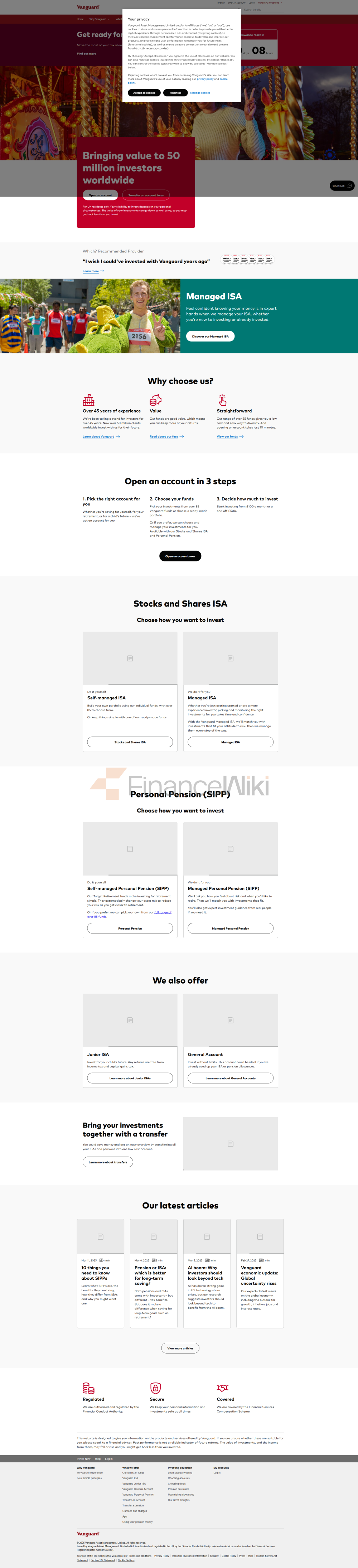

The UK Branch Of Vanguard Investor UK (Vanguard Group), Whose Online Investment Platform Was Launched In 2017. Vanguard Investor UK Itself Is A US-based Global Investment Management Company Established In 1975. Vanguard Investor UK Is Registered In The UK And Is Regulated By The UK Financial Conduct Authority (FCA). The Launch Of The Platform Enables UK Investors To Access Its Low-cost Investment Products And Services Directly Through Vanguard's Platform.

Vanguard Investor UK Offers A Range Of Investment Products And Services Suitable For Both Individual And Institutional Investors. Here Are Some Of The Key Features And Services Of Vanguard Investor UK:

Broad Range Of Investment Products: Vanguard Offers A Wide Range Of Investment Products Including Index Funds, Exchange Traded Funds (ETFs), Actively Managed Funds And Retirement Accounts. These Products Cover A Wide Range Of Asset Classes Around The World Such As Stocks, Bonds And Diversified Market Indices.

- Index Funds:

Vanguard Offers A Wide Range Of Index Funds That Passively Track Specific Market Indices Such As FTSE 100, S & P 500, Etc. Index Funds Typically Have Lower Management Fees And Are An Effective Tool For Achieving Diversification.

- Exchange Traded Funds:

Vanguard's ETFs Are Also Passively Managed And Track A Broad Range Of Market Indices. ETFs Are Flexible And Can Be Bought And Sold On A Stock Exchange Like Stocks.

- Actively Managed Funds:

- Retirement Accounts:

- Index Investing: Vanguard Investor UK Is One Of The Pioneers In Index Investing. Most Of Its Products Use Passive Management Strategies That Track Market Indices, Resulting In Lower Management Fees And Provide Market Average Returns.

- Portfolio Management: Vanguard Offers Digitized Portfolio Services To Help Investors Build And Manage A Diverse Portfolio. These Services Are Often Tailored To The Investor's Risk Tolerance And Financial Goals.

- Fund Management Costs

- Account Fees

- Management Fee (for Escrow Services Only)

In Addition To Passively Managed Products, Vanguard Also Offers A Number Of Actively Managed Funds. These Funds Are Managed By Professional Investment Managers And Are Designed To Outperform Market Performance Through Stock Picking And Market Timing Strategies.

Vanguard Offers Individual Retirement Accounts (SIPPs) To Help Investors Save For Retirement. Investors Can Make Tax-friendly Investments Through These Accounts.

Low Fee Structure:

Vanguard Is Known For Its Low-cost Investment Products And Typically Charges Lower Management Fees. This Is Because Vanguard Has Adopted A Unique Ownership Structure In Which The Company Is Owned By Its Fund Holders, Allowing It To Operate At A Lower Cost.

