🏢 Company Profile & Basic Information

eToro is a leading global social trading and multi-asset investment platform dedicated to making financial markets more accessible through innovative technology. Its core idea is to enable ordinary people to participate in the global financial markets through social collaboration and investor education. Known for its unique CopyTrader features and user-friendly interface, eToro attracts tens of millions of users around the world.

>

📜 background

Founded in 2007 and headquartered in Tel Aviv, Israel, eToro was co-founded by founders Yoni Assia, Ronen Assia, and David Ring. Originally named RetailFX, eToro's vision was to break down the barriers of traditional finance and enable ordinary investors to trade stocks, cryptocurrencies, commodities, forex, and other assets through an intuitive online platform. In 2010, eToro established itself as a leader in social trading with the launch of the OpenBook social investing platform and the CopyTrader feature, which allowed users to copy the strategies of top traders. As of December 2024, eToro has over 38 million registered users and 3.5 million active accounts. On May 14, 2025, eToro was listed on the NASDAQ in the United States through an IPO under the ticker symbol "ETOR", with a valuation of $5.5 billion.

💰 Registered capital

eToro's registered capital information is not explicitly disclosed in public filings, but according to its SEC filings and IPO disclosures, the company raised approximately $620 million through the issuance of 11.92 million shares of common stock ($52 each) at the time of its 2025 IPO. These funds are used for global expansion, platform technology upgrades, and compliance system construction. As a multi-country regulated fintech company, eToro is required to meet the minimum capital adequacy requirements of local regulators in its operating entities (e.g., Europe, UK, Australia, etc.), such as the European Union's Capital Requirements Regulation (CRR).

👥 Key executive backgrounds

Yoni Assia (CEO)

Yoni Assia is the co-founder and CEO of eToro and has over 20 years of fintech experience. He was involved in software development and financial market research before founding eToro, where he drove the concept of social trading. Yoni graduated from the Open University of Israel with a bachelor's degree in computer science.

Hedva Ber (Deputy CEO & Global Chief Operating Officer)

Hedva Ber joined eToro in 2021 and has over 25 years of banking and finance experience. She previously served as Head of Banking Supervision at the Bank of Israel and as Chief Risk Officer at Leumi Bank. She holds a Ph.D. in Economics from the Hebrew University of Jerusalem.

Tuval Chomut (Chief Technology Officer)

Tuval joined eToro in 2019 and is responsible for product, technology and business solutions. He was a co-founder of software companies ITG and Clicktale and holds a degree from the University of California, Los Angeles (UCLA).

Avi Sela (Chief Compliance Officer)

Avi has been with eToro since 2007 and is responsible for legal affairs, compliance, operational risk management, and payments operations. He holds an MBA and a Bachelor of Laws (LL.B) from a top university in Israel.

🤝

consultants

eToro's advisory team is made up of senior experts in the financial, regulatory, and technology fields, and the following are some of the core members:

Shmuel Hauser, former Chairman of the Israel Securities Authority (ISA), has been an advisor to eToro since 2021, focusing on global regulatory affairs.

Inès de Dinechin: With 30 years of experience in the European financial markets, he was CEO of Lyxor Asset Management and Aviva Investors France, and is currently a member of the Advisory Board of eToro.

Giancarlo Devasini is a senior counsel at Willkie Farr & Gallagher and co-founder of the Digital Dollar Project, assisting eToro in its compliance efforts in the digital currency space.

Santo Politi: Co-founder and General Partner of Spark Capital, providing strategic investment and business development advice to eToro.

🏬 shareholding structure

eToro is a private company until its 2025 IPO and is primarily owned by venture capital firms, including 27 institutions, including Social Leverage, SoftBank, Velvet Sea Ventures, Spark Capital and ION Group. After the IPO, eToro became a public company with a partial stake held by public shareholders. Founders Yoni Assia and Ronen Assia still hold significant shares, according to SEC filings, but the exact percentage is not disclosed. In addition, eToro repurchased a portion of its shares as treasury shares through a self-tender offer for re-issuance to PIPE (Private Investment Public Equity) investors.

