General Information

Australia-based Icon FX Brokerage Is Committed To Providing Clients With A Safe And Advanced Trading Environment. Icon FX Offers A Variety Of Market Tools That Cater To Different Trading Preferences, Allowing Clients To Explore Various Opportunities In Financial Marekt. The Brokerage Offers MT4 And CTrader Trading Platforms. Icon FX Offers Two Types Of Trading Option Accounts. In Addition, The Brokerage Offers Clients Demo Accounts For Them To Practice And Familiarize Themselves With Trading Platforms And Tools Before Committing To Real Money.

Pros And Cons

Pros:

- Competitive Spreads: Icon FX Offers A Variety Of Trading Instruments With Competitive 0.9 And 0.0 Spreads, Making It Possible For Clients To Maximize Their Trading Profits.

- Support For MT4: The Addition Of The Popular And Powerful MetaTrader 4 (MT4) Trading Platform Enables Clients To Use Advanced Trading Tools, Utilize Expert Advisors, And Implement Various Trading Strategies.

- Demo Accounts Available: Icon FX Offers Demo Accounts That Enable Clients To Practice And Become Familiar With The Trading Platform And Tools Without Risking Real Money.

- No Minimum Deposit Requirement: Icon FX Has No Minimum Deposit Requirement, Making It Easier For Traders Of All Levels To Enter.

Cons:

- Limited Customer Support Hours: Icon FX Does Not Offer 24/7 Customer Support, Which May Be Inconvenient For Customers Who Need Immediate Assistance Outside Of Normal Business Hours.

