Bank Name and BackgroundFull

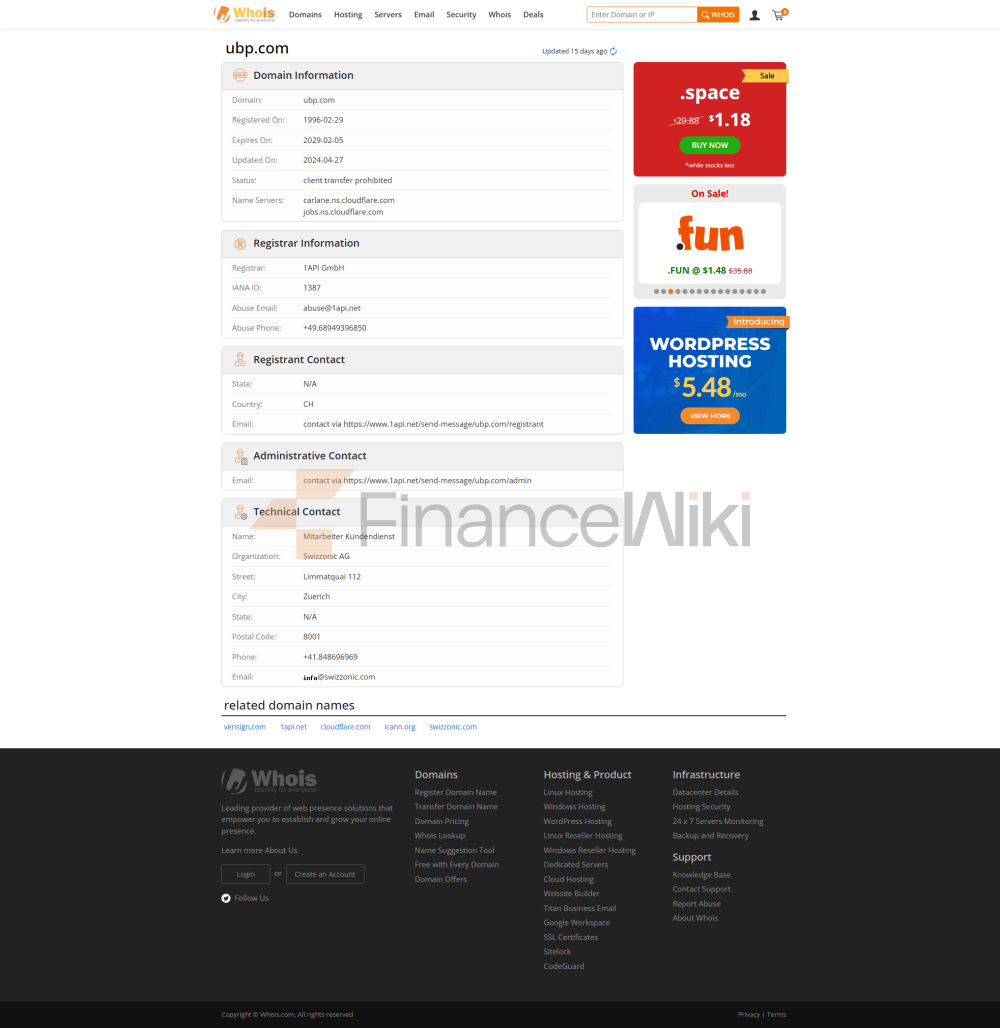

Name and Date of Establishment: Union Bancaire Privée (UBP), founded in 1969, has a history of more than 50 years, focusing on providing wealth management services to high-net-worth clients.

Headquartered in Geneva, Switzerland, UBP is a private bank of Swiss origin trusted by clients around the world.

Shareholder Background: UBP is an independent bank held by private shareholders and is privately owned. The bank is not publicly listed, is still controlled by the family, and retains a strong private banking character and flexibility.

Scope of

ServicesUBP has an extensive business network around the world, and its main customer groups are high-net-worth individuals, family offices, institutional investors, etc. UBP's services cover wealth management, asset management, investment banking and other fields. While the bank's core markets are concentrated in Europe and Switzerland, it operates in Asia, the Middle East and the Americas, with a number of overseas branches. UBP has multiple offices around the world and is well-known for its personalized wealth management services and customized investment solutions.