⚖️ Nature of the company

eToro is a fintech company focused on providing social trading and multi-asset investment services. Its business model combines brokerage services, social networks and educational platforms, and it is a non-bank financial institution. eToro operates as a marketplace maker or broker-by-agent through its global subsidiaries with a hybrid model of Straight Through Processing (STP) and No Dealing Desk (NDD).

📋 Full name and abbreviation

Full name: eToro Group Ltd.

Abbreviation: eToro

🏢 Name of sub-parent

company Parent company: eToro Group Ltd. (Israel)

Main subsidiary:

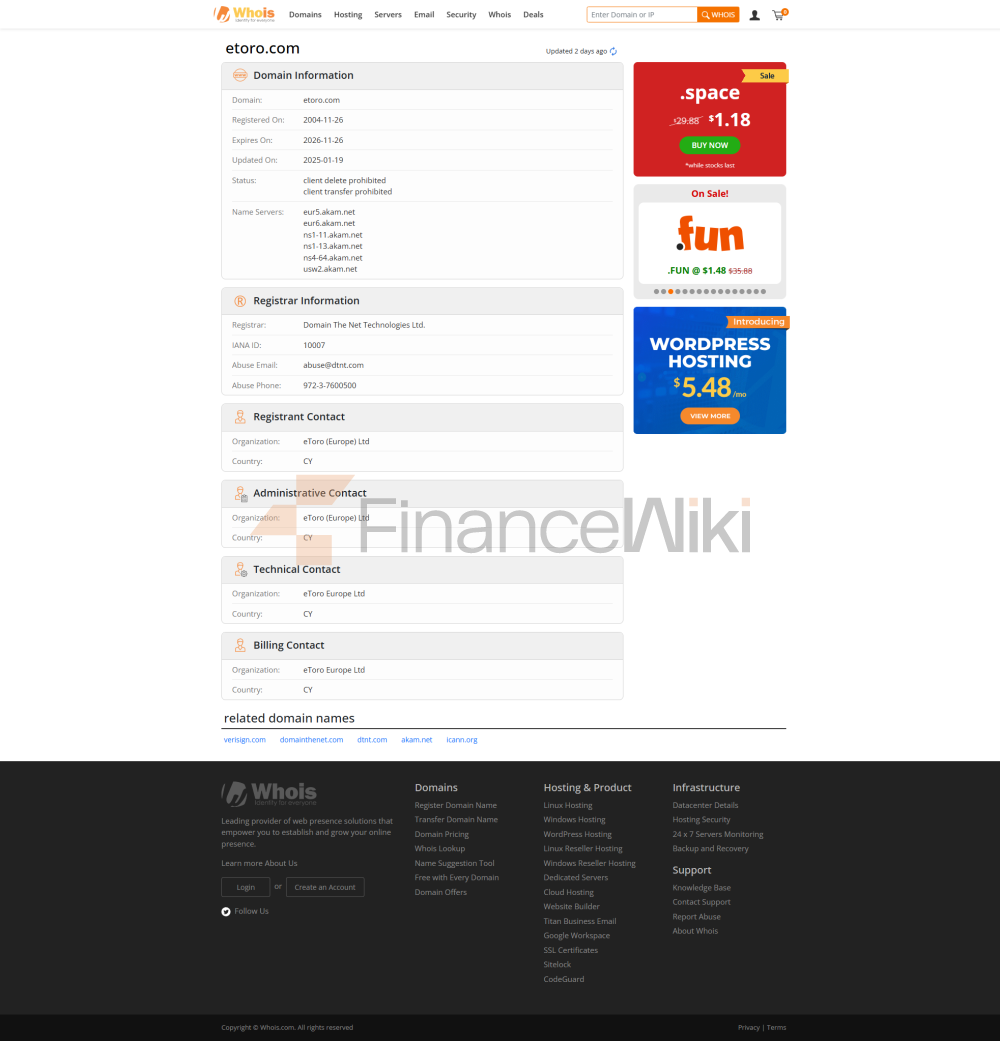

eToro (Europe) Ltd. (Cyprus).

eToro (UK) Ltd. (UK)

eToro AUS Capital Limited (Australia)

eToro USA Securities Inc. (USA)

eToro X Limited (Gibraltar, providing crypto wallet services).

eToro (ME) Limited (Abu Dhabi Global Market)

eToro (Seychelles) Ltd. (Seychelles).

