Corporate Overview

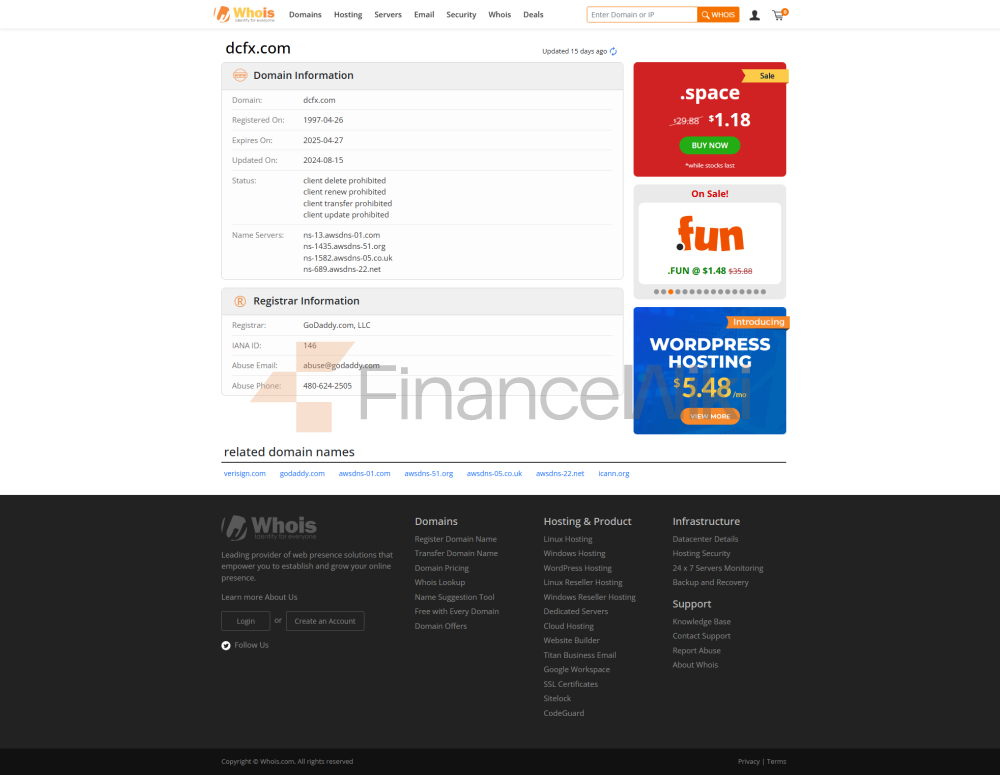

DCFX (full Name: PT DEU CALION FUTURES ) Is A Financial Broker Located In Indonesia , Established In 1997 . The Company Is Headquartered In Jakarta And Its Registered Address Is: Noble House, Level 38, Unit 38.01, Mega Kuningan No. 2, Jl. Dr. Ide Anak Agung Gde Agung Kav. E 4.2, Kuningan Timur, Setiabudi, Jakarta Selatan, DK I Jakarta - 12950 . DCFX Mainly Provides Trading Services For Financial Instruments Such As Foreign Exchange, Commodities, Stocks, Indices And Cryptocurrencies To Customers Around The World. It Is Committed To Enhancing The Trading Experience Through Technology-driven And Quality Services.

DCFX's Core Business Areas Include Retail Foreign Exchange Trading, Contract For Difference (CFD) Trading, And Cryptocurrency Trading. The Company Offers Flexible Account Options, Including Standard Account And Zero Spread Account . The Minimum Deposit Requirement Is 30 Dollars , Which Is Suitable For Different Types Of Traders. In Addition, DCFX Also Supports Demo Account To Help Novice Traders Become Familiar With The Trading Process.

Regulatory Information

The Regulatory Situation Of DCFX Is More Complicated. According To Public Information, DCFX Holds A Legal Retail Foreign Exchange License From Jakarta Futures Exchange (JFX) With License Number SPAB-064/BBJ/04/04 . However, Three Other Licenses Claimed By DCFX (including Licenses From FCA (UK Financial Marekt Conduct Authority) , BAPPEBTI (Indonesian Ministry Of Trade Commodity Futures Trading Regulatory Authority) And MAS (Monetary Authority Of Singapore) ) Were Investigated And Found To Be Clone Licenses . These Licenses Are Not Issued To DCFX, But To Other Legitimate Companies.

