General Information

AMarkets Is An Online Forex Broker Based In Saint Vincent And The Grenadines That Offers A Variety Of Attractive Trading Conditions, Such As High Leverage, And Access To Popular Trading Platforms Such As MetaTrader4 And MetaTrader5. It Offers A Wide Range Of Trading Tools Covering Six Asset Classes, Including Forex, Stocks And Cryptocurrencies. AMarkets Also Offers A Mobile Trading App For Android And IOS Users, Allowing Traders To Access Their Accounts Anytime, Anywhere. It Offers Multiple Language Options To Cater To Different Customer Bases.

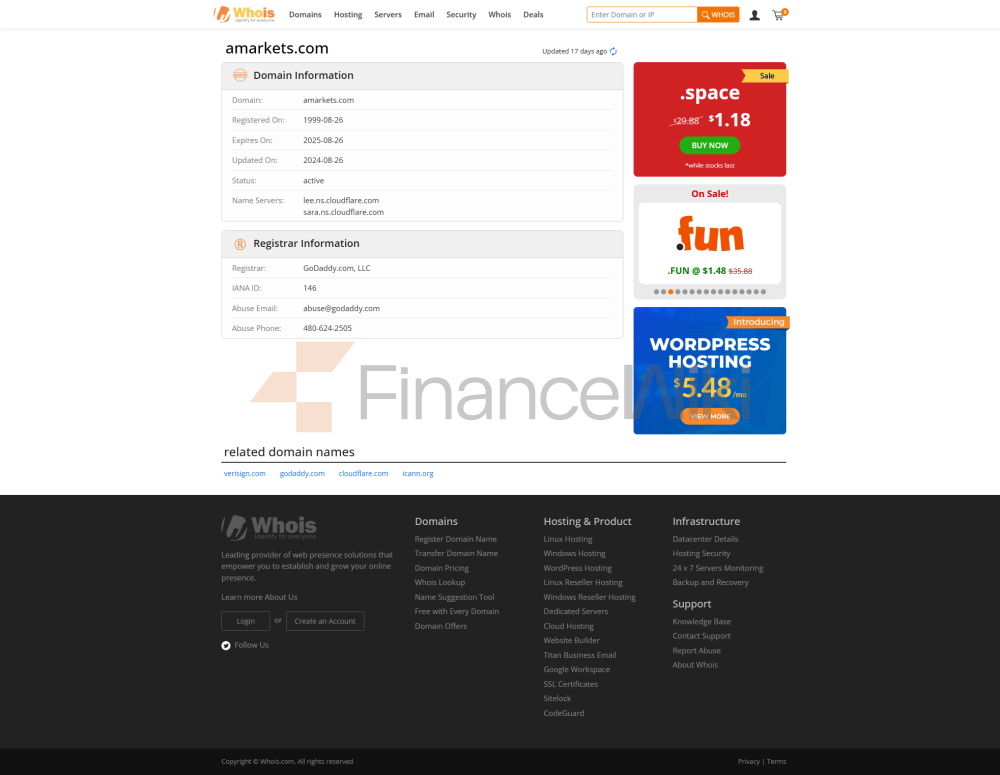

However, It Is Important To Note That AMarkets Operates Without A License And Is Not Regulated By Any Recognized Financial Institution Group. Traders Should Consider This Factor And Conduct Thorough Research Before Deciding To Trade AMarkets.

Is AMarkets Legal Or A Scam?

As Previously Mentioned, AMarkets Is Registered In Saint Vincent And The Grenadines, But It Is Not Regulated By Any Recognized Financial Institution Group. The Lack Of Regulation May Raise Concerns Among Some Traders About The Safety Of Their Funds. Traders Are Advised To Exercise Caution And Conduct Thorough Research Before Dealing With Unregulated Brokers.

It Is Recommended To Give Preference To Brokers That Are Regulated By Reputable Regulators As They Provide Traders With An Additional Layer Of Supervision And Protection.

