Corporate Profile

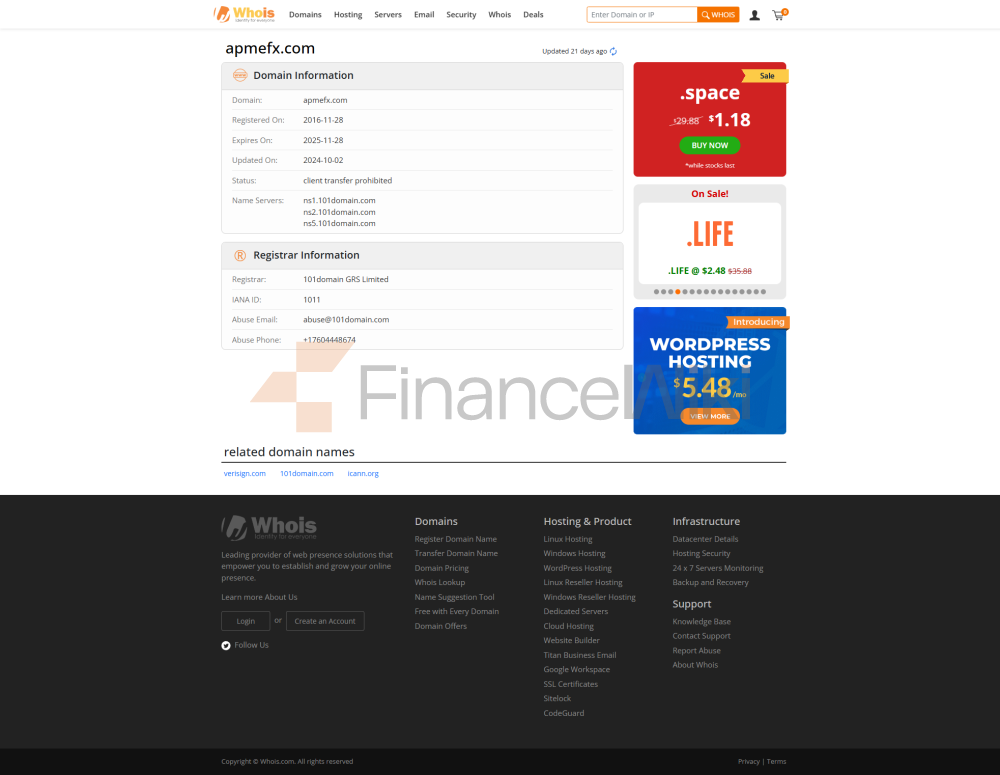

APME FX Is An Online Trading Platform Located In Cyprus , Regulated And Licensed By The Cyprus Securities And Exchange Commission (CySEC). The Full Name Of The Company Is APME FX , Established In 2017 , With A Registered Capital Of 1 Million Euros And Its Headquarters In Nicosia, Cyprus. As A Regulated Cyprus Investment Company (CIF), APME FX Aims To Provide Safe And Transparent Financial Trading Services To Traders Worldwide.

Through The Use Of The MetaTrader 5 (MT5) Platform, The Company Provides Its Clients With A Diverse Range Of Trading Tools, Including Foreign Exchange, Options, Futures And Swaps , And Supports A Variety Of Deposit And Withdrawal Methods. APME FX's Executive Team Has Extensive Industry Experience, And Its Core Members Have Served Well-known Financial Institution Groups, Providing A Solid Foundation For The Company's Stable Operation.