>

📅 Founded

eToro was founded in 2007 and initially operated under the RetailFX brand.

🌍 country of registration

eToro Group Ltd. is registered in Israel and its subsidiaries are registered in Cyprus, the United Kingdom, Australia, the United States, Gibraltar, the United Arab Emirates and the Seychelles.

📍 Address of the headquarters in English

Head Office Address: 4 Prof. Abraham Frumer St., Tel Aviv, Israel

Other Main Office Address:

: 24th Floor, One Canada Square, Canary Wharf, London E14 5AB

USA: 221 River St., 9th Floor, Hoboken, NJ 07030Australia

: Level 3, 60 Castlereagh Street, Sydney NSW 2000

UAE: Office 207 and 208, 15th Floor, Al Sarab Tower, ADGM Square, Al Maryah Island, Abu Dhabi

Cyprus: Kanika International Business Center, 7th Floor, 4 Profiti Ilia Street, Germasogeia, LimassolUK

🟢 business status

eToro is currently active and serving more than 100 countries around the world, with a successful listing on the NASDAQ in May 2025 to further strengthen its market position. However, in some countries (e.g., the Philippines, India), the company has suspended or restricted its services due to regulatory issues.

🏷️

eToro belongs to the FinTech and online brokerage services industry, specifically social trading platforms and multi-asset investment platforms.

📊 Market segment

eToro is positioned in the retail investment market and primarily serves retail clients, as well as supporting both professional clients and Eligible counterparties. Its markets cover the world, including Europe, Asia Pacific, the Middle East, North America and Latin America.

🛠️

service

eToro offers the following core services:

Social Trading: With the CopyTrader feature, users can automatically copy the trading strategies of other investors.

Multi-asset investment: Support real trading and CFD trading of stocks, ETFs, cryptocurrencies, commodities, indices, forex and other assets.

Smart Portfolios: Thematic portfolios managed by eToro, covering cryptocurrency, technology, and more.

eToro Money: Reduces foreign exchange conversion fees with account management, Visa debit card and instant withdrawals.

Educational resources: eToro Academy offers free financial education courses for beginners and professional investors alike.

Demo Account: A $100,000 demo account is available for practice trading.

📜 Regulatory information

eToro is heavily regulated by a number of top-tier financial regulators, and the following is the key entity and regulatory information:

eToro (Europe) Ltd

regulator: Cyprus Securities and Exchange Commission (CySEC)

license number: 109/10

Effective date: 2010

Note: Serving the European Economic Area (EEA) and other countries, client funds are protected by the European Union's Markets in Financial Instruments Directive (MiFID) with payouts of up to €20,000.

eToro (UK) Ltd.

regulator: Financial Conduct Authority (FCA)

Licence number: Undisclosed (regulated by the FCA, compliant with the Financial Services Compensation Scheme (FSCS) and pays up to £85,000

). Effective date: 2013

eToro AUS Capital Limited

regulator: Australian Securities and Investments Commission (ASIC).

License number: 491139

Effective date: 2016

eToro USA Securities Inc

> Regulators: U.S. Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA)

license number: SEC #8-70212, FINRA CRD #298361

Effective date: 2019

eToro X Limited

regulator: Gibraltar Financial Services Commission (GFSC

). License No.: 1333B

Effective Date: 2018

eToro (ME) Limited

regulatory authority : Abu Dhabi Global Market Financial Services Regulatory Authority (FSRA)

License Number: 220073

Effective Date: 2020

eToro (Seychelles) Limited

regulator: Seychelles Financial Services Authority (FSAS)

license number: SD076

eToro's client funds are held with regulated U.S. banks and are FDIC-insured (up to $250,000). The company employs an account segregation policy to ensure that client funds are segregated from the company's assets.

