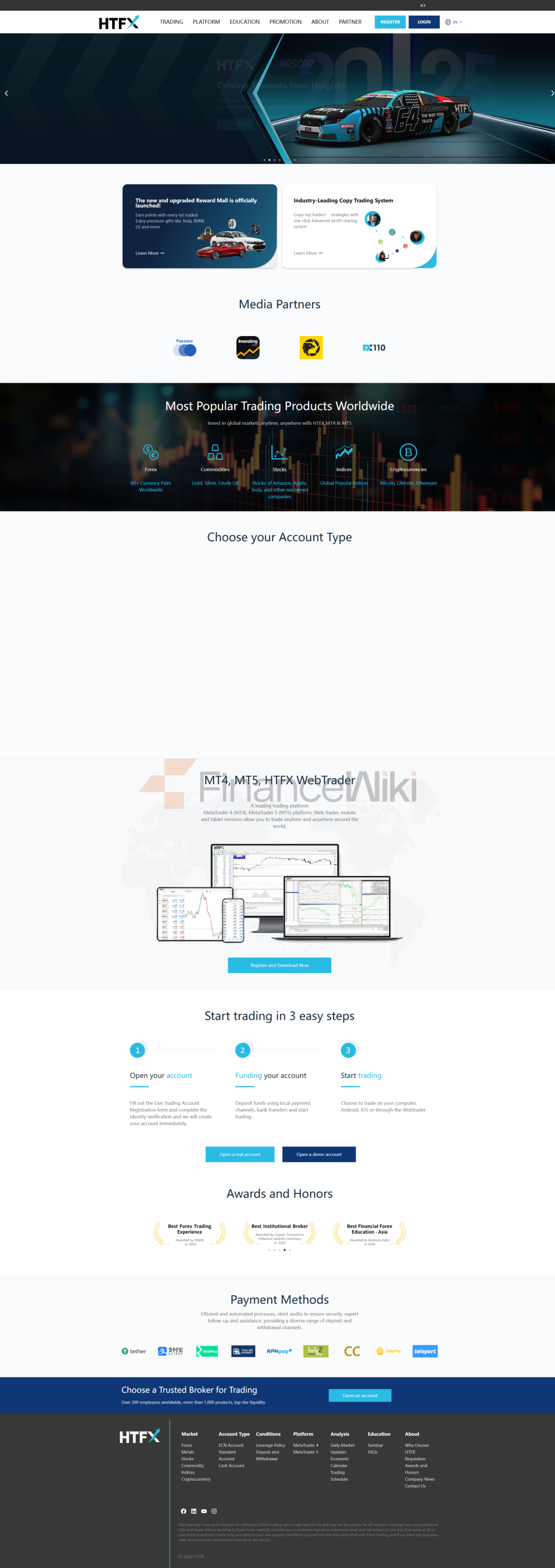

The HTFX Brand Was Established In 2018 And Is A Leading Global Financial Services Company. It Holds Multi-country Licenses Including FCA (Financial Conduct Authority), CySEC (Cyprus Securities And Exchange Commission), Etc. It Has Offices In Many Regions Such As The UK, Cyprus, Indonesia, Thailand, Malaysia, Vietnam, Taiwan, Hong Kong, Vanuatu, Etc. The HTFX Foreign Exchange Platform Provides CFD Trading Products Such As Foreign Exchange, Precious Metals, Stocks, Indices, Cryptocurrencies, Etc. Provide Mainstream Popular Trading Software Including MT4 And MT5, And A Variety Of Account Types Such As Standard Account, ECN Account, And Cent Account. We Also Provide Global Analysis Tools, Publish In-depth Global Economic Reports Every Day, And Track Real-time Market Dynamics, So That The Global Market Is At Your Fingertips.

