Company Profile

Full Name Of The Company : LBLV (Lblv Group) Date Of Establishment : 2017 Headquarters Location : Seychelles Registered Capital : Undisclosed Regulatory License : Revoked Financial Services Authority (FSA) Supervision , Original License Number Undisclosed Executive Background : Undisclosed Details Advisory Team : Undisclosed Industry Association Members : Undisclosed Compliance Statement : Due To FSA Regulation Has Been To Be Revoked, Investors Need To Carefully Evaluate Its Legality And Security

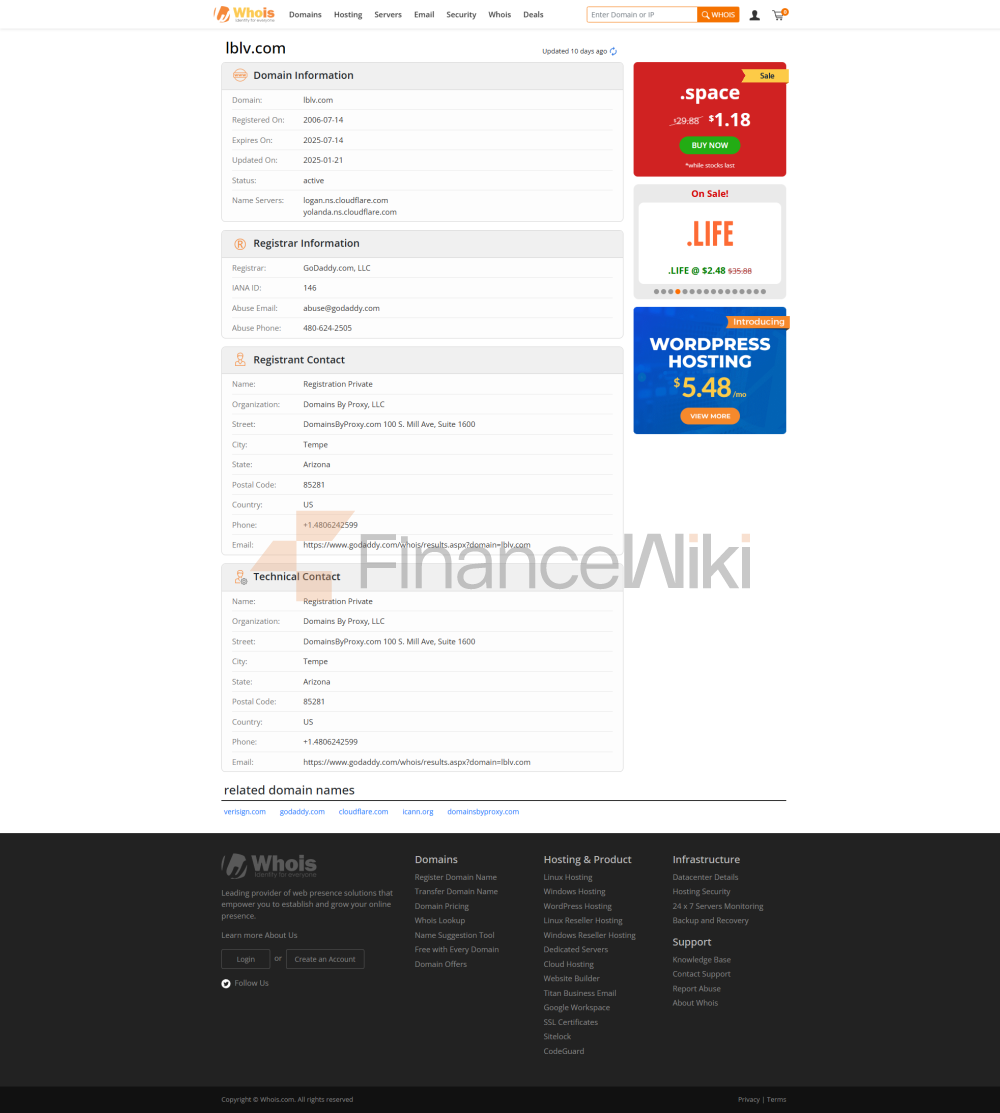

LBLV Is A Seychelles-based Forex Broker That Has Been In Business Since 2017. The Company Offers Trading Services In A Variety Of Financial Instruments, Including Forex, Indices, Stocks, Metals, Commodities And Digital Currencies. However, As Its Regulatory License Was Revoked By The Seychelles Financial Services Authority (FSA), Investors Need To Be Highly Vigilant About Risk Management.

Core Business

Main Business Areas : Forex Brokerage, Contract For Difference (CFD) Trading Service Objects : Global Retail Traders (not Applicable To Specific Regions Such As The United States, North Korea, Etc.) Technical Platform : LBLV Trader Platform (provides Cross-device Support) Risk Management : Offers A Variety Of Account Types, With A Maximum Leverage Of 1:400

LBLV's Core Business Covers A Variety Of Financial Marekt Trading Tools, Providing Traders With A Variety Of Investment Options. Its Technical Support Includes A Flexible Trading Platform And Multiple Trading Tools, But Its High-risk Leveraged Trading And Regional Restrictions Are Aspects That Traders Need To Pay Special Attention To.

