Verified: KOSEI Securities Co., Ltd. Was Established In April 1961. It Is A Securities Company Mainly Engaged In Trading, Brokerage, Underwriting Business, Sales And Other Related Services. The Company Is Regulated By The Japanese FSA.

Its Main Focus Is On Stocks, Bonds, Investment Trusts, ETFs/REITs, Futures/options, Insurance Products And IDeCo Pension Plans. However, Due To The Inaccessibility Of Its Official Website, There Are Concerns About The Reliability Of Its Trading Platform. Customers Should Choose This Platform At Their Own Discretion And Pay Attention To Risks.

Pros:

- Long History: KOSEI Securities Has Been In Operation Since 1961, Demonstrating A Long History And Extensive Experience In The Securities Industry.

- Regulated By The FSA: The Company Is Regulated By The Japan Securities Dealers Association And The Japan Financial Services Agency, Ensuring Compliance With Industry Standards And Regulations.

- Product Diversification: KOSEI Securities Offers A Wide Range Of Market Instruments, Including Stocks, Bonds, Investment Trusts, ETFs/REITs, Futures/options, Insurance Products, And IDeCo Pension Plans.

- Technology Infrastructure: KOSEI Securities Utilizes Advanced Internal Systems Such As "KICS/i5" And The 24/7 Monitoring System "Kics Manager" To Support Its Trading Operations.

Cons:

- Website Inaccessibility: The Official Website Inaccessibility Raises Concerns About The Reliability And Transparency Of Its Trading Platform, Which May Affect Account Management And Trade Execution.

- Commission Fees: KOSEI Securities Charges Its Clients Commission Fees During The Course Of Trading, Which May Affect The Clients' Overall Costs.

- Limited Information: Despite The Availability Of Online Services Such As "KOSEI Club" For Account Holders, There May Be Limitations In The Availability And Depth Of Information Available To Clients Regarding Investment Decisions.

- Platform Limitations: Dependence On Internal Systems Such As "KICS/i5" And Concerns About Website Accessibility May Indicate Potential Limitations In The Technical Infrastructure That Supports The Firm's Trading Operations.

- Uncertain Trading Experience: Lack Of Transparency And Accessibility Issues Will Create Uncertainty For Investors, Affecting Their Overall Trading Experience With KOSEI Securities.

Regulatory/Security Situation

KOSEI SECURITIES Is A Financial Institution Group Regulated By The Financial Services Agency (FSA). It Has A Retail Foreign Exchange License (license Number: Kinki Treasurer (Gold Merchant) No. 14). This License Ensures That The Company Operates Within The Legal Framework Set By The Regulator, Providing Investors With A Certain Level Of Safety And Security.

However, The Inaccessibility Of Their Official Website Has Raised Concerns About The Reliability Of Their Trading Platform. An Inaccessible Website Can Lead To Problems With Account Management, Trade Execution, And Access To Important Information. This Lack Of Transparency Can Create Uncertainty And May Affect The Overall Trading Experience For Investors.

PRODUCTS & SERVICES

KOSEI SECURITIES Offers Stocks, Bonds, Investment Trusts, ETFs/REITs, Futures/options, Insurance Agents, And IDeCo Pension Plans.

- STOCK: KOSEI SECURITIES Offers Stock Trading That Allows Investors To Buy And Sell Shares Of Publicly Traded Companies.

- BONDS: KOSEI SECURITIES Provides Access To The Bond Market, Allowing Investors To Trade Government, Municipal, Corporate, And Other Types Of Bonds.

- INVESTMENT TRUST: KOSEI SECURITIES Offers Investment Trusts, Which Are Professionally Managed Funds That Pool Funds From Multiple Investors To Invest In A Diverse Portfolio Of Stocks, Bonds, And Other Securities.

- ETF/REIT: KOSEI SECURITIES Allows Investors To Trade Exchange-traded Funds (ETFs) And Real Estate Investment Trusts (REITs), Which Are Investment Funds That Trade On The Stock Market.

- FUTURE/OPTIONS: KOSEI SECURITIES Offers Futures And Options Trading, Which Are Derivative Financial Instruments That Allow Investors To Speculate On Future Price Movements Of Underlying Assets Such As Stocks, Commodities, Or Indices.

- INSURANCE AGENCY: KOSEI SECURITIES Offers Insurance Products Through Licensed Insurance Agents That Allow Investors To Protect Their Investments And Manage Risk.

- IDeCo Pension Plan: KOSEI SECURITIES Offers An Individually Defined Contribution (iDeCo) Pension Plan, A Savings Plan That Allows Individuals To Accumulate Retirement Benefits By Investing In Stocks, Bonds, And Other Securities.