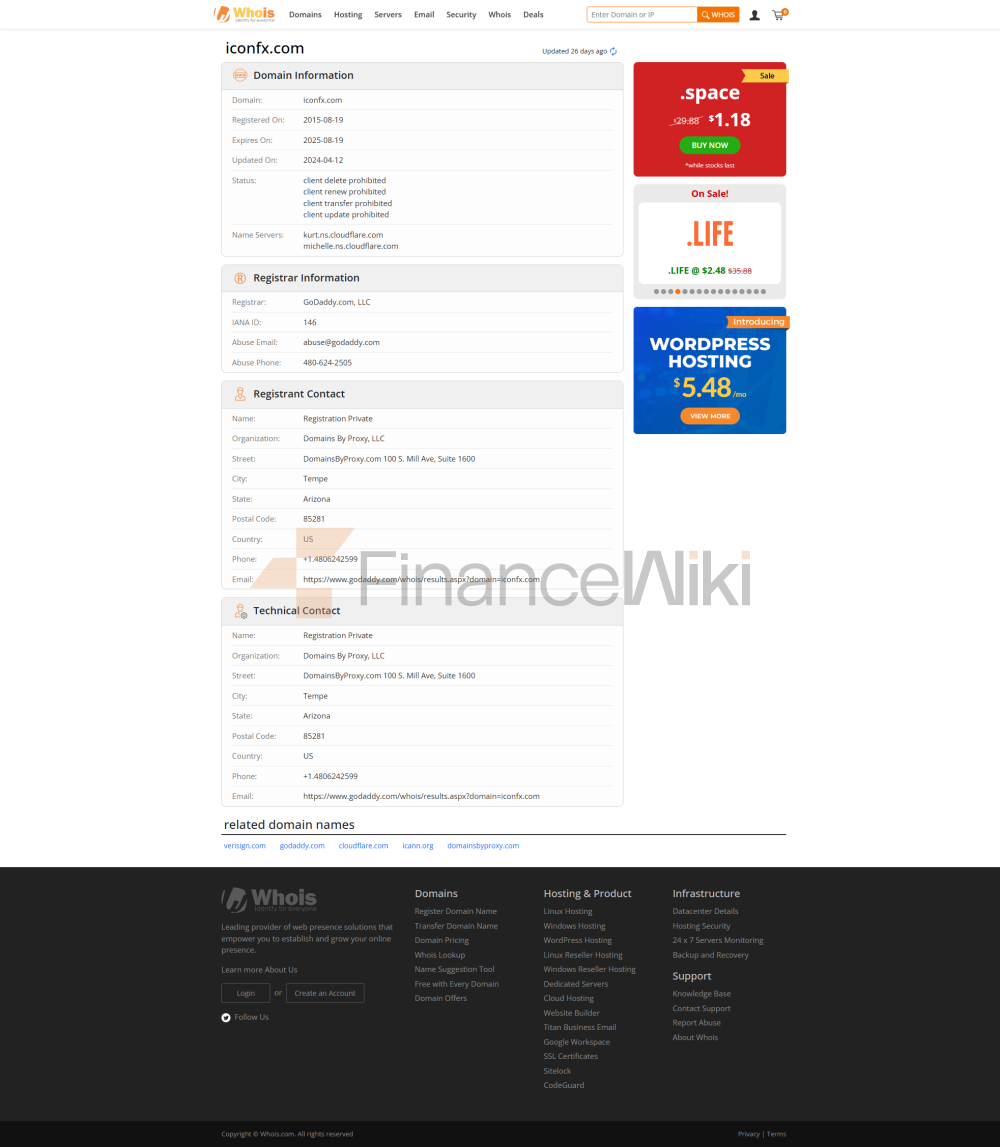

Is Icon FX Safe?

Icon FX Claims To Prioritize Customer Protection By Implementing Measures Such As Segregated Funds. This Means That Customer Funds Are Kept Separate From Company Funds In Segregated Accounts At A-rated Banks. This Setup Ensures The Independence And Protection Of Clients' Assets. They Also Emphasize Collaboration With Top-tier Liquidity Providers To Provide Clients With The Best Spreads And Liquidity.

However, Icon FX Is Not Regulated. Forex Trading Is Not Explicitly Regulated. This Raises Concerns About The Broker's Compliance With Industry Regulations And Regulations In The Forex Trading Market.

Market Tools

Icon FX Offers A Range Of Trading Tools Including The Following:

- Forex: Icon FX Allows Clients To Trade Various Currency Pairs On The Forex Market. This Includes Major Currency Pairs Such As EUR/USD, GBP/USD, And USD/JPY, As Well As Minor And Exotic Currency Pairs.

- Indices: Icon FX Provides An Avenue To Trade Indices That Represent A Specific Segment Or Group Of Stocks Of The Stock Market. Examples Of Indices Available For Trading Include The S & P 500 Index, Dow Jones Industries Average Index, And Nasdaq Indices.

- Commodities: Icon FX Allows Clients To Trade Commodities, Which Are Physical Commodities Such As Gold, Silver, Oil, Gas, And Agricultural Commodities. Trading Commodities Can Provide Opportunities For Diversification And Hedging Strategies.

- Cryptocurrencies: Icon FX Offers Trading Services Like Bitcoin, Ethereum, Litecoin, And Other Popular Digital Currencies. Trading Cryptocurrencies Involves Speculating On Their Price Fluctuations Without Actually Owning The Underlying Asset.

- Precious Metals: Icon FX Also Offers The Option To Trade Precious Metals Such As Gold, Silver, Platinum, And Palladium. These Metals Are Often Seen As Stores Of Value And Can Be Traded As Commodities On Financial Marekt. Trading Precious Metals Can Be Used As A Hedge Against Inflation And Economic Uncertainty.

Account Type

Icon FX Offers Two Types Of Trading: Standard Account And Professional Account.

Standard Account:

- Lot Size: The Minimum Trading Volume Is 0.01 Micro Lots.

- Base Currency: Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), Euro (EUR), British Pound Sterling (GBP), Japanese Yen (JPY), US Dollar (USD)

- Deposit Fee: Free

- Withdrawal Fee: Free

- Minimum Funding Amount Applicable

The Standard Account Is For Retail Traders Who Wish To Trade On A Standard Contract Size Without Paying Any Commission Per Trade.

Professional Account:

- Lot Size: The Minimum Trading Volume Is 0.01 Micro-lots.

- Base Currency: Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), Euro (EUR), British Pound Sterling (GBP), Japanese Yen (JPY), US Dollar (USD)

- Deposit Fee: Free

- Withdrawal Fee: Free

Professional Accounts Are For More Advanced Traders Who Require Tighter Spreads And Are Willing To Pay Commissions For Each Trade.

