Bank Basic

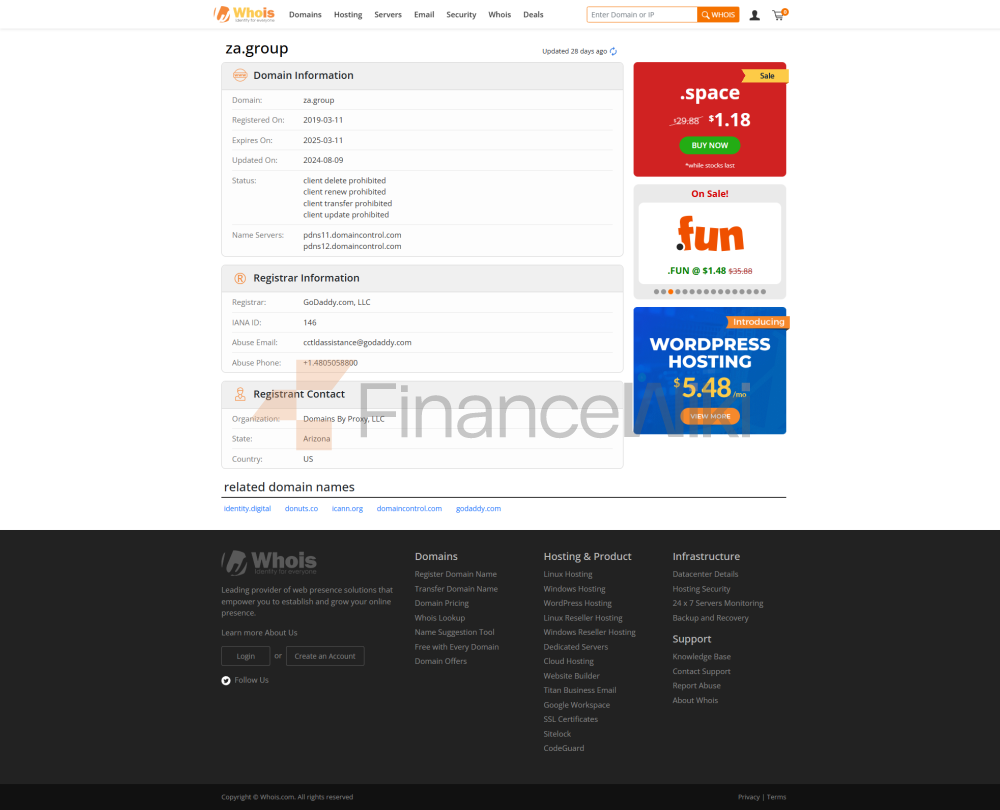

InformationZA Bank Limited is the first virtual bank in Hong Kong, established in 2020, under the category of commercial banks, headquartered in Hong Kong. Jointly owned by ZhongAn Online P&C Insurance and Sinolink Group, it is a privately held, unlisted company with a diverse shareholder background, reflecting its market-oriented operation characteristics. As a digital bank, ZA Bank is technology-driven and aims to provide customers with convenient and secure financial services. ZA Bank Limited is a subsidiary of ZA Online (6060.HK) and Besta Group ( 1168.HK). As a digital-only bank, it is headquartered in Times Square, Causeway Bay, Hong Kong, and its major shareholders include ZA International (51%) and local financial institutions in Hong Kong. The bank officially opened on 24 March 2020 and is one of the first eight institutions to be granted a virtual banking licence by the Hong Kong Monetary Authority.

Prepared and opened

ZhongAn Online, a joint venture between Bestar and China CITIC Bank International to form ZhongAn Virtual Finance Limited, applied for a virtual banking license in Hong Kong, and invited Ke Ching Fai, who was the former CEO of Hang Seng Bank, to serve as a director. However, China CITIC Bank International withdrew from the joint venture before the virtual banking license was issued, and China CITIC Bank International Executive Director Cooper Lijun also resigned as a director of ZhongAn Virtual Finance Limited on February 8. Ke Ching-fai also resigned as a Director in April 2019.

A virtual bank is one in which the bank does not have a physical branch and relies on online banking and the like to conduct its business.

On 27 March 2019, Hong Kong Monetary Authority announced the issuance of the first batch of virtual banking licences, with the winning bidder including "ZhongAn Virtual Finance Limited".

ZA Bank was originally scheduled to open in November 2019, but it was postponed to December 18 and officially opened on March 24, 2020.

Shareholder

BackgroundZA Bank is wholly owned by ZhongAn International, a non-wholly owned subsidiary of ZhongAn Online. In October 2021, ZhongAn Online announced that ZhongAn International intends to conduct multiple rounds of financing, in addition to receiving capital injection from Warrior, a wholly-owned subsidiary of the original shareholders ZhongAn Technology, Bestar, and Chow Tai Fook Agent of the Cheng Yu-Tung family, and introducing AIA's investment project Opportunities Fund as a new shareholder. By the end of June 2022, the total amount raised is US$382 million. Based on the amount of capital increase, it is equivalent to the overall valuation of ZhongAn International of about US$1.75 billion (about HK$13.65 billion), becoming a local fintech unicorn in Hong Kong.

