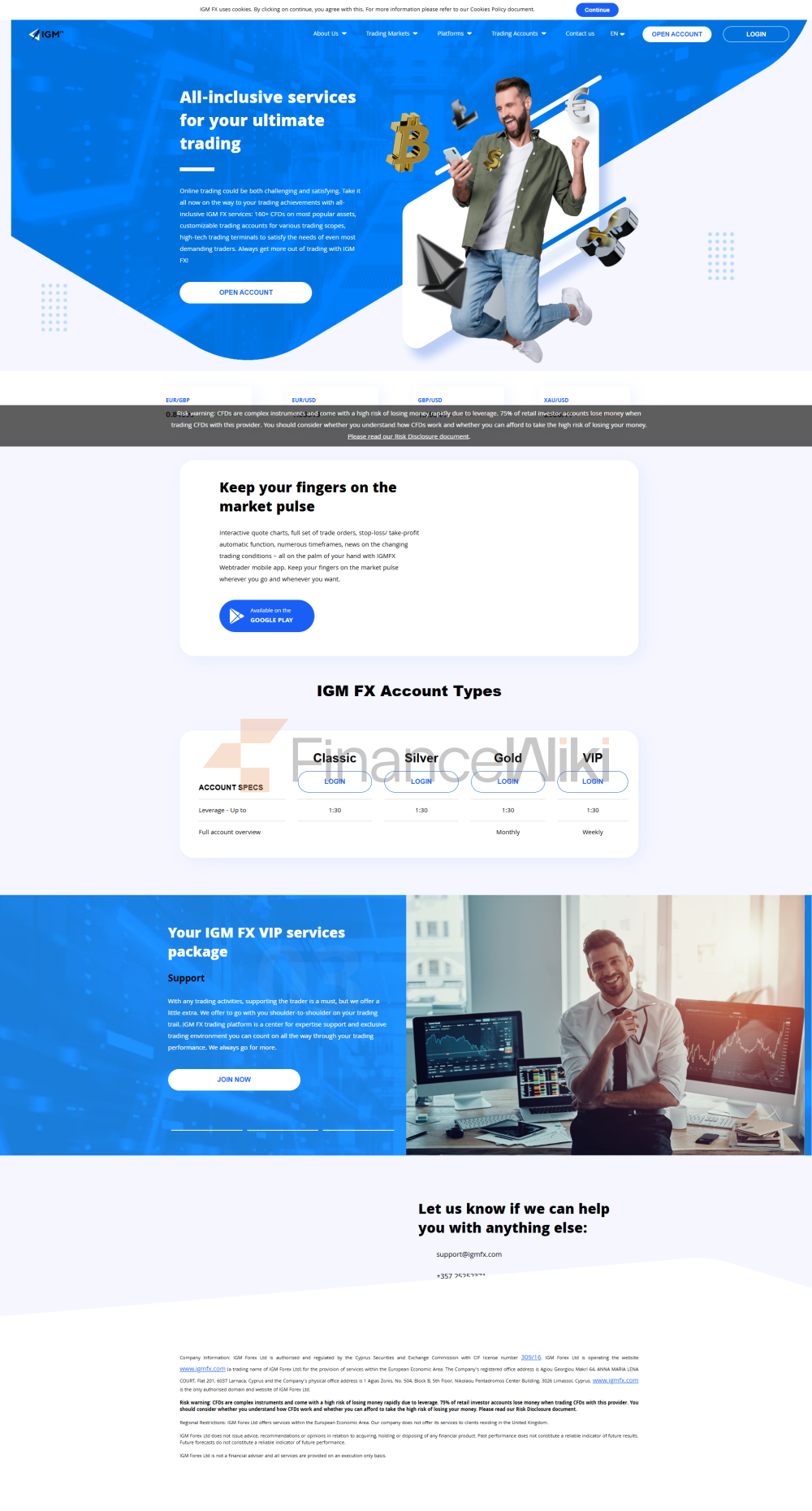

Corporate Profile

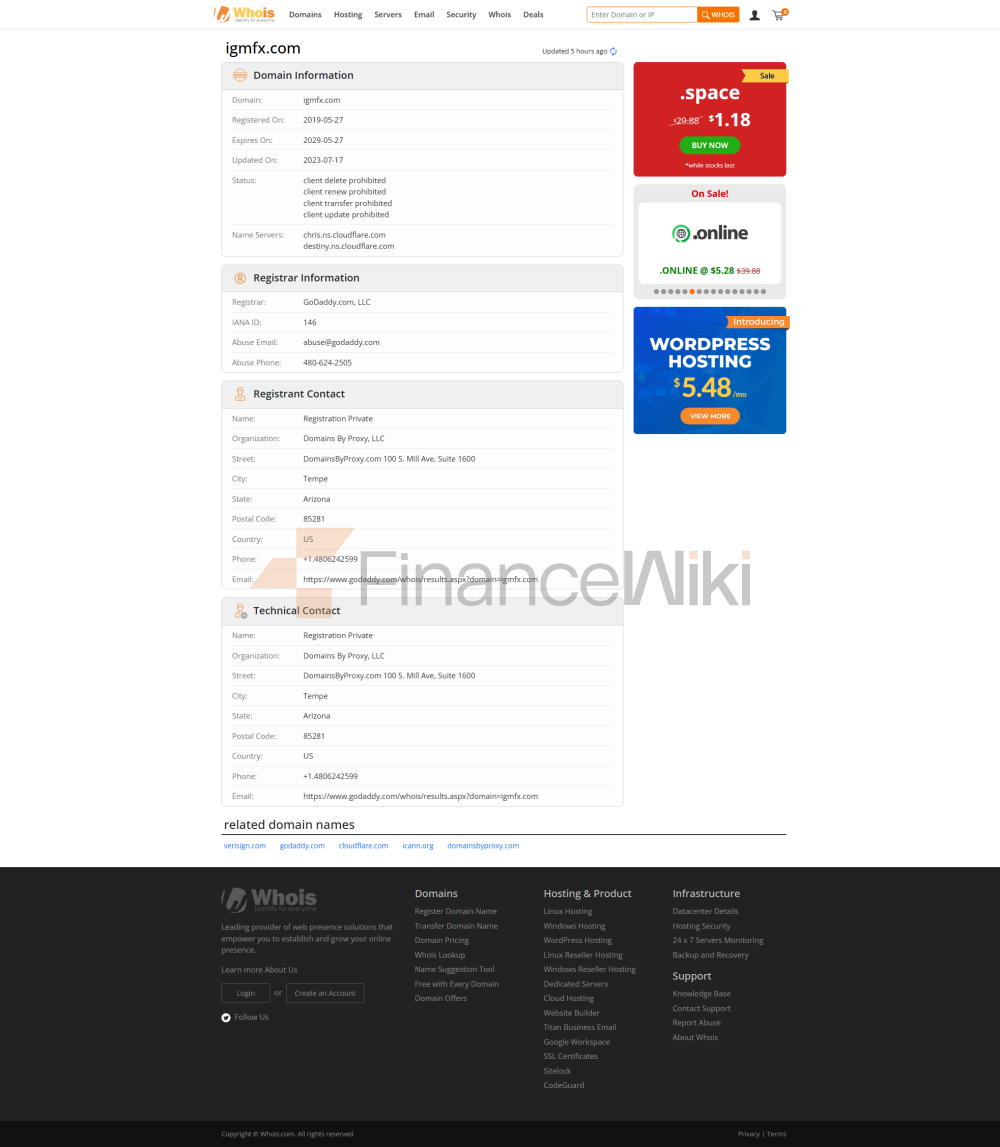

IGM FX (full Name: IGM Forex Ltd) Is A Cyprus-registered Contract For Difference (CFD) Brokerage Company Established On August 16, 2016 And Headquartered In Limassol, Cyprus. The Company Is Regulated By The Cyprus Securities And Exchange Commission (CySEC) And Holds CIF License Number 309/16 . IGM FX's Business Scope Covers The European Economic Area (EEA) And Provides A Diverse Range Of Financial Derivatives Trading Services To Retail And Professional Traders.

IGM FX Has A Registered Capital Of 250,000 EUR (approx. RMB 1.875 Million) , Which Meets CySEC's Minimum Capital Requirements For Brokerage Firms. The Company Connects Directly To Liquidity Providers Through The "Straight-Through Processing (STP) " Model, Providing Clients With A Low-latency And High-transparency Trading Environment.

Regulatory Information

IGM FX Is Regulated By The Cyprus Securities And Exchange Commission (CySEC), Which Covers Compliance With Trading Products, Security Of Client Funds, And Enforcement Of Anti-money Laundering (AML) Measures. CySEC Is An Accredited Financial Regulator For Internal Ads In The European Economic Area (EEA), Ensuring Compliance And Transparency In IGM FX's Operations.

