Corporate Profile

INVAXA Is A Seychelles-registered Forex Broker, Established In 2022 And Headquartered In CT House, Office 9A, Providence, Mahe, Seychelles . As An Offshore Regulated Enterprise, INVAXA Offers Trading Services To Traders Around The World On A Wide Range Of Financial Instruments, Including Forex, Stocks, Commodities, Cryptocurrencies, Indices And Futures. INVAXA's Corporate Architecture Is Designed To Meet The Needs Of Different Types Of Traders, Providing Clients With A Flexible Trading Experience Through A Diverse Range Of Account Types And Trading Tools.

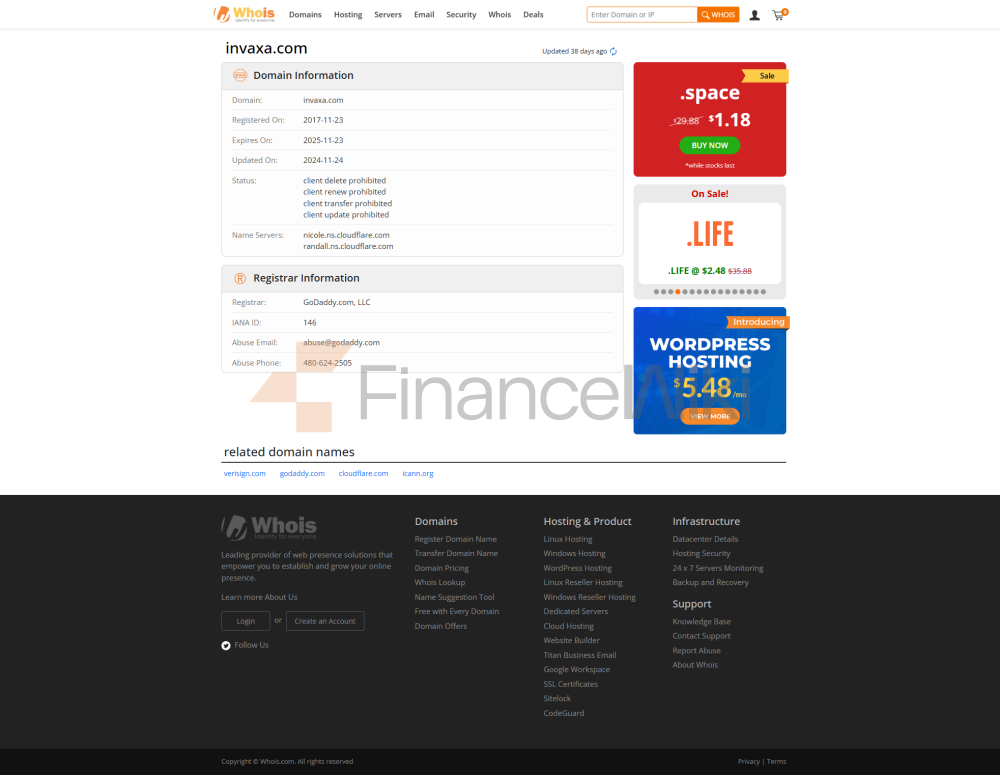

Regulatory Information

INVAXA Is Regulated By The Seychelles Financial Services Authority (FSA) And Holds A Retail Foreign Exchange License With License Number SD103 . This Is An Important Qualification For Its Compliance Operations, Ensuring That Its Trading Activities Comply With Relevant Laws And Regulations. Although INVAXA Is Regulated By An Offshore Regulator, The Legality And Transparency Of Its License Require Additional Attention.

Trading Products

INVAXA Offers A Diverse Product Selection Covering The Following Five Asset Classes:

- Forex : Offers Trading In Over 50 Currency Pairs.

- Stocks : Allows Trading Of Multiple Stock Indices And Individual Stocks.

- Commodities : Including Trading Of Commodities Such As Gold And Crude Oil.

- Cryptocurrency : Supports Trading Of Mainstream Cryptocurrencies Such As Bitcoin And Ethereum.

- Index : Provides Trading Of Multi-country Stock Indices.

- Futures : Allows Trading Of Multiple Futures Contracts.

Trading Software

INVAXA's Trading Activities Are Conducted Through Its Proprietary Invaxa Platform , Which Supports Desktop And Mobile End (iOS, Android) Operations. The Main Features Of The Platform Include:

- Copy Trading Function: Allows Traders To Copy The Strategies Of Other Traders.