Icon FX Also Offers Demo Accounts For Traders Who Wish To Practice And Familiarize Themselves With The Platform Before Trading With Real Money. Demo Accounts Simulate Real Market Conditions And Allow Traders To Trade With Virtual Money.

Leverage

Icon FX Offers A Maximum Leverage Ratio Of 1:500. Leverage Is A Powerful Tool Offered By Forex Brokers That Allows Traders To Control Larger Market Positions With Less Capital. With A High Leverage Ratio Such As 1:500, Traders Are Able To Trade At A Much Larger Volume Than The Amount Of Currency They Have In Their Account.

The Advantage Of High Leverage Is That It Allows Traders To Potentially Amplify Their Profits. For Example, If A Trader Has $100 In Their Account And They Use Leverage Of 1:500, They Can Control A Position Size Of $50,000. If The Market Moves 1% In Their Favor, They Will Earn A Profit Of $500, Which Is A Significant Return On Their Initial Investment.

However, High Leverage Can Lead To Higher Returns, But It Also Comes With Increased Risk. The Same Amplification Effect Can Lead To Both Greater Profits And Potentially Large Losses. If The Market Is Unfavorable To A Trader's Position, Their Losses Are Also Amplified By The Leverage Ratio.

Spreads And Commissions

Icon FX Offers Different Types Of Accounts To Meet The Diverse Needs Of Traders. Icon FX Offers Competitive Spreads On Its Standard And Professional Accounts. Standard Accounts Have Spreads As Low As 0.9 Pips Without Any Commission Fees. Professional Accounts, On The Other Hand, Have Even Lower Spreads Starting From 0.0 Pips But Charge A $7 Commission Fee Per Round-trip Trade. Traders Can Choose The Corresponding Account Type According To Their Trading Preferences And Goals.

Trading Platform

Icon FX Offers Its Clients Two Powerful And Widely Acclaimed Trading Platforms: MetaTrader 4 (MT4) And CTrader.

Deposits And Withdrawals

Icon FX Offers Its Customers A Diverse Range Of Deposit And Withdrawal Options To Meet Different Needs.

Customers Can Use Credit Cards, Including MasterCard, Visa And JCB, To Deposit Or Withdraw Funds, Providing A Convenient And Widely Used Method For Financial Transactions. In Addition, The Acceptance Of Debit Cards Such As MasterCard And Visa Further Expands Customers' Flexibility In Managing Their Funds.

For Those Who Prefer Traditional Banking Methods, Accepting Bank Telegraphic Transfers Provides A Safe And Reliable Channel To Access And Withdraw Funds. This Option Is Particularly Suitable For Customers Who Prefer To Make Transfers Directly From Their Bank And Value The Stability And Reliability Associated With Bank Transfers.

Furthermore, Icon FX Actively Embraces The Growing Trend Of Digital Assets By Allowing Cryptocurrency Transactions. Customers Can Make Deposits And Withdrawals Using Popular Cryptocurrencies Such As Bitcoin (BTC), Tether (USDT), USD (USDC) And Ethereum (ETH), Catering To Those Who Favor The Speed And Advantages Of Blockchain-based Transactions.

Client Server

Clients Can Visit Their Office Or Contact The Client Server Hotline Through The Information Provided Below:

Email: Support@iconfx.com (24/5)

Additionally, Clients Can Also Connect With This Broker Via Social Media, Such As Twitter, Facebook, Instagram, And LinkedIn.

Additionally, Icon FX Provides A Frequently Asked Questions (FAQ) Section On Its Website To Help Clients Answer Frequently Asked Questions And Provide Relevant Information. The FAQ Section Is Designed To Address Common Questions And Concerns That Investors May Have About The Company's Services, Processes, And Investment Opportunities. Icon FX Offers An Online Messaging Feature Within Its Trading Platform. This Allows Traders To Communicate Directly With Customer Support Or Other Traders Through The Platform.

Conclusion

Overall, Icon FX Offers Competitive Trading Conditions, A Diverse Range Of Trading Products, And Support Through Various Channels. There Is No Minimum Deposit Required To Start Trading With Icon FX, And No Commission Charged By This Broker. However, The Company Has Gone Beyond Its Regulatory Reach, Which Has Raised Some Concerns That Clients Should Carefully Consider These Risks Before Choosing To Trade With Icon FX.