As A Regulated Brokerage Firm, IGM FX Must Comply With The Following Core Regulations:

- Segregated Deposit Of Client Funds : The Client's Trading Funds Are Completely Segregated From The Company's Working Funds And Held In Segregated Bank Accounts.

- Anti-Money Laundering And Counter-Terrorist Financing : IGM FX Implements Strict Client Identity Verification Procedures (KYC) To Ensure The Legitimacy Of Trading Activities.

- Transparency And Disclosure : IGM FX Regularly Submits Reports To Regulators To Ensure Openness And Transparency Of Trading Data.

Trading Products

IGM FX Offers Clients More Than 160 Tradable Assets Covering The Following Main Categories:

- Forex (Forex) : Includes Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Minor Currency Pairs.

- Commodities : Covers Commodities Such As Crude Oil, Gold, Silver, Etc.

- Index : Provides CFD Trading Of World-renowned Stock Indices (such As Dow Jones, S & P 500, FTSE 100).

- Stocks : Includes CFD Of Individual Stocks Of World-renowned Companies Such As Apple, Google, Tesla, Etc.

- Cryptocurrency : Provides Trading Services For Mainstream Cryptocurrencies Such As Bitcoin And Ethereum.

Trading Software

IGM FX Mainly Provides Trading Services To Customers Through The IGM FX Webtrader Platform. The Platform Supports Desktop And Mobile Devices (web-based Browsers), Does Not Require Download And Installation, And Has The Following Features:

- User-friendly Interface : With An Intuitive Design, It Is Suitable For Both Beginners And Advanced Traders.

- Low Quote Latency : Thanks To The STP Mode, IG M FX's Quote Latency Is Controlled At 100ms .

- Technical Analysis Tools : Built-in Multiple Charting Tools And Technical Indicators (e.g. RSI, MACD, Bollinger Bands).

- Real-time News And Market Data : Provides The Latest Market Dynamics And Economic Calendar.

Although IGM FX Does Not Offer A Dedicated Mobile Trading Application, Its Web-based Platform Performs Well On The Mobile End And Is Able To Meet Customers' Portability Needs.

Deposit And Withdrawal Methods

IGM FX Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Credit/Debit Cards : Visa And MasterCard Are Supported, And Withdrawals And Deposits Can Be Made In Real Time.

- Bank Transfer : Customers Can Complete The Deposit And Withdrawal Of Funds Through International Bank Transfer.

- Cryptocurrency : Some Trading Accounts Support The Use Of Cryptocurrencies Such As Bitcoin For Deposit And Withdrawal.

Minimum Deposit Amount : The Minimum Deposit Requirement For IGM FX Is EUR 100 (approx. RMB 750) .

Customer Support

IGM FX Provides Multilingual Customer Support Services, Including English, Chinese, Russian, Etc. Customers Can Get Help In The Following Ways:

- Live Chat : Communicate With Customer Service Through The Live Chat Function Of The Official Website.

- Email : Send An Email To Support@igmfx.com For Professional Answers.

- Telephone Support : Call The Customer Service Center In Cyprus At + 357 25 252 371 .

Although The Customer Support Service Of IGM FX Covers A Wide Range, There Is Still Room For Improvement In Terms Of Response Speed And Problem Resolution Efficiency.

Core Business And Services

Main Service Areas

IGM FX's Core Business Is To Provide Contracts For Difference (CFD) Trading Services To Retail And Professional Traders. Its Differentiating Advantages Are Reflected In The Following Aspects:

- Low Spreads : IGM FX Spreads Start From 0.03 Pips (EUR/USD Currency Pair) , Which Is In Line With The Industry Average.

- Flexible Leverage : Retail Trading Accounts Offer 1:30 Leverage , And Professional Trading Accounts Support 1:400 Leverage .

- Educational Resources : IGM FX Provides Clients With Basic Trading Education And Market Analysis Reports To Help Clients Improve Their Trading Skills.

Target Client Group

The Target Clients Of IGM FX Include:

- Retail Traders : Seeking An Easy-to-use Trading Platform And Low Threshold Deposit Requirements.

- Professional Traders : Need A Trading Environment With High Leverage And Low Latency.

- Institutional Investors : Want To Hedge Risk Or Carry Trades Through The CFD Market.

