Corporate Profile

CLSA Premium Is A Global Financial Services Company Headquartered In Sydney, Australia, With Subsidiaries In Hong Kong And New Zealand. Established In 1986, CLSA Premium Holds Regulatory Licenses In Multiple Jurisdictions, Including A Financial Services License Issued By The Australian Securities And Investments Commission (ASIC) (AFSL No: 226602), A License Issued By The Securities And Futures Commission (SFC) In Hong Kong (ALB893), And A License Issued By The Financial Marekt Authority (FMA) In New Zealand (No: 1762). CLSA Premium's Business Scope Covers Financial Instruments Such As Foreign Exchange Trading, Precious Metals Trading, Commodity Trading, Share Contracts For Difference (CFD) And Credit Contracts For Difference (CFD). The Company Provides A Diverse Range Of Financial Products And Services To Global Clients, Including Standard Accounts, Premium Accounts And Professional Accounts, Meeting The Trading Needs Of Different Clients.

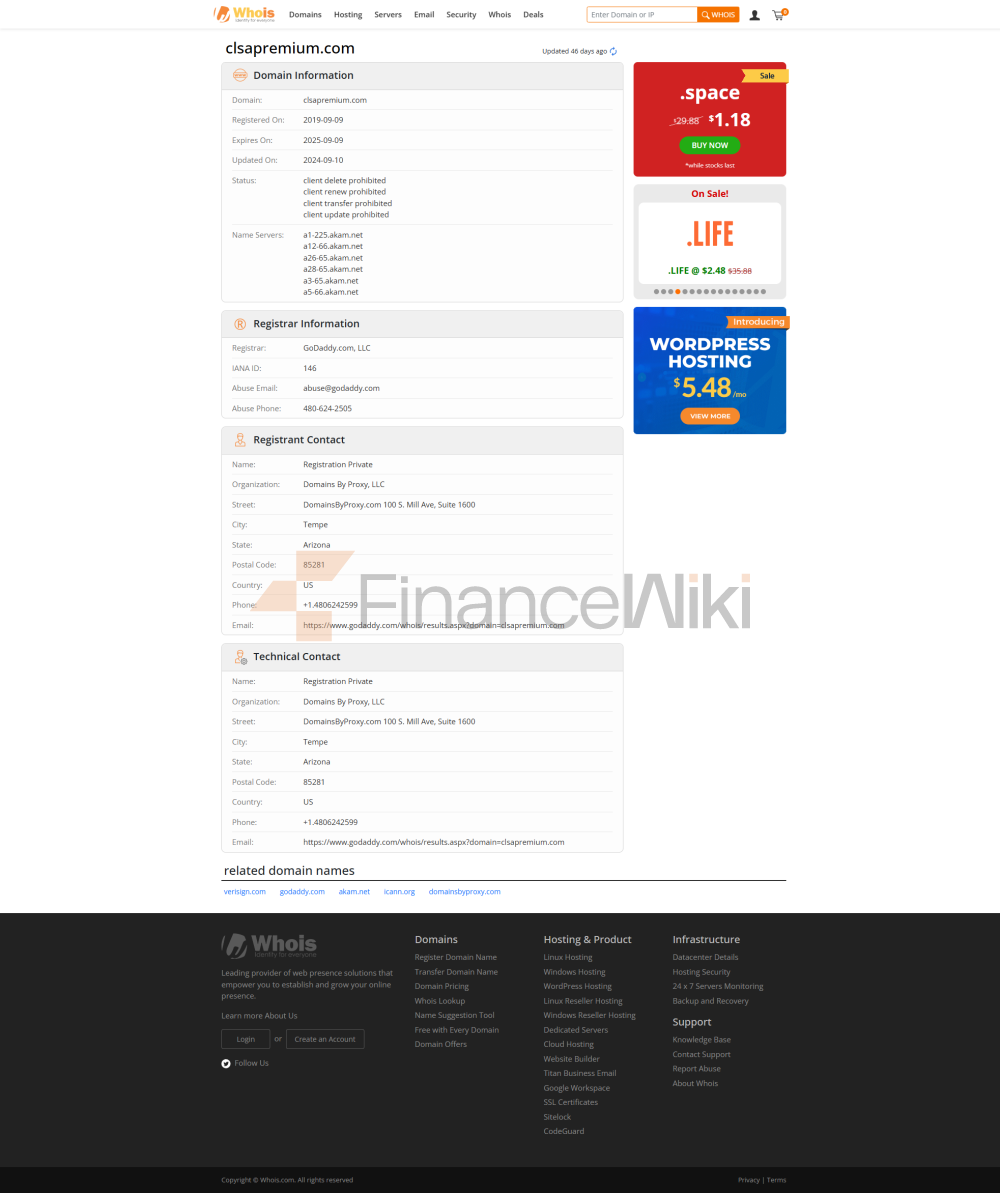

Regulatory Information

CLSA Premium Holds Regulatory Licenses In Multiple Jurisdictions To Ensure That Its Business Complies With Local Laws And Regulations. The Following Is Its Regulatory Authority And License Information:

- Australia : Holds A Financial Services License (AFSL No: 226602) Issued By The Australian Securities And Investments Commission (ASIC).

- Hong Kong : Regulated By The Securities And Futures Commission (SFC) In Hong Kong With License Number ALB893.

- New Zealand : Regulated By The Financial Marekt Authority (FMA) In New Zealand With License Number 1762.

All Business Of CLSA Premium Follows The Compliance Requirements Of The Relevant Regulators To Ensure The Safety Of Clients' Funds And The Transparency Of Transactions. The Company Also Provides Account Opening Service Without Minimum Deposit Requirements. Customers Can Complete Deposit And Withdrawal Operations By Bank Transfer Or Telegraphic Transfer.

Trading Products