- Personalized Expert Advisor: Provides Customized Trading Tools.

- Powerful Technical Indicators: Integrates Multiple Technical Analysis Tools To Support Traders In Conducting In-depth Market Analysis.

Deposit And Withdrawal Methods

INVAXA Allows Customers To Complete Deposits And Withdrawals In The Following Ways:

- Credit Card : Supports A Variety Of Major Credit Cards.

- Telegraphic Transfer : Maximum Processing Time Is 3 To 5 Business Days .

- Electronic Wallet : Provides Fast Processing Of Deposits And Withdrawals.

INVAXA Accepts Currencies Including USD, EUR And GBP And Does Not Charge Any Deposit And Withdrawal Fees.

CUSTOMER SUPPORT

INVAXA Offers Its Clients A Comprehensive Range Of Customer Support Services, Including:

- 24x5 Telephone Support : + 248 4373413.

- Email Support : Support@invaxa.com.

- Access To The Trading Center : Provides Real-time Market Data For All Account Types.

Clients Can Get Help With Trading, Account Management And Technical Support Through These Channels.

Core Business And Services

INVAXA's Core Business Is To Provide Multi-asset Class Trading Services. Its Differentiated Advantages Include:

-

Leverage INVAXA Provides Leverage Up To 1:500 , Allowing Traders To Trade On A Larger Scale With Smaller Funds.

-

Account Types INVAXA Offers Four Account Types:

- Entry-level Account : Minimum Deposit $250 , Commission Starting At 17 Units/lot .

- Entry-level Account : Minimum Deposit $2,500 , Commission Starting At 8 Units/lot .

- Professional Account : Minimum Deposit $10,000 , Commission Starting At 7 Units/lot .

- Elite Account : Minimum Deposit $50,000 , Commission Starting At 6 Units/lot .

Spreads Spreads For Different Account Types Start From 0.1 Pips , Meeting The Needs Of Different Types Of Traders.

No Overnight Interest/Islamic Account Options INVAXA Offers Clients Trading Options Without Overnight Interest To Meet The Needs Of Specific Traders.

Technical Infrastructure

INVAXA's Trading Platform Is Based On The Proprietary Invaxa Platform , Which Provides Traders With A Smooth Trading Experience Through Powerful Technical Indicators And Real-time Market Data Analytics. Its Technical Infrastructure Supports Multi-device Operation, Ensuring That Traders Can Complete Their Trades In Any Situation.

Compliance And Risk Control System

INVAXA's Compliance Statement Is As Follows:

- Compliance : INVAXA Strictly Complies With The Regulatory Requirements Of The Seychelles Financial Services Authority (FSA) To Ensure The Transparency And Legality Of Its Trading Activities.

- Risk Warning : There Are High Risks In Financial Marekt Trading, And Traders Need To Choose The Appropriate Trading Strategy According To Their Risk Tolerance.

Market Positioning And Competitive Advantage

INVAXA's Main Market Positioning Is To Serve Traders On A Global Scale. Its Competitive Advantages Include:

- Multi-asset Class Trading : Offer A Comprehensive Selection Of Financial Products.

- Low Spreads And Commission Structures : Offer Traders Affordable Trading Costs.

- Flexible Account Selection : Meet The Needs Of Traders From Novice To Professional.

Customer Support And Empowerment

INVAXA Is Committed To Providing Its Clients With Comprehensive Trading Support, Including Real-time Market Data, Personalized Advisors And Professional Risk Management Tools. These Services Are Designed To Help Traders Make Informed Decisions In Complex Market Environments.

Social Responsibility And ESG

Although INVAXA Does Not Explicitly Mention Social Responsibility And ESG Related Content In Its Corporate Introduction, As A Regulated Enterprise, Its Compliance Operations And Risk Management Measures Are An Important Manifestation Of Its Social Responsibility.

Strategic Cooperation Ecology

INVAXA Has Not Yet Announced The Relevant Information Of Its Strategic Cooperation Ecology.

Financial Health

INVAXA Has Not Disclosed The Relevant Data Of Its Financial Health, Including Registered Capital And Management Scale.

Future Roadmap

INVAXA Has Not Announced Its Future Roadmap, Including Long-term Plans Such As Product Expansion And Market Expansion.