Technical Infrastructure

IGM FX's Technical Infrastructure Is Based On A "straight-through Processing (STP) " Model, Where All Transactions Are Directly Connected To Top-tier Liquidity Providers (e.g. Goldman Sachs, JPMorgan Chase, Etc.), Ensuring Efficient And Transparent Trade Execution.

IGM FX's Servers Are Hosted In Hong Kong And Singapore To Ensure Lower Latency And More Stable Connections For Asian Clients.

Compliance And Risk Control System

Compliance Statement

IGM FX Strictly Complies With The Regulatory Requirements Of The Cyprus Securities And Exchange Commission (CySEC), Ensuring The Legality And Transparency Of All Business Activities. The Company Is Regularly Audited By CySEC To Ensure Compliance.

Risk Management System

IGM FX Adopts Multi-level Risk Control System , Including:

- Margin System : Clients Are Required To Pay A Certain Percentage Of Margin When Opening Positions To Ensure That Trading Risks Are Manageable.

- Mandatory Position Squaring Mechanism : When The Client's Account Equity Is Reduced To The Margin Call Level ( 100% For Retail Accounts And 20% For Professional Accounts), Unpositioned Squaring Positions Will Be Forced Position Squaring.

- Risk Segregation : IGM FX Uses The Capital Segregation Mechanism To Ensure That Client Funds Are Not Lost Due To Fluctuations In The Company's Other Businesses.

Market Positioning And Competitive Advantage

Market Positioning

IGM FX Is Positioned To Provide "high Transparency, Low Cost" CFD Trading Services. The Target Customers Are Traders Who Require High Efficiency And Transparency In Trade Execution.

Competitive Advantage

- Low Spreads : IGM FX's Spreads Are Competitive, Especially When It Comes To Mainstream Currency Pairs And Index CFDs.

- Transparent STP Mode : IGM FX Is Directly Connected To Top Liquidity Providers Through The STP Mode, Ensuring Transparency And Efficiency In Trade Execution.

- Flexible Leverage : IGM FX Provides Professional Traders With Leverage Up To 1:400 To Meet Their High-risk Appetite.

Customer Support And Empowerment

IGM FX Helps Clients Improve Their Trading Capabilities By:

- Education And Resources : Provides Basic Trading Tutorials, Market Analysis Reports, And Economic Calendars.

- Customer Support : Multi-lingual, Multi-channel Customer Support Services Ensure That Clients Can Get Timely Help When They Encounter Problems.

- Trading Tools : Through The IGM FX Webtrader Platform, Clients Can Use A Variety Of Technical Analysis Tools And Charting Capabilities.

Social Responsibility And ESG

IGM FX's Performance In Terms Of Social Responsibility And ESG (environmental, Social And Governance) Is Unclear. There Is Currently No Public Information Indicating That IGM FX Has Taken Special Measures In Terms Of Environmental Protection, Social Responsibility Or Corporate Governance.

Strategic Cooperation Ecology

The Main Partners Of IGM FX Include:

- Liquidity Provider : Working With Top Banks Such As Goldman Sachs And JPMorgan Chase To Ensure Liquidity And Transparency Of Transactions.

- Payment Service Provider : Working With VISA And MasterCard To Support Clients' Access To Funds.

Financial Health

Financial Liquidity

The Registered Capital Of IGM FX Is 250,000 Euros , Which Meets The Minimum Requirements Of CySEC. The Company Ensures The Safety And Liquidity Of Its Clients' Funds Through Strict Capital Management Measures.

Financial Transparency

IGM FX Regularly Submits Financial Reports To CySEC To Ensure The Transparency And Compliance Of Its Financial Position.

Future Roadmap

The Future Strategic Priorities Of IGM FX May Include:

- Expanding Trading Products : Adding More Trading Varieties Of Cryptocurrencies And Emerging Assets.

- Enhancing Customer Support : Optimizing Support For Client Server Channels, Especially In Asian Markets.

- Technology Upgrade : Further Optimize The Performance And User Experience Of The IGM FX Webtrader Platform.

Summary

IGM FX Is A CFD Brokerage Regulated By CySEC, With Its Low Spreads, High Transparency And Flexible Leverage Ratio, It Has Gained A Foothold In The Highly Competitive CFD Market. Although The Company Lacks A Dedicated Mobile App And In-depth Educational Resources, Its Core Technology And Compliance Have Earned It The Trust Of Some Traders. In The Future, IGM FX Needs To Make Further Efforts In Customer Support, Market Education And Technological Innovation To Consolidate Its Market Position.