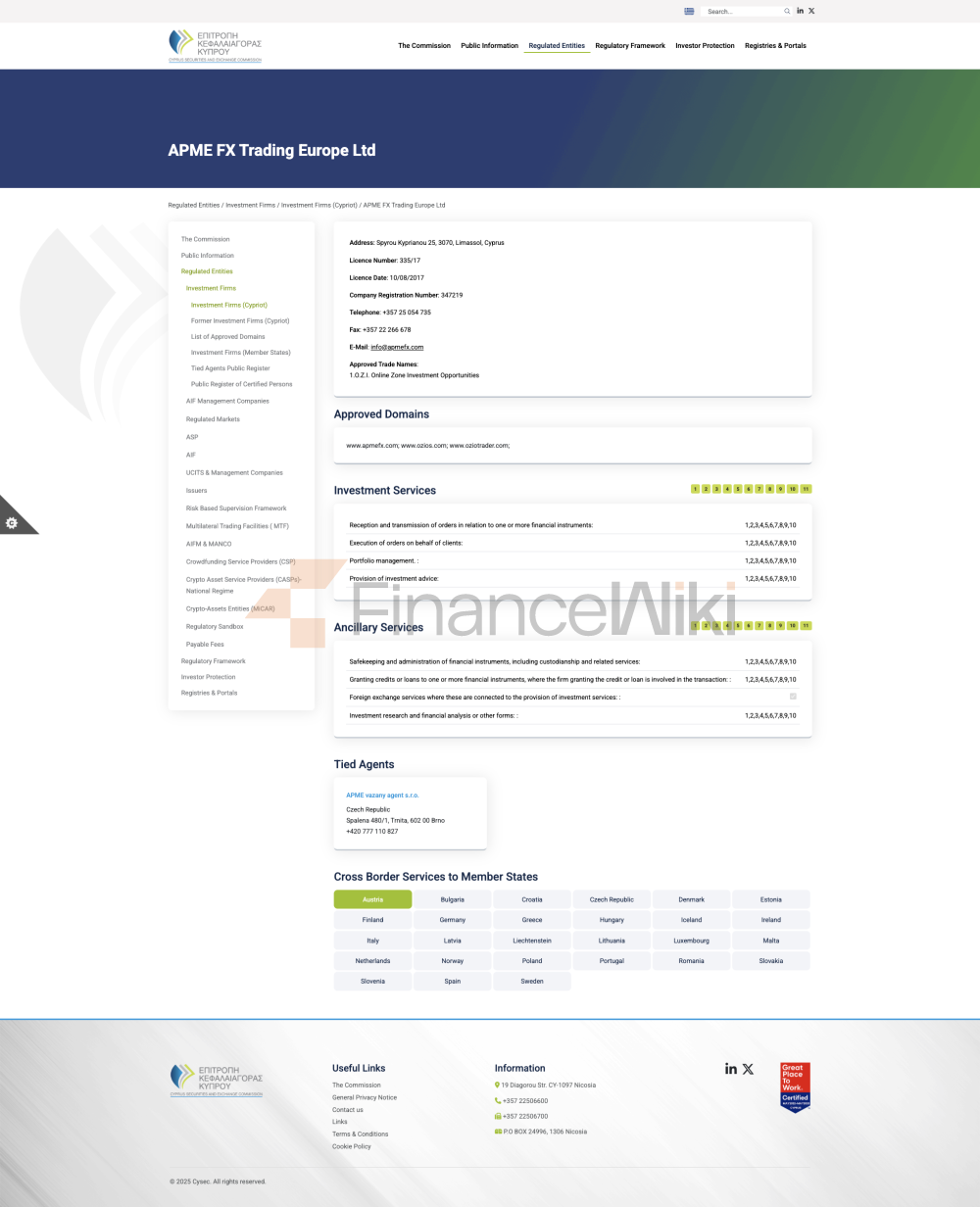

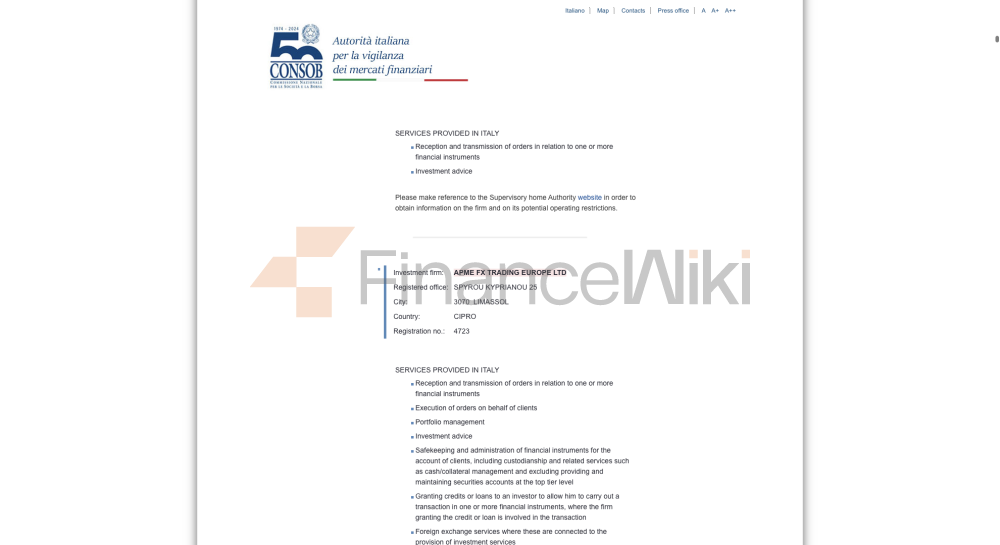

Regulatory Information

APME FX, As A Regulated Cyprus Investment Company (CIF), Holds A CIF License Issued By CySEC With License Number 335/17 .

- Regulatory Authority : Cyprus Securities And Exchange Commission (CySEC)

- Regulatory Advantages : CySEC Is An Authoritative Regulator Recognized By The European Union, Ensuring That Brokers Meet High Standards In Terms Of Capital, Operations And Compliance. Compliance Statement : APME FX Strictly Complies With The European Union General Data Protection Regulation (GDPR), Anti-Money Laundering (AML) And Counter-Terrorism Financing (CFT) Regulations, Providing Clients With A Safe And Secure Trading Environment.

Trading Products

APME FX Offers A Wealth Of Trading Tools Covering The Following Categories:

- Forex (Forex) : Supports Major Currency Pairs And Cross-currency Pairs Such As EUR/USD, GBP/USD, Etc.

- Options : Includes Buy Options And Sell Options , Allowing Traders To Buy Or Sell The Underlying Asset At A Fixed Price For A Specified Period Of Time.

- Futures : Provides Standardized Contracts For Hedging Market Risk Or Speculative Trading. The Underlying Assets Include Commodities, Stock Indices, And Interest Rates .

- Swaps : Allows Traders To Exchange Assets At Pre-agreed Prices For Hedging The Risk Of Exchange Rate Or Interest Rate Fluctuations.

