Fiyostat Is A Well-known Financial Institution Group Based In Japan That Specializes In Foreign Exchange (forex) Trading Services. As A Regulated Broker, Fiyostat Operates Under The Supervision Of Japanese Financial Services Institutions, Ensuring Compliance With Strict Regulations And Providing Traders With A Safe Trading Environment.

Focusing On Providing A Comprehensive Trading Experience, Fiyostat Offers A Wide Range Of Financial Instruments, Including Major And Minor Currency Pairs, As Well As Other Asset Classes Such As Commodities And Indices. Traders Can Choose From A Variety Of Account Types To Suit Their Individual Needs, Whether They Are Beginners Or Seasoned Professionals. Designed To Be User-friendly And Feature-rich, The Company's Trading Platform Offers Advanced Charting Tools, Technical Analysis Indicators, And Real-time Market Data To Help Traders Make Informed Trading Decisions.

Fiyostat Also Emphasizes Customer Satisfaction By Providing Excellent Customer Support Services And Educational Resources. Traders Have Access To Educational Materials, Webinars, And Seminars To Enhance Their Trading Skills And Knowledge. In Addition, The Company Also Offers Convenient Deposit And Withdrawal Options, Ensuring A Seamless Experience For Its Customers.

Advantages

Regulation And Security: Fiyostat Is Regulated By The Japanese Financial Services Agency, Providing A Compliance And Safe Trading Environment.

Wide Range Of Financial Instruments: Traders Can Choose From A Wide Range Of Major And Minor Currency Pairs, Commodities, And Indices, Thus Diversifying Their Portfolios.

User-Friendly Trading Platform: Feature-rich Platform That Offers Advanced Charting Tools, Technical Analysis Indicators, And Real-time Market Data.

Customer Support & Education: Emphasizes Customer Satisfaction, Providing Excellent Customer Support And A Wealth Of Educational Resources.

Disadvantages

Market Accessibility: Mainly Focused On The Japanese Market And May Limit Availability For International Traders.

Feature Availability: The Availability Of Certain Features And Services May Vary Depending On Different Trading Account Types.

Execution Speed: During Periods Of Intense Market Volatility, Some Users Report That Execution Speed Can Be Further Improved.

Fiyostat Corporation Is A Regulated Financial Institution Group Operating In Japan. It Holds A Retail Foreign Exchange License, Which Is Supervised And Regulated By The Japanese Financial Services Agency (FSA). License Number, Fiyostat Is 2010001063860, Effective From September 30, 2007.

As A Regulated Entity, Fiyostat Is Bound By Rules And Regulations Established By The FSA To Ensure Compliance And Protect The Interests Of Investors. The FSA Is Responsible For Supervising And Monitoring The Financial Institution Group In Japan In Order To Maintain The Stability And Integrity Of The Financial System.

The Type Of License Referred To As "non-sharing" Means That Firestor Is Not Authorized To Share Its License With Other Entities Or Individuals.

Firestor's Status As A Regulated Financial Institution Group And Its Compliance With Regulations Imposed By The FSA Provide Customers And Investors With A Degree Of Assurance Regarding The Company's Operations And Compliance With Industry Standards.,

Firestor Offers A Diverse Range Of Market Tools To Meet The Needs Of Traders. Through Their Trading Platform, Which Includes Mt4/zero, Mt5 And Evo, Traders Have Access To A Variety Of Financial Instruments.

1. Currency Pairs: Fiyostor Offers A Wide Selection Of Currency Pairs On Their Trading Platform. For Mt4/zero, There Are 30 Currency Pairs Available, Including Major Currency Pairs Such As Usd/jpy, Eur/usd, Gbp/usd And Aud/usd. It Also Covers Cross Currency Pairs And Currency Pairs Involving The Japanese Yen (jpy), Such As Eur/jpy, Gbp/jpy And Cad/jpy. MT5 Offers All 25 Currency Pairs, Similar To Mt4/zero, While Evo Offers 12 Currency Pairs.

2. CFD Stocks: Traders Can Also Access Prices And Information On CFD Stocks Through The MT4 Trading System. This Includes Popular Stocks Such As Nikkei 225 Futures, New York Dow Jones Index Futures, UK FTSE 100 Futures, And Nasdaq 100 Index Futures. These Tools Enable Traders To Monitor And Analyze Trends In A Variety Of Markets, Which Helps Make Informed Trading Decisions.

3. Commodities: Fixtor Enables Traders To Trade Commodities Through Their Platform. The Mt4 Trading System Offers Gold Spot Exchange Rates, Allowing Traders To Monitor And Analyze The Price Movement Of This Precious Metal. In Addition, North Sea Crude Oil Futures And WTI Crude Oil Futures Are Also Offered, Providing Opportunities For Trading Oil-related Instruments.

By Providing A Diverse Range Of Market Tools, Fiyostol Allows Traders To Adopt Different Trading Strategies And Take Advantage Of Various Market Opportunities. Traders Can Explore Currency Markets, Track Stock Indices And Trade Commodities, Providing Them With A Comprehensive Trading Experience.