Fees And Commissions

KOSEI Securities Provides Its Clients With The Products And Services Required During The Course Of Trading And Charges A Commission Fee. For Online Trading Of Securities Trading Accounts, The Commission Fee To Be Paid Is Calculated Based On The Contract Price.

For Contracts With A Contract Amount Not Exceeding JPY 1,000,000, The Commission Fee Is 0.601% Of The Contract Price, Including Taxes And Fees. For Contracts With A Contract Amount Exceeding JPY 1,000,000, A Fixed Commission Fee Of JPY 1,100 Is Charged.

Internal System

KOSEI Securities Utilizes Its Internal System "KICS/i5", A 24/7 Monitoring System Called "Kics Manager", And A Backup System That Follows Its Business Continuity Plan (BCP).

This "KICS/i5" System Is A Pre/back Office System For Securities Based On IBM's "System I" Platform. According To The Limitations And Suspicious Appearance Of This Platform, There Is A Certain Risk In The Market.

KOSEI CLUB

"KOSEI CLUB" Is An Internet Service Provided By KOSEI Securities For Clients With Accounts. Account Info Queries, Stock Trading And Online Trading Of Cash Stocks, Futures And Options Can Be Carried Out From Home Computers. The Service Is Available 24/7, Except During Data Updates.

In Addition, "Trading Support J-GX" Is An Information Tool Available To KOSEI Club Members, Providing Access To Real-time Price Information And News, As Well As Portfolio Management, Chart Analysis, And Order Placement Functions For Stock Holdings, Which Can Be Operated From A Computer, Tablet, Or Smartphone.

Client Server

Clients Can Contact The Client Server Department Using The Information Provided Below:

Tel: + 81 06 6209 0821

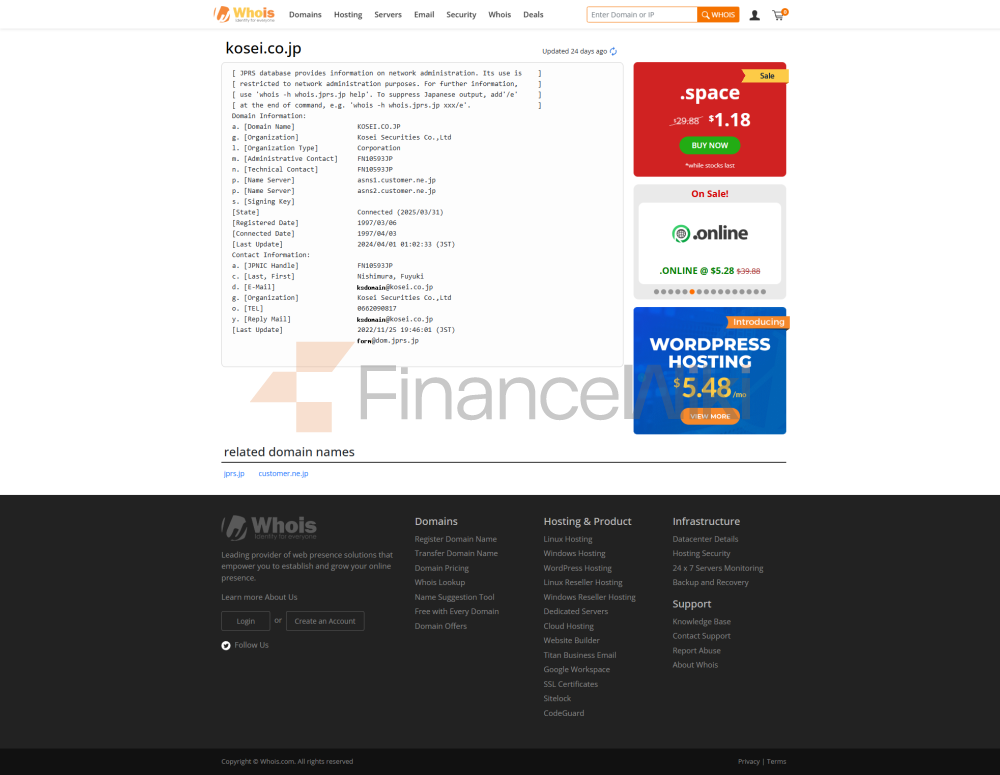

URL: Https://www.kosei.co.jp/

Conclusion

In Conclusion, KOSEI Securities Co., Ltd. Is A Long-established Securities Firm With Extensive Experience In The Industry And Diverse Market Tools.

However, Concerns About Website Accessibility, Commission Fees, Limited Information, Platform Limitations, And Potential Uncertainties In The Trading Experience Have Raised Questions About The Overall Reliability And Transparency Of KOSEI Securities.