Regulation &

ComplianceUBP is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and has certain compliance requirements in a number of international markets. As a Swiss bank, UBP participates in Switzerland's deposit insurance scheme, which provides some security for customers' deposits. In terms of compliance, UBP is committed to complying with international financial regulations and implementing strict anti-money laundering measures. In recent years, UBP has performed well in terms of regulatory compliance, with no major breaches recorded.

Key indicatorsof financial health

: UBP's capital adequacy ratio is relatively stable, often exceeding international regulatory requirements, reflecting its strong capital strength. According to the latest financial report, UBP's capital adequacy ratio has broadly remained above 14%, well above the minimum regulatory requirements.

Non-performing loan ratio: As a private bank with a high-net-worth client base, UBP has low credit risk and its non-performing loan ratio is generally kept at a low level in the industry. Since it mainly provides personalized services to high-end customer groups, the probability of non-performing loans is small.

Liquidity Coverage Ratio: UBP's liquidity coverage ratio is relatively sufficient, and it is able to maintain sufficient liquidity to cope with customer demand and market volatility in the event of unexpected market conditions.

Deposit & Loan

ProductsDeposits: The deposit products provided by UBP are mainly concentrated in high-net-worth customers, and one of its features is fixed deposits and high-yield savings accounts. Banks' deposit rates are usually competitive in line with market rates, but they are not designed to attract large numbers of ordinary depositors.

Loans: UBP's loan products are mainly for its high-net-worth customers, including housing loans, car loans, personal credit loans, etc. Loan interest rates vary depending on the customer's qualifications, and generally offer more flexible repayment options, but their loan products are more personalized and high-end than other commercial banks.

List of Common

FeesUBP does not charge a monthly or annual fee for account management, but it does provide customized wealth management services based on the client's needs and asset size, so some services may incur higher fees. For cross-border transfers or high-value transactions, UBP charges a fee that is usually higher than that of a regular commercial bank.

Digital Service Experience

APP and Online Banking: UBP provides efficient mobile banking and online banking services, and its APP has relatively high user ratings and comprehensive functions. Through its mobile app, customers can achieve real-time transfers, bill management, portfolio monitoring, and more. At the same time, UBP also provides a variety of innovative investment tools, and continues to promote the application of artificial intelligence customer service and robo-advisors at the technical level.

Technological innovation: UBP continues to innovate in digitalization, providing technologies such as AI customer service, robo-advisors, and support for open banking APIs to ensure that customers can experience leading fintech services.

Customer Service Quality

Service Channels: UBP offers round-the-clock phone support, live chat support, and social media responsiveness. Customers can get in touch with the bank's staff through a variety of channels, and the response time is faster to solve problems.

Complaint handling: UBP has a high efficiency in handling customer complaints, and the bank has a strict internal complaint management mechanism, which has a low complaint rate and a short average resolution time. Customer satisfaction is generally high, especially among its high-end customer base.

Multi-language support: UBP provides multi-language support to ensure that customers across the globe receive high-quality services, especially among cross-border customers in regions such as Asia and the Middle East.

Security measures

: UBP has a high level of deposit security, and the bank participates in the Swiss deposit insurance program to ensure the safety of customer deposits. In addition, the bank employs advanced anti-fraud technologies, such as real-time transaction monitoring and anomaly detection, to ensure the safety of customer funds.

Data security: UBP is ISO 27001 certified, proving its competence in information security management. At the same time, the bank has not had any major data breaches in the past few years, and the information security of customers has been fully guaranteed.

Featured Services and Differentiated

Market Segments: UBP has launched featured accounts and wealth management products for specific markets such as students and the elderly, such as fee-free student accounts and exclusive wealth management products designed for elderly customers. In addition, UBP has also made a presence in the field of green finance, providing ESG (environmental, social, governance) investment products to attract customers who focus on sustainable investment.

High-net-worth services: UBP provides customized private banking services for high-net-worth clients, including wealth planning, tax planning, family trust and other services. Private banking services have a high threshold, but can provide customers with in-depth financial advice and wealth management solutions.