What Is TD Markets?

Established In 2015, TD Markets Is A Forex And Binary Options Broker Registered In South Africa, Supporting The MT4 Platform. In Terms Of Regulation, It Has Been Verified That TD Markets Holds More Licenses Than The Financial Industry Conduct Authority (FSCA).

In Terms Of Account Types, TeleTrade Offers A Variety Of Options To Suit The Needs Of Different Traders. In Addition, It Offers A Demo Account Option For Traders Who Wish To Test Their Trading Strategies Before Opening A Live Account. TeleTrade's Clients Have Access To A Wide Range Of Financial Marekts. The Company Also Offers A Range Of Tools And Analysis To Help Traders Make Informed Decisions.

Pros & Cons

Pros: • Multiple Tiered Account Options • Access To A Wide Range Of Markets • Low Minimum Deposit Requirements • Up To 500:1 Leverage • Trading Tools And Resources

Cons: • Unregulated • Limited Funding Options

Alternative Brokers For TD Markets

Depending On The Specific Needs And Preferences Of Traders, There Are Many Alternative Brokers To Choose From, Including:

UFX - User-friendly Trading Platform And A Wide Range Of Tradable Assets, Suitable For Both Beginners And Experienced Traders.

Valutrades - Offering Competitive Spreads, Reliable Trade Execution, And Multiple Trading Platforms, It Is A Good Choice For Traders Looking For A Reliable Broker.

TD Ameritrade - A Long-established Brokerage Platform That Offers A Wide Range Of Trading Tools And Resources To Investors At All Levels.

Is TD Markets Safe?

