🏢 Company Profile & Basic Information

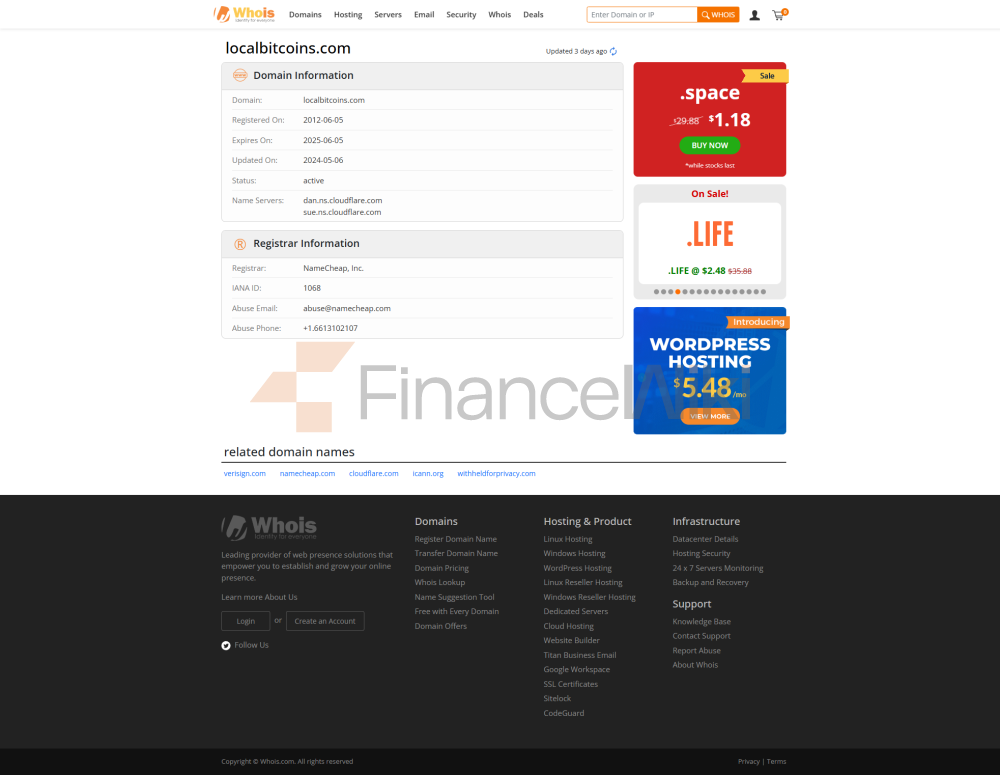

LocalBitcoins (full name: LocalBitcoins Oy, abbreviation: LocalBitcoins) is a privately held company founded in June 2012, headquartered in Helsinki, Finland, with its registered address:

Firdonkatu 2 T 63, 00520 Helsinki, Finland。

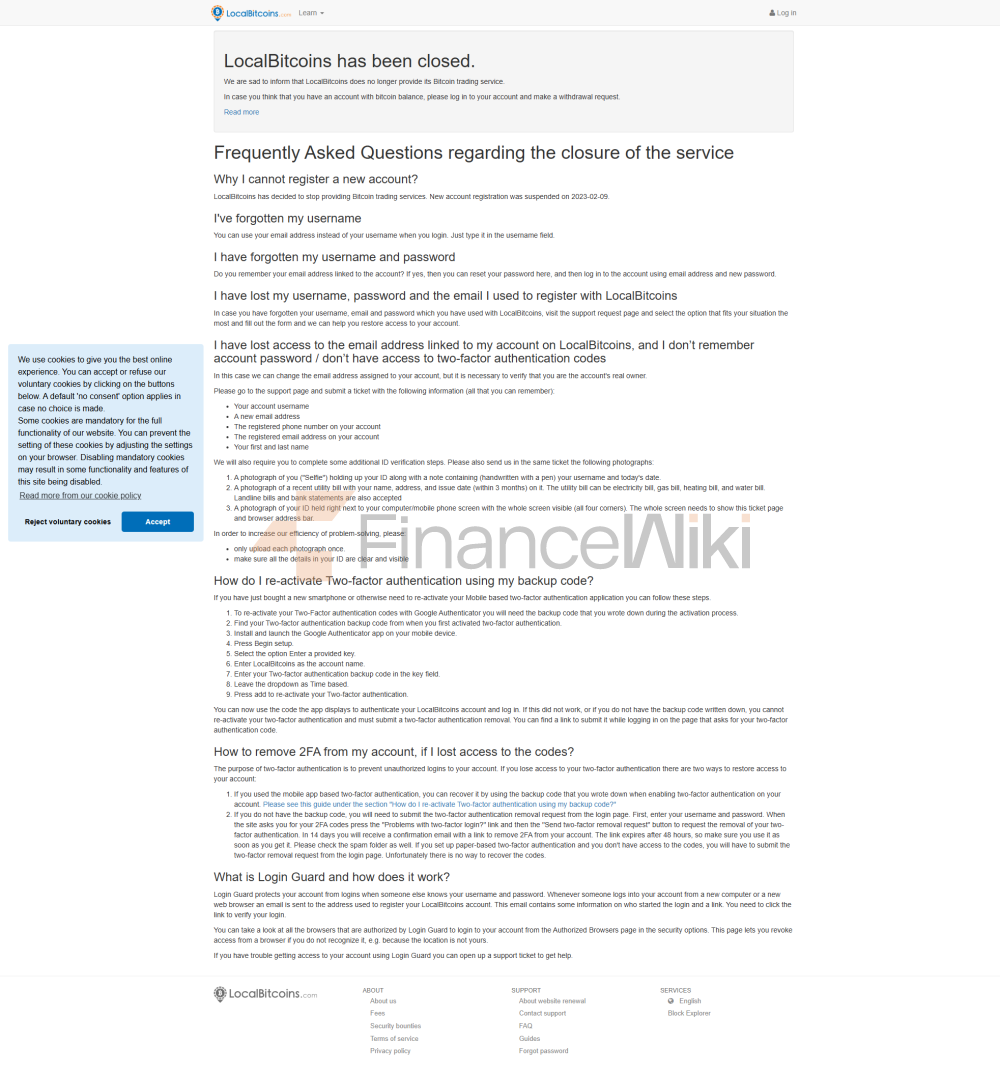

The company is registered in Finland with registration number 2855415-2 and its registered capital is not disclosed. Since February 9, 2023, the suspension of new user registration and the subsequent termination of all trading services have entered the operational termination phase.

🧭 Company nature and shareholding structure

LocalBitcoins is an unlisted private limited company (OY) with no parent company or public holding structure. The original shareholding was controlled by founder Jeremias Kangas, and later by his brother Nikolaus Kangas as an executive, with no public introduction of external venture capital or public market capital.

👥 Executive background and founding team

Jeremias Kangas: Founder, member of Bitcoin's early technical community, building the platform architecture.

Nikolaus Kangas: Successor CEO, who led strategy during the platform's compliance transformation.

Sara Leppänen: CEO from 2022 to 2023.

The Company did not disclose details of its advisory board or membership in industry associations.

📣 Corporate Communications & Operations Statement

The Company publishes compliance updates, technical change descriptions, and end-of-service announcements on the Blog channel and support page of its official website. In 2023, the CEO will issue a closure notice to the public and users at the time of the shutdown.

📜 Regulatory information

LocalBitcoins has been regulated by the Finnish Financial Supervisory Authority (FIN-FSA) since October 14, 2019 and is licensed as a virtual currency service provider with registration number 2855415-2.

📅 Regulatory effective date: 2019-10-14

🏛️ Regulatory authority: Financial Supervisory Authority of Finland (FIN-FSA).

🗂️ Business Classification and Market Positioning

The company is classified as a virtual asset service provider (VASP), providing peer-to-peer transaction matching services for Bitcoin users around the world. The core advantage of the platform is the self-service advertising system that does not require centralized wallet custody and can freely set prices and payment methods.

🛠️ core business and service model

provides BTC trading advertising system and Escrow protection;

Support multi-language and localized payment (including bank transfer, cash, etc.);

Establish a user rating mechanism to enhance the trust of the platform;

Mandatory KYC process since 2019 (supported by Onfido);

Use Elliptic tools for blockchain transaction monitoring.

💱 Trading Products & Platform Features

only Bitcoin (BTC) trading;

Web platform + Android app (no iOS client);

Core features such as escrow, dispute resolution, ad auto-matching, and more are available.

💳 Deposit and withdrawal methods

deposit: set the payment method (bank, wire transfer, PayPal, cash, etc.) through the advertisement;

Withdrawal: After the transaction is successful, the seller releases the BTC to the buyer's wallet.

The platform does not provide custodial wallet services, and users need to bind an external BTC address.

🧰 Technical infrastructure

The system is built in-house to serve users in 100+ countries around the world. In 2019, we began working with Elliptic to monitor transactions, strengthen anti-money laundering capabilities, and integrate Onfido for identity verification. The platform has undergone frequent technical maintenance due to high traffic and compliance adjustments.

🛡️ Compliance system and risk control measures

Since its inclusion in FIN-FSA regulation, the platform has strictly implemented identity verification, transaction monitoring and compliance reporting systems. With the introduction of monitoring tools in 2019, transactions were further regulated and anti-money laundering controls were strengthened by ceasing services in high-risk countries such as Iran.

🌍 market segmentation and competitive positioning

serving the needs of global retail bitcoin trading;

The advantage is that there is no need for centralized asset custody + high payment freedom;

During the High Activity Period (2020), the quarterly transaction volume reached $612 million.

🤝 Customer Support & User Empowerment

provides an online FAQ, identity verification guide, and customer support page;

Support user rating, dispute appeal, document review, etc.;

Users are free to create ads, set prices, and set country ranges.

🌱 Social Responsibility & ESG

Although there is no formal ESG report, the platform is committed to:

comply with Finnish law and EU Anti-Money Laundering Directive No. 5;

refuse to serve users in high-risk jurisdictions;

Strengthen financial transparency, respond to regulatory and law enforcement agencies and cooperate with investigations.

🤝 Strategic cooperation and ecosystem partners

to cooperate with Onfido to implement automated identity verification;

Partnering with Elliptic to monitor on-chain behavior of BTC transactions;

Establish compliance standards in long-term communication with Finnish regulatory authorities.

📉 Financial health

The platform does not disclose the details of income and expenses. It is estimated that 2019-2020 is its peak period, and gradually towards a recession after 2021. The reason for the closure was not disclosed as financial difficulties, but from the perspective of increased supervision, user churn, and peer competition, compliance and operating cost pressures may be important factors.

📅 Roadmap and Termination of Operations

📅 2023-02-09: Officially announced the suspension of new registrations;

📅 2023-02-16: Officially closed all trading services;

📅 2023-03 Late stage: The withdrawal channel of user funds will be closed, and the platform will file and process.