Corporate Profile

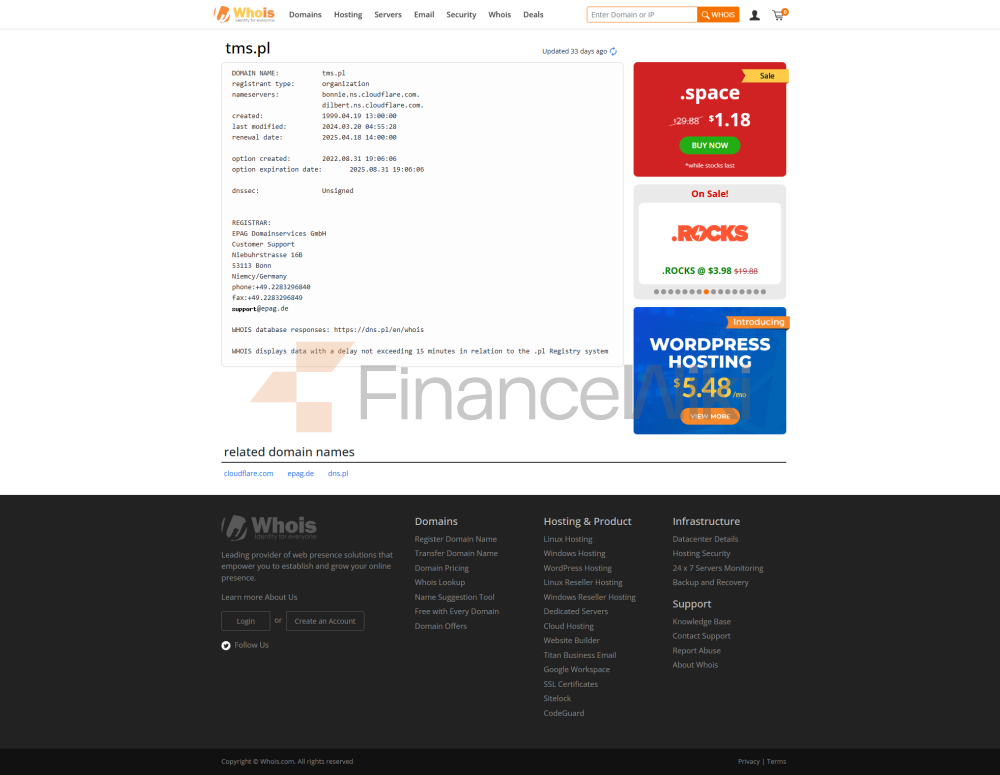

TMS Was Established In 1997 And Is Headquartered In Malta . It Is A Well-known Online Trading Platform That Provides A Diverse Range Of Financial Instruments And Services To Traders Around The World. As An Unregulated Institution, TMS Mainly Provides Traders With A Convenient Trading Experience Through Its Platform, Especially In The Fields Of Foreign Exchange, CFD Stocks, ETFs, Commodities And Cryptocurrencies.

TMS's Core Business Positioning Is To Provide Traders Seeking A Diverse Range Of Assets And Efficient Trading Tools. The Platform Supports A Wide Range Of Trading Methods, Including Contracts For Difference (CFDs) On Forex, Stocks, Indices, Commodities And Cryptocurrencies, As Well As ETFs. By Offering Multi-account Types, Flexible Deposit And Withdrawal Methods, And A Robust Trading Platform, TMS Strives To Meet The Needs Of Different Traders.

Regulatory Information

TMS Is Currently Unregulated , Which Means Its Operations Are Not Overseen By Any Official Financial Regulator. Although Traders Can Trade Through Their Platform, The Non-regulated Status Of The Platform May Present The Following Risks:

- Limited Dispute Resolution Avenues : In The Event Of A Dispute, Traders May Not Be Able To Make An Effective Complaint Or Appeal Through The Regulator.

- Latent Risks To The Safety Of Funds : Unregulated Platforms May Lack Transparency In The Management Of Funds, Increasing The Likelihood Of Funds Being Lost.

- Operational Transparency Issues : Non-regulators May Fail To Fully Disclose The Details Of Their Operations And The Flow Of Funds.

Traders Should Fully Understand These Latent Risks And Have A Risk Management Plan In Place When Choosing TMS To Trade.

