX bietet eine Fülle von Handelsprodukten, darunter Devisen, Edelmetalle, Rohöl und CFD usw., die Händlern eine Vielzahl von Investitionsmöglichkeiten bieten. Hohe Hebelwirkung Die Das vom Unternehmen angebotene 400: 1 Leverage Ratio kann Händler ansprechen, die ein hohes Risiko und eine hohe Belohnung suchen. Demo-Konto Demo-Konto bietet eine praktische Plattform für Anfänger, um das Handelsrisiko zu reduzieren. Compliance-Probleme mit DirectFX können sich jedoch negativ auf die Marktpositionierung und Wettbewerbsfähigkeit auswirken. DirectFX unterstützt seine Händler durch: Bildungsressourcen Das Unternehmen stellt Ressourcen wie Trading-Tutorials, Marktanalyse-Tools und Wirtschaftskalender zur Verfügung, um Händlern zu helfen, ihre Handelsfähigkeiten zu verbessern. Customer Support The company offers multi-channel customer support services via phone, email, and social media. Demo account Demo account allows traders to Practice risk-control in a real market environment. Es wurden keine spezifischen Informationen über die Erfüllung der sozialen Verantwortung, des Umweltschutzes und der Corporate Governance (ESG) durch DirectFX gefunden. DirectFX gibt keine spezifischen Informationen über seine strategischen Partner oder Ökosysteme preis. DirectFX legt seinen Finanzstatus nicht offen, einschließlich Schlüsseldaten wie Einnahmen, Ausgaben, Gewinne usw. Aufgrund begrenzter offizieller Informationen über DirectFX ist sein zukünftiger Entwicklungsplan derzeit nicht verfügbar. Anmerkungen DirectFX hat derzeit offensichtliche Compliance-Probleme, und Händler sollten bei der Auswahl seiner Dienste die latenten Risiken sorgfältig berücksichtigen. Aufgrund des Vorhandenseins von Klonlizenzen kann die Sicherheit des Kapitals der Investoren nicht gewährleistet sein. Anlegern wird empfohlen, vor jeder Handelsaktivität eine detaillierte Überprüfung der Compliance und der aufsichtsrechtlichen Qualifikationen des Unternehmens durchzuführen. Regulatory Information

Trading Products

Trading Software

Einzahlungs- und Auszahlungsmethoden

Customer Support

Core Business and Services

Technical Infrastructure

Compliance and Risk Control System

Marktpositionierung und Wettbewerbsvorteil

Customer Support and Empowerment

social sibility and ESG

Strategic Cooperation ecosystem

Finanzielle Gesundheit

Future roadmap