name and background

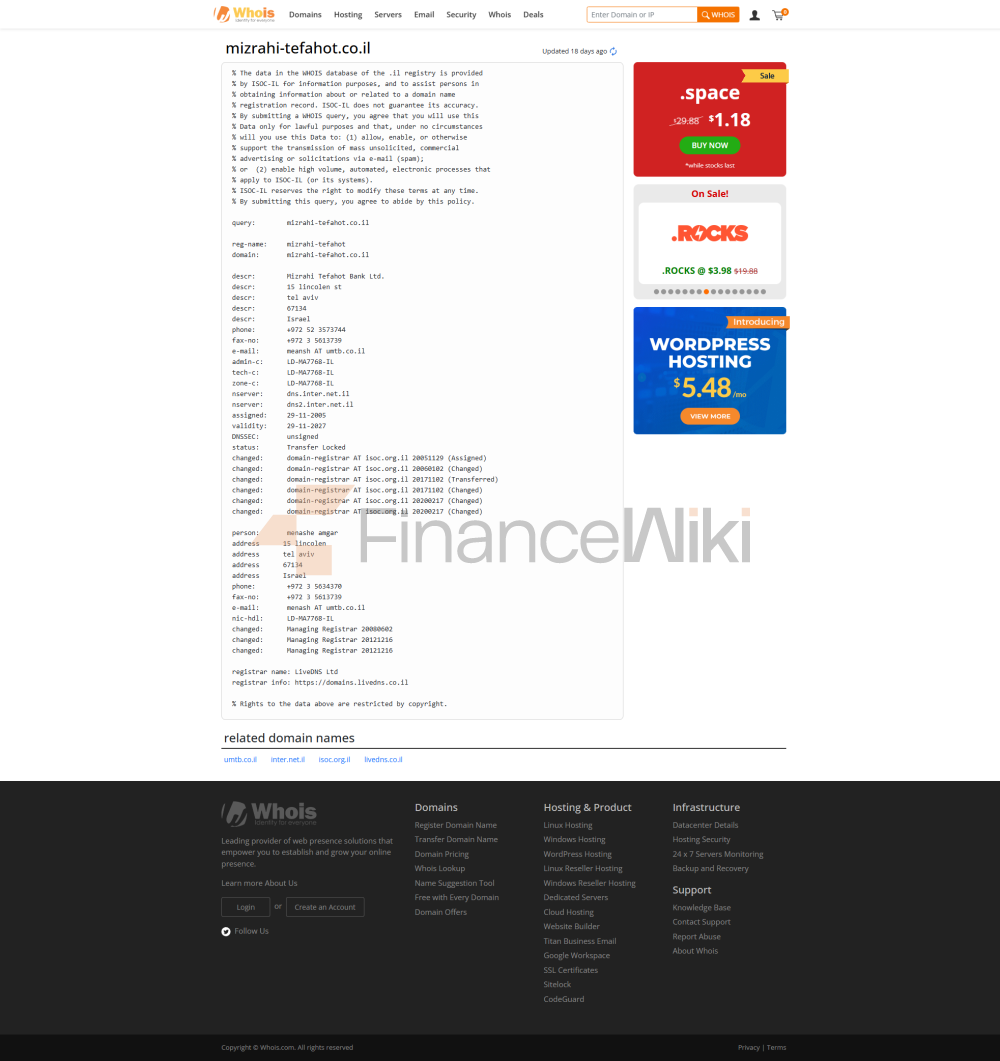

full name: Mizrahi Tefahot Bank Ltd. (Hebrew: בנק מזרחי טפחות)

founded in 1923 by the World Mizrahi Movement, and in 2005 through the United Mizrahi Bank and Tefahot Israel Mortgage Bank merged to form its current name.

