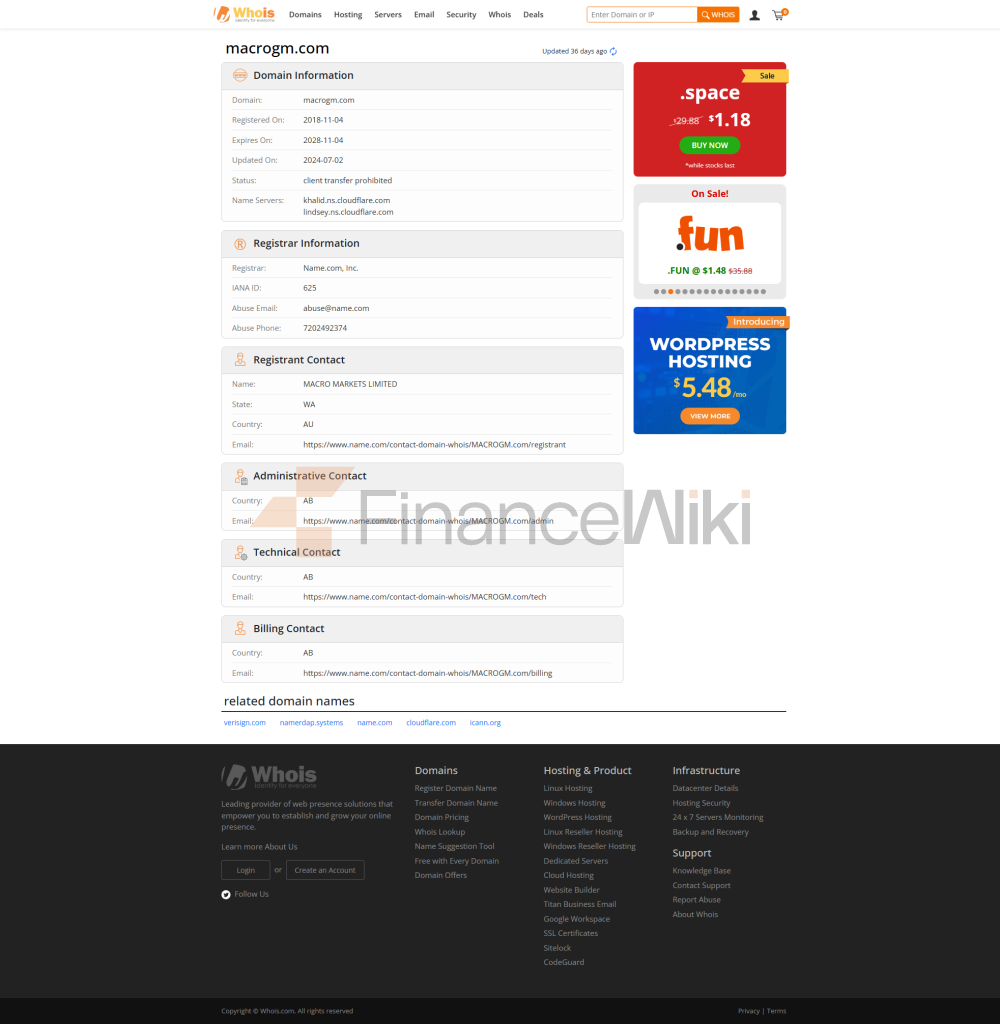

Macro Group Was Established In 2010 And Is Headquartered In Sydney, Australia. After Years Of Steady Development, It Currently Owns Subsidiaries Such As Macro Global, Macro Markets, Macro Bullion, Etc.