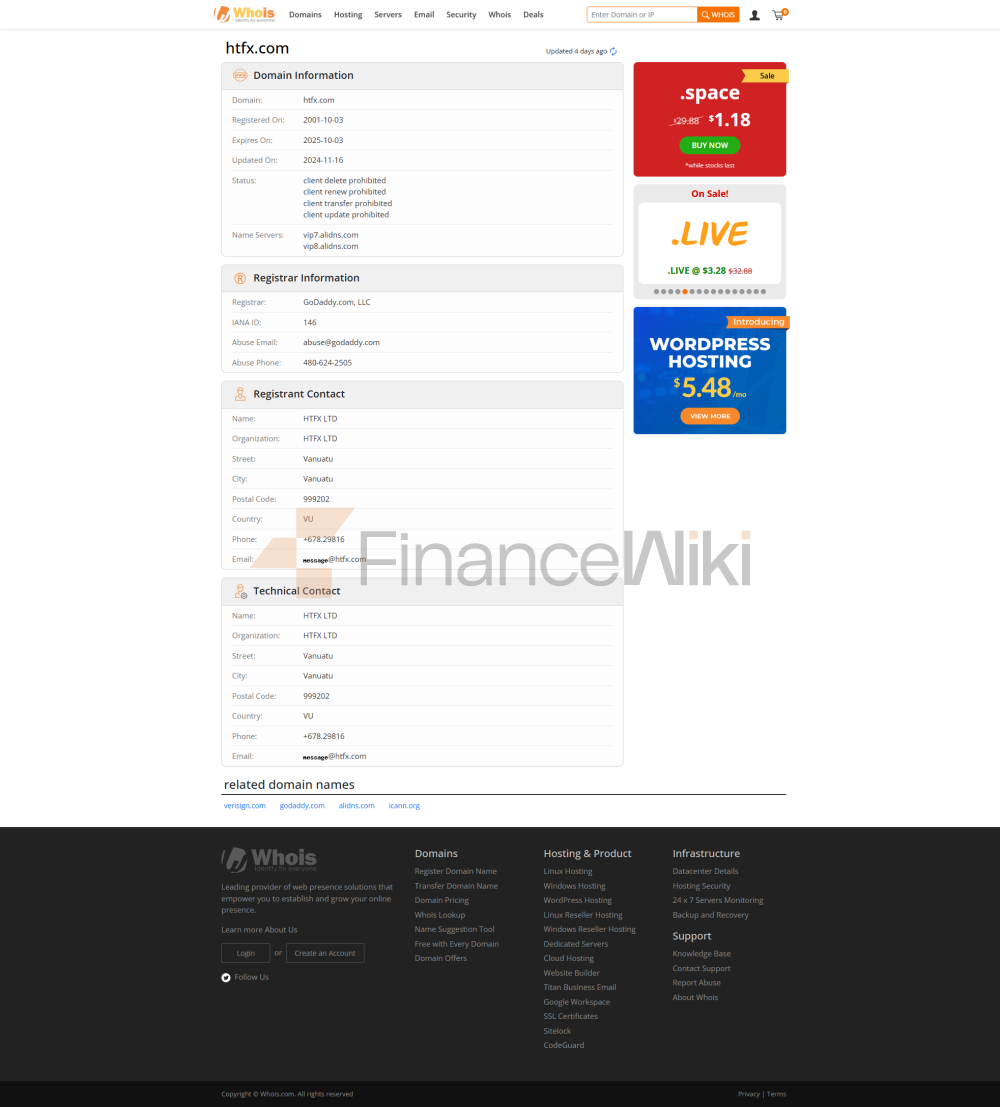

- According To Its Official Website, It Is Currently Regulated By Three Countries, Namely:

- UK Financial Marekt Authority (FCA): HTFX Limited Is Regulated By The FCA And Is Open To Professional Investors. License Number: 822279FCA Is Responsible For Regulating Banking, Insurance And Investment Businesses, Including Securities, And Strictly Supervises All Financial Institution Groups Registered In Its Territory.

- Cyprus Securities And Exchange Commission (CYSEC): HTFX EU Limited Is Regulated By CYSEC. License Number: 332/17, Cyprus Securities And Exchange Commission, Abbreviated As "CySEC", Is The Financial Regulator In The Republic Of Cyprus.

