Overview

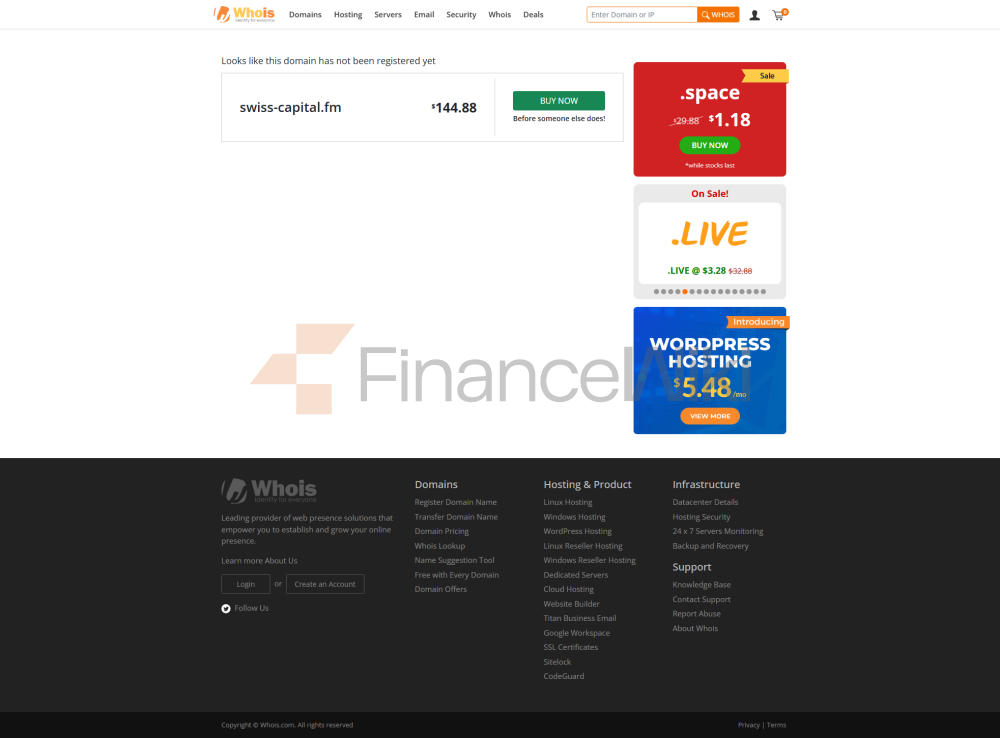

Founded In 2020, Swiss Capital Is Purportedly Based In China And Operates As An Unregulated Brokerage Firm. Despite Offering A Maximum Leverage Ratio Of 1:200 And Providing Access To Various Trading Platforms Such As MetaTrader 4 (MT4) And WebTrader, It Has A Poor Reputation For Being Accused Of Scams. The Company's Website Is Currently Down, Further Heightening Concerns About Its Credibility . Furthermore, While It Offers Access To A Wide Range Of Payment Methods And Demo Accounts, The Availability Of Key Information Such As Customer Support Remains Unclear. Traders Should Exercise Caution And Conduct Thorough Due Diligence Before Dealing With Swiss Capital.

Regulation

Swiss Capital Operates As A Brokerage Firm With No Regulatory Oversight. As A Broker, Swiss Capital Facilitates Trading And Trading In A Variety Of Financial Marekts Without Being Subject To Regulatory Requirements. This Lack Of Supervision Sets It Apart From Other Financial Entities, Allowing Swiss Capital To Operate With A Degree Of Autonomy And Flexibility. However, The Lack Of Regulatory Oversight Also Raises Concerns About Investors' Latent Risk, As There May Not Be Adequate Safeguards In Place To Protect Their Interests. Despite This, Swiss Capital Continues To Provide A Platform For Individuals And Institutions Seeking Brokerage Services, Using Its Independence To Provide Clients With Tailored Solutions.

Pros And Cons

Swiss Capital Offers A Diverse Range Of Market Tools And Trading Leverage Of Up To 1:200, As Well As Advanced Trading Platforms Like MT4 And WebTrader. However, Being An Unregulated Brokerage And The Lack Of Transparency Regarding Withdrawal Policies And Fees Raise Concerns About Investor Protection.

Market Tools

Swiss Capital Offers A Comprehensive Range Of Market Tools Distributed Across Different Asset Classes:

Forex (Forex): Clients Can Trade Currencies And Speculate On Exchange Rates Between Different Currency Pairs, Such As EUR/USD, GBP/JPY Or USD/JPY.

Indices: Swiss Capital Offers The Opportunity To Trade Stock Market Indices, Enabling Investors To Speculate On The Performance Of An Entire Market Or Sector. For Example, The S & P 500, FTSE 100 Or Nasdaq Composite Index.

Commodities: Investors Can Trade Commodities Such As Precious Metals (gold, Silver), Energy (crude Oil, Natural Gas), Agricultural Products (corn, Wheat), And Industrial Metals (copper, Aluminum).