Fiyostol Offers Different Types Of Trading Accounts To Meet The Different Needs Of Its Clients. Here Are The Main Account Types Offered, Fiyostol:

1. Live Account: This Is A Real Trading Account That Allows Clients To Trade With Real Money. It Is Required To Complete The Account Opening Procedure, Including Providing The Necessary Documents And Meeting The Account Opening Conditions.

2. Demo Account: Fiyostor Also Offers Demo Accounts For Clients Who Wish To Practice Trading Or Test Their Strategies Without Risking Real Money. Demo Accounts Simulate Real Market Conditions And Provide Clients With Virtual Balances To Trade.

These Account Types Provide Access To Fiyostor's Trading Platforms, Including Mt4 Zero, Mt5, Evo. Clients Can Choose The Platform That Suits Their Preferences And Trading Strategies.

Fiyostol Offers Different Leverage Options For Its Corporate Accounts Across Various Trading Platforms (e.g. Mt4, Mt5 And Evo). Leverage Represents The Ratio Of Borrowed Funds To The Trader's Equity Fund And Determines The Size Of Trading Positions A Trader Can Hold Relative To Their Account Balance.

For MT4 And MT5 Corporate Accounts, Leverage Varies By Currency Pair And Is Updated Every Monday. Maximum Leverage Available Up To 60 Times For Most Currency Pairs. Apply The Leverage (margin Rate) Calculated By The Financial Futures Association, If It Is Below The Maximum Leverage Set By The Financial Futures Association, Fiyostol, Using The Lower Leverage Determined By The Financial Futures Association. It Is Important To Note That Leverage Cannot Be Selected By The Trader, But Is Determined Based On The Applicable Interest Rate.

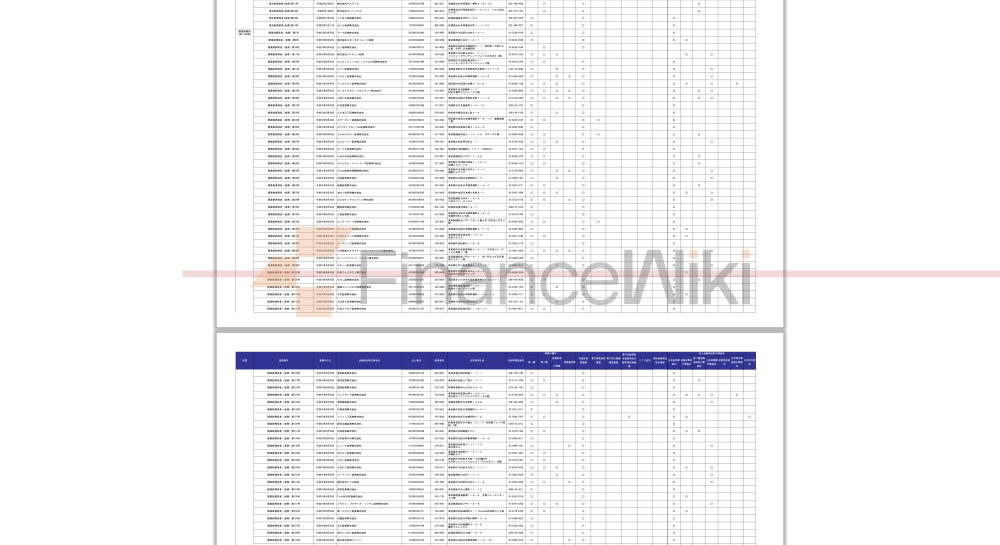

The Leverage Ratio For Each Currency Pair Is Subject To Change. Here Is An Example Of The Leverage Ratio As Of The Above Application Start Date:

- USD/JPY: 40.00 To 40.00

- EUR/JPY: 40.00 To 40.00

- GBP/USD: 50.00 To 50.00

- USD/CHF: 60.00 To 60.00

Similarly, For EVO Corporate Accounts, Leverage Is Determined By The Financial Futures Trading Association. Leverage Is Updated Every Saturday And Will Be Applicable From The Following Monday. Maximum Leverage Available Up To 99 Times For Certain Currency Pairs. Here Are Some Examples Of Leverage Ratios As Of The Application Start Date Mentioned:

- USD/JPY: 51.28 To 51.54

- EUR/JPY: 59.17 To 59.52

- GBP/USD: 67.56 To 67.56

- USD/CHF: 72.99 To 75.18

It Is Important To Understand The Margin Required To Open A Position As Leverage Affects The Amount Of Margin Required To Open And Maintain A Position. In Addition, The Company Account Leverage Announced On Saturday Is Subject To Change The Following Tuesday And May Be Subject To Temporary Changes Due To Sudden Fluctuations In The Market.

Traders Are Advised To Refer To The Official Website Of Firestore Or Contact Their Customer Support For Up-to-date Information And Specific Details Regarding The Leverage And Margin Requirements For Their Company Accounts.

Firestore Offers Competitive Spreads, ZERO And EVO Platforms On Its Mt5, Mt4 For Major Currency Pairs. Spreads Are Offered In Points And May Change In Real Time.

