Unternehmensprofil

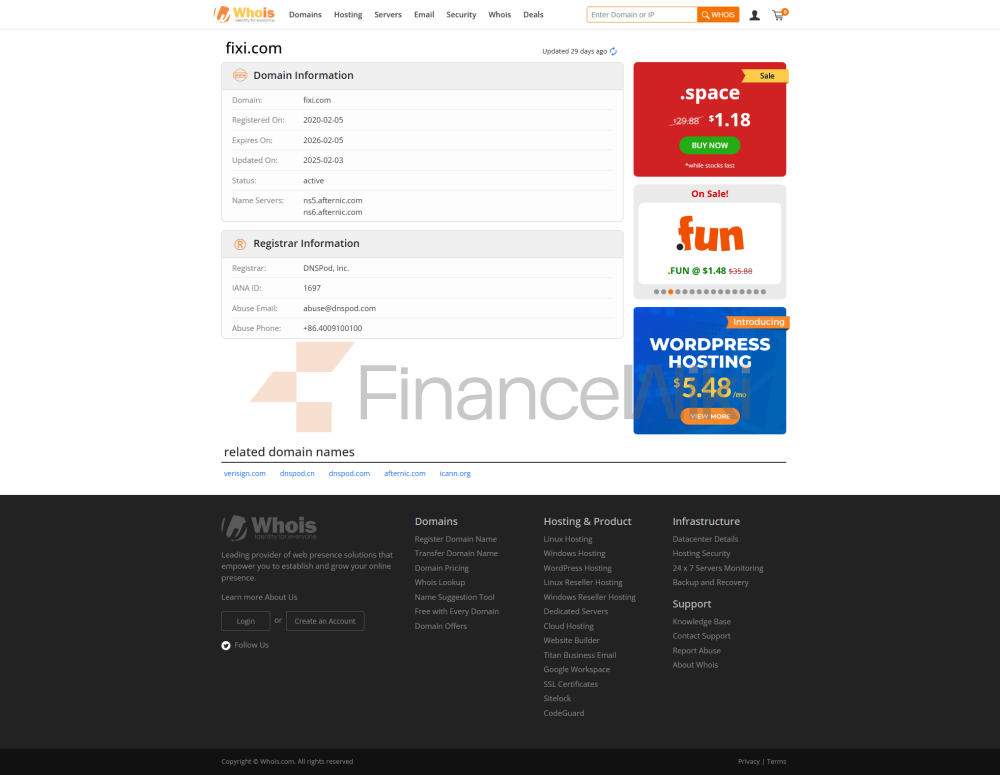

Vollständiger Name des Unternehmens : FIXI Gründungsdatum : Das genaue Gründungsdatum wird nicht bekannt gegeben. Standort des Hauptsitzes : Vereinigtes Königreich Eingetragenes Kapital : Nicht bekannt gegeben. Regulatorische Lizenz : Nach Angaben der FCA ist die Echtheit der Lizenz zweifelhaft. Die Lizenznummer lautet 448399, aber die FCA hat die Lizenz nicht offiziell anerkannt. FIXI ist ein im Vereinigten Königreich ansässiges Finanzunternehmen, das Handelsdienstleistungen für eine Vielzahl von Marktinstrumenten anbietet, darunter Währungspaare, Edelmetalle und Indizes. Das Unternehmen bietet drei verschiedene Arten von Handelskonten an: Standardkonto, professionelles Konto und islamisches Konto, mit einer Mindesteinlagepflicht von 100 Dollar. Die FCA hat jedoch die Rechtmäßigkeit ihrer Lizenz in Frage gestellt und ihre offizielle Website ist unzugänglich, was das Risiko des Handels erhöht. Registered Country : UK Regulator : FCA (UK Financial Conduct Authority) Regulatory Status : Die FCA hat angedeutet, dass ihre Lizenz ein verdächtiger Klon sein könnte und keine wirksame regulatorische Anerkennung hat. FIXI behauptet, eine FCA-Lizenz mit der Lizenznummer 448399 zu besitzen, aber die FCA hat klargestellt, dass es Zweifel an der Rechtmäßigkeit und Authentizität dieser Lizenz gibt. Diese Warnung hat einen erheblichen Einfluss auf die Glaubwürdigkeit und Legitimität von FIXI, und Händler müssen bei der Auswahl dieser Plattform die regulatorischen Risiken sorgfältig berücksichtigen. Currency pairs : Precious Metals : Index : / p> FIXI bietet eine breite Palette von Handelstools, die die wichtigsten Devisen-, Edelmetall- und Indexmärkte abdecken und sich an verschiedene Händler richten. Der spezifische Reichtum und die Markttiefe seiner Handelsinstrumente sind jedoch nicht detailliert. Supported Trading Platforms : FIXI bietet Händlern ein effizientes und bequemes Handelserlebnis durch MT4 und MT5, aber die Stabilität und die technischen Unterstützungsmöglichkeiten der Plattform sind nicht klar angegeben. Unterstützte Zahlungsmethoden : Die von FIXI bereitgestellten Zahlungsmethoden sind einfach und direkt, aber das Fehlen vielfältigerer Optionen, wie Banküberweisungen, Kryptowährungen usw., kann die Erfahrung einiger Händler beeinträchtigen. Support Channels : FIXI hat begrenzte Kundensupport-Kanäle, es fehlt an Live-Chat und Online-Kundenservice und es ist möglicherweise nicht effizient genug, um dringende Probleme zu lösen. Hauptgeschäftsbereiche : Service Targets : Differentiating Advantages strong: Trade Execution : Server und Netzwerk : Die technische Infrastruktur von FIXI basiert auf MT4 und MT5, aber die spezifische Leistung des Servers und des Netzwerks ist nicht detailliert. Compliance Statement : Risk Management System : Dem Risikomanagementsystem von FIXI mangelt es an Transparenz, und eine hohe Hebelwirkung kann das Handelsrisiko erhöhen. Darüber hinaus erhöhen FCA-Fragen zur Einhaltung der Vorschriften das latente Risiko weiter. Flexibilität : Competitive : Nachteile : FIXI versucht, die Händler durch flexible Kontotypen und wettbewerbsfähige Preise, aber regulatorische Risiken und Website-Probleme haben einen größeren Einfluss auf ihre Marktpositionierung. Risk Warning : Es besteht Ungewissheit über die zukünftige Entwicklung von FIXI, insbesondere für den Fall, dass die Anfechtung der Lizenz durch die FCA nicht gelöst wurde. Potenzielle Händler müssen bei der Auswahl der Plattform sorgfältig abwägen. Q1: Wird FIXI von einer Gruppe von Finanzinstituten reguliert? Q2: Wie kann ich das Kundendienstteam von FIXI kontaktieren? Q3: Was trading platform are available in FIXI? Q4: Was is the minimum posit amount? FIXI bietet eine breite Palette von Handelsprodukten und flexiblen Kontotypen, aber die regulatorischen Probleme und die Funktionalität der Website bergen erhebliche Risiken. Potenziellen Händlern wird empfohlen, bei der Auswahl von FIXI Fragen der Einhaltung von Vorschriften und der Transparenz sorgfältig zu prüfen, und es wird eine umfassende Due-Diligence-Prüfung empfohlen. Regulatory Information

Trading products

Trading Software

Einzahlungs- und Auszahlungsmethoden

Customer Support

Core Business and Services

Technische Infrastruktur

Compliance and Risk Control System

Marktpositionierung und Wettbewerbsvorteil

Future Roadmap

Häufig gestellte Fragen (FAQ)

SCHLUSSFOLGERUNG