Exchange-Traded Funds (ETFs): Swiss Capital Facilitates The Trading Of ETFs. These Funds Provide Exposure To A Diversified Portfolio Of Assets Including Stocks, Bonds, Commodities, Or Other Financial Instruments, And Are Traded On The Stock Market.

Stocks: Clients Have The Opportunity To Buy And Sell Shares In Listed Companies, Enabling Them To Participate Directly In The Ownership Of These Businesses And Potentially Benefit From Capital Appreciation And Dividends.

Leverage

Swiss Capital Offers Its Clients Trading Leverage Of Up To 1:200. Leverage Allows Traders To Control Larger Positions With Relatively Little Capital, Thereby Amplifying Potential Profits And Losses. With A Leverage Ratio Of 1:200, Clients Can Undertake Positions Of Up To 200 Times Their Initial Margin Deposit Amount. This High Level Of Leverage Offers Traders The Opportunity To Increase Their Purchasing Power, Potentially Amplifying Their Returns On Successful Trades. However, Using Leverage To Trade Also Increases The Level Of Risk, As Losses Can Exceed The Initial Investment. Therefore, Traders Should Exercise Caution And Implement Risk Management Strategies When Using Leverage For Trading Activities.

Spreads

Swiss Capital Uses Spreads As Its Primary Fee Structure For Trading Activities. For The Base Currency Pair EUR/USD, The Spread Is Around 2.5 Pips, Which Represents The Difference Between The Bid And Ask Prices. Although This Spread Is Wide Relative To The Industry Average Of 1.5 Pips, It Is The Main Cost That Traders Incur When Executing Trades. It Is Worth Noting That Swiss Capital Does Not Charge Trading Fees, Which Means That There Are No Additional Fees Other Than The Spread When Entering Or Exiting A Position. Traders Should Consider The Impact Of Wider Spreads On Their Profitability And Trading Strategy, Especially When Conducting High-frequency Or Scalping Trading Techniques. Crunching Spreads Are Usually Preferred.

Deposits And Withdrawals

Swiss Capital Offers A Variety Of Payment Methods For Deposits, Including Credit/debit Cards, Telegraphic Transfers, And Digital Payment Platforms Such As UnionPay, ApplePay, SamsungPay, American Express, Alipay, Discover, And Diners International. However, The Broker Lacks Transparency In Terms Of Withdrawal Policies And Does Not Provide Information On Minimum Deposit And Withdrawal Amounts Or Any Related Information. This Lack Of Clarity Has Raised Concerns, Especially In Light Of Complaints From Some Clients That They Were Persuaded To Invest Large Sums Of Money Only To Be Subjected To Fraud. Without Clear Guidance On Deposit And Withdrawal Processes, Clients May Face Difficulties Accessing Funds Or Understanding The Costs Involved. This Opacity Undermines Trust And Shows That Swiss Capital Needs More Transparency And Accountability In Its Financial Operations.

Trading Platform

Swiss Capital Offers Its Clients Two Powerful Trading Platforms: MetaTrader 4 (MT4) And WebTrader. Through MT4, Traders Have Access To A Feature-rich And User-friendly Platform Widely Recognized For Its Advanced Charting Tools, Technical Indicators, And Automated Trading Capabilities Through Expert Advisors (EAs). The Flexibility Of MT4 Allows Traders To Execute Trades Across A Variety Of Asset Classes, Efficiently Manage Their Portfolios, And Comprehensively Analyze Market Trends. In Addition, Swiss Capital Also Offers The WebTrader Platform, Which Enables Traders To Access The Market Directly From Their Web Browser, Without The Need To Download Or Install Anything. WebTrader Offers A Seamless Trading Experience, Real-time Quotes, One-click Trading Functionality, And A User-friendly Interface That Can Be Accessed Anywhere There Is An Internet Connection. Whether Using The Rich Features Of MT4 Or The Convenience Of WebTrader, Swiss Capital Ensures That Its Clients Have Access To Cutting-edge Trading Technology To Effectively Pursue Their Investment Goals.

Conclusion

Swiss Capital Operates As An Unregulated Brokerage Offering A Wide Range Of Market Instruments Including Forex, Indices, Commodities, ETFs, And Stocks. Despite The Lack Of Regulatory Oversight, Clients Have Access To Trading Leverage Of Up To 1:200, Enabling Them To Amplify Potential Profits And Losses. While The Broker Uses Spreads As Its Main Fee Structure, With The Benchmark EUR/USD Currency Pair Having Spreads Of Around 2.5 Pips, It Does Not Charge Trading Fees. However, The Lack Of Transparency Regarding Withdrawal Policies And Related Matters Has Raised Concerns About The Availability Of Funds And Latent Risk For Investors. Swiss Capital Offers Two Robust Trading Platforms, MetaTrader 4 (MT4) And WebTrader, Which Provide Clients With Advanced Charting Tools, Technical Indicators And Automated Trading Capabilities. Despite The Provision Of These Services, The Broker's Website Is Currently Inaccessible, Leading To Allegations Of Fraud. This Situation Emphasizes The Importance Of Caution And Due Diligence When Considering Working With Swiss Capital.