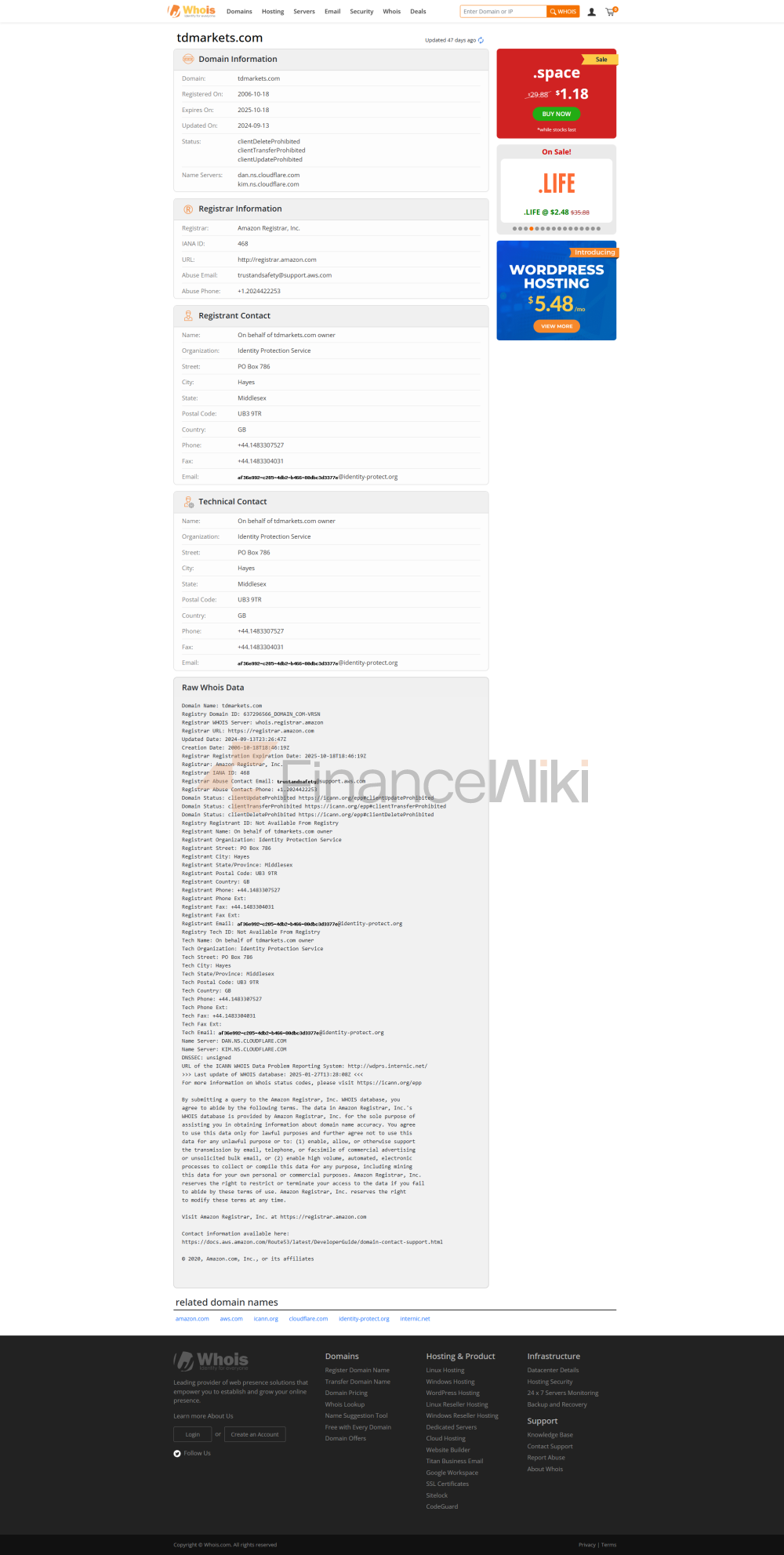

TD Markets Claims To Offer Some Protections Such As Account Segregation, Liability Protection, Anti-money Laundering Protocols, And Cooperation With Major Banks, Which Is Positive. However, The Concern Is That TD Markets Does Not Have Effective Regulation. Their Financial Sector Regulatory Authority Of South Africa (FSCA, No. 49128) License Has Expired. This Means There Is No Government Or Financial Institution Group Overseeing Their Operations, Which Makes Investing With Them Risky. The Lack Of Effective Regulation And Expired Licenses Can Raise Concerns About The Safety And Legality Of TD Markets. Effective Regulation Is Essential As It Provides Oversight, Ensures Compliance With Industry Standards And Provides Investor Protection Measures.

If You Are Considering Investing With TD Markets, It Is Important To Conduct Thorough Research Before Making A Decision And Weigh The Latent Risks Against The Potential Returns. In General, It Is Recommended To Invest With A Well Regulated Broker To Ensure Your Funds Are Protected.

Is TD Markets Safe?

TD Markets Offers A Variety Of Trading Instruments Covering Different Asset Classes Including Forex, Precious Metals, Energy, Indices, Stocks, Cryptocurrencies And ETFs. Here Is A Brief Description Of Each Market Instrument:

- Forex: TD Markets Offers A Comprehensive Range Of Forex Trading Pairs For Traders To Invest In, Including Major, Minor And Exotic Currency Pairs.

- Precious Metals: The Company Offers Investors The Opportunity To Trade Gold And Silver.

- Energy: TD Markets Offers Access To The Energy Market Where Traders Can Invest In Crude Oil And Natural Gas.

- Indices: Traders Can Invest In Global Equity Indices Such As The S & P 500, Nasdaq, Germany's DAX30, And The UK's FTSE 100 Through TD Markets.

- Stocks: TD Markets Allows Traders To Invest In Major Global Stocks From Companies Such As Google, Apple, Amazon, And Others.

- Cryptocurrencies: The Platform Provides Traders With Access To Major Cryptocurrencies Such As Bitcoin, Ethereum, And Ripple.

- ETFs: TD Markets Provides Access To Exchange-traded Funds (ETFs) That Track The Performance Of Various Industries, Including Biotech, The S & P 500, And Gold Trusts.

Overall, TD Markets Offers Traders A Diverse Range Of Financial Marekts And Tools Across Multiple Asset Classes. However, Traders Should Be Aware Of The Latent Risks That May Be Present In Each Investment And Consider The Broker's Current Regulatory Status Before Investing.

