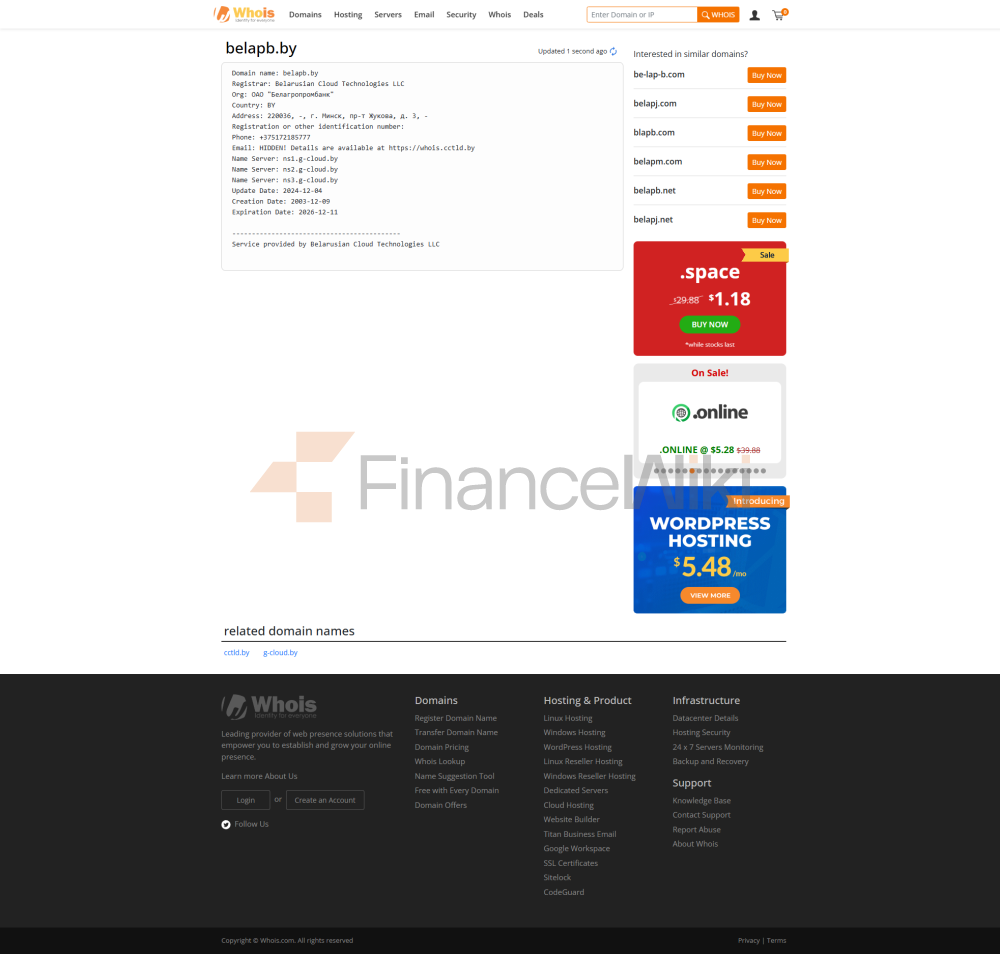

The full name of the Belarusian Agricultural Bank (Public Joint Stock Company "Belagroprombank"), one of the central pillars of the financial system of the Republic of Belarus, reveals its legal entity nature as a public joint-stock company. The bank was officially incorporated in the National Bank of Belarus on September 3, 1991, and its headquarters is located at 3 Zhukova Street in Minsk.

Belarusian Agricultural Bank occupies a significant market position in the Belarusian financial market. At the end of 2011, the bank was the second largest bank in Belarus, with a market share of 24%. As of December 2024, it remains the second-largest bank, with outstanding performance in key indicators such as total assets (14.4%), regulatory capital (15.4%), customer loans (20.3%) and customer funds (18.9%).

Regulatory Environment & Compliance FootprintThe

operations of the Belarusian Agricultural Bank are strictly regulated by the National Bank of Belarus (NBRB). The National Bank not only supervises it on a day-to-day basis, but also provides support at critical moments, such as the injection of 640 million Belarusian rubles (about $250 million) of capital into the bank in 2022 to strengthen its capital strength.

