Corporate Overview

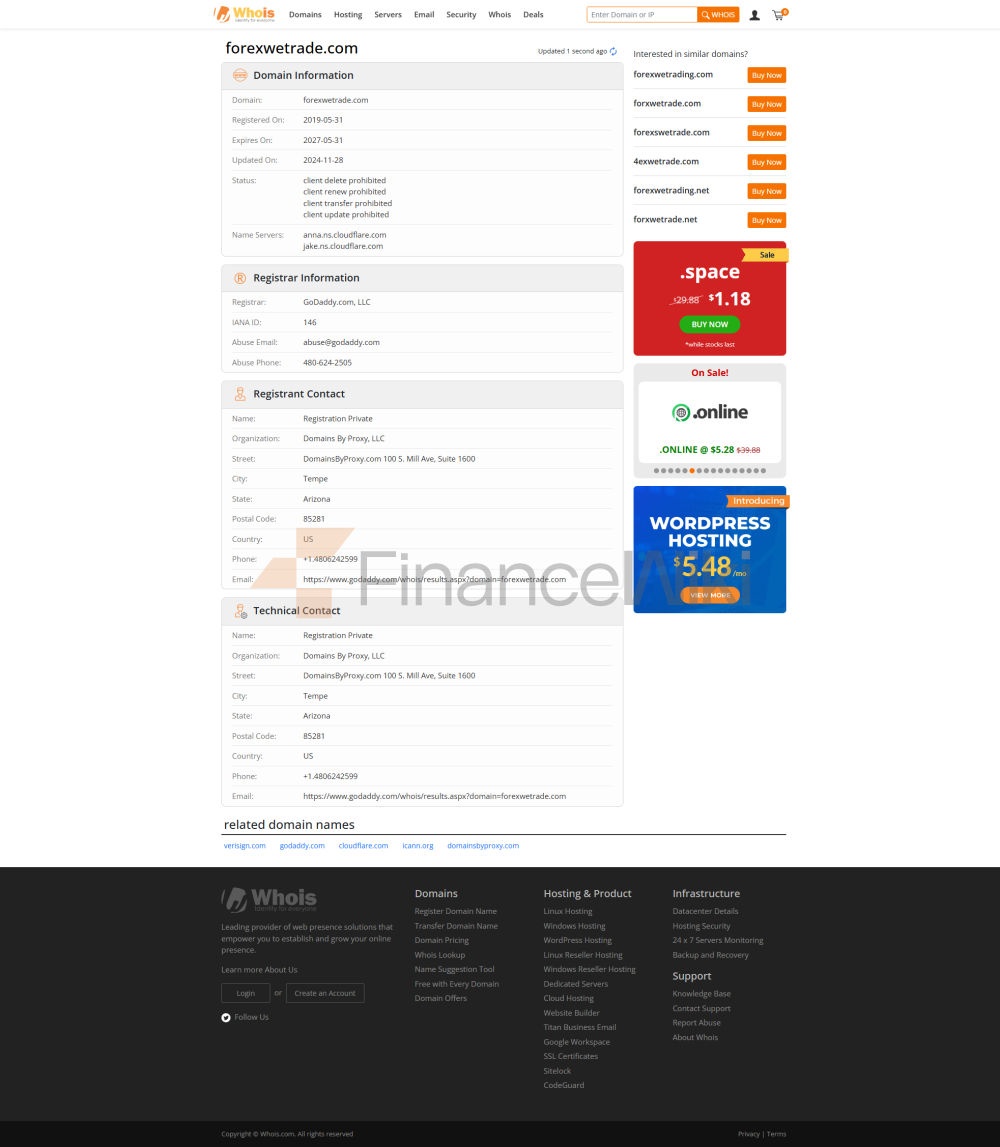

WeTrade International LLC (referred To As WeTrade) Was Established In 2015 And Is A Foreign Exchange Broker Registered In Saint Vincent And The Grenadines And Headquartered In United Kingdom . The Company's Registered Capital Is 1945 LLC 2022 , Focusing On Providing Diversified Financial Derivatives Trading Services To Global Clients.