📈 trading products

eToro offers a wide range of trading products, including:

stocks: Live stock trading on major exchanges in the United States, Europe, Asia, etc., with zero commissions (non-leveraged long positions only).

ETFs: Exchange-traded funds covering technology, healthcare, energy and other industries.

Cryptocurrencies: 70+ crypto assets are supported, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), etc. (limited to 3 for US users).

Commodities: Commodities such as gold, oil, and gas (mainly traded through CFDs).

Forex: 50+ currency pairs, such as EUR/USD, GBP/USD.

Indices: S&P 500, Nasdaq 100 and other major global indices.

Options: Options trading on stocks and ETFs in the U.S. market (select regions only).

Non-leveraged long trades are real assets, while leveraged or short trades are CFDs. CFD trading carries a high level of risk and can result in a total loss of principal.

💻 trading software

eToro offers its own eToro trading platform, including:

web: HTML5-based, multi-language, intuitive interface, including real-time charts, social feeds and CopyTrader features.

Mobile app: iOS and Android versions, support advanced charts, price alerts, and account management, with a rating of 4.5 or higher on the App Store and Google Play.

eToro Money App: For account management and Visa debit card operations.

The platform does not support MetaTrader 4/5 or third-party trading software, focusing on its own ecosystem. eToro also provides an API for developers to integrate their services.

💸 deposit and withdrawal methods

Deposit Methods:

bank

transferCredit/Debit Cards (Visa, Mastercard)

E-wallets (PayPal, Skrill, Neteller, depending on the region)

minimum deposit: $50 ($10 in the US and UK, $500 possible for bank transfers).

Withdrawal method:

bank transfer, credit card or e-wallet.

Withdrawal fee: $5 (waived for Platinum and above members).

Minimum withdrawal amount: $30.

Processing time: 1-2 business days (depending on payment method).

All transactions are denominated in USD, and non-USD transactions are subject to a currency conversion fee of 0.5%-1.5%. Cryptocurrency transfers to the eToro wallet are free of charge, but there are blockchain network fees.

📞 customer support

eToro offers multi-channel customer support:

online help center: FAQs, guides, and tutorials covering account management, trading, and compliance issues.

Help ticket: Submit a problem through the official website, and the average response time is 24 hours.

Live Chat: Platinum and above only ($5,000+ account balance) only.

Phone Support: Platinum and above members only, depending on region.

Support 20 languages, service coverage worldwide. Customer feedback shows that eToro has a fast response time, but some users are unhappy with withdrawal delays and hidden fees.

>

🔑 Core business and services

eToro's core business is social trading and multi-asset investing, which is achieved by:

CopyTrader: Users can copy other investors' trading strategies with a minimum copy amount of $200, Up to 100 traders can be copied.

Smart Portfolios: Professionally managed portfolios that cover specific sectors or top trader strategies.

Commission-free stock trading: Non-leveraged stocks and ETFs are commission-free (excluding CFDs).

Cryptocurrency trading: Support mainstream crypto assets, provide dedicated wallets and exchange services.

Education & Community: eToro Academy and social dynamics facilitate user learning and interaction.

🖥️ Technical Infrastructure

eToro's technical infrastructure is based on cloud computing and a self-developed platform, with key features including:

High availability: Globally distributed servers to ensure low latency and high stability.

Data security: SSL encryption is used to protect user data, which is GDPR and PCI-DSS compliant.

AI & Big Data: For risk scoring, trader performance analysis, and personalized recommendations.

Real-time calculation: Support dynamic leverage calculation and market data updates.

Mobile-first: The platform is designed with mobile as the core to optimize the user experience.

The company's R&D center is located in Tel Aviv and continues to invest in AI, blockchain, and user interface optimization.

🛡️ compliance and risk control system

eToro's compliance and risk management system adheres to global regulatory requirements:

compliance measures:

Client funds are segregated and held with regulated banks.

Comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) policies.

Regular external audits are conducted to ensure transparency.

Risk control system:

real-time leverage monitoring to prevent users from overtrading.

Negative Balance Protection (except for the United States), which limits losses not to exceed the account balance.

