Corporate Overview

Britannia Financial Group (Britannia For Short) Is A Global Financial Services Company Headquartered In London And Bahamas . The Company Was Established In 20XX With A Registered Capital Of XXX Million Pounds And Incorporated In The Bahamas. Britannia Provides A Comprehensive Range Of Financial Services To Clients Around The World, Including Trading, Wealth Management, Private Banking And Trust Solutions. Its Business Scope Covers Four Main Categories: Trading, Global Investments, Banking And Trusts, And Securities. With Over 20 Years Of Industry Experience, The Firm Is Committed To Providing A Diverse Range Of Services To Individual Investors, High Net Worth Individuals And Institutions.

Regulatory Information

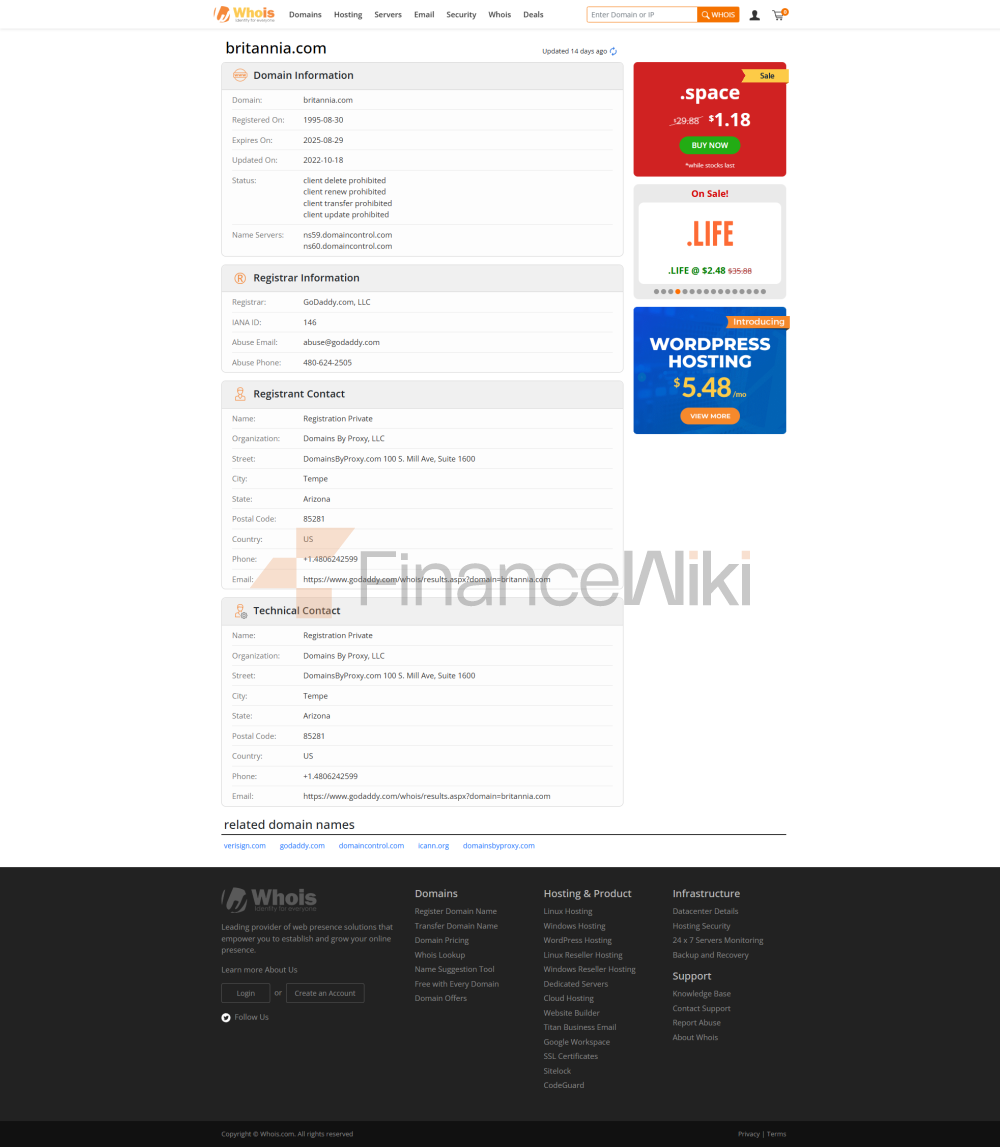

Britannia Is Currently In Status Beyond The Regulation Of The UK Financial Conduct Authority (FCA) With Its FCA License Number 739949 . This Status May Create Latent Risks For Investors Seeking Additional Protection And Regulatory Oversight. Additionally, Britannia's Operations In The Bahamas Are Regulated By Local Financial Regulators, Ensuring Compliance With Its Services. The Company Emphasizes The Protection Of Customer Data In Its Privacy Policy, Employing Advanced Encryption Technology And Strict Security Measures To Prevent Data Leakage.

Trading Products

Britannia Offers A Diverse Range Of Trading Products, Including:

- Futures : Covers Major Global Markets Such As The London Stock Exchange And The Dubai Gold And Commodities Exchange. Options : Offers Flexible Investment Strategies That Adapt To Different Risk Preferences.