Trading Products

TMS Offers A Diverse Range Of Tradable Assets Covering Multiple Financial Sectors. Here Are Its Main Trading Product Categories:

- Forex : Traders Can Access Dozens Of Currency Pairs Through The MT5 Platform, Covering Major And Minor Currency Pairs (e.g. EUR/USD, GBP/USD, Etc.) And Enjoy Real-time Exchange Rate Updates And Advanced Trading Tools.

- CFD Stocks : Offers More Than 2200 Stocks From Major Exchanges (e.g. Germany, Spain, France And The UK), Supporting Traders To Invest In Different Market Conditions.

- CFD Indices : Offers CFD Trading From Major Global Indices (e.g. Dow Jones, S & P 500, FTSE 100, Etc.), Helping Traders To Diversify Their Portfolios In Bull And Bear Market Conditions.

- Commodity CFD : Supports Traders To Invest In Sectors Such As Energy (e.g. Crude Oil), Precious Metals (e.g. Gold And Silver), And Agricultural Products (e.g. Wheat).

- ETF CFD : Provides ETF Investment Opportunities In Different Industries Around The World, Covering Areas Such As Technology, Healthcare, And Biotech, Helping Traders Modernize Their Portfolios.

- Cryptocurrency CFD : Supports CFD Trading On Bitcoin, Ethereum, And Other Major Cryptocurrencies. Traders Can Amplify Their Gains Through Leverage, But At The Same Time Take On Higher Risks.

Trading Software

The Main Trading Platform Of TMS Is MetaTrader 5 (MT5) , Which Is A Globally Widely Used Trading Tool With The Following Core Features:

- Intuitive User Interface : MT5 Supports One-click Trading Of Multiple Asset Types And Provides A Variety Of Chart Types And Analytical Tools To Help Traders Develop Effective Trading Strategies.

- Advanced Analytics Features : Built-in Technical Analysis Tools (such As Trend Lines, Fibonacci Tools, And Chart Indicators), As Well As Economic Calendars And News Event Alerts, Help Traders Capture Market Opportunities In A Timely Manner.

- Multiple Order Types : Support Multiple Trading Methods Such As Market Orders, Limit Orders, Stop-loss Orders, And Take-profit Orders To Meet The Needs Of Different Trading Strategies.

- Mobile Trading : TMS Provides Mobile Applications That Allow Traders To Trade In Real Time From Any Location, While Providing Timely Market Data And Analytical Tools.

Deposit And Withdrawal Methods

TMS Offers A Variety Of Payment Methods To Facilitate Traders' Deposits And Withdrawals, Including:

- Credit And Debit Cards : Traders Can Make Fast Deposits Through Visa Or MasterCard With No Additional Fees, And The Deposit Limit Is 250,000 PLN .

- Automatic Payments : Includes Payment Methods Such As Przelewy24, MBank, And Pay With Orange, Which Supports Fast Money Transfers. Some Payment Methods Charge A 2% Processing Fee .

- Bank Transfer : Support Free Transfer In Multiple Currencies Such As PLN, USD And EUR, Especially Mbank Transfer Allows Unlimited Deposits.

- Quick Payment : Support Mobile Payment Methods Such As BLIK, Which Is Convenient For Traders To Complete Fund Operations Quickly.

In Terms Of Withdrawals, TMS Promises To Complete The Transfer Of Funds Within One Working Day To Ensure The Liquidity Of Traders.

Customer Support

TMS Provides 24/7 Customer Support And Supports Multiple Contact Methods:

- Phone Support : Traders Can Contact The Customer Support Team At + 48 602 348 048 Or + 48 783 540 400 , Or By Phone Before 8pm.

- Email Support : General Inquiries Can Be Emailed At Dommaklerski@tms.pl , And Client Server Can Be Contacted At Dok@tms.pl .

- Online Support : In Addition, TMS Offers An Online Complaint Form Where Traders Can Submit Feedback And Complaints Through The Website.

TMS Also Offers Educational Resources Through Its Website, Including Forex And Stock Market Training, Market Analysis Blogs, Video Tutorials, And A Comprehensive Dictionary Of Investment Terms To Help Traders Improve Their Skills And Understand Market Dynamics.

Core Business And Services

The Core Business Of TMS Mainly Focuses On The Following Aspects:

- Diversified Trading Tools : Provide A Rich Selection Of Financial Products To Meet The Investment Needs Of Different Traders. Advanced Trading Platform : Based On The MT5 Platform, It Provides Powerful Analytical Functions And An Intuitive Operation Interface.