Stop-loss orders and risk management tools are available to assist users in managing their positions.

Nonetheless, eToro has been fined or restricted from operating without a license in the Philippines, India, Canada, etc., demonstrating its compliance challenges in emerging markets.

📍 Market positioning and competitive advantage

Market Positioning: eToro is positioned as a social trading platform for retail investors, with an emphasis on ease of use, community collaboration, and multi-asset selection, targeting both beginners and experienced investors.

Competitive Advantage:

Social Trading Leader: CopyTrader and OpenBook features are unique and appealing to users looking to learn and copy strategies.

Multi-asset platform: covering stocks, cryptocurrencies, foreign exchange, etc., to meet diversified investment needs.

User-friendly interface: Intuitive web and mobile apps lower the barrier to entry for newbies.

Global regulation: Authorized by top regulatory authorities in many countries to enhance user trust.

Educational Resources: eToro Academy and community dynamics provide users with continuous learning opportunities.

Key competitors include Robinhood, Webull, Binance, and Interactive Brokers, but eToro's social features and multi-asset portfolio give it an edge in the retail market.

🌟 Customer support and enablement

eToro empowers clients by:

educational support: eToro Academy offers free courses, videos, and webinars ranging from basic investing to advanced strategies.

Community Engagement: Users can view other traders' portfolios, risk scores, and historical performance to facilitate knowledge sharing.

Personalized tools: Provide risk management settings, price alerts, and portfolio analysis.

eToro Club: A balance-based membership program (starting at $5,000) with exclusive services such as priority support and exclusive market analysis.

Demo Account: A $100,000 demo account helps newbies practice risk-free trading.

🌱 Social Responsibility & ESG

eToro has taken the following initiatives in the areas of social responsibility and ESG (Environmental, Social, Governance):

Financial Inclusion: Promote global user participation in financial markets through low barriers to entry (minimum $50) and multi-language support.

Sustainable Investing: Offering a smart portfolio of ESG-themed investments, covering clean energy and green technology.

Community Education: Educate the public about finance and invest through eToro Academy.

Transparent governance: Regular disclosure of compliance and financial information, subject to oversight by regulators in multiple countries.

However, eToro's specific quantitative metrics in the ESG space, such as carbon emission data, have not been publicly disclosed.

🤝 Strategic cooperation ecosystem

eToro has strategic partnerships with:

financial institutions: Partnered with Goldman Sachs to lead the 2025 IPO program.

Payment service provider: Partnered with Visa to issue the eToro Money debit card, which supports instant deposits and withdrawals.

Technology partners: Work with cloud computing providers such as AWS to optimize platform performance.

Regulators: Maintain close cooperation with CySEC, FCA, ASIC, etc. to ensure compliant operations.

Investment companies: Cooperate with venture capital institutions such as SoftBank and Spark Capital to obtain funding and strategic support.

In addition, eToro strengthened its technological capabilities with the acquisition of Spaceship (a financial software company, September 2024).

>

💹 financial health

According to PitchBook data, eToro's revenue for the past 12 months ended December 31, 2024 was $12.6 billion, showing strong financial performance. The $620 million IPO raised in 2025 further strengthens its capital strength. Approximately 95% of eToro's assets under management (AUM) is cash or underlying assets, indicating that its business is highly dependent on user trading activity. The company is not supported by the parent company of the bank, and there is no possibility of bailing out in the event of bankruptcy, but the multi-country supervision and customer fund segregation policy reduce systemic risk.

🚀 future roadmap

eToro's future growth plans include:

global expansion: plans to enter more emerging markets while obtaining more regional regulatory approvals (e.g., New York State license in 2024).

Technology upgrade: Increase investment in AI and blockchain technology, and optimize the function of CopyTrader and intelligent combination.

Localization: Enhanced multi-currency account support, tax reporting, and local payment options in key markets including the UK, Germany, France, Australia, and the UAE.

Product diversification: Launched more financial products, such as fixed income securities and high-yield savings accounts.

ESG Deepening: Expanding sustainable investment products and publishing more detailed ESG reports.