Pros And Cons

AMarkets Offers A Wide Range Of Trading Tools And Multiple Account Types. It Also Offers Demo Accounts That Provide Traders With The Opportunity To Practice And Familiarize Themselves With The Platform Before Trading With Real Money. The Broker Offers A Generous Leverage Option Of Up To 1:3000, Which Is Attractive To Experienced Traders Looking For Higher Potential Returns. AMarkets Supports The Widely Used MT4 And MT5 Trading Platforms, Providing Traders With Reliable And Efficient Trading Tools. It Does Not Charge Any Deposit Or Withdrawal Fees.

A Significant Drawback To AMarkets Is The Lack Of Specific Regulation, While The Lack Of Regulation By A Recognized Financial Institution Group May Cause Concern For Some Traders. AMarkets Has A Relatively High Minimum Deposit Requirement Of $100, Which Can Be A Hindrance For Traders With Limited Funds. This ECN Account Charges A Commission Fee, Which May Affect The Trading Profitability Of Certain Traders.

Market Tools

AMarkets Offers Its Clients A Wide Range Of Trading Markets, Offering Diverse Opportunities For Both Beginners And Experienced Traders. Traders Have Access To A Variety Of Markets, Including Currency Pairs, Indices, Commodities, Metals, Energy Products, Cryptocurrencies, Stocks, And ETFs. This Wide Selection Allows Traders To Choose From A Wide Range Of Instruments And Diversify Their Trading Portfolio According To Their Preferences And Trading Strategies.

Account Types

AMarkets Offers A Total Of 4 Account Types: Crypto, Fixed, Standard, And ECN. The Minimum Deposit To Open An Account Is, MBT $10,100, $100, And $200, Respectively. It Also Offers Islamic Account Options For Traders Who Abide By Islamic Trading Rules. It Also Offers Traders Demo Accounts That Can Develop Traders' Trading Skills And Reduce Trading Risks.

Standard: Standard Accounts Are For Both Novice And Experienced Traders. It Offers Floating Spreads (from 1.3 Pips), Zero Trading Fees For Forex And Metals, And Supports Instant And Market Execution. The Minimum Initial Deposit Requirement Is $100/€100 And Traders Can Use Leverage Up To 1:3000. Trading Hours Start At 00:00 On Monday Until 23:00 Eastern European Time (EET) On Friday. The Account Is Denominated In USD And EUR. Clients Also Get Negative Balance Protection.

Fixed: The Fixed Account Has Fixed Spreads, So It Is Ideal For Clients Who Wish To Pay A Fixed Amount For Each Trade. Suitable For Position Trading. It Shares Many Similarities With The Standard Account. The Difference Is That It Has Fixed Spreads And Only Offers 28 Forex Trading Instruments Instead Of The 44 Currency Pairs Offered By The Standard Account.

Electronic Communication Network: ECN Features Direct Execution Of Orders At Prime Brokers. It Is Suitable For Scalp Trading Due To Its Fast Order Execution Speed. The Minimum Deposit Is 200 Dollars 200 Euros With Spreads As Low As 0 Pips. Users Of This Account Will Pay A Commission Of $2.50/€2.50 Per Lot Of 1 Lot. It Offers All Trading Instruments And Offers Negative Balance Protection. The Stop Loss Requirement Is 40%, While The Margin For Hedging Positions Is 50%.

Cryptocurrency: Crypto Accounts Are Denominated In MBT (1 MBT = 0,001 BTC) And Share Similarities With Standard Accounts. It Offers A Minimum Leverage Ratio (1:100) With Spreads Floating From 1.3 Pips. Users Of Crypto Accounts Have Access To All Trading Instruments And Negative Balance Protection.

Islamic Account (no Overnight Interest): Customers Who Want To Comply With Sharia Law Can Apply For An Islamic Account. Islamic Account Is A Variant Of Fixed Account, Standard Account And ECN Account With No Swap Fees Or Additional Fees. It Is Not Available For Crypto Accounts. To Use An Islamic Account, Open Any Supported Account And Send A Request To Activate The Islamic Option In The Personal Area. The Swap-free Service Is Not Available For Stocks, Indices, Cryptocurrencies, Commodities And Bonds.

Demo Account: AMarkets Offers A Demo Account That Allows You To Try Financial Marekt Without The Risk Of Losing Money.

