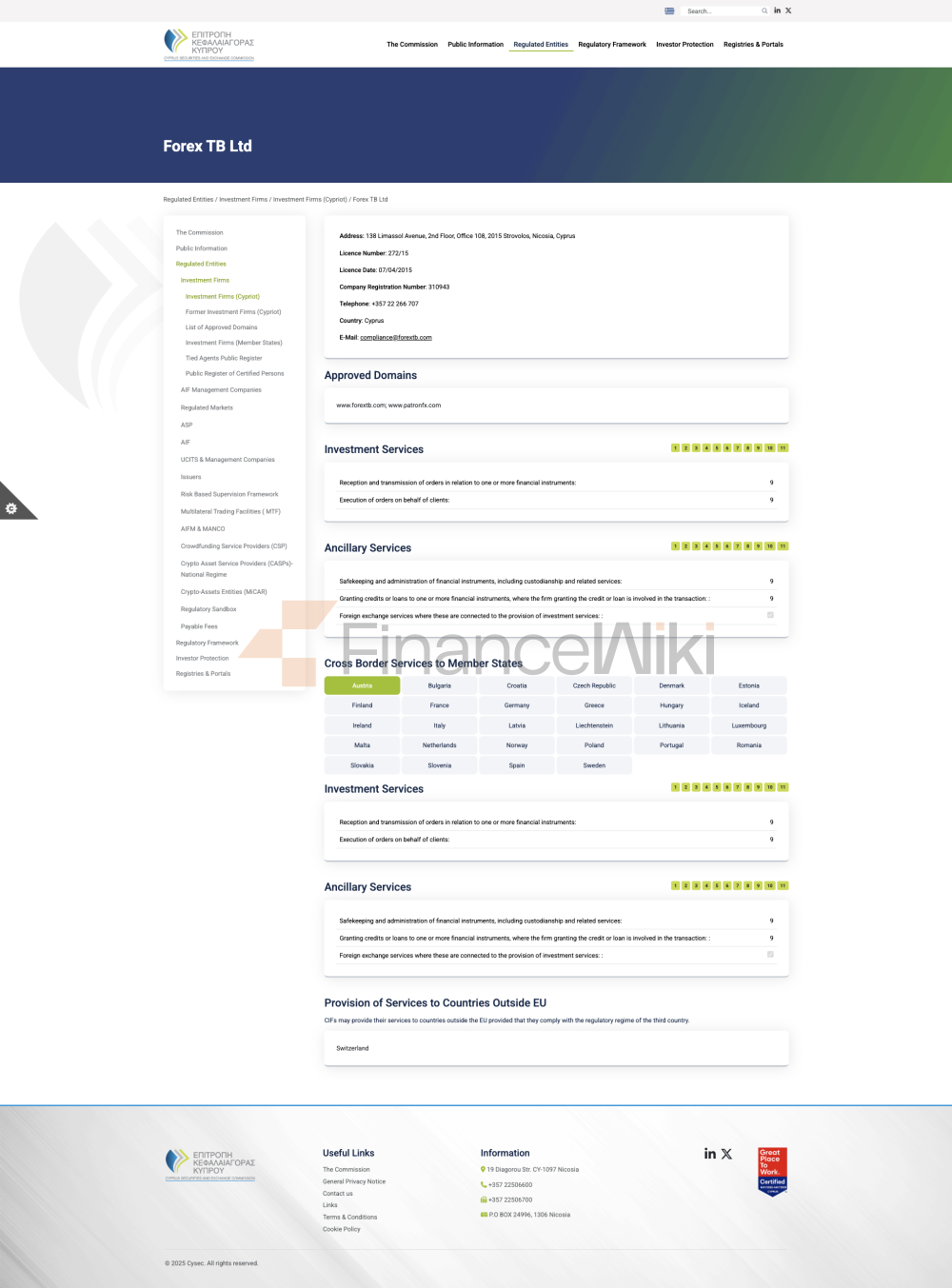

Verified: Forex TB Ltd Abbreviation (FXTB) Is Operated Through The Website Https://www.forextb.com/, The Domain Name Was Registered On January 30, 2012 And Is Headquartered In Cyprus.

As For Regulation, It Has Been Verified That FXTB Is Currently Authorized And Regulated By The Cyprus Securities And Exchange Commission (CySEC) With License Number 272/15.

Note: Regulated Does Not Mean Certain Safety, Investment Is Risky, Traders Need To Be Extremely Cautious In Case Of Damage To Their Funds.

According To The Company's Official Website:

Account TypeStandard Account: Minimum Deposit 250 EUR, Spread - EUR/USD 3.0, GBP/USD 3.4, USD/JPY 3.3, Crude Oil 0.12 USD, 1 Free Withdrawal.

Gold Account: Minimum Deposit 25,000 EUR, Spread: EUR/USD 2.7, GBP/USD 3.1, USD/JPY 3.0, Crude Oil 0.11, Free Withdrawal 1 Time Per Month.

Platinum Account: Minimum Deposit 100,000 EUR, Spread: EUR/USD 2.1, GBP/USD 2.5, USD/JPY 2.4, Crude Oil 0.10, 3 Free Withdrawals Per Month.

VIP Account: Minimum Deposit 250,000 EUR, Spread: EUR/USD 1.6, GBP/USD 2.0, USD/JPY 1.9, Crude Oil 0.08, No Withdrawal Fee.

Leverage

Retail Client Leverage: Up To 1:30

Professional Client Leverage: Up To 1:400

Trading Products

Forex Currency Pairs, Major Currency Pairs (e.g. EUR/USD, GBP/USD)

Commodities

Stocks And Indices CFDs

Major Global Stocks (e.g. Apple, Google)

Major Stock Indexes (e.g. S & P 500, FTSE 100)

Cryptocurrency

Bitcoin (BTC)

Ethereum (ETH)

Deposit Method

Bank Telegraphic Transfer, Credit/debit Card (Visa, MasterCard), E-wallet (e.g. Skrill, Neteller), Cryptocurrency, Alipay/WeChat (supported In Some Regions).

Processing Time: Instant To 24 Hours.

Withdrawal Method

Bank Telegraphic Transfer, E-wallet, Cryptocurrency.

Processing Time: 1-3 Business Days (the Specific Time Depends On The Method).

Trading Platform

MetaTrader 4 (MT4), For Beginners.

Educational Resources

Online Seminars, Video Tutorials, E-books And Guides, Market Analysis And News, Economic Calendar, Trading Signals And Strategies.

Features

Regulated: Authorized And Regulated By The Cyprus Securities And Exchange Commission (CySEC).

Diversified Trading Products: Covering Multiple Asset Classes Such As Foreign Exchange, Precious Metals, Energy, And Cryptocurrencies

Flexible Account Types: Meet The Needs Of Different Traders, From Beginner To Professional

Advanced Trading Platforms: Support Multiple Trading Platforms To Meet The Operating Habits Of Different Traders

Quality Customer Support: Multi-language, Multi-channel 24/7 Customer Service Support

Rich Educational Resources: Help Traders Improve Their Trading Skills And Knowledge

Notes

High Leverage Risk: High Leverage Can Amplify Profits, But It Also Increases Potential Risk Of Loss

Fee Structure: Pay Attention To The Spread And Commission Structure Of Different Account Types, And Choose The Most Suitable Account

Market Volatility: Some Trading Products (such As Cryptocurrencies) Are Highly Volatile And Need To Be Traded With Caution

Geographical Restrictions: Some Services And Products May Not Be Available Due To Regional Regulations

Fund Safety: Ensure Deposits And Withdrawals Through Official Channels To Avoid Fraud