Headquarters location: 7 Abba Hillel Silver Road, Ramat Gan, Israel

Shareholder Background:The bank is jointly controlled by the Ofer Group and the Wertheim Group, each holding approximately 20.705% of the shares, totaling 41.41% of the shares, with the remaining shares held by the public, and the bank is listed on the Tel Aviv Stock Exchange (symbol: MZTF). Privatization began in 1995, with the Ofer-Wertheim Group increasing its stake to 51% in 1997, the acquisition of a 50% stake in Bank Yahav in 2008, and the wholly-owned acquisition of Union Bank of Israel in 2020. Since 2020, Moshe Lari has served as Chief Executive Officer and Moshe Vidman has served as Chairman of the Board.

service scope

Coverage area:Bank Mizrahi-Tefahot serves the whole of Israel, covering Tel Aviv, Jerusalem, Haifa, Ashdod, Netaniya and other cities, and has overseas branches in the United Kingdom (London) and the United States (Los Angeles) to support cross-border financial services. The bank works with major global banks through an international network to provide efficient international transaction support.

Number of offline outlets: As of 2024, banking groups (including Bank Yahav and Union Bank) operate approximately 205 branches and business centers covering major cities and regions in Israel.

ATM distribution: The number of ATMs is not disclosed, and they are distributed in branches, business districts, and shopping malls, supporting cash deposits, contactless payments, and cardless withdrawals.

services and products

Bank Mizrahi-Tefahot offers a diverse range of financial services to individuals, families, corporates and high-net-worth clients, with product lines including:

personal banking: Savings accounts, chequing accounts, fixed deposits, mortgages, consumer loans, credit cards (Visa, MasterCard) and investment products are available. Featured services include short-term shekel deposits (1 month to 1 year, interest rates fluctuate with the market) and fast loan approval (within 24 hours).

Corporate Banking: Commercial loans, trade finance (letters of credit, guarantees), cash management, payroll programs, and foreign exchange services for SMEs and large enterprises. Banks use regional business centers to customize financial solutions for enterprises.

Private Banking: provides wealth management, investment advisory and cross-border account services to high-net-worth clients and foreign residents, with dedicated international private banking centers (e.g. Ashdod, Jerusalem, Netaniya).

Capital Markets Services: Offering securities trading, mutual fund and options trading through Etgar Portfolio Management, covering the Tel Aviv Stock Exchange and international markets.

Mortgages: Offers about one-third of the Israeli market mortgages through the "Tefahot" brand, supporting multiple loan tracks.

other services: including pension consulting (based on the Nobel Prize model), trust services (through Mizrahi-Tefahot Trust Company) and letter of credit discounting services.

regulatory and compliance<

span style="font-size: inherit"> regulators:Bank Mizrahi-Tefahot is regulated by the Bank of Israel and follows the Israeli Banking Act and international financial standards such as the Basel Accord.

Deposit Insurance Program: The bank participates in the Israeli Deposit Insurance Program to protect customer deposits, the exact amount of which is not disclosed.

Recent compliance record: The bank's compliance record is generally good, but in 2020 it was included in the UN's list of 112 companies supporting settlement activities in the West Bank and the Golan Heights, which involved international law disputes. In 2021, the Norwegian KLP Pension Fund and other institutions (e.g. PFZW in the Netherlands, United Methodist Church in the United States) divested due to their role in settlement financing. Banks strictly enforce Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations and are subject to regular regulatory scrutiny.

financial health

Bank Mizrahi-Tefahot ranks third in the Israeli banking sector by assets, with the following key metrics (based on 2024 data):

Capital Adequacy Ratio (CAR) : Approximately 12%-15%, higher than the 10% required by the Bank of Israel, indicating a solid capital buffer.

Non-performing loan ratio (NPL): Credit loss provision of NIS 109 million in the second quarter of 2023, down from NIS 247 million in the previous year, and NPL below the industry average of approximately 1%.