Spreads And Commissions

If You Want To Trade AMarkets, It Is Recommended That You Take The Time To Calculate These Transaction Costs. Regarding The Spread, A Brief Description Has Been Given When Describing The Account Type. For An Ecn Account, Users Of This Account Will Pay A Commission Of $2.50/€2.50 Per Lot For 1 Lot. For The Other Three Account Types, The AMarkets Website Shows No Commission.

Leverage

AMarkets Offers Traders Maximum Leverage Of Up To 1:3000, Which Is Considered One Of The Highest Leverage Options Available In The Forex Trading Industry. This Generous Leverage Can Be Advantageous For Experienced Professional Traders Looking To Maximize Potential Profits. However, It Is Important To Acknowledge That High Leverage Also Comes With Higher Risk.

It Is Important To Note That The Maximum Leverage Of 1:3000 Is Applicable For Standard Trading Accounts, While Crypto Accounts Offer A Maximum Leverage Of 1:100. Traders Should Consider Their Trading Strategies And Risk Management Practices When Deciding On The Appropriate Leverage Size For Their Specific Needs.

How Do I Open An Account?

To Open An Account With AMarkets, You Can Follow These General Steps:

1. Visit The Official Website Of AMarkets At Https://www. AMarkets.com/. Find The "Open Account" Button On The Homepage And Click On It.

2. You Will Be Redirected To The Account Registration Page. Fill In The Required Information Accurately, Including Your Name, Email Address, Phone Number And Country Of Residence.

3. Select The Account Type That Suits Your Trading Needs. AMarkets Usually Offers Different Types Of Accounts, Such As Standard Accounts, ECN Accounts Or Islamic Accounts, Each With Its Own Characteristics And Trading Conditions. Review Account Types And Select The Account Type That Matches Your Preferences.

4. Read And Agree To The Terms And Conditions Of AMarkets. Make Sure To Understand The Risks Involved In Trading And The Broker's Policies. Click The "Open Account" Button To Complete The Registration Process.

5. Once Your Account Has Been Successfully Registered, You May Receive A Confirmation Email With Further Instructions. Follow The Instructions Provided To Verify Your Email Address And Activate Your Account.

6. After Your Account Has Been Activated, You May Proceed To Fund Your Trading Account. AMarkets Offers Various Deposit Methods Such As Bank Telegraphic Transfer, Credit/debit Cards And Electronic Payment Systems. Once Your Account Is Deposited, You Can Access AMarkets, For Example Metatrader4 (mt4) Or Metatrader5 (mt5), To Start Trading In Financial Marekt.

Trading Platform

AMarkets Supports MetaTrader4 And MetaTrader5, In Addition To The AMarkets App Also Provides A Trading Platform For IPhone And Android Smartphone Users.

AMarkets App: This AMarkets App Is The Ideal Solution For People Who Want To Trade With AMarkets On The Go. It Works On Iphone, Ipad And Android Devices. It Offers Trading Tools Across 7 Asset Classes And Is Available In English, Indonesian, Malay, Farsi, Russian, Turkish And Uzbek. Users Of The App Have 24/7 Customer Support, Real-time Quotes, Real-time And Simulated Trading, And Deposit And Withdrawal Capabilities.

MetaTrader4: MT4 Is Considered The Best Trading Platform For Both Beginners And Experienced Traders. The App Offers 30 Indicators And Supports 9 Timeframes, A Lock-in Option And A Single-threaded Strategy Tester. Accessible Via Mobile App (iOS And Android), Web End Point And PC/MAC Download.

MetaTrader5: MT5 Is An Advanced Version Of The MT4 Trading Platform. It Offers More Indicators, Timeframes, And An Updated Strategy Tester Compared To MetaTrader4. It Also Offers Partial Order Execution, Built-in Economic Calendar, Embedded MQL5 Community Chat, 6 Types Of Pending Orders, Market Depth, And Hedging Options. It Is Ideal For Copy Traders (social Trading) And Algorithmic Trading. Accessible Via Mobile Apps (iOS And Android), Web Endpoints, And PC/MAC Downloads.

