A General Understanding Of TFI

TFI Markets Ltd Has Been Operating In The Financial Services Industry Since 1999, Initially As A Public Limited Company Before TFI Converted To Its Current Name. Working In The Industry For Over Two Decades, TFI Has Carved Out A Niche Market Specialising In Currency Exchange, Third Party Payments And Risk Mitigation Solutions Primarily For Corporate Clients.

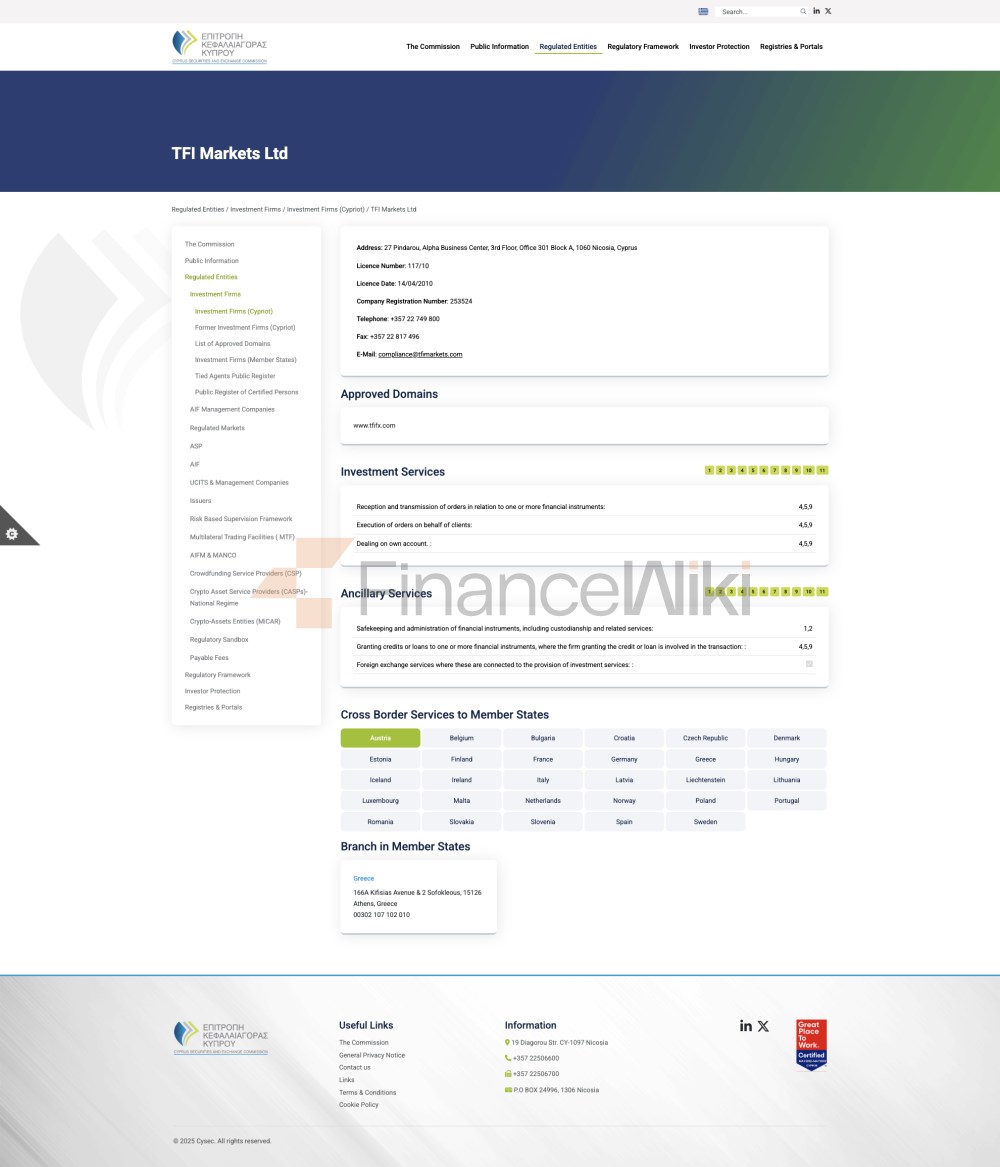

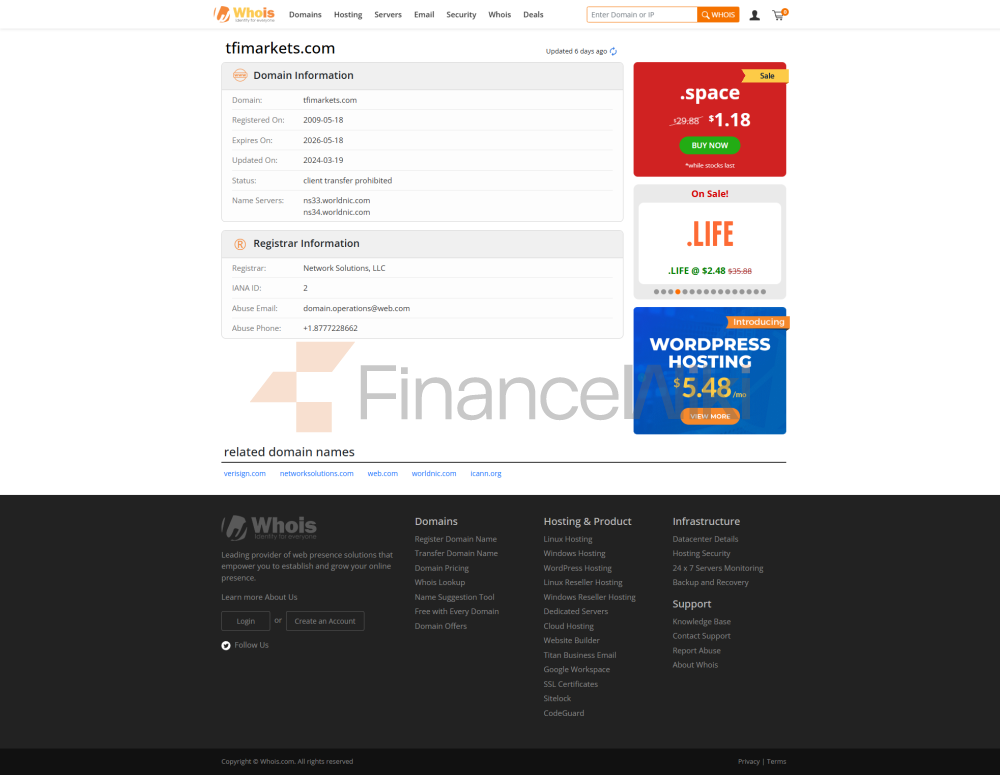

They Offer Services Such As Currency Payments, Currency Exchange And Currency Risk Management. Licensed By The Central Bank Of Cyprus And The Cyprus Securities And Exchange Commission (cysec), TFI Operates Under Strict Regulatory Oversight, Ensuring A Certain Level Of Trust And Reliability For Its Clients. The Company Also Sponsors Various Financial And Business Events, Such As The Investing Cyprus Cipa Awards And The Business Awards, Further Solidifying Its Position In The Financial World.

Pros And Cons

Pros:

- Physical Office Location: TFI Markets Has A Physical Office In Cyprus And A Trade Branch In Greece, Providing Clients With A Tangible Point Of Contact.

- Multiple Support Channels: The Company Offers A Variety Of Client Server Methods, Including Telephone And Email.

- Nothing But Trading Commissions: TFI Markets Does Not Charge Any Non-trading Commissions, Reducing The Overall Cost For Clients.

- Free Multi-currency Accounts: Free Multi-currency Accounts For Every Client, Facilitating Seamless International Transactions.