Liquidity Coverage Ratio (LCR): 100% above regulatory requirements, maintaining sufficient liquidity through diversified deposits and international funding sources.

total assets of the bank in 2023 will be about NIS 400 billion (about $108 billion), and profits will decline slightly in the fourth quarter of 2024, but dividends will increase, showing financial resilience. S&P Maalot is rated ilAAA (negative outlook) and Fitch is rated A- (negative outlook).

digital service experience<

span style="font-size: inherit">App & Online Banking: Bank Mizrahi-Tefahot's mobile app and online banking (www.mizrahi-tefahot.co.il) have a rating of around 4.2 stars (Google Play and App Store out of 5 stars) and are highly praised for their user-friendly interface and real-time features.

Core features:

Face recognition: fingerprint login is supported, but face recognition is not explicitly supported.

real-time transfers: supports domestic and international transfers, and provides cross-border services through the SWIFT system (code MIZBILIT).

Bill Management: Supports utility bills, mobile recharges, and insurance payments, as well as 18 months of transaction history and tax certificate printing.

integration of investment instruments: supports stocks, mutual funds, and options trading, covering the Tel Aviv Stock Exchange and international markets.

technical innovation:AI customer service: AI customer service is not explicitly provided, but real-time digital assistance is provided via online banking and phone.

Open Banking API: In response to Israel's open banking reform, support API data sharing, and improve fintech integration.

Hybrid Banking: Launched the "Personal Banker" service, which combines branches and digital channels to provide a customized experience.

customer service

Bank Mizrahi-Tefahot offers multi-channel customer service with a focus on personalization:

Phone: Customer Hotline*8860 or + 972-76-8048860 for round-the-clock support.

e-mail: Inquiries (without sensitive information) are handled through the secure message box or abuse@umtb.co.il on the official website.

Live chat: Online banking and mobile apps provide live chat capabilities to respond quickly to customer needs.

Branch services: Face-to-face consultations are available at about 205 branches, and some branches only offer counter services on Mondays and Wednesdays (9:00-14:00, Fridays 9:00-12:00).

security measures

Bank Mizrahi-Tefahot adopts a multi-layered security mechanism:

Anti-Money Laundering & Anti-Fraud: Monitor suspicious transactions in real-time in accordance with the AML/CFT requirements of Israeli banks, and record all transactions as legal evidence.

transaction security: a one-time verification code is required for large-value transfers, and the account will be locked if the password is incorrect for 5 consecutive times.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel.

> network security: online banking uses SSL encryption, multi-factor authentication (password + SMS verification), and obtains ISO 27001 Information Security Management Certification, becoming the first bank in Israel to receive this standard.

featured services and differentiation

Bank Mizrahi-Tefahot stands out in the Israeli banking industry with its unique positioning:

Mortgage Leader: By "Tefahot" The brand accounts for about one-third of Israel's mortgage market, offering fast approvals and multiple loan tracks.

Hybrid banking model: Combining branch and "personal banker" services to provide customers with a seamless online and offline experience, it has been ranked number one in the Israeli Banking Services Survey for the fourth year in a row.

International Private Banking: Customized services for expatriates and newcomers (Olim Chadashim) with dedicated international banking centers (e.g. Ashdod, Jerusalem).

Pension Consulting: Provide pension consulting services based on the Nobel Prize model to meet the needs of individuals and self-employed people.

Social Responsibility: Supporting local businesses (such as the Katom Israel digital complex) and the "Independent" Fund (in partnership with the Jewish Affairs Bureau, providing business grants of NIS 7,000 to NIS 50,000).

summary

Bank Mizrahi-Tefahot, Israel's third-largest bank, offers a diverse range of financial solutions to individual and corporate clients through its leadership in the mortgage market, hybrid banking model, and international service capabilities. Its 205 branches, solid financial performance and advanced digital platforms such as ISO 27001 certified online banking meet the needs of customers ranging from retail to high net worth customers. Despite the controversy involving settlement financing, its localized service and customer orientation make it a trusted financial partner for Israel.