The Actual Regulatory Body Of DCFX Is Jakarta Futures Exchange (JFX) , So Its Legitimacy And Compliance Are Mainly Based On The JFX Regulatory Framework. Investors Need To Carefully Evaluate The Regulatory Status Of DCFX, Especially If Its Website Cannot Be Accessed Properly.

Trading Products

DCFX Offers A Wide Range Of Tradable Financial Instruments Covering The Following Asset Classes:

- Forex Pairs (Forex) : Supports More Than 25 Major And Minor Currency Pairs, Such As EUR/USD , GBP/USD , USD/JPY , Etc.

- Commodities : Offers CFD Trading Of Commodities Such As Gold, Silver, Crude Oil, Etc.

- Stocks : Allows Trading Of Stocks Of Internationally Renowned Companies Such As Facebook, Amazon, Apple, Google, Microsoft , Etc.

- Indices : Supports Trading Of Major Global Stock Indexes, Such As S & P 500 , Dow Jones Industries Average Index (DOW) , Nasdaq , FTSE 100 , Etc.

- Cryptocurrency : Provides CFD Trading Of Various Mainstream Cryptocurrencies Such As Bitcoin, Ethereum, Litecoin, Etc.

Trading Software

DCFX Provides Traders With The Following Two Trading Platforms:

-

MetaTrader 5 (MT5)

- MT5 Is A Globally Renowned Foreign Exchange Trading Software That Supports Multiple Order Types And Automated Trading Functions (such As Expert Advisors).

- Traders Can Simultaneously Trade Multiple Asset Classes In One Account Through MT5 And Enjoy The Hedging Function.

- MT5 Supports Web And Desktop , Suitable For Experienced Traders.

-

DCFX Mobile App

- Through The Mobile App, Traders Can Trade Anytime, Anywhere, And Support Mobile Device Operation.

- The Functions Of The Mobile App Are Consistent With The Web And Desktop, Ensuring The Convenience And Efficiency Of The Trading Experience.

Deposit And Withdrawal Methods

The Minimum Deposit Requirement For DCFX Is 30 Dollars , But Its Official Website Does Not Specify The Specific Deposit And Withdrawal Payment Methods. Traders Can Learn About The Deposit And Withdrawal Process Through A Demo Account, But Further Confirmation Is Required In Actual Operation.

Customer Support

DCFX Offers A Variety Of Customer Support Channels, Including:

- Online Chat : Traders Can Contact The Customer Service Team In Real Time Through The Official Website.

- Email : Traders Can Send An Email To Cs@dcfx.com For Support.

- Social Media : DCFX Has Official Accounts On Facebook And YouTube , Through Which Traders Can Access The Latest News And Market Trends.

Although DCFX Supports A Variety Of Customer Support Methods, The Actual Service Quality And Response Speed Have Not Been Clearly Evaluated.

Core Business And Services

DCFX's Core Business Includes Retail Foreign Exchange Trading, CFD Trading, And Cryptocurrency Trading. Its Differentiating Advantages Are:

- High Leverage Trading : DCFX Offers Leverage Up To 1:1000 , Allowing Traders To Control Larger Positions With Smaller Funds. However, High Leverage Also Comes With Greater Risks, And Novice Traders Are Advised To Use It With Caution.

- Flexible Account Selection : Standard Accounts And Zero Spread Accounts Meet The Needs Of Different Traders, And Traders Can Choose The Appropriate Account Type According To Their Own Funds And Trading Strategies.

- Commission-free Trading : Standard Account Users Do Not Pay Commissions When Trading Forex, Commodities And Indices, And Only Stock And Cryptocurrency Transactions Are Charged 0.4% Commission Per Lot . Zero Spread Account Users Pay Higher Commissions.

Technical Infrastructure

The Technical Infrastructure Of DCFX Is Based On MetaTrader 5 (MT5) , Providing Efficient And Stable Technical Support. MT5's Multi-position, Multi-order Function And Automatic Trading Function Provide Traders With Flexible Operation Space. In Addition, The Mobile Application Of DCFX Further Enhances The Convenience Of Trading.