- Risk Management Tools: TFI Offers Specialized Tools For Managing Currency Risk, Helping Businesses Reduce The Risk Of Currency Fluctuations.

Cons:

- Enterprise Services Only: TFI Marketplace Is Exclusively For Legal Entities And Individual Traders Do Not Participate In Its Services.

- Lack Of Educational Content: The Company's Website Does Not Offer Educational Resources And Is Not Well Suited For Beginners For Clients New To Currency Trading.

- Limited Deposit/Withdrawal Options: The Only Deposit And Withdrawal Method Available Is Via Bank Telegraphic Transfer, Which May Not Be Suitable For All Clients.

Market Tools

TFI Markets Specializes In Currency Pair Trading, Focusing On Corporate Clients With Unique Requirements For Currency Pairs, Hedging And Risk Mitigation. While The Brokerage Does Not Offer A Wide Range Of Instruments Such As Commodities, Stocks Or Indices, It Excels In Its Niche Market. The Focus Is On Providing Businesses With Comprehensive Solutions To Effectively Manage Currency Risk.

This Limited But Highly Specialized Offering Fits Their Business Model And Is Designed To Serve Corporate Clients With Advanced Needs, Including Extended Payment Deadlines And 24-hour Access To Money Market Pricing. The Lack Of A Wide Range Of Trading Tools May Deter Some Traders; However, TFI Money Market's Expertise Makes It A Strong Contender For Businesses Focused On Currency Trading.

Account Types

TFI Market Primarily Serves Corporate Clients, And Its Account Features Reflect This Focus. The Minimum Deposit Requirement Is Only $1, Providing A Lower Barrier To Entry For Businesses Of All Sizes.