Number of users and

performanceZA Bank has exceeded 300,000 users in the year since its official opening,

andas of July 31, 2021, the bank has more than 400,000 users, with HK$7.7 billion in deposits and HK$1.36 billion in loans as of the end of June 2021.

As of the end of 2022, ZA Bank had more than 650,000 users, making it the largest number of virtual banks.

As of June 30, 2023, ZA Bank's retail user base has expanded to nearly 700,000. The balance of deposits was approximately HK$10.7 billion and the total balance of loans was approximately HK$4.9 billion.

As of the end of 2023, the bank's customer deposits amounted to approximately HK$11.7 billion, the highest among the eight virtual banks in Hong Kong. The outstanding balance of the loan was approximately HK$5.32 billion. During the year, ZA Bank provided commercial banking services to more than 100 Web3 companies, including more than 80% of the virtual asset trading platforms (VATPs) in Hong Kong, and the transfer transaction volume of Web3 corporate customers exceeded US$1 billion.

In a media interview, the bank's management said that deposits in the first quarter of 2024 increased by 50% compared to the end of 2023.

Scope of Services

As an online-only bank:

the service covers the whole of Hong Kong

, and the network of no physical branches

has more than 2,000 JETCOs in Hong Kong ATMs provide cash services

to support cross-border financial services

regulation and compliance

in China and Hong Kongand are fully regulated by the Hong Kong Monetary Authority (HKMA

). Participated in the Hong Kong Deposit Protection Scheme (up to HK$500,000)

and passed the HKMA's "Virtual Banking Regulatory Assessment Framework" review

of the anti-money laundering system in 2023 and was rated as "in line with expectations"

for deposits and loan products

piggy bank – up to 5% p.a., no fees for withdrawals at any time§

Multi-currency time deposits, including HKD, RMB and USD

, can be exchanged 24x7 at any time

With your physical ZA card, you can withdraw cash for free at Visa ATMs in Hong Kong

, and you can get 4 hike coupons every Tuesday and earn more deposits

ZA card

support Apple Pay and Google Pay

up to 200% cash back on purchases

, select the last 6 digits

Visa debit cards with no annual fees, finance fees, or late fees

local transfers (FPS supported).

free and instant inter-bank transfers,

receive HKD and RMB via FPS mobile number

, support credit card repayment, tax and premium payment, etc.

The "Frequently Received Recipients" section on the transfers home page allows for faster and more convenient transfersGlobal

Transfers

created with Wise, ZA Remit has 0 hidden markups and fees

ZA Remit supports 16 currencies, including PHP, USD, GBP, and more.

50% of money transfers via Wise are completed in less than 20 seconds

, and SWIFT also supports the receipt of cross-border money transfersInsurance

Italy's top insurance group Generali and Together with

Generali's dedicated MDRT team

, ZA Insure provides comprehensive coverage and you can access ZA Assure's product coverage in less than 3 minutes via the mobile app. Yes, it's easier than ever to buy insuranceChoose

from a variety of insurance products to suit different needs, including critical illness protection, savings, life insurance, and deferred annuity

loans

- a

variety of loans, including installment loans, Card Statement Instalment, Debt Transfer and Payroll Fast Pass to meet different

needsAnnualised Percentage Rate (APR) as low as 1.30% for

new banking customers to know their approval result within 90 seconds for an

instalment loan amount of up to HK$1,000,000

fund

choose from the world's top funds, including AllianceBernstein, Allianz, Fidelity, Fidelity, Franklin Templeton, Taikang and UBSOpen

an investment account in as fast as 1 minuteOpen an investment

account with your investment account to subscribe to currencies, stocks and bond funds

Subscribe to money market funds with a subscription fee as low as 0

Stocks

choose from over 6,000 U.S. stocks and 3,000 ETFs.

Regardless of the purchase price, during the brokerage promotion period, our brokerage commission is $0.012 per share, with a minimum of $3.88 per order. Waiver of storage fees.

Free real-time quotes, 24 x 7 real-time financial news, market valuations, ETF classifiers and other professional analysis tools!

Crypto

Asia's first licensed bank to offer cryptocurrency trading services to retail investors

enjoy $0 commission for the first 3 months after activating the service during the promotion

period2 Trade directly with your deposit and enjoy a seamless investment experience

Trading amounts from USD 70 / HKD 600, buy more or buy less, it's up to you to decide 24

x 7 list

common trading fees

Account Management: Zero monthly feeLocal

transfer: Free

cross-border remittance: 0.1% handling fee (minimum HK$20)

No minimum deposit balance requirement

ATM withdrawals: the first 5 free

digital service experiences

per monthmobile app score 4.9 (2024 App Store data)

Core innovative features:

"5-minute account opening", full-process digitization

, "AI credit assessment", real-time loan approval

, "intelligent financial analysis" tools,

open API connections, third-party services

and customer service quality

24/7Cantonese/English/MandarinAI customer

serviceAverage response time90 secondsComplaint

handling timeliness: 2 working daysSocial

media customer service coverageWhatsApp/ WeChat

security measures

using FIDO2 biometric authentication

standard real-time transaction monitoring system

to pass ISO 27001 Information Security Management Certification

: 45% year-on-year increase in cybersecurity investment in 2023Featured

services and differentiation

"ZA Card": The first bank card without a number in Hong Kong

"ZA Invest":

"Cross-border Remittance", a low-threshold fund investment platform: supporting real-time payment to more than 20 banks in the Mainland

"ZA merchants": the market status and honor of one-stop digital banking services

for SMEs

ranked No. 1 in Hong Kong in terms of the number of virtual bank customers (as of 2024Q1),

"Best Digital Bank" by The Asian Banker 2023, "

Most Innovative Virtual Bank" by Fintech Awards

Awarded the "Smart Banking Gold Award" by HKMACointon

History & Business

DevelopmentZA Bank is the most comprehensive virtual bank in Hong Kong, covering commercial banking, card payment, cross-border inward remittance, investment and insurance in addition to basic deposit, loan and transfer services.

In October 2020, ZA Bank launched ZA Card, Hong Kong's first customised Visa Debit Card, which allows users to choose the last 6 digits on the card face with no annual fee, interest and late fees. Launched in November, the physical ZA Card allows users to withdraw cash at nearly 3 million Visa ATMs worldwide and withdraw cash for free at more than 3,000 Visa-accepted banks in Hong Kong. According to the data released by ZA Bank, ZA Card is one of the most active Visa cards in Hong Kong, with an average of 1 use per user every 2 days.

ZA Bank officially launched its business banking service on 22 March 2021 with no minimum deposit for savings accounts. On 30 April of the same year, ZA Bank announced its participation in the SME Financing Guarantee Scheme of Hong Kong Mortgage Corporation.

In May of the same year, three insurance products were officially launched on the ZA Bank App, and the first life savings insurance plan was launched in December.

In October 2021, ZA Bank launched the "Payroll FastPass", a revolving loan product that allows users to choose their own payroll date and receive their monthly salary as early as 7 days before the original payroll date.

In January 2022, ZA Bank was granted a securities dealing license by the Securities and Futures Commission, making it the first virtual bank to be granted such a license.

In April 2022, ZA Bank partnered with Generali Hong Kong to distribute Generali's critical illness, life insurance and Qualifying Deferred Annuity Policy (QDAP) products.

In August 2022, ZA Bank launched its fund investment service, becoming the first virtual bank in Hong Kong to provide banking, investment and insurance services.

In November 2022, ZA Bank partnered with Wise, a UK-based technology company, to provide users with international remittance services, including AUD, USD, GBP, CAD, and SGD.

In December 2022, ZA Bank launched a currency exchange service and provides real-time exchange rate quotes. Users can exchange USD, CNY, HKD, AUD, CAD, CHF, EUR, GBP, IDR, INR, JPY, KRW, MYRN, NZD, SGD, and THB anytime and anywhere, with no exchange fee.

In April 2023, ZA Bank CEO Yao Wensong said that it would provide customers with the exchange of cryptocurrencies for fiat currencies through licensed cryptocurrency exchanges, allowing customers to withdraw their funds in Hong Kong dollars, yuan and US dollars after depositing cryptocurrencies on licensed exchanges. It is currently operating with two licensed cryptocurrency exchanges in Hong Kong, HashKey and OSL.

In April 2023, ZA Bank announced the "Banking for Web3" development blueprint, aiming to become the preferred banking partner of the Web3 ecosystem, providing basic commercial banking services to Web3 enterprises, and acting as a settlement bank for a licensed virtual asset exchange in Hong Kong.

In May 2023, ZA Bank announced the launch of a virtual asset trading service to retail investors through a partnership with a local licensed virtual asset exchange, providing users with comprehensive financial services. At the same time, it also plans to launch a U.S. stock trading service. In the same month, ZA Bank participated in the "e-HKD" pilot scheme launched by the Hong Kong Monetary Authority to pilot tokenized asset settlement, becoming the first virtual bank to be selected for the scheme.

In May 2023, ZA Bank's parent company "ZhongAn International" raised nearly HK$500 million from Bestar (01168), one of its shareholders, to further promote its business expansion.

In August 2023, HashKey Exchange, Hong Kong's first licensed retail exchange for virtual assets, was officially launched, and ZA Bank is one of the official partner banking partners, providing fiat currency deposit and withdrawal services.

In November 2023, ZA Bank received approval from the Securities and Futures Commission to prepare to launch a U.S. stock trading service.

In February 2024, ZA Bank officially launched its U.S. stock trading service. In the same month, the bank launched the "Money Poppy", a savings sub-account that separates savings from daily expenses, and users can unlock additional APR by completing designated monthly challenges. The bank also became the first virtual banking partner of Global Markets in Hong Kong, providing financing solutions to merchants in the Global Exchange ecosystem through credit assessment models.

In April 2024, ZA Bank announced that it would provide dedicated banking services to stablecoin issuers in Hong Kong to protect their fiat currency reserves.