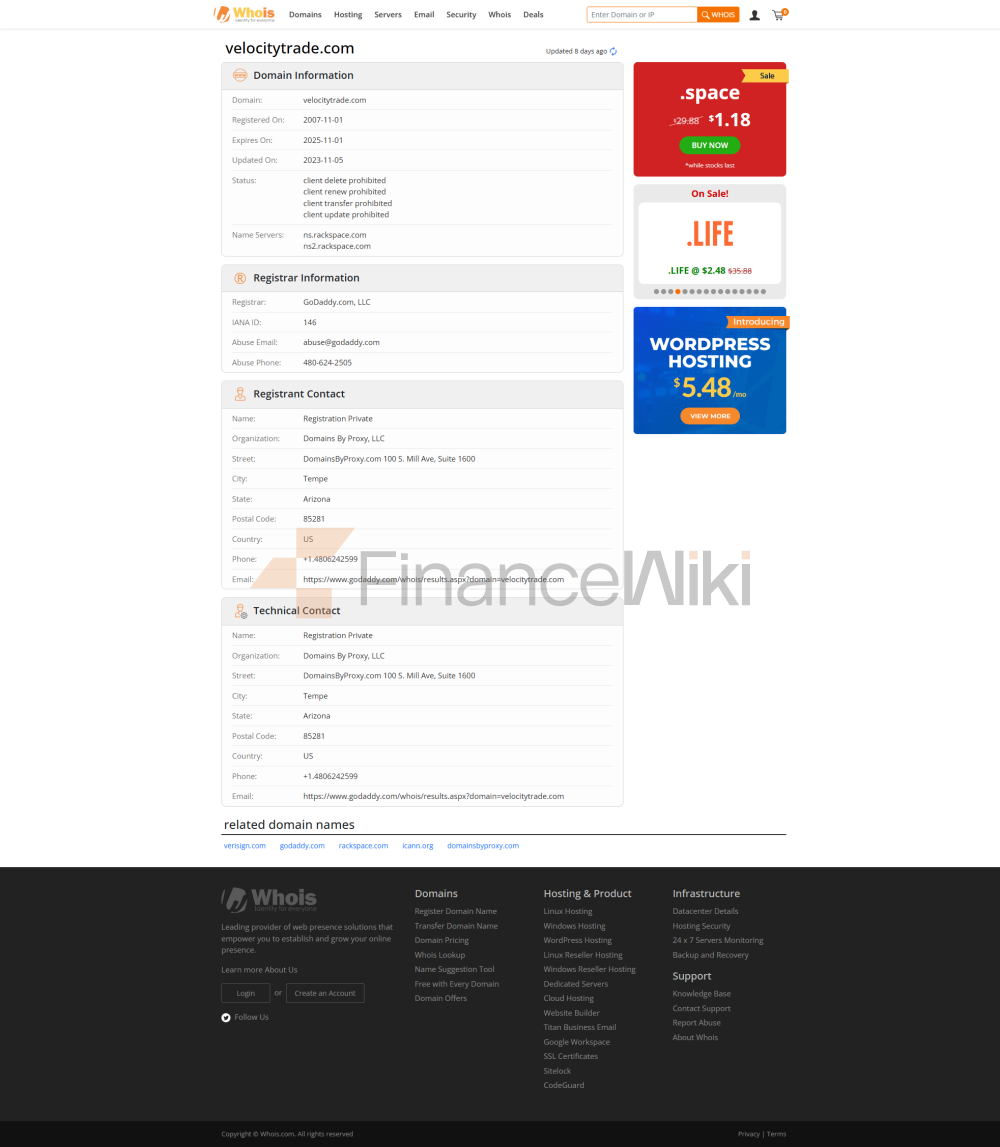

Basic Information & Regulation

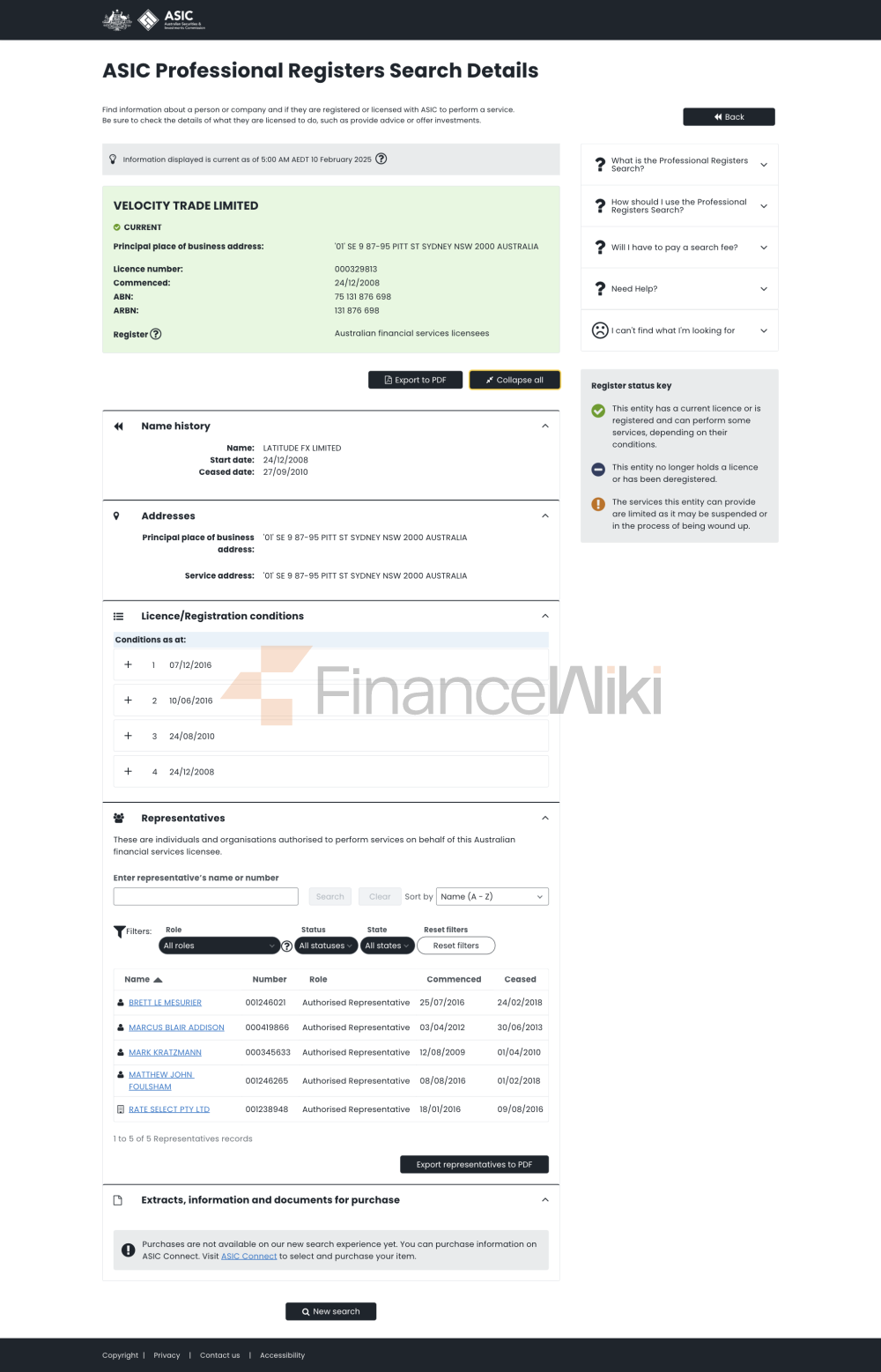

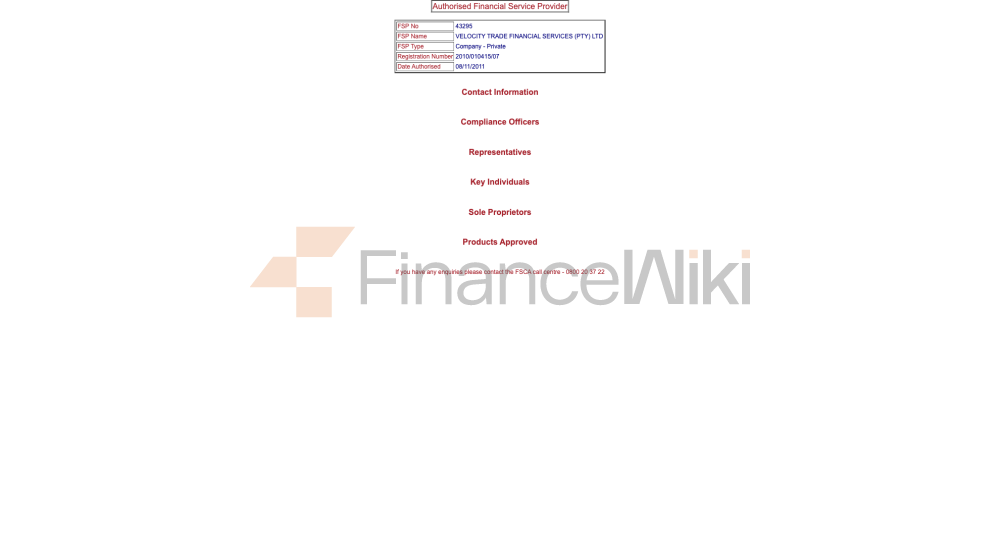

Velocity Trade Was Established In 2007 And Is Headquartered In Australia. It Has Offices In Europe, North America And Africa, And Provides Services To Users From Canada, South Africa And Many European Countries. Velocity Trade Is Regulated By A Number Of Regulators Around The World, Such As The UK FCA (regulation Number: 497263), The South African FSCA (regulation Number 43295), The New Zealand FMA, And The Australian ASIC.

Security Analysis

Velocity Trade Has A Pass-through License From The UK FCA And An Investment Advisory License From The Australian