For The MT5 Platform, Some Examples Of Spreads Include USD/JPY With A Spread Of 0.6 Pips (Sell: 138.509, Buy: 138.515), EUR/JPY With A Spread Of 1.1 Pips (Sell: 149.733, Buy: 149.744), And GBP/JPY With A Spread Of 1.6 Pips (Sell: 172.156, Buy: 172.172).

On The MT4/ZERO Platform, The Spread Is Slightly Lower. For Example, The Spread Between USD/JPY Is 0.5 Pips (Sell: 138.514, Buy: 138.519), EUR/JPY Is 0.5 Pips (Sell: 149.741, Buy: 149.746), And GBP/JPY Is 1.5 Pips (Sell: 172.163, Buy: 172.178).

The EVO Platform Offers A Wider Spread Compared To The Other Two Platforms. Examples Of Spreads On This Platform Include USD/JPY With 2.2 Pips (Sell: 138.506, Buy: 138.528), EUR/JPY With 2.6 Pips (Sell: 149.730, Buy: 149.756), And GBP/JPY With 4.5 Pips (Sell: 172.145, Buy: 172.190).

Please Be Sure To Note That These Spreads Are Subject To Market Fluctuations And May Change Depending On Market Conditions. Traders Should Always Check The Live Exchange Rates On The Platform For Up-to-date Spreads.

Fyosto Charges Fees For Certain Services And Transactions. Here Is An Overview Of The Fees Associated With Fyosto:

1. Deposit And Withdrawal Fees:

- Transfer Payment From ATM/Bank Window: Fees Depend On The Financial Institution Group Used By The Client.

- Quick Deposit (Instant Reflection): Free Deposit Of 5,000 Yen Or More.

- Withdrawals To Receiving Financial Institution Group: Free Withdrawals Of 5,000 Yen Or More. Withdrawals Of Less Than 5,000 Yen Incur A Transfer Fee Of 330 Yen.

2. Certificate Issuance Fee:

- Proof Of Balance: There Is A Free Charge For Issuing Proof Of Balance In PDF Format. If A Physical Copy Is Requested By Mail, A Payment Of 1,100 Yen Per Copy (tax Included) Is Required.

- Copy Of Customer Ledger: Copy Of Customer Ledger Stating The Settlement Amount Of 1,100 Yen (tax Included) Per Year In Relation To Customer Transaction Costs. Copies Cannot Be Issued For More Than 10 Years.

Please Be Sure To Note That, If Applicable, The Transfer Fee Will Be Borne By The Customer. Various Certificates Will Be Sent By Easy Registered Mail Within Two Weeks Of The Fee Transfer.

Customers Can Apply For The Issuance Or Enquiry Fee In The Following Ways. Fiyostat Provides Customer Support During Business Hours. Applications Can Be Made By Phone Or Email Using The Contact Information Provided.

Fiyostat Offers Convenient Options For Deposit And Withdrawal Transactions.

Exit:

Customers Can Initiate A Withdrawal Request By Visiting The "My Page" Section Of Their Account. Withdrawals Of More Than 5,000 Yen Are Free Of Charge, And Withdrawals Of Less Than 5,000 Yen Are Free Of Charge 5,000 Yen, Resulting In A Transfer Fee Of 330 Yen. If The Account Balance Is 330 Yen Or Less And The Withdrawal Is Made, The Transfer Amount Will Be 0 Yen, Resulting In A Balance Of 0 Yen. The Withdrawal Amount Is Subject To The Remaining Margin Or The Amount Available For Trading. It Should Be Noted That The Withdrawal Of The Position May Result In Insufficient Margin, And The Loss Will Be Stopped Immediately. Withdrawal Acceptance Time And Transfer Time Depend On The Withdrawal Amount And The Specific Time Period On Working Days.

Deposit:

Firestall Offers Two Deposit Methods: "Express Deposit" And "Bank Transfer".

1. Quick Deposit: This Method Allows For Quick Deposits. Corporate Customers Can Make Quick Deposits Using GMO Aozora Net Bank, Sumishin SBI Net Bank, PayPay Bank, Rakuten Bank Or Japan Post Bank. Make Sure That The Account At, Fiyosito Matches The Account Name Used For Quick Deposits. Account Name Mismatches May Hinder The Quick Deposit Process.

2. Bank Transfer: When Making Bank Transfer Deposits, It Is Necessary To Fill In The Login ID Or Account Number And Foreign Exchange Account Name (pseudonym) Continuously As The Name Of The Transfer Requestor. The Payer Name Must Match The Payer Name, Fiyosito Foreign Exchange Transaction Account. If The Transfer Is Made From A Different Name, Fiyostol Reserves The Right To Cancel The Payment, Even After The Transfer Has Been Completed And The Transaction Has Taken Place. It Is Important To Note That Any Losses Due To This Situation Will Be The Responsibility Of The Customer, And Any Costs Associated With The Refund Will Be Borne By The Customer. The Timing Of The Bank Transfer Reflects The Completion Time Of The Transfer Procedure, And If Completed Before 15:00 On A Working Day, It Will Usually Be Completed On The Same Day.

Customers Can Find Their Specific Transfer Account Number, Fiyostol Account, In Their "My Pages" Section.