Development Milestones

Key Funding Rounds : Undisclosed Major Strategic Partnerships : Undisclosed Industry Awards : Undisclosed Management Scale Breakthrough : Undisclosed

Due To Limited Information, LBLV's Development Milestones Cannot Provide Detailed Data.

Regulatory Information

Regulatory Authority : Seychelles Financial Services Authority (FSA) Compliance Statement : The Original Regulatory License Has Been Revoked, Investors Need To Pay Attention To Its Compliance

LBLV Was Regulated By The Seychelles Financial Services Authority (FSA), But Its License Was Recently Revoked. This Means That Investors Cannot Rely On The FSA's Protection Mechanism And Need To Evaluate The Legitimacy And Safety Of Their Business For Themselves.

Trading Products

Currency : EURUSD, AUDGBP, USDJPY And Other Major And Minor Currency Pairs Index : S & P 500, NASDAQ, FTSE 100 Stocks : Amazon, Microsoft, Apple And Other Technology Companies Metals : Gold (XAU), Silver (XAG), Aluminum, Platinum Commodities : Brent Crude Oil, Coffee, Natural Gas Digital Currency : Bitcoin, Ethereum, Cardano

LBLV Offers Over 1400 Trading Instruments, Covering Six Major Market Areas. However, Its Regulatory Issues May Increase Trading Risks, Requiring Careful Selection Of Trading Instruments.

Trading Software

Trading Platform : LBLV Trader (Cross-Device Support) Features : Cross-platform Access, Multiple Charts And Timeframes, SSL Encryption, Flexible Layout, Technical Indicator Tools

LBLV's Trading Platform Supports Multiple Devices And Secures Transactions Through SSL Encryption. However, Its High Leverage Trading And Regional Restrictions May Negatively Impact The User Experience.

Deposit And Withdrawal Methods

Deposit Methods : Credit/Debit Card (Visa, MasterCard), Bank Transfer, Digital Currency Wallet Available Currencies : EUR, USD, GBP, JPY, AUD Withdrawal Methods : Consistent With Deposit Methods

LBLV Has A Variety Of Deposit And Withdrawal Methods, But It Should Be Noted That Its High Minimum Deposit Amount (5000 USD) And Regional Restrictions (such As The United States).

Customer Support

Support Channels : Email, Phone, Live Chat, Facebook, Instagram Language Support : English, Thai, Russian, Portuguese

LBLV Offers A Variety Of Customer Support Channels, But Investors Need To Be Aware That Its Regulatory Issues May Affect Service Quality.

Core Business And Services

Account Types : Beginner Account, Basic Account, Premium Account, Elite Account, Elite Enhanced Account, VIP Account Minimum Deposit : $5,000 For Beginner Account, $1 Million For VIP Account Leverage : Up To 1:400

LBLV Has A Variety Of Account Types Designed To Meet The Needs Of Different Traders. However, Its High Minimum Deposit And High Leverage Trading Can Pose Challenges For Novice And Small Capital Traders.

Technical Infrastructure

Trading Platform : LBLV Traders (cross-device Support) Security : SSL Encryption Reliability : Undisclosed

LBLV's Technical Infrastructure Supports Cross-device Trading, But The Stability And Reliability Of Its Platform Need To Be Further Verified.

Compliance And Risk Control System

Compliance Statement : The Original Regulatory License Has Been Revoked, And Investors Need To Carefully Evaluate Its Compliance Risk Management System : Provides Highly Leveraged Trading, But Does Not Disclose Specific Risk Management Tools

LBLV's Risk Management System Lacks Transparency, And Investors Need To Be Vigilant About The Risks Posed By Its Highly Leveraged Trading.

Market Positioning And Competitive Advantage

Market Positioning : Forex Brokers Offering Diverse Trading Tools Competitive Advantage : Diverse Account Types And Trading Tools

Although The LBLV Offers A Diverse Range Of Trading Tools, Its Regulatory Issues And High-risk Operations Could Undermine Its Market Competitiveness.

Customer Support And Empower

Support Services : 24-hour Exclusive Support, Account Manager Access, Technical Indicators And Technical Analysis Tools Empower Tools : Islamic Account Options, Mobile Trading Capabilities

Lblv Offers Several Customer Support And Empower Tools, But Its Regional Restrictions And High Minimum Deposits May Affect The User Experience.

Social Responsibility And ESG

Social Responsibility : Undisclosed ESG : Undisclosed

LBLV Has Not Disclosed Its Social Responsibility And ESG Activities. Investors Need To Pay Attention To The Impact Of Its Business On The Environment, Society And Governance.

Strategic Cooperation Ecosystem

Partners : Undisclosed Ecosystem : Undisclosed

LBLV Has Not Disclosed Its Strategic Cooperation Ecosystem. Investors Need To Pay Attention To The Sustainability And Future Development Of Its Business.

Financial Health

Financial Status : Undisclosed Transparency : Low

The Financial Health And Transparency Of LBLV Are Not Disclosed, And Investors Need To Carefully Evaluate Its Latent Risk.

Future Roadmap

Development Plan : Undisclosed Innovation : Undisclosed

The Future Roadmap Of LBLV Is Not Disclosed, And Investors Need To Pay Attention To The Continuity And Innovation Ability Of Its Business.