- Vanuatu Financial Services Commission (VFSC): HTFX VU Limited Is Regulated By Vanuatu Financial Services Commission VFSC License Number: 700650

HTFX · Company Profile

HTFX Overview

HTFX Is A Well-known Forex Broker Based In The United Kingdom, Regulated By The FCA And CySEC. Minimum Deposit Is 50 Dollars And Maximum Leverage Is Up To 1:500, Offering Competitive Spreads From 0 Pips.

Traders Can Use The MetaTrader4 (MT4) And MetaTrader5 (MT5) Platforms To Trade A Wide Range Of Assets Including Forex, Precious Metals, Commodities, Cryptocurrencies And Stocks. HTFX Offers Standard Accounts, Sub-accounts And ECN Accounts, As Well As Demo Account Options.

Customer Support Is Available Via Email And Website Request Forms. Deposits And Withdrawals Can Be Made Via T Ether, Skrill, Bank Transfer, Bitcoin, Fasapay And Neteller. Traders Can Also Benefit From Educational Resources Such As The Economic Calendar.

Is HTFX Legal Or Fraudulent?

HTFX Is A Regulated Forex Broker, Regulated By The UK Financial Conduct Authority (FCA) And The Cyprus Securities And Exchange Commission (CySEC). The Broker Holds A Straight-through Processing (STP) License, Ensuring Transparent And Efficient Execution Of Clients' Trades. HTFX's FCA License Number Is 822279 And CySEC License Number Is 332/17.

Being Regulated By These Reputed Bodies Means Compliance With Strict Financial And Operational Standards, Providing Traders With A Certain Confidence And Security When Conducting Trading Activities With HTFX.

Pros And Cons

As A Forex Broker Regulated By The UK Financial Conduct Authority (FCA) And The Cyprus Securities And Exchange Commission (CySEC), HTFX Offers Several Advantages. It Offers Low Minimum Deposits (50 Dollars), High Maximum Leverage (up To 1:500) And Tight Spreads From 0 Pips.

Traders Can Use The Popular MetaTrader 4 And MetaTrader 5 Platforms And Choose From A Variety Of Tradable Assets. The Broker Offers Three Account Types To Suit The Preferences Of Different Traders, While Also Offering Demo Accounts For Practice. In Addition, HTFX Offers Responsive Customer Support And Multiple Deposit And Withdrawal Options. However, Customer Support Channels Are Limited.

Market Tools

HTFX Offers Its Clients A Diverse Range Of Trading Products, Including:

1. Forex: Offers A Wide Selection Of Currency Pairs, Enabling Traders To Participate In The Forex Market And Trade The Value Of One Currency Relative To Another.

2. Precious Metals: Trade Precious Metals Such As Gold, Silver, Platinum, And Palladium. These Precious Metals Are Often Viewed As Safe Haven Assets And Can Be Used To Diversify.

3. Commodities: Trade A Wide Variety Of Commodities Such As Crude Oil, Natural Gas, Agricultural Commodities. These Commodities Provide Exposure To Global Economic Trends And Geopolitical Developments.

4. Indices: Access To Major Stock Market Indices From Around The World, Allowing Traders To Speculate On The Overall Performance Of A Particular Stock Market.

5. Energy: Trade Energy Products Such As Crude Oil And Natural Gas, Which Are More Affected By Supply And Demand Dynamics And Geopolitical Factors.

6. Cryptocurrences: Trade In Popular Cryptocurrencies Such As Bitcoin, Ethereum, Litecoin, Etc. Cryptocurrences Are Known For Their High Volatility, Offering The Potential For Large Price Swings.

7. Stocks: Access To A Variety Of Individual Company Stocks, Enabling Traders To Invest In Specific Companies And Participate In Their Performance In Financial Marekts.

By Offering A Wide Range Of Trading Products, HTFX Offers Its Clients The Flexibility To Explore Various Financial Marekts And Implement Different Trading Strategies Based On Their Preferences And Market Outlook.

Account Types

HTFX Offers Three Types Of Trading Accounts To Suit The Preferences Of Different Traders.

