Overview

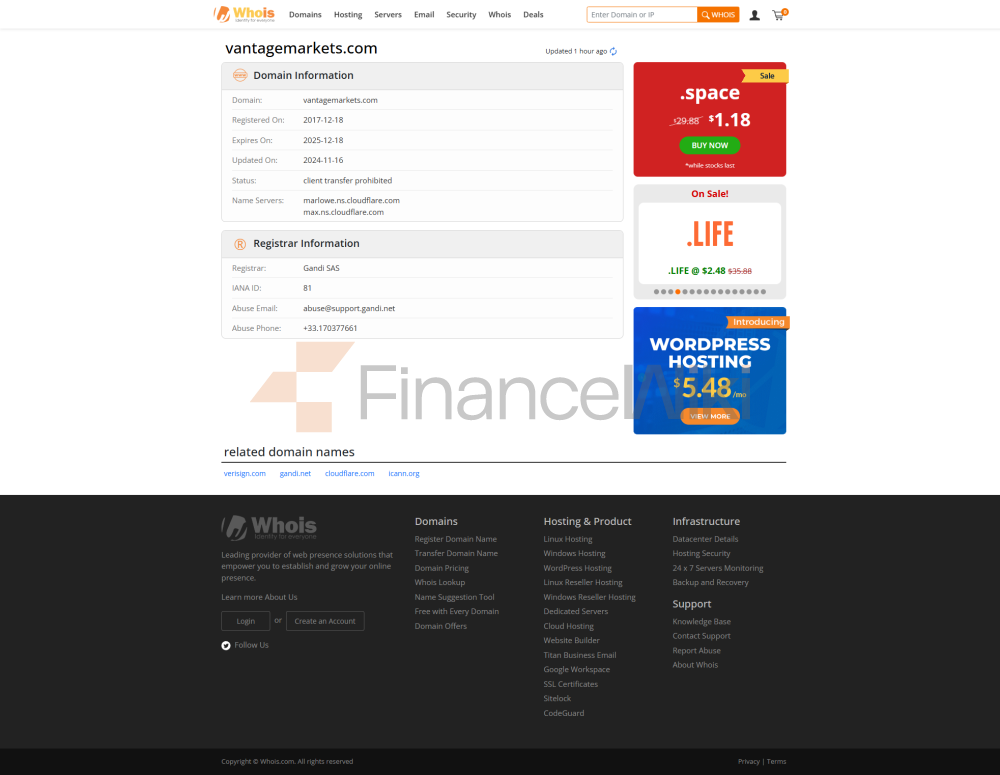

VANTAGE GLOBAL PRIME PTY LTD Is A Foreign Exchange And CFD Brokerage Established In Australia In 2012, Headquartered In Sydney, And Has Branches In South Africa, Vanuatu, And The United Kingdom. It Mainly Provides Copy Trading, Educational Services, Market Analysis, Client Server, Etc. Its Affiliates Are VANTAGE MARKETS (PTY) LTD, Vantage Global Limited, Vantage Global Prime LLP, And Its Competitors Are FOREX.COM, Admiral Markets, AVATrade, Equitrade Capital, Trade Nation, And Finalto.