Accounts

TD Markets Offers Four Real Account Types, Including TDM Gold, TDM Pro, TDM Mini And TDM Islamic, With Minimum Deposit Requirements Of 50 Dollars, 1000 Dollars, 50 Dollars And 50 Dollars Respectively. Here Is A Brief Description Of Each Account Type:

- TDM Gold: This Account Is Designed For Entry-level Traders. The Minimum Deposit Requirement Is 50 Dollars And Offers Fixed Spreads On Multiple Instruments. Traders Can Choose The Account That Best Suits Their Needs Based On The Size Of The Initial Deposit, Level Of Trading Experience And Desired Trading Style. It Is Important To Note That Each Account Has Different Trading Conditions, So Traders Should Carefully Review The Details Of Each Account Before Making A Decision.

Leverage

TD Markets Offers Its Clients Maximum Leverage Ratios Up To 1:500, Which Is Considered Extremely High When Compared To Other Regulators.

TD Markets Offers High Leverage Ratios That Give Traders More Flexibility When Managing Their Investments. However, The Risks Involved Need To Be Understood, As The Higher The Leverage, The Greater The Risk Of Taking On Significant Losses. Prudent Use Of Leverage And Good Money Management Are Recommended To Reduce Risk. Traders Should Always Consider Their Own Trading Experience, Risk Tolerance And Financial Goals When Deciding On The Leverage To Use For Each Trade.

Spreads And Commissions

TD Markets Offers 1.8 Spreads For TDM Mini Accounts, TDM Islamic Accounts And TDM Gold Accounts And 0.1 Spreads For TDM Pro Accounts.

Additionally, There Is No Commission For TDM Mini Accounts, TDM Islamic Accounts And TDM Gold Accounts, While TDM Pro Accounts Charge $8.

Trading Platform

TD Markets Offers MT4, A Powerful And User-friendly Trading Platform For Traders' Needs Across A Wide Range Of Operating Systems. Through The MT4 Trading Platform, Clients Can Seamlessly Access Their Accounts And Trade On Windows, Android, IPhone OS, Linux OS And Webtrader. This Wide Range Of Supported Operating Systems Gives Traders The Flexibility To Choose Their Preferred Device While Ensuring A Consistent And Reliable Trading Experience. The Platform Offers Advanced Charting Tools, Real-time Market Quotes And A Wide Range Of Indicators To Help Traders Analyze The Market And Make Informed Trading Decisions. Overall, TD Markets' Trading Platform Offers Powerful Features And Ease Of Use That Enable Traders To Navigate The Financial Marekt Efficiently And Effectively.

Trading Tools

TD Markets Provides An Economic Calendar, News And Insights.

Economic Calendar: An Important Tool For Traders, The Economic Calendar Provides Valuable Information About Upcoming Economic Events And Announcements. TD Markets Offers A Comprehensive Economic Calendar That Covers Events From Major Global Economies, Including Central Bank Policy Announcements, Economic Growth Indicators, And Economic Events Affecting Various Instrument Categories.

Client Server

The Online Chat Service Is Considered The Best Way To Contact Customer Support; The Chat Icon At The Top Of The Website Will Take You To The Online Assistant Service, Fast And Helpful. Alternatively, You Can Contact The Broker Via Their Email Or Phone Number.

Clients Can Visit Their Office Or Contact The Client Server Department Using The Information Provided Below:

Tel: + 27 010 300 0011

Email: Care@tdmarkets.com

In Addition, Clients Can Also Connect With This Broker Via Social Media Such As Twitter, Facebook, Instagram And Linkedin.

CONCLUSION

TD Markets Is A Broker That Offers Multiple Trading Instruments, High Leverage, And A Variety Of Trading Accounts. While They Offer A User-friendly Trading Experience And Educational Resources, There Are A Few Caveats.

An Important Aspect To Note Is That TD Markets Has No Regulatory Oversight. This May Raise Concerns For Traders Who Prioritize Investor Protection And Regulatory Compliance.

Ultimately, The Suitability Of TD Markets As A Trading Platform Depends On The Specific Needs And Preferences Of Individual Traders. Conducting Thorough Due Diligence Is Essential To Ensure A Positive And Safe Trading Experience.