Bonus

This Bonus Offer Is Available To Clients Who Trade Using A Real Account. Deposit Funds To An AMarkets Trading Account. The Offer Is Valid For Both Standard And Fixed Accounts Opened On The Metatrader4 And Metatrader5 Platforms Using USD Or EUR As The Account Currency. The Maximum Bonus Amount Per Client Is $5,000/EUR 5,000. After Making A Deposit, A Portion Of The 20% Deposit Amount Is Deposited As A Non-withdrawable Bonus Into The "Credit" Column Of The Client's Trading Account. The Bonus Can Be Used For All Transactions, Including Withdrawals.

It Is Important To Note That This Bonus Offer Cannot Be Used In Conjunction With Other Bonuses And Promotions At AMarkets. This Is A One-time Offer, Which Means That Clients Can Only Receive This Bonus Once. For More Details, Clients Can Refer To The Bonus Accumulation Rules For Specific Terms And Conditions Related To The Bonus Offer.

Deposits And Withdrawals

When It Comes To Deposits And Withdrawals, Like Many Other Brokers, AMarkets Provides A Detailed Form With Important Information About Currencies, Payment Methods, Minimum Amounts, Arrival Dates, Fees, And More. Viable Payment Methods Are MasterCard, In Zero Card, Ethereum Bitcoin, Tons Ether, Large Bitcoin, And Ethereum, A Cash, And E, Among Others. Customers Can Keep An Eye Out For Withdrawal Processing Fees And Minimum Amounts. Deposits And Withdrawals Are Free, Simple, And Can Be Made Through Multiple Payment Methods.

Educational Resources

The Broker Offers A Wide Variety Of Educational Resources, Including Trading Tools, Analysis, Forex News, VPS Hosting, Copy Trading, And AutoChartist, Which Traders Can Use To Improve Their Trading Skills And Abilities. Additional Resources Include An Economic Calendar, Trading Calculators, Market Sentiment Indicators, Expert Advisors, Trading Ideas, And Trading Of The Week

Customer Support

AMarkets' Customer Support Is Very Diverse And Comprehensive. Not Only Does It Have Multiple Customer Support Channels, Including Phone, Mail, And Live Chat, But It Also Supports 20 Different Languages And Is Available 24/7.

Email: Support@amarkets.com, Reception@amarkets.com

Phone Number: + 44 3307772222

Social Media: Facebook, Instagram, LinkedIn, YouTube, Tons Telegram

Conclusion

AMarkets Is A Global Forex Broker For Both Beginners And Experienced Traders Who Need A User-friendly Platform, A Large Number Of Trading Tools, And Support For Professional Strategies Such As Copy Trading And Algorithmic Trading. It Offers Generous Leverage, Fast Order Execution, And Direct Access To Global Financial Marekt. It Offers Different Account Types For A Variety Of Trading Needs, As Well As Islamic Trading Options For Those Who Want To Abide By Sharia Law. Withdrawals, And Deposits On The Platform Are Free Of Charge.

It Is Worth Emphasizing That AMarkets Operates Without A License And Is Not Regulated By Any Recognized Financial Institution Group. The Lack Of Regulation May Raise Concerns Among Traders Who Prioritize The Safety Of Their Funds. Traders Are Advised To Exercise Caution And Conduct Thorough Research Before Dealing With Unregulated Brokers.

FAQ (Frequently Asked Questions)

Q: Is This Broker Well Regulated?

A: No, There Is Currently No Effective Regulation. It Is Recommended That You Pay Attention To Its Latent Risk.

Q: Does This Broker Offer MT4/MT5?

A: Yes AMarkets Offers Both MT4 And MT5 For You To Choose From.

Q: How Much Leverage Does This Broker Offer?

A: The Maximum Leverage AMarkets Has Is 1:3000. Please Note That This Leverage May Only Be Available For Certain Accounts And Products. Please Consult The Article Or The Dealer's Website For Specific Information.

Q: What Is Copy Trading?

A: Copy Trading Is An Investment Service That Allows Investors To Earn On Financial Marekt By Following The Strategies Of Experienced Traders And Copying Their Trades. In Turn, Professional Traders Profit By Earning Commissions Using Strategies.