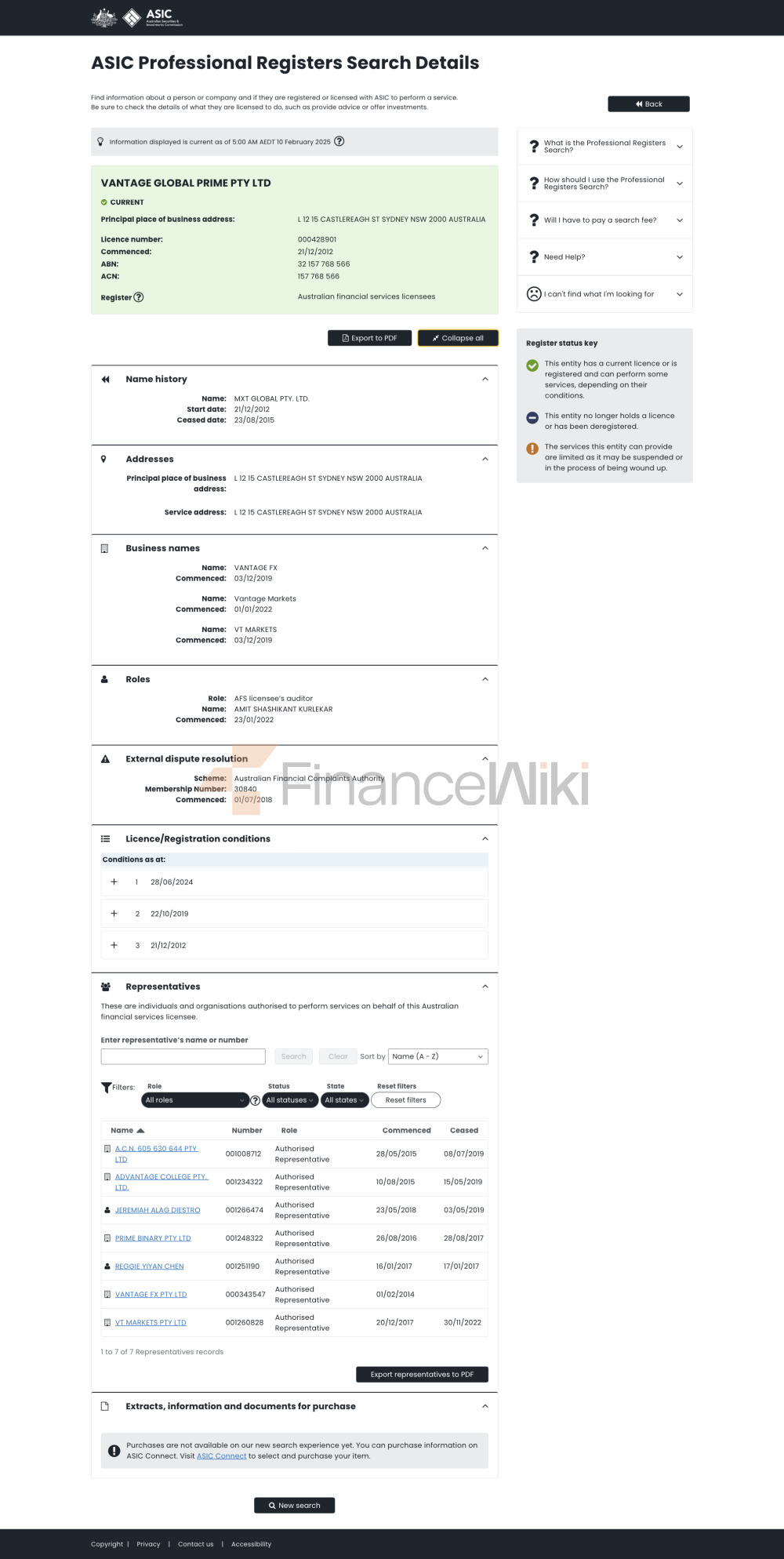

According To The Information On Its Official Website, Vantage Is Regulated By ASIC, FSCA, VFSC, And FCA, And Relevant Information Has Been Checked On The Corresponding Official Website. Vantage Does Not Provide Relevant Services To Canada, China, Romania, Singapore, The United States, And Jurisdictions Or Regions On The FATF And European Union/United Nations Sanctions Lists.

Vantage Provides FasaPay, AstroPay, China Union Pay, VISA And Other Deposit Methods With A Minimum Threshold Of $50. Vantage Provides Vantage App, Metatrader 4, MetaTrader 5, ProTrader, Webtrader, Metaquotes Apps And Other Trading Platforms For Customers To Use. Trading Varieties Include Foreign Exchange, Index, Energy, Precious Metals, Bonds, Funds And Other Varieties. You Can Contact Vantage To Open Agency Services.