- Flexible Fund Management : Support A Variety Of Deposit And Withdrawal Methods, Reducing The Obstacles For Traders To Operate Their Funds.

- Educational Resources : Helping Traders Improve Their Investment Skills Through Blogs, Videos And Training Courses.

Technical Infrastructure

The Technical Infrastructure Of TMS Is Based On The MetaTrader 5 Platform, Which Is Known For Its Stability And Efficiency. MT5 Not Only Supports Multiple Trading Tools And Analytical Functions, But Also Extends The Convenience Of Trading Through Its Mobile App. In Addition, TMS Ensures The Safety And Fast Transfer Of Traders' Funds Through Its Efficient Payment Processing System.

Compliance And Risk Control System

Since TMS Is Not Regulated, Its Compliance And Risk Control System Mainly Relies On Its Internal Mechanisms. TMS Provides A Range Of Tools And Resources To Help Traders Manage Risk, Including:

- Stop Loss And Take Profit Tools : Support Traders To Set Stop Loss And Take Profit Orders To Control Potential Market Volatility Risk.

- Leverage Management : The Platform Offers A Variety Of Leverage Options, Which Traders Can Adjust According To Their Risk Tolerance.

- Market Analysis : Helps Traders Make More Informed Investment Decisions By Providing Real-time Market Data And Professional Analysis Reports.

Market Positioning And Competitive Advantage

The Market Positioning Of TMS Is Mainly Focused On Providing A Flexible Trading Platform For Traders Seeking To Diversify Their Investments. Its Main Competitive Advantages Include:

- Wide Range Of Trading Tools : Supports The Trading Of A Variety Of Financial Products, Helping Traders To Diversify Their Portfolios.

- Powerful Trading Platform : Based On The Advanced Technology Of MT5, It Provides An Intuitive Operation Interface And Rich Analysis Tools.

- Flexible Money Management : Supports Multiple Payment Methods, Reducing The Obstacles For Traders To Operate.

- Rich Educational Resources : Helps Traders Improve Their Investment Skills By Providing Market Training And Analysis Tools.

Although These Advantages Attract A Large Number Of Traders, The Non-regulated Status Of TMS Remains Its Main Disadvantage, Increasing The Potential Trading Risks.

Customer Support And Empowerment

TMS Provides Support To Traders Through Multiple Channels, Including Phone, Mail, And Online Platforms, Ensuring That Traders Can Get Help In A Timely Manner. In Addition, Its Education Resource Center Provides Training In Market Analysis, Trading Strategies, And Technical Tools To Help Traders Improve Their Investment Skills.

Social Responsibility And ESG

Currently, TMS Does Not Explicitly Mention Social Responsibility And ESG Initiatives In Its Public Information. However, As A Non-regulatory Body, Its Main Social Responsibility May Focus On Protecting The Safety Of Traders' Funds And Providing A Transparent Trading Environment.

Strategic Cooperation Ecosystem

TMS Has Not Mentioned Significant Strategic Cooperation With Other Institutions In Its Public Information. However, The Openness And Diversity Of Its Platform May Lay The Foundation For Its Future Cooperation With Fintech Companies Or Data Analytics Institutions.

Financial Health

Since TMS Is Not Regulated, Its Financial Health Mainly Depends On Its Operational Transparency And Fund Management Mechanism. When Choosing A TMS, Traders Should Pay Particular Attention To Its Funds Protection Mechanism And Account Security Measures.

Future Roadmap

The Future Roadmap Of A TMS May Focus On The Following Areas:

- Enhancing Regulatory Transparency : Although Currently Unregulated, TMS May Seek Regulatory Licenses In The Future To Enhance Traders' Trust.

- Expanding Trading Tools : With The Popularity Of Cryptocurrencies And Emerging Assets, TMS May Further Enrich Its Trading Products.

- Optimized Customer Support : Enhanced Customer Experience By Introducing AI Customer Service And Multi-language Support.

In Summary, TMS Offers Traders A Wealth Of Investment Options Through Its Diverse Trading Tools And Flexible Platform. However, Its Non-regulated Status Remains A Latent Risk Point For Traders. Traders Should Fully Understand These Risks And Take Effective Risk Management Measures When Choosing TMS For Trading.