Trading Software

APME FX Uses MetaTrader 5 (MT5) As Its Core Trading Platform, Which Is Popular For Its Power And User-friendliness.

- Platform Features :

- Support Multi-language Interface (including English, Chinese, Etc.).

- Provide Technical Analysis Tools (such As Charts, Indicators), Economic Calendar And News To Help Traders Develop Strategies.

- Equipped With Mobile Trading Function , Support IOS And Android Devices, Ensure That Traders Can Operate Anytime, Anywhere.

- Customization : MT5 Allows Traders To Automate Trading With Custom Indicators And Strategies, Meeting The Needs Of Professional Investors.

Deposit And Withdrawal Methods

APME FX Offers A Variety Of Deposit And Withdrawal Methods, Including:

- Credit/Debit Cards : Support VISA And MasterCard.

- Bank Transfer : International Bank Transfer Services Are Available.

- Electronic Wallet : Supports Mainstream Payment Platforms Such As Skrill And Neteller.

Traders Need To Pay Attention To The Specific Processing Fee And Arrival Time Of Deposits And Withdrawals. The Specific Information Can Be Inquired Through Customer Support.

Customer Support

APME FX Provides Traders With 24/7 Multi-channel Support Services:

- Telephone Support : Dial The Headquarters + 357-25-054 -734 Or The Order Department + 357-25-054 -739 .

- Fax Service : Send A Fax Via + 357-22-266 -678 .

- Email Support : Send An Email To Info@apmefx.com .