Vantage Office Address: Level 12, 15Castlereagh Street, Sydney, New South Wales, 2000, Australia, Company Number: 157 768 566.

Basic Information & Regulators

Vantage Markets Was Established In 2009 By A Highly Specialized Team With Extensive Experience In The Financial, Foreign Exchange And Technology Fields. The Company Is Headquartered In Sydney, Australia. The Company Currently Holds A Full License From The Australian Securities And Investments Commission (license Number: 428901), An STP License From The UK Financial Marekt Conduct Authority (license Number: 590299), And An STP License From The Cayman Islands Monetary Authority (license Number: 1383491).

Security Analysis

Vantage Markets Is Currently Regulated By Two Mainstream Regulators, The Australian Securities And Investments Commission And The UK Financial Marekt Conduct Authority.

Main Business

Vantage Markets Provides Investors With A Wide Range Of Trading Tools, Mainly Including Foreign Exchange, Indices, Energy, Soft Commodities, Precious Metals, US Stock CFDs, UK And European Stock CFDs, And Australian Stock CFDs.

Leverage & Accounts

To Meet The Investment Needs Of Different Users, Foreign Exchange Broker Vantage Markets Has Set Up A Total Of Four Types Of Accounts: Standard STP Account (minimum Deposit Of $200), Original Spread ECN Account (minimum Deposit Of $500), Professional ECN Account (minimum Deposit Of $20,000). The Maximum Leverage Of The Account Is As High As 1:500. In Addition, The Company Has Set Up An Islamic Account For Muslim Traders, Which Has A Minimum Deposit Of $200 And Does Not Incur Swap Or Interest Charges On Overnight Positions.

Spreads & Commission Fees

Major Spreads In A Standard STP Account Are From EUR USD 1.4 Pips, GBP USD 1.6 Pips, AUD USD 1.4 Pips, And AUD JPY 1.5 Pips With No Commission Charged. Major Spreads In An Original Spreads ECN Account Are From EUR USD 0.1 Pips, GBP USD 0.6 Pips, AUD USD 0.4 Pips, And AUD JPY 0.5 Pips With $3 Commission Charged Per Lot Traded. Major Spreads In A Professional ECN Account Are From EUR USD 0.0 Pips, GBP USD 0.5 Pips, AUD USD 0.3 Pips, And AUD JPY 0.4 Pips With $2 Commission Charged Per Lot Traded.

Trading Platform

Vantage Markets Provides Traders With The Most Popular Online Foreign Exchange Trading End Point In The Market - MT4 And MT5 Trading Platforms. The MT4 Trading Platform Has A Variety Of Powerful Chart Types, Supporting Desktop Version, Web Version, Mobile Devices, Etc. MT5 Provides A Full Set Of Trading Needs Including Foreign Exchange, Commodities And Indices, And Has Complete Control Over All Quotes From Liquidity Providers. MT5's Two Account Types (equity Account And Hedged Account) Allow Traders To More Easily Manage Account Risk The Way They Want.

Deposit And Withdrawal

Vantage Markets Offers A Variety Of Flexible Deposit Options, Mainly Domestic EFT (supports AUD), Domestic Express Transfer (only Available In Australia), International EFT (supports AUD, USD, GBP, EUR, SGD, NZD, CAD), BPAY (only Available In Australia), POLi Pay (only Available In Australia), VISA/MASTERCARD Credit/Debit Card (supports AUD, USD, GBP, SGD, JPY, NZD, CAD), JCB (supports JPY), China UnionPay (accepts USD), Skrill & NETELLER (supports AUD, USD, GBP) , SGD), Broker-to-broker, FasaPay (supports USD), Bank Of Thailand Instant Telegraphic Transfer (accepts USD). Vantage FX Does Not Charge Any Internal Fees For Any Deposits/withdrawals. However, Transactions Between Foreign Banking Institutions May Impose Certain Intermediary Transfer Fees On Either Party, Which Are Not Controlled By Vantage FX And Are Borne By The User.