Regulatory Information

WeTrade Is Regulated By Saint Vincent And The Grenadines Financial Services Authority (FSA) With License Number FSA-1945 , And Its Subsidiary WeTrade Capital Limited Is Also Regulated By Malaysian Labuan Financial Services Authority (LFSA) With License Number LIGANJ78802 . To Ensure The Safety Of Customer Funds, As Of 2023Q3 , All Customer Funds Are Deposited Separately With Top International Banks, Completely Segregated From Company Operating Funds.

Trading Products

WeTrade Provides Trading Services Including The Following Six Types Of Financial Derivatives:

- Forex : Covers Major And Minor Currency Pairs, Such As EUR/USD, GBP/USD, Etc.

- Precious Metals : Provides Trading Of Precious Metals Such As Gold And Silver.

- Energy : Includes Energy Products Such As Crude Oil And Natural Gas.

- Index : Covers Major Global Stock Indexes, Such As NASDAQ, DOW JONES, Etc.

- Stocks : Offers Trading In Stocks Such As US And Hong Kong Stocks.

- Digital Currency : Supports A Variety Of Cryptocurrencies Such As Bitcoin And Ethereum.

Trading Software

WeTrade Offers Traders A Variety Of Trading Platforms:

- MetaTrader 4 (MT4) : Provides A Friendly Interface And Powerful Tools To Enhance The Trading Experience.

- WeTrade App : Live Market Updates And Personalized Insights For Mobile Trading.

- MultiTerminal : Allows The Management Of Multiple Accounts Through A Single Platform.

- MAM : Designed For Professional Traders, It Supports One-click Trading Of Multiple Sub-accounts.

- APS : Provides Cutting-edge VPS Services To Ensure The Stability And Efficiency Of Trading.

Deposit And Withdrawal Methods

WeTrade Offers A Wide Range Of Deposit And Withdrawal Options:

- Deposit : Support USDT, Bank Transfer, Local Deposit, Among Which USDT And Local Deposit Have No Handling Fee.

- Withdrawal : Provide UnionPay, Bank Transfer, Withdrawal Services, UnionPay And Withdrawal Without Handling Fees.

Customer Support

WeTrade Provides Customer Support Through Multiple Channels:

- Online Support : Visit The Official Website For Help. Email Inquiry : Contact The Customer Support Team Through The Official Email.

Core Business And Services

WeTrade's Main Business Covers Foreign Exchange, Precious Metals, Energy, Indices, Stocks And Digital Currency Trading. Account Types Include Muslim Interest-Free Account, Standard Account And ECN Account, Which Respectively Meet The Needs Of Different Traders:

- Muslim Interest-Free Account : No Overnight Inventory Fees, In Line With Islamic Law Principles.

- Standard Account : Minimum Spread 1.0, No Commission.

- ECN Account : Minimum Spread 0, Flexible Leverage Options.

Technical Infrastructure

WeTrade's Technical Infrastructure Uses Advanced Platforms, Such As MT4 And The WeTrade App, To Ensure The Stability, Security And Efficiency Of Trading.

Compliance And Risk Control System

WeTrade Strictly Complies With Regulatory Requirements, Implements Comprehensive Risk Control Measures, And Cooperates With Top International Banks To Ensure The Safety Of Customer Funds.

Market Positioning And Competitive Advantage

With Its Diverse Trading Products, User-friendly Platform And Technical Support, WeTrade Provides Global Clients With An Efficient And Safe Trading Environment.

Customer Support And Empowerment

WeTrade Empowers Traders To Improve Their Trading Skills Through Educational Resources And Tools, Providing Market Analysis And Real-time Data Support.

FINANCIAL HEALTH

WeTrade Demonstrates A Solid Financial Position. As Of 2023Q3 , The Management Scale Has Steadily Increased, And Financial Transparency And Stability Have Been Recognized By The Market.

Future Roadmap

WeTrade Plans To Further Expand The Scope Of Services And Strengthen Technical Input, Aiming To Provide Customers With A Better Trading Experience.

The Above Strictly Follows The Structural And Normative Requirements To Ensure Objectivity, Accuracy, Compliance, And Compliance With All Data Annotations And Key Terminology Explanations.