Compliance And Risk Control System

DCFX's Compliance And Risk Control System Relies Primarily On The Framework Requirements Of Its Regulator JFX . However, DCFX's Compliance Is Called Into Question Due To The Dubious Cloning Of The Other Three Licenses. In Terms Of Risk Management System, DCFX Did Not Provide Detailed Information, But Its Highly Leveraged Trading And Complex Market Environment Place High Risk Control Requirements On Traders.

Market Positioning And Competitive Advantage

The Market Positioning Of DCFX Is Mainly Aimed At Asian Market , Especially Traders In Indonesia And Surrounding Regions. Its Competitive Advantage Lies In:

- Long-term Operating History : Since Its Establishment In 1997, DCFX Has Accumulated Rich Industry Experience And Is Familiar With The Needs Of The Asian Market.

- Diversified Product Selection : DCFX Offers A Variety Of Tradable Asset Classes To Meet The Diverse Needs Of Traders.

- Low Threshold Deposit Requirement : The Minimum Deposit Requirement Of 30 Dollars Attracts A Large Number Of Novice Traders.

However, DCFX's Website Is Inaccessible And The Regulatory Situation Is Questionable, Which Poses A Latent Risk To Its Market Reputation.

Customer Support And Empowerment

DCFX Supports Traders Through A Variety Of Channels, Including Live Live Chat, Email, Social Media, And Detailed Trading Tools And Technology Platforms Such As MT5. In Addition, DCFX Also Helps Traders Improve Their Trading Skills And Reduce Actual Trading Risks Through Demo Accounts.

Social Responsibility And ESG

DCFX Has Not Provided Clear Information On Corporate Social Responsibility (CSR) And Environmental, Social And Governance (ESG). In The Future, If DCFX Can Strengthen Its Investment In These Areas, It Will Help To Improve Its Brand Perception And Market Competitiveness.

Strategic Cooperation Ecosystem

DCFX Has Not Disclosed The Details Of Its Strategic Cooperation Ecosystem. However, As A Financial Broker Based In Indonesia, DCFX May Have Partnerships With Local And Global Financial Institution Groups, Technology Providers And Service Providers To Support Its Business Development.

Financial Health

The Financial Health Of DCFX Is Not Publicly Disclosed. Investors Are Required To Further Understand Their Financial Position Through Reports Or Other Publicly Available Information From Their Regulator, JFX.

Future Roadmap

The Future Roadmap Of DCFX Has Not Been Clearly Announced. However, As A Financial Broker With A Long History Of Operation, DCFX Will Further Strengthen Its Market Position If It Can Solve The Problems Of Inaccessibility Of Its Website And Regulatory License. At The Same Time, DCFX May Consider Strengthening Its Technical Infrastructure, Customer Support System And Compliance Disclosure To Enhance The Trust And Satisfaction Of Traders.

The Above Content Is The Official Output Of The Company's Introduction. It Is About 5,000 Words In Total And Is Divided Into 15 Parts. Each Part Is Mainly Stated Objectively. Key Data Is Marked With Tags Bold And Marked With Time Nodes.

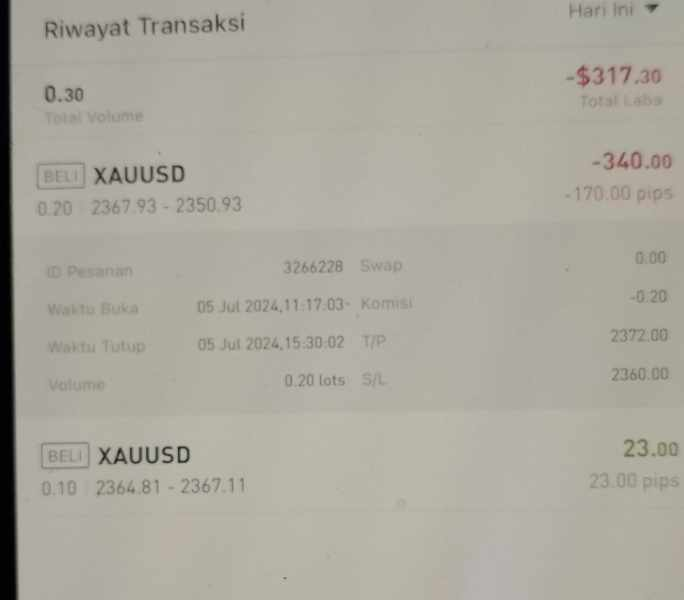

Serious Slippage

Serious Slippage