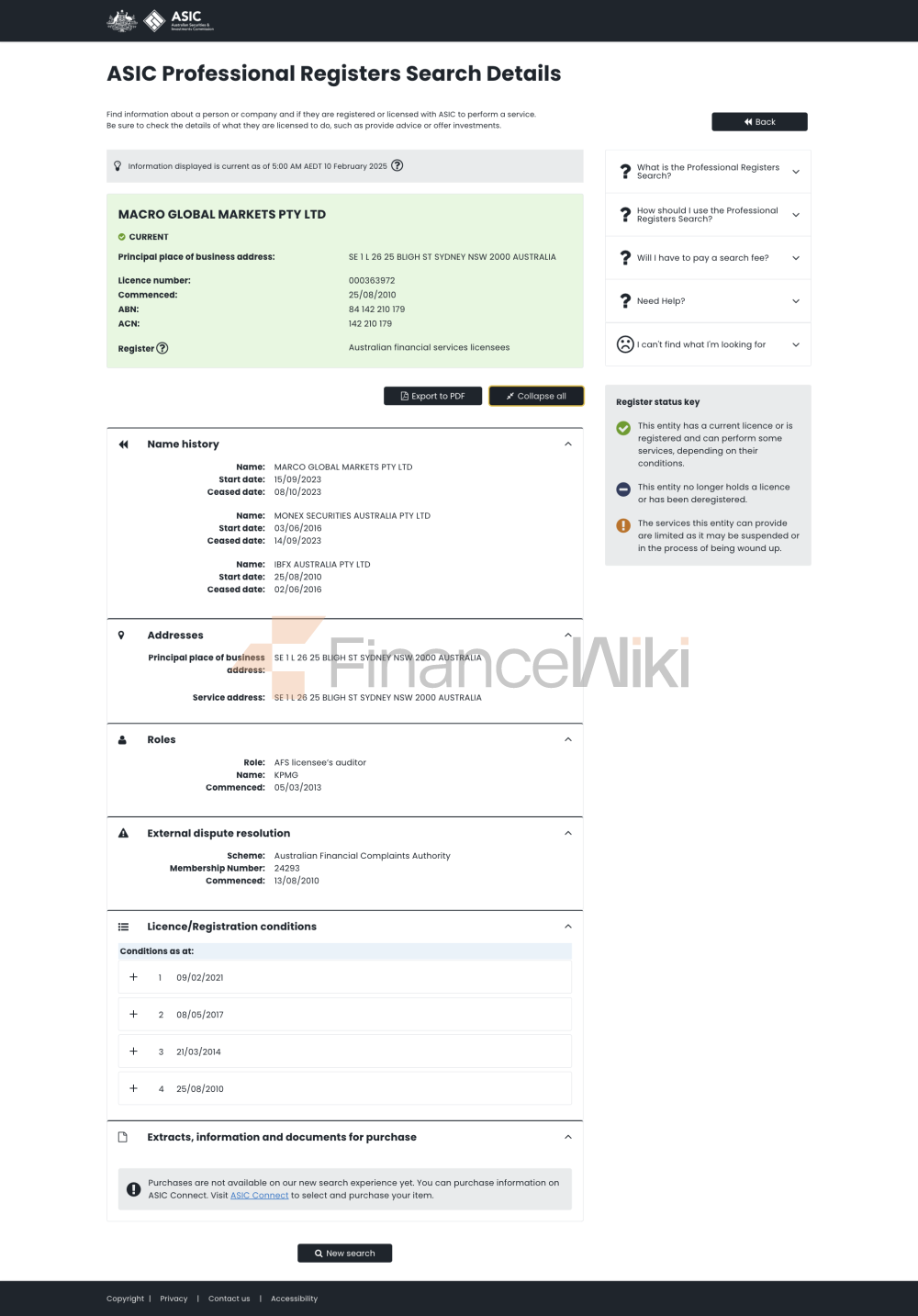

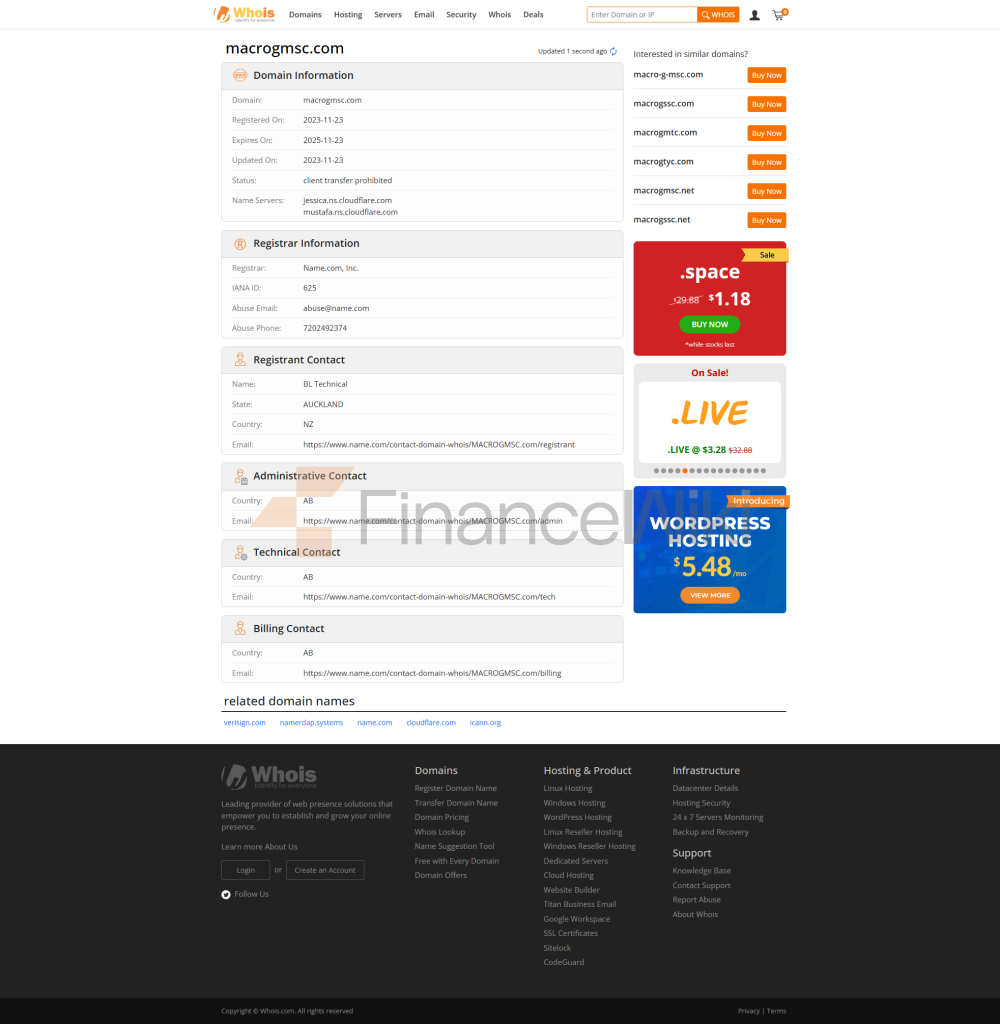

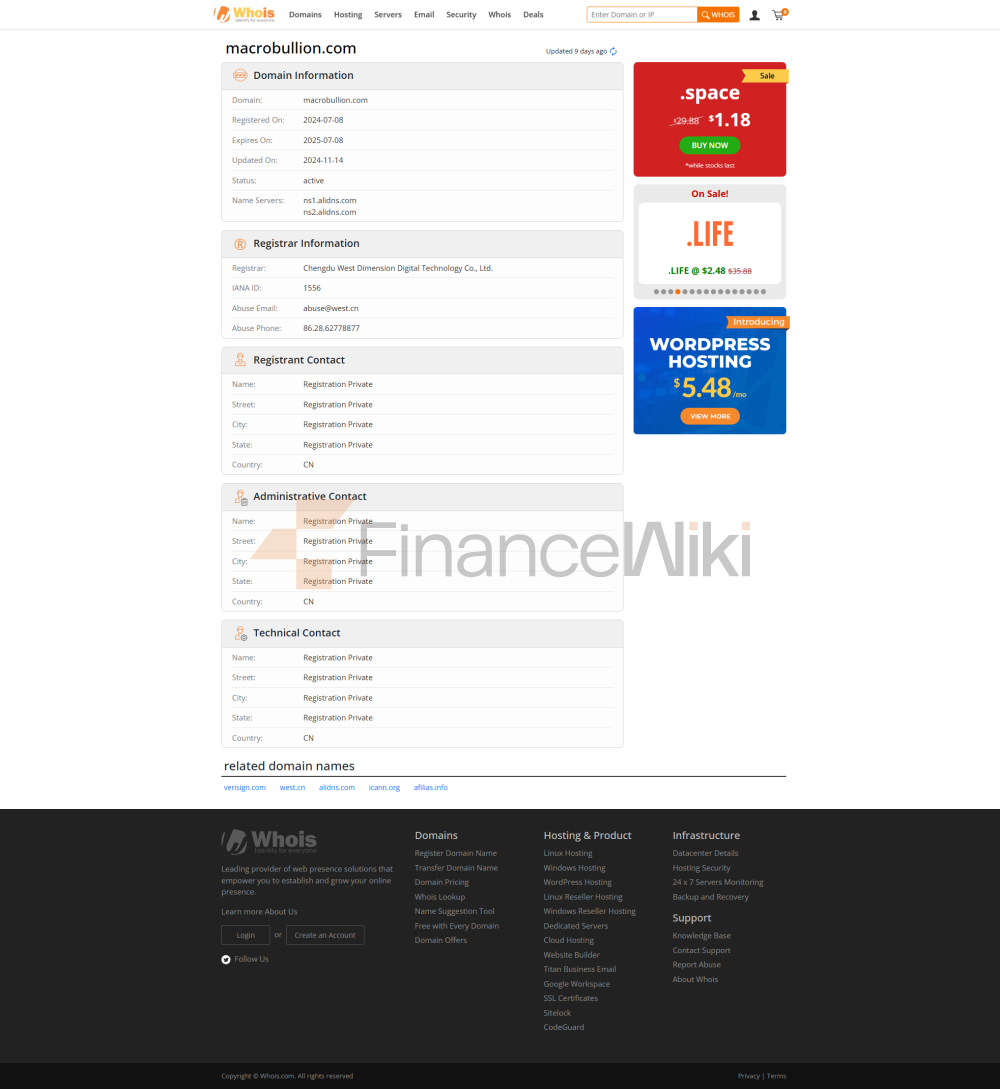

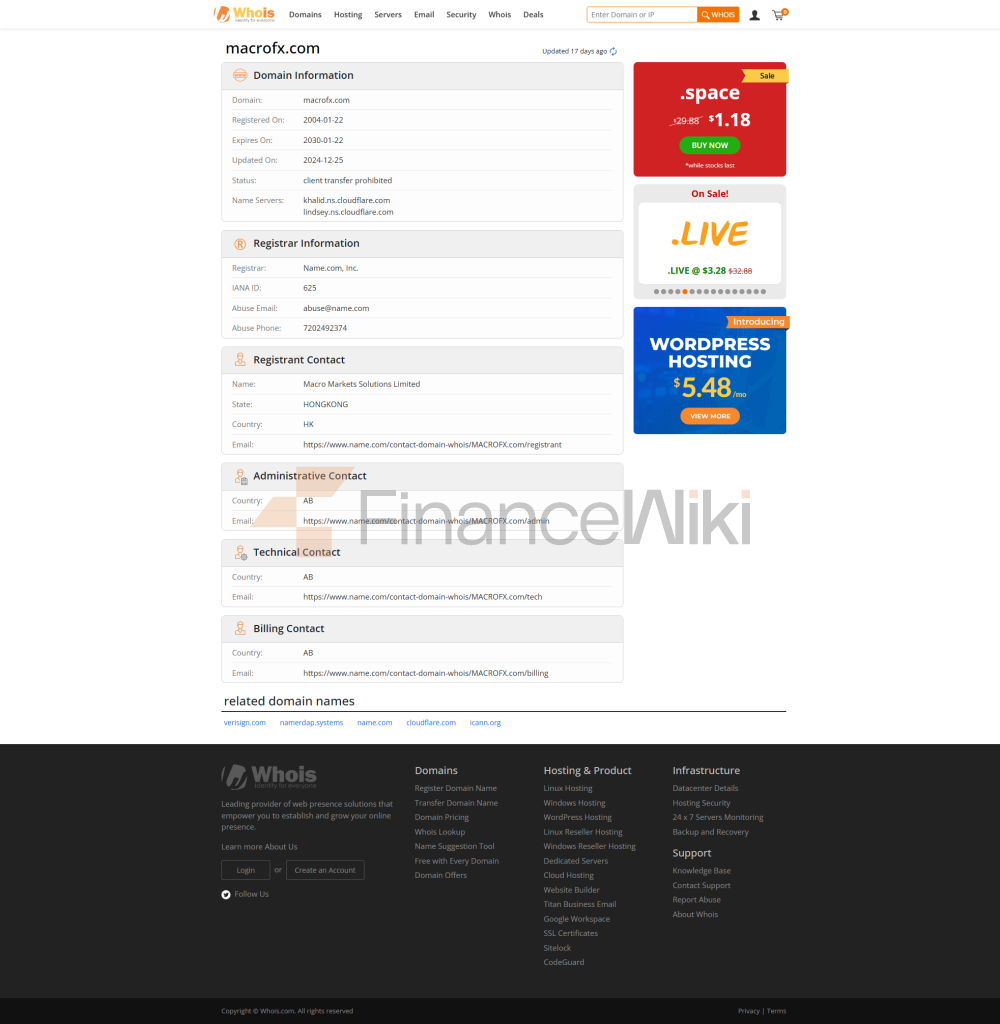

Macro Global Is The Trading Name Of Macro Global Markets Pty Ltd. It Is Regulated By The Australian Securities And Investments Commission (Australian Financial Services License (AFSL): 363972) And Provides Corresponding Financial Services To Professional And Institutional Clients. The Address Is Located At Level 2, 35 Clarence Street, Sydney NSW 2000. Regulatory Number: AFSL 363972. Macro Markets Is A Trading Name Of Macrofx (Seychelles) Limited, Regulated By The Seychelles Financial Services Authority (FSA), Which Provides