However, It Is Worth Noting That The Firm Only Deals With Legal Entities Such As Corporations, Corporations, Partnerships, And Agencies. It Is Not Designed For Individual Traders Or Retail Investors. There Are Mainly Two Types Of Accounts Offered: Corporate Accounts, And Personal Accounts, Both Available, With A Minimum Difference Of $3. Withdrawal Fees Vary Depending On The Method And Amount, But Are Generally Cost-effective. Although This Broker Does Not Offer Accounts With Different Features Or Customization Options, Its Standard Accounts Are Robust Enough To Meet The Needs Of Most Corporate Clients.

How Do I Open An Account?

Opening An Account TFI Marketplace Is A Straightforward Process, But Does Require Some Standard Due Diligence Given The Focus Of The Business.

- Visit The Website: First Navigate To The Official TFI Marketplace Website: TFI Marketplace.

- Registering An Account: Find And Click The "Open Account" Or "Register" Button, Usually Located At The Top Right Of The Home Page. Fill In Your Personal Details And Other Required Information To Initiate The Registration Process.

Leverage

Leverage For TFI Marketplace Starts At 1:1, Which Is A Conservative Level And In Line With The Company's Risk Mitigation Philosophy. Since TFI Primarily Serves Corporate Clients Who May Not Be Interested In High-risk, High-reward Trading Strategies, Leverage Options Are Tailored To Accommodate A More Cautious Approach To Trading. This Conservative Leverage Product Favors Corporate Clients Seeking Stability And Minimizing Risk In Their Trading Activities. It May Not Appeal To Traders Seeking High Leverage To Maximize Returns, But It Dovetails Well With Brokerages' Broader Focus On Providing A Stable And Secure Trading Environment.

Spreads And Commissions

The TFI Market Operates In A Floating Spread Pattern. Minimum Spreads Start At $3 For Both Corporate And Individual Accounts. Importantly, There Are No Commissions For Currency Exchanges. Brokers' Non-trading Fees Are Transparent And There Are No Hidden Fees.

Internal Transfers As Well As Account Opening Or Maintenance Fees Are Free. For Inactive Accounts Over Five Years, There Is An Account Maintenance Fee Of €80. This Transparent Fee Structure Is Suitable For Businesses That Need Clear And Predictable Transaction Costs For Budgeting And Financial Planning.

Trading Platform

TFIMarkets Provides A Sophisticated Trading Platform That Seamlessly Integrates With The Fix4.4 Protocol To Automate Frequent Currency Exchanges. This Feature-rich Platform Caters To A Wide Range Of Trading Needs By Providing Real-time Account Balance Updates As Well As Facilitating The Smooth Flow Of Trading Orders. With A "quote" Session, Clients Can Access The Company's Real-time Pricing Data. This Real-time Information Can Be Fed 24/7 Into The Client's Own Trading System, Ensuring That They Are Kept Abreast Of The Latest Market Data.

To Further Cater To Different Trading Strategies And Needs, The Platform Offers A Variety Of Types Of Trading Sessions. "Market Trading" Sessions Allow For The Immediate Execution Of Currency Exchange Orders At Market Prices.

Customer Support

TFI Markets Ltd Gives Priority To Customer Support Through A Number Of Contact Routes. The Head Office Is Ideally Located In Nicosia, Cyprus, At 27 Pindarou, Alpha Business Center, Block A, 3rd Floor. You Can Contact Them By Phone (+ 357) 22 749 800 Or Fax (+ 357) 22 817 496. For Postal Correspondence, PO Box 16022, 2085, Nicosia, Cyprus.

In Addition To Its Main Office In Nicosia, TFI Markets Has A Representative Office In Limassol, Cyprus, At 3 Krinou, The Oval, 9th Floor, Office 901, Ayios Athanasios, And The Contact Number Is (+ 357) 25 749 800. They Also Have A Branch Office In Athens, Greece, At 166 A Kifissias Avenue & Sofokleous 2 Str., Office 004, Marousi. You Can Contact The Athens Office At (+ 30) 210 710 20 10. These Multiple Locations And Different Contact Details Underline TFI Markets' Commitment To Providing A Convenient And Comprehensive Client Server.

Conclusion

TFIMarkets Has Established Itself As A Reliable And Professional Broker In The Forex Market, Serving Corporate Clients In Particular. With A Focus On Risk Management, Pricing Transparency And Strong Customer Support, The Broker Is Quite Attractive To Businesses Looking For A Stable And Secure Trading Environment. The Broker May Not Offer A Wide Range Of Trading Tools Or Deposit Methods, But It Specializes In Forex And Corporate Clients, Making It An Attractive Option For Businesses With Specific Trading Needs.