CLSA Premium Offers A Wide Range Of Financial Trading Products, Including The Following Main Categories:

- Forex Trading : Covers Major Currency Pairs (e.g. EUR/USD, GBP/USD) And Emerging Market Currency Pairs.

- Precious Metals Trading : Includes Precious Metals Markets Such As Gold/USD And Silver/USD.

- Commodity Trading : Provides Trading Services For Energy Products Such As Crude Oil And Natural Gas, As Well As Agricultural Products.

- Stock Contracts For Difference (CFDs) : CFD Trading Covering Major Global Stock Markets.

- Credit Contracts For Difference (CFDs) : CFD Trading Including Fixed Income Products Such As Corporate Bonds And Government Bonds.

Trading Software

CLSA Premium Uses The MT5 Trading Platform , Which Provides A Variety Of Professional Technical Analysis Indicators To Support The Execution Of Convenient And Fast Trading Operations. Through MT5, Investors Can Check The Global Real-time Quotes, Charts And Expert Comments Anytime, Anywhere, And Keep Up With The Global Financial Marekt. The Platform Supports Desktop, IOS Mobile And Android Mobile Versions, Ensuring That Investors Can Access Account And Transaction Information 24/7.

Deposit And Withdrawal Methods

CLSA Premium Does Not Have A Minimum Deposit Requirement For Opening An Account. Customers Can Complete The Deposit And Withdrawal Operation Through Bank Transfer Or Telegraphic Transfer . Usually, The Deposit Funds Will Arrive Within One Working Day. It Should Be Noted That The Transit Bank Or The Remittance Bank May Charge Additional Transfer Fees. The Specific Amount Needs To Be Checked With The Relevant Bank. CLSA Premium Does Not Charge Any Additional Fees.

Customer Support

CLSA Premium Provides Comprehensive Customer Support Services. Customers Can Contact The Company By:

- Phone : + 61 2 8880 5588. Email : Services.au@clsapremium.com.

- Social Media : Follow The Official Accounts Of CLSA Premium On Platforms Such As Facebook, LinkedIn, Twitter And Instagram.