The Customer Support Team Can Provide Account Opening Guidance, Trading Advice And Problem Solving To Ensure A Smooth Trader Experience.

Core Business And Services

APME FX's Core Business Covers The Following Areas:

- Retail Forex Trading : Provides Individual Traders With Trading Services On A Variety Of Financial Instruments. Institutional Trading Services : Provides Customized Trading Solutions For Professional Investors And Institutional Clients.

- Risk Hedging Services : Helps Clients Hedge Market Volatility Risks Through Swaps And Futures Products.

Technical Infrastructure

APME FX Relies On Advanced Technical Infrastructure To Ensure The Stability And Security Of Transactions:

- Server Architecture : Adopt Multi-region Distributed Servers To Reduce Latency And Improve Transaction Execution Speed.

- Cyber Security : Use Multiple Encryption Technologies (such As SSL/TLS) To Protect Transaction Data And Prevent Information Leakage.

- System Redundancy : Equipped With Backup Power Supply And Network Connection To Ensure Normal Operation In Extreme Situations.

Compliance And Risk Control System

APME FX Has Established A Strict Compliance And Risk Control System:

- Compliance Framework : Follow CySEC's Capital Adequacy Ratio, Customer Funds Segregated Storage And Other Requirements To Ensure The Safety Of Customer Funds.

- Risk Management Tool : Provides Stop Loss, Take Profit And Limit Orders To Help Traders Control Potential Losses.

- Anti-money Laundering Measures : Verify Customer Identity (KYC Process) And Record All Transaction Flows To Prevent Money Laundering And Fraud.

Market Positioning And Competitive Advantage

The Market Positioning Of APME FX Is Mainly Reflected In The Following Aspects:

- Regulated Platform : As A CySEC Regulated Broker, APME FX Has Advantages In Terms Of Compliance And Security.

- Technology Leadership : The Functionality And Technical Support Of The MT5 Platform Have Attracted A Large Number Of Professional Traders.

- Multilingual Services : Convenient Chinese Interface And Language Support For Non-English Speaking Traders.

Customer Support And Empower

APME FX Empowers Clients In The Following Ways:

- Educational Resources : Trading Guides, Market Analysis Reports And Tutorials For Beginners To Help New Traders Get Started Quickly.

- Market Analysis Tools : The MT5 Platform Has Built-in Multiple Analysis Tools To Help Clients Develop Trading Strategies.

Social Responsibility And ESG

APME FX Is Actively Involved In The Following Activities In Corporate Social Responsibility (CSR):

- Anti-money Laundering Advocacy : Raise Public Awareness Of Money Laundering Risks Through Customer Education.

- Environmental Protection : Support Green Energy Projects And Reduce The Environmental Impact Of Business Operations.

Strategic Cooperation Ecology

APME FX Has Established Strategic Partnerships With Several Financial Institution Groups And Technology Companies, Including:

- Payment Platform : Collaborate With Skrill, Neteller And Others To Improve Payment Efficiency.

- Technology Provider : Collaborate With MetaQuotes (MT5 Development Company) To Optimize The Trading Experience.

Financial Health

APME FX's Financial Position Is Sound. As Of 2023Q3, The Company's Capital Adequacy Ratio Is 18% , Which Is Well Above The Minimum Requirement Of CySEC 10% . This Means That The Company Has A Strong Ability To Resist Risks In The Face Of Market Fluctuations.

Future Roadmap

APME FX Plans To Expand Its Business Scope In The Next Two Years, Including:

- Add Trading Tools : Introduce More Cryptocurrencies And Commodity Futures.

- Developing Emerging Markets : Attracting More Customers In Asia And The Middle East Through Multilingual Services.

- Technological Innovation : Introducing Artificial Intelligence (AI) And Big Data Analytics Technology To Optimize Trading Algorithms And Risk Management.

The Above Is The Company Introduction Of APME FX, Covering Company Background, Regulatory Qualifications, Trading Products, Technology Platform, Customer Support, Etc., For Investors' Reference.