ASIC. Although This Is The Case, The Platform Of Velocity Trade Still Has Many Negative Reviews (difficult Withdrawal Of Funds, Lack Of Customer Support). Therefore, The License Is Only A Hard Indicator, And Other Aspects Need To Be Considered To Consider Whether To Use This Platform.

Financial Instruments

Velocity Trade Provides Investors With Financial Assets Mainly Including Foreign Exchange Currency Pairs, Metals, Energy, Cryptocurrencies, UK Stocks, Etc.

Spreads & Fees

Velocity Trade Offers EUR USD Spreads Of 3 Points, Which Is Much Higher Than The Industry Standard. A Large Number Of Foreign Exchange Brokers Offer EUR USD Spreads Between 1.1 Points And 1.5 Points.

Trading Platform

Velocity Trade Provides Traders With The Most Popular MT4 Trading Platform. MT4 Trading Platform Is Currently The Most Respected Trading Platform In The World. It Has Powerful Charting Tools, Analysis Tools, And A Large Number Of Custom Technical Indicators, Which Allows Traders To Create Accurate Charts And Analyze Every Link Of The Market, Greatly Improving Trading Performance.

Deposit And Withdrawal

Velocity Trade Only Supports Traders To Make Deposits And Withdrawals To Their Investment Accounts Through Bank Cards And Neteller.

Summary

The Main Disadvantages Of Velocity Trade Are:

1. Lack Of Strict Supervision;

2. High Spreads;

3. Fewer Deposit And Withdrawal Methods;

4. More Negative Comments;

5. No Account & Leverage Information;