When it comes to deposit insurance, the Belarusian Agricultural Bank enjoys a unique advantage: all deposits are fully guaranteed by the state. What's more noteworthy is that the bank has historically not had to pay any premiums to the Deposit Insurance Fund, in stark contrast to other banks. This full state guarantee and historical premium waiver is at odds with the bank's exposure to severe international financial sanctions, including SWIFT disconnections and correspondent account closures. This actually reflects the strong determination and ability of the Belarusian government to maintain domestic financial stability by ensuring the operation of core banks through direct guarantees and capital injections. However, the National Bank of Belarus is drafting a new deposit insurance bill, which in the future may require major state-owned banks, including the Agricultural Bank of Belarus, to start paying premiums, which heralds a possible structural change in the deposit insurance system.

In terms of compliance record, the Belarusian Agricultural Bank has faced severe challenges from international sanctions in recent years. In September 2021, a number of major European banks, including Deutsche Bank, closed their correspondent accounts, cutting off their direct links to the European financial system. Subsequently, in March 2022, the European Union further banned the provision of SWIFT financial information services to designated banks such as the Agricultural Bank of Belarus, resulting in its exclusion from major global payment systems. Canada has imposed similar restrictions on the bank, prohibiting it from issuing negotiable securities, debt with maturities longer than 90 days, and prohibiting the provision of insurance and reinsurance services. This domestic stability has come at the expense of international financial connectivity. For clients, this means that the security of their funds in Belarus is covered by the state, but they face extremely high barriers and costs when doing business internationally.

Despite these challenges, the international rating agency S&P Global Ratings upgraded the foreign currency long-term credit rating of Belarusian Agricultural Bank from "CC" to "CCC" in November 2023 and reaffirmed the rating of "CCC" in November 2024 with a stable outlook. This indicates that the rating agency believes that the bank will be able to continue to meet its debt obligations in the absence of capital controls by the Central Bank of Belarus, and that government support is a key factor in maintaining its stability. However, Moody's has withdrawn its rating on the Agricultural Bank of Belarus in June 2023. Moody's revocation of the rating may hint at the complexity and limitations of assessment in a sanctions environment, where it is difficult for international institutions to conduct effective assessments in the absence of transparency and comparable data.

Financial Health Profiling

toassess the financial health of the Belarusian Agricultural Bank requires a review of key indicators such as its capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio.

In terms of capital adequacy, the 640 million Belarusian rubles (about $250 million) injected by the government in 2022 has played a key role in supporting its capital position. This improved the bank's risk-adjusted capital adequacy ratio to 5.5% as at 30 September 2022 from 4.4% at the end of 2021. While this level may not be high internationally (for example, Basel III is usually more demanding), timely government funding underscores the country's commitment to its financial stability and avoids further deterioration in capital.

With regard to the non-performing loan ratio, the available information does not provide specific and up-to-date data on the Agricultural Bank of Belarus. However, the non-performing loan ratio of the Belarusian banking sector as a whole reached 13.7% in the third quarter of 2017, and mandatory lending is considered a serious problem that could damage asset quality. This suggests that the bank, acting as an agent of the government, may have credit risk in its loan portfolio due to policy guidance rather than purely commercial considerations. Although the average non-performing loan ratio in the Central and South-East Europe (CESEE) region fell to a record low of 2.08% in June 2024, the exceptional economic and regulatory environment in Belarus may make its situation different and requires careful assessment.

TheLiquidity Coverage Ratio (LCR) is the highlight of the Belarusian Agricultural Bank. As of July 1, 2022, the bank's liquidity coverage ratio indicator exceeded 250% and the net stable funding ratio indicator exceeded 120%, both well above the minimum regulatory requirements. Its liquidity buffer is ample and includes an unrestricted portfolio of cash, interbank deposits and securities, representing approximately 24% of total assets. In addition, the bank has no outstanding foreign currency-denominated debt and the law prohibits the issuance of new foreign currency debt, which further reduces its foreign currency liquidity risk. Customer deposits remained stable, benefiting from timely adjustment of interest rates and government funding.

Deposit & Loan Product MatrixAgricultural

Bank of Belarus offers a diverse range of deposit and loan products to meet the needs of individual and corporate customers.