- Forex : Coverage Of Major Global Currency Pairs To Ensure Liquidity.

- Stocks : Connect Major Global Stock Markets To Provide Diversified Investment Opportunities.

- Commodities : Includes Precious Metals, Energy And Other High-demand Commodities.

Trading Software

Britannia Provides Traders With Advanced Trading Software That Supports Multi-platform Operation (including PC, MAC And Mobile Devices). The Software Features Powerful Market Analysis Tools, Including Real-time Charts, Technical Indicators, And Market Data. In Addition, Traders Can Access Market Depth And Order Flow On Major Global Exchanges Through This Platform.

Deposit And Withdrawal Methods

Britannia Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Transfer : Fast Access To Funds Through International Or Local Bank Transfers.

- Credit/Debit Card : Supports Mainstream Payment Methods Such As Visa And MasterCard.

- E-Wallet : Convenient Deposits And Withdrawals Through E-wallets Such As PayPal.

Customer Support

Britannia Provides Multi-channel Customer Support Services To Meet The Needs Of Different Customers:

- Telephone Support : Provides 24/7 Multilingual Client Server To Ensure Timely Response.

- Email Support : Customers Can Contact Relevant Business Departments Through Dedicated Mailboxes.

- Live Chat : Resolve Clients' Transaction And Account-related Issues In Real Time.

Core Business And Services

Britannia's Core Business Includes The Following Four Areas:

- Transaction Services : Provide Retail And Institutional Clients With Access To Global Markets, Supporting Transactions In A Variety Of Financial Instruments.

- Global Investments : Provide Customized Wealth Management, Asset Management, And M & A Advisory Services To High Net Worth Individuals And Institutions.

- Banking & Trust : Provides Private Banking And Trust Solutions To International Clients While Enjoying Tax Advantages Through Britannia Bank & Trust, Located In The Bahamas.

- Securities Services : Provides A Full Range Of Securities Brokerage Services Covering Wealth Management, Asset Management And M & A Advisory.

Technology Infrastructure

Britannia Has A Robust Technology Infrastructure To Support Its Global Financial Services. The Company Adopts The AIoT Risk Control System To Monitor Trading Risks In Real Time Through Artificial Intelligence And IoT Technology. In Addition, Its Trading System Supports High-frequency Trading, Ensuring Low Latency And High Efficiency. The Company Also Regularly Updates Its Security Protocols To Comply With The Latest Data Protection Regulations.

Compliance And Risk Control System

Despite Currently Being Outside The FCA Regulatory Status, Britannia Still Follows A Strict Compliance And Risk Control System. The Company Ensures That Its Business Operations Are Transparent And Compliant With Industry Standards Through The Compliance Statement . Its Risk Management System Includes:

- Market Risk : Reduce Risk Through A Diversified Portfolio And Real-time Market Monitoring.

- Operational Risk : Use Advanced Technology To Ensure The Stability Of The Trading Process.

- Credit Risk : Strict Customer Screening And Credit Evaluation Mechanism.

Market Positioning And Competitive Advantage

Britannia Has The Following Competitive Advantages In The Market:

- Diversified Services : Provide Comprehensive Services Such As Trading, Wealth Management, Private Banking, Etc. On One Platform. Global Coverage : Connect Major Global Markets To Provide Clients With A Wealth Of Investment Opportunities.

- Tax Advantage : Banking And Trust Businesses Located In The Bahamas Provide Clients With Tax-neutral Advantages.

Customer Support And Empowerment

Britannia Is Committed To Providing A Full Range Of Services And Support To Its Clients Through Its Customer Support Center . Its Support Team Is Composed Of Experienced Financial Professionals Who Are Able To Provide Professional Market Analysis And Investment Advice To Clients. In Addition, The Company Regularly Holds Investor Education Events To Help Clients Improve Their Investment Skills.

Social Responsibility And ESG

Britannia Values Its Social Responsibility And Actively Participates In Community Building And Charitable Activities. The Company Integrates Environmental (E), Social (S) And Corporate Governance (G) Principles In Its Operations To Ensure That Its Business Activities Have A Positive Impact On The Environment And Society.

Strategic Collaboration Ecology

Britannia Has Established Strategic Partnerships With Several Well-known Financial Institution Groups And Fintech Companies Around The World. These Collaborations Not Only Enhance Its Technical Prowess, But Also Provide Its Clients With A Wider Range Of Services And Market Opportunities.

FINANCIAL HEALTH

As Of The Third Quarter Of 2023, Britannia's Management Size Has Reached XX Billion US Dollars . The Company Has Maintained Stable Financial Performance Through Diversified Products And Services, Providing Long-term Value Growth For Its Shareholders And Customers.

Future Roadmap

Britannia Plans To Further Expand Its Global Presence In The Coming Years, Particularly In The Asia-Pacific And Middle East Markets. The Company Also Plans To Enhance Its Technology Infrastructure And Enhance The Trading Experience And Customer Support Services.