Investment Costs:

How Much You Need To Pay To Invest In Vanguard Consists Of Three Main Components. You Are Only Required To Pay Vanguard's Management Fees If Vanguard Selects And Manages Your Investments For You.

Ongoing Costs (including OCF): This Fee Covers The Management Of The Funds In Which You Invest. It Pays The Day-to-day Management Fees And Management Fees. Ready-made Portfolio: 0.22% To 0.24%; Individual Funds: 0.06% To 0.78%

Fund Transaction Costs: When Managing A Fund, Stocks Or Bonds Need To Be Bought And Sold, Which Means Fees Such As Transaction Costs And Taxes Have To Be Paid. Size And Experience Keep These Costs As Low As Possible, But This Can Still Affect The Returns You Get From Your Fund. Ready-made Portfolio: 0.02% To 0.07%; Individual Funds: 0.01% To 0.69%

One-time Fees: When You Invest In Vanguard ETFs, You Incur A One-time Fee Due To The So-called "bid-ask Spread". This Is Because ETFs Are Traded In A Similar Way To Stocks Because There Is An Ask Price (the Price At Which You Can Buy An ETF) And A Buy Price (the Price At Which You Sell An ETF). The Difference Between The Buy Price And The Ask Price Is Called The "spread".

The Investment Amount Is 0--250,000 Pounds, And 0.15% Of The Investment Amount Is Charged Annually; When The Investment Amount Exceeds 250,000 Pounds, 375 Pounds Is Charged Annually.

When You Choose To Transfer Out Of The Fund, Convert The Fund, Withdraw Money, Close Your Account, No Fees Are Charged.

The Specific Fee Is Subject To Change. You Need To Know The Specific Fee Information On The Official Website Before Investing. (https://www.vanguardinvestor.co.uk/what-we-offer/fees-explained)

Educational Resources: Vanguard Provides A Wealth Of Educational Resources, Including Market Analysis, Investment Guides And Financial Advice, To Help Investors Make Informed Investment Decisions.

Ethical And Sustainable Investing: Vanguard Also Offers Investment Products That Meet Environmental, Social And Corporate Governance (ESG) Standards To Meet The Needs Of Clients Who Want To Make Ethical And Sustainable Investments.

Customer Support: Vanguard Offers A Reliable Customer Support Service To Help Investors With Account Management And Investment Related Issues.

24/7 Chatbot Phone: UK 0800 587 0460 Abroad + 44 (0) 20 3753 5087 Lines Are Open Monday To Friday 9am To 5pm (closed On Public Holidays)

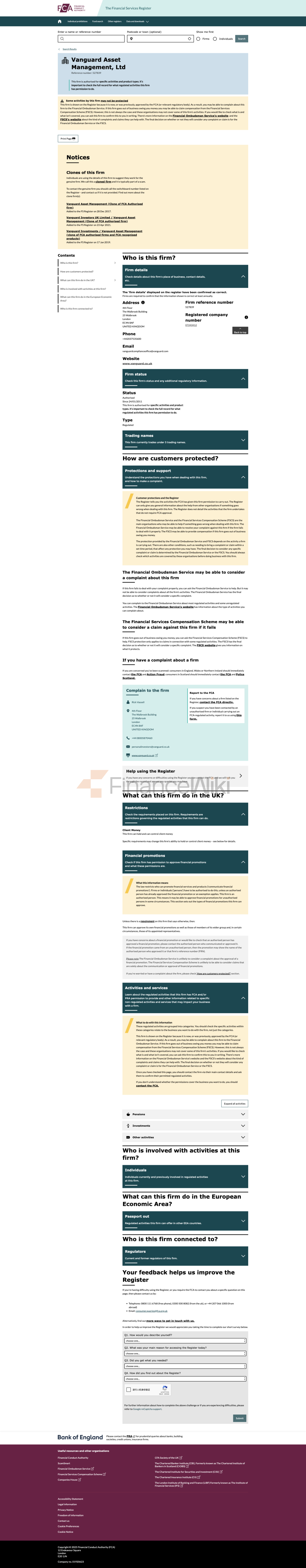

Regulatory Compliance: Vanguard Investor UK Is Regulated By The UK's Financial Conduct Authority (FCA), Ensuring That Its Services Comply With Industry Standards And Legal Requirements.

Overall, Vanguard Investor UK Helps Investors Achieve Their Long-term Financial Goals Through Its Low-cost, Efficient And Transparent Investment Products. Its Extensive Product Selection And Educational Resources Make It An Important Choice For Both Individual And Institutional Investors In The UK.