In Addition, The Company Offers An Educational Resource Center To Help Novice Traders Quickly Familiarize Themselves With Forex Trading, Including Content Such As Trading Strategy Sharing And Weekly Market Highlights.

Core Business & Services

CLSA Premium's Core Business Includes Forex Trading, Precious Metals Trading, Commodities Trading, Equity CFD, And Credit CFD. The Company Offers Differentiated Leverage Ratios In Different Jurisdictions, Such As:

- Australian Subsidiary : Forex Leverage Up To 1:200, Precious Metals Leverage Up To 1:100, And Commodities Leverage Up To 1:20.

- Hong Kong Subsidiary : Forex Leverage Up To 1:20.

- New Zealand Subsidiary : Forex Leverage Up To 1:200, Gold/USD Leverage Up To 1:200, Silver/USD Leverage Up To 1:100.

Technical Infrastructure

CLSA Premium's Technical Infrastructure Is Based On The MT5 Trading Platform , Which Is Known For Its Efficiency And Stability. The MT5 Platform Supports A Variety Of Chart Types And Analytical Tools, Including Technical Indicators (e.g. Moving Averages, Relative Strength Indices (RSI)) And Plotting Tools (e.g. Trend Lines, Fibonacci Retracements). In Addition, The Platform Provides In-depth Market Analysis And Real-time News Updates To Help Traders Better Grasp Market Dynamics.

Compliance And Risk Control System

CLSA Premium Follows A Strict Risk Control System To Ensure The Safety Of Client Funds And Transparency Of Transactions. The Company Ensures That Its Business Meets Regulatory Requirements Through Regular Audits And Threat And Risk Assessments. In Addition, The Company Also Provides Overnight Interest Service, When A Trader Holds A Position In Margin Foreign Exchange Contracts Or CFDs Overnight, Interest Will Be Charged Or Paid According To The Swap Rate. This Mechanism Helps Traders Manage The Risk Of Holding Positions Overnight.

Market Positioning And Competitive Advantage

CLSA Premium's Market Positioning Is Mainly Focused On Providing Diversified Financial Products And Services To Customers Around The World. Its Competitive Advantages Include:

- Broad Product Portfolio : Covering Multiple Markets Such As Foreign Exchange, Precious Metals, Commodities, Stocks And Credit CFDs.

- Flexible Trading Accounts : Standard, Premium And Professional Accounts Are Available To Meet The Needs Of Different Traders.

- Efficient Trading Platform : The MT5 Platform Supports Fast Execution And Multiple Analytical Tools.

- 24/7 Customer Support : 24/7 Customer Support Via Phone, Email And Social Media.

Social Responsibility And ESG

CLSA Premium Engages In Philanthropy Through Its CITIC CLSA Trust To Support Projects Aimed At Improving Education And Alleviating Poverty. The Company Also Reserves Funds For Emergency Assistance In Global And Regional Disaster Situations, Demonstrating Its Support For Communities In Times Of Crisis.

Strategic Collaboration Ecology

CLSA Premium Has Strategic Partnerships With Multiple Agencies And Organizations, Such As Financial Services Firms In Asia, Australia, The Americas And Europe. These Partnerships Help The Company Provide A Wider Range Of Financial Services And Expand Its Business Reach.

Financial Health

The Financial Health Of CLSA Premium Has Not Been Publicly Disclosed In Detail, But The Company Ensures The Stability And Sustainability Of Its Business Through Strict Risk Management And Compliant Operations.

Future Roadmap

The Future Roadmap Of CLSA Premium Includes The Following Aspects:

- Product Innovation : Continue To Develop And Launch More Financial Products To Meet The Diverse Needs Of Customers.

- Market Expansion : Further Expand Its Business Coverage In Asia, Australia, America And Europe.

- Technology Upgrade : Continuously Optimize Its Technology Infrastructure To Improve The Trading Experience And Customer Support Level.

The Above Is A Detailed Introduction To CLSA Premium.