The Standard Account Requires A Minimum Deposit Of 50 Dollars And Access To A Wide Range Of Trading Instruments, Including Forex, Precious Metals, Commodities, Indices, Energy, Cryptocurrencies And Stocks. Traders Can Trade Using An Expert Advisor (EA) And Using Leverage Up To 1:500. The Account Has An Overnight Interest Swap Fee, But No Commission, With Spreads Starting At 1.5 Pips.

For Traders Seeking A Smaller Starting Deposit, The Cent Account Also Requires 50 Dollars To Start Trading. It Offers Similar Features To The Standard Account, Including Access To Forex And Precious Metals Instruments, The Option To Use The EA, And Leverage Up To 1:500. The Account Also Incurs An Overnight Interest Swap Fee, But Like The Standard Account, No Commission Is Charged And Spreads Start At 1.5 Pips.

For Users Seeking A More Advanced Trading Experience, The ECN Account Requires A Higher Starting Deposit Amount Of 500 Dollars. It Offers A Wider Range Of Trading Tools Including Forex, Precious Metals, Commodities, Indices, Energy, Cryptocurrencies And Stocks. Traders Can Take Advantage Of The EA And Enjoy Lower Spreads Starting From 0 Pips.

However, This Account Has A Commission Of 7 Dollars Per Lot Traded. Similar To Other Accounts, The ECN Account Has Leverage Up To 1:500 And Incurs Overnight Interest Processing Fees.

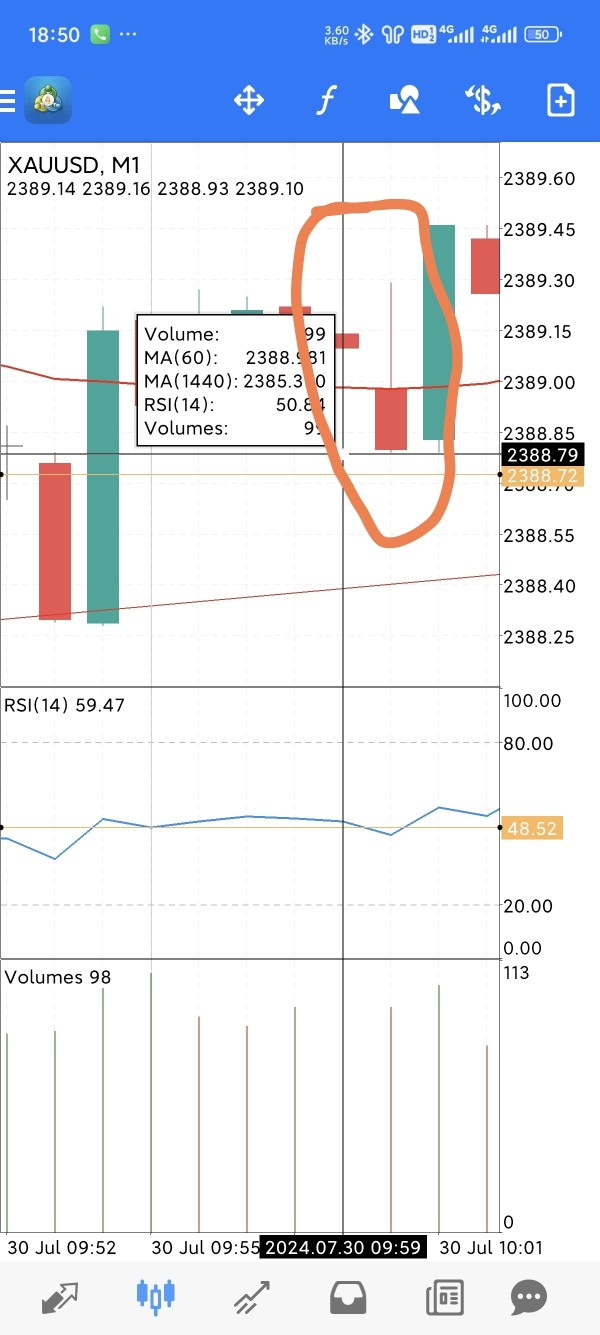

Serious Slippage

Serious Slippage