Financial Services To Professional And Institutional Clients. The Address Is Located At Providence Complex Office 3, 1st Floor, Room B11, Providence. Regulatory Number: SD139. Macro Bullion Is The Trading Name Of Macro Markets Solutions Limited, A Member Of The Hong Kong Bullion Trading House, Class AA, No. 229, Which Provides Financial Services To Professional And Institutional Clients. The Address Is Located At Room B, 28/F, Plaza88, 88 Yeung Uk Road, Kwai Chung, New Territories, Hong Kong.

Market Tools

Macro Markets Offers Five Categories Of Hot Tradable Assets . Specifically, Their Product Lineup Covers Forex , Providing Access To The Largest And Most Liquid Markets In The World. Traders Can Also Participate In The Global Index , Thus Gaining Access To A Wider Range Of Market Movements. For Those Interested In Individual Companies, Stocks Trading Is Available. This Broker Also Offers Trading In Metals And Energy , Providing Opportunities For Commodity Markets.

Account Types

Macro Markets Offers Four Tailored Account Types , Aimed At Traders Of Different Experience Levels:

Standard Account Is Suitable For Beginners With A Minimum Deposit Of $100 . It Offers Medium Spreads, Ideal For Those Just Starting Out In Trading. The Professional Account That Requires $200 Minimum Deposit Has Similar Features, But Is Aimed At More Experienced Traders.

For Those Seeking More Advanced Trading Conditions, The Premium Account Requires $500 Minimum Deposit And Offers Lower Spreads. The ECN Account With $1000 Minimum Deposit Is Tailor-made For Professional Traders, With Lowest Spreads And Direct Market Access, Despite Trading Fees.

All Accounts Use The Popular MT4 Platform , Providing A Familiar And Powerful Trading Environment. It Is Worth Noting That All Accounts Have Market Execution, A Minimum Trade Lot Size Of 0.01, A Maximum Trade Lot Size Of 20, Unlimited Maximum Open Positions And A Mandatory Position Squaring Level Of 50%. The Broker Also Offers Free Accounts And Supports Expert Advisors For All Account Types, Allowing For Automated Trading Strategies.