In terms of deposit products, the bank provides demand and time deposit services. It is worth noting that its fixed-term irrevocable deposit products are attractive. For example, the Belarusian ruble "Income Plus" fixed deposit, which will be launched in 2024, will have a maturity of 370 days and a fixed annual interest rate of up to 15% for the first 95 days, after which it will be reduced to 12.20%. In addition, the bank adjusted the interest rates on fixed-term irrevocable deposits in the Belarusian ruble and the Russian ruble in May 2025 and January 2025, respectively, to adapt to market changes. The average deposit rate in Belarus is about 9.72% at the beginning of 2025, and the level of interest rates of the Belarusian Agricultural Bank is in line with the high interest rate environment in the country. For deposits in foreign currency, deposits of the Belarusian Agricultural Bank are fully guaranteed by the state, which provides depositors with an extremely high level of security.

In terms of loan products, the Belarusian Agricultural Bank, as a government agent, actively participates in state projects and provides special loans for the agricultural industry. For example, under the "Wider Circle" program, the bank provides loans for the purchase of agricultural machinery and equipment to corporate clients. This shows that it plays a central role in supporting the real economy, especially the agricultural sector. The average bank lending rate in Belarus is about 11.600% in January 2025, although no specific rates and thresholds for mortgages, car loans and personal lines of credit are provided. As the second largest loan provider in Belarus, the bank's market share in customer loans reached 20.3% in December 2024, demonstrating its importance in the credit market. Demand for private sector loans in Belarus as a whole grew in the first half of 2024, especially in consumer durables (e.g. automobiles), suggesting that the Belarusian Agricultural Bank may also have a presence in this consumer credit market.

digital service experienceBelarusian

Agricultural Bank is committed to enhancing the customer experience through its mobile app and online banking services.

The bank's mobile app allows users to make mobile online banking quick and easy. Core features include: search for nearby ATMs and branches, view news and bank exchange rates, and check account and banking service information. For cardholders, the service can be activated through a simple online registration procedure and a PIN or fingerprint login can be set up for quick access. In order to make deposits, payments, and other transactions, users need to install a mobile key. The app is constantly evolving and offers a smartwatch app for Wear OS that allows users to view card information, check balances, and brief bills.

customer service quality

Belarusian Agricultural Bank offers a variety of customer service channels to meet the needs of its customers.

The bank offers 24/7 phone support, including numbers from landlines and major mobile operators. In addition, online calling, co-browsing and online consulting services are available, as well as a "Call to Order" function, which indicates that it has an online chat and response mechanism. In terms of multilingual support, its mobile app supports both English and Russian, which is essential for serving domestic and potential international customers in Belarus.

security measures

TheAgricultural Bank of Belarus has implemented a number of measures in terms of fund and data security to protect customer assets and information.

In terms of the security of funds, deposits of Belarusian Agricultural Bank are fully guaranteed by the state, which means that the safety of the client's funds is ultimately guaranteed by the Belarusian government. In the area of anti-fraud technology, although there is no direct mention of the specific anti-fraud technical details of the Belarusian Agricultural Bank, the Belarusian banking sector is generally concerned about the trend of fraudulent activities and has taken measures to combat fraud using payment instruments and means of payment. For example, banks will protect against common frauds such as phishing and SMS phishing.

market position and accoladesBelarusian

Agricultural Bank occupies a significant market position in the Belarusian financial system.

In terms of industry rankings, the bank is the second largest bank in Belarus. As of December 2024, it ranks among the top banks in Belarus in terms of total assets, regulatory capital, client loans and client funds. For example, it has a market share of 20.3% in customer loans and 18.9% in customer funds.

In terms of awards and accolades, in 2017 the Belarusian Agricultural Bank was awarded "Best Corporate Bank", "Best Corporate Social Responsibility Bank" and "Best Retail Bank" by the Global Banking & Finance Awards. In addition, in 2023, Belarusian Agricultural Bank, together with Bank of Belarus, Belarusian Gazprombank, Technobank and the leasing company ASB Leasing, was recognized by the Development Bank of the Republic of Belarus (DBRB) as the "Best Partner" for projects to support SMEs. These awards and recognitions reflect the bank's significant contributions to specific areas and national development. Despite the lack of accolades such as the latest international "Best Digital Bank" or "Most Innovative Awards" for 2023-2024, it has been recognized for its performance in the domestic market and in specific sectors.