Leverage

The Company Offers A Flexible Leverage Ratio Of 1:1 To 500:1. Leverage Can Amplify Your Profits, But It Can Also Amplify Your Losses. If The Market Goes Against You, You May Lose More Than Your Deposit Amount. For Example, If The Firm Offers Maximum Leverage Up To 1:500, This Means You Can Control Positions Worth 500 Times Your Initial Deposit Amount. If You Deposit $100, You Can Control Positions Worth $50,000.

Spreads And Commissions

Macro Markets Offers A Tiered Account Structure With Different Spread Conditions Across Its Four Account Types. Standard And Professional Accounts Have Medium Spreads, While Premium And ECN Accounts Have Lower Spreads For More Active Traders. It Is Worth Noting That The Broker Advertises Minimum Spreads Starting From 0.1 Pips On Its Homepage, Which May Apply To ECN Account Types. However, Macro Markets Has Not Revealed Its Commission Structure.

Promotion

Macro Markets Is Currently Running An Enticing Mid-life Promotion That Offers Clients A Generous 10% Deposit Bonus. Designed To Reward Traders And Increase Their Trading Capital, This Seasonal Event Offers New And Existing Clients The Perfect Opportunity To Boost Their Investment Potential.

This Promotion Is Simple And Impactful: Every Time They Make A Deposit, Clients Receive A 10% Bonus That Is Fully Unlocked And Instantly Tradable. This Bonus Is Available For Deposits Of All Sizes, Ranging From $200 To $50,000, With A Maximum Bonus Cap Of $5,000. For Example, A Deposit Of $200 Will Receive A $20 Bonus, Thus Bringing The Total Trade Balance To $220. While A Deposit Of $50,000 Will Receive A Maximum Bonus Of $5,000, Thereby Creating A Large Trade Balance Of $55,000.

What Makes This Offer Special Is Its Flexibility And Potentially Great Rewards. The Bonus Funds Are Not Just A Nominal Increase, But Are Fully Integrated Into The Trade Balance, Allowing Traders To Take Advantage Of These Additional Funds During Market Activities. This Structure Encourages Active Trading, As Each Trade Brings Traders Closer To Realizing The Full Benefits Of The Bonus.

Trading Platform

The Company Offers Multiple Trading Platforms To Its Clients, Including The MT4 Trading Platform And The Web End Point.

• The MetaTrader 4 (MT4) Platform Is The Most Popular Trading Platform In The World. Millions Of Traders Use Them To Trade Various Financial Instruments, Including Forex, CFDs, And Stocks.

Web Endpoint Is A Web-based Trading Platform That Allows You To Trade From Any Device With An Internet Connection. It Is A Simplified Version Of The MT4 Platform, But Still Offers Several Useful Features.

Both Platforms Are Available To Clients Of Mega Forex. The Platform That Works Best For You Will Depend On Your Individual Trading Needs And Preferences. If You Are A Professional Trader Who Wants Access To A Wide Range Of Features, Then The MT4 Trading Platform Is A Good Choice. If You Are Looking For A More Streamlined Platform That Can Be Accessed From Anywhere, Then Web Endpoint Is A Good Choice.

Copy Trading

Macro Markets Has Enhanced Its Offering With The Copy Trading Feature . This Social Trading Tool Allows Users To Automatically Copy The Strategies Of The Best Performing Traders On The Platform.

The Copy Trading Feature Is Designed To Bridge The Gap Between Novice And Experienced Traders, Providing Unique Learning Opportunities While Potentially Rewarding. Users Can Browse A Range Of Successful Traders, Analyze Their Performance Metrics, And Select Traders Who Wish To Follow Their Strategies.

Client Server

The Company Offers Support For Client Server Through Multiple Channels, Including Email, Phone, And Online Chat. Traders Also Have Access To A Customized VIP Client Server Program, Which Includes A Dedicated Account Manager And Priority Support.

The Platform Is Available In 8 Languages To Better Serve Traders From Different Regions Or Countries.

Customers Can Contact The Client Server Department Using The Information Provided Below:

Email: Info@macrofx.com, Macrofxcom@gmail.com

24/7 Multilingual Online Messaging

Social Media: Facebook, Twitter, YouTube, Linkedin And Instagram

Phone: + 61 4 3486 9014 (Australia)