General Information

Rox Capitals Is An Online Brokerage Based In The United Kingdom. Rox Capitals Offers Five Classes Of Tradable Instruments Including Forex, Stocks, Commodities And Cryptocurrencies. They Offer Multiple Account Types To Suit Traders Of Different Experience Levels While Offering Competitive Spreads And Advanced Trading Tools. The User-friendly MetaTrader 5 Platform Enhances Convenience And Analytical Capabilities.

Pros And Cons

In Terms Of Pros, Rox Capitals Offers Access To Popular Markets And Assets Including Forex, Stocks, Commodities And Cryptocurrencies To Name A Few. They Offer Competitive Spreads To Reduce Costs And Maximize Returns. With Multiple Account Types, Traders Can Choose The Option That Suits Their Preferences. Rox Capitals Also Offers Educational Resources To Increase Knowledge.

This Broker Has Regional Restrictions That Limit Accessibility For Traders From Certain Countries. Customer Support Has Limited Hours And May Cause Inconvenience To Traders In Different Time Zones.

Market Tools

Rox Capitals Offers A Wide Range Of Market Tools That Provide Traders With A Diverse Range Of Exploration And Investment Options. The Platform Offers A Comprehensive Range Of Market Tools As Follows:

Forex: Forex Trading Involves Buying And Selling Currencies. With Rox Capitals, Traders Have Access To The Global Currency Market To Trade In Over 40 Major, Minor And Exotic Currency Pairs.

Contracts For Difference (CFDs): CFDs Are Financial Derivatives That Allow Traders To Speculate On The Price Movements Of Various Assets Without Holding The Underlying Asset. Rox Capitals Offers CFD Trading On Multiple Instruments, Including Global Indices, Stocks And Cryptocurrencies.

Precious Metals: Rox Capitals Allows Traders To Participate In Trading Precious Metals, Particularly Gold And Silver. Precious Metals Trading Has Been Popular For Centuries. Through Rox Capitals, Traders Can Participate In This Market And Benefit From Potential Fluctuations In The Price Of Gold And Silver.

Cryptocurrencies: Rox Capitals Allows Trading Cryptocurrencies In The Form Of Contracts For Difference. Traders Can Speculate On The Price Movements Of Popular Cryptocurrencies Such As Bitcoin, Ethereum, Dash, Ripple, Etc.

Stocks: Rox Capitals Offers Trading Of More Than 40 Major Stocks.

Account Types

Rox Capitals Offers Four Different Account Types To Suit Different Trader Needs: Micro, Mini, Standard, And ECN.

Micro Accounts Are The Easiest To Access, Requiring Only A Minimum Deposit Of $10, Ideal For Beginners Or Those Looking To Test The Waters With Minimal Risk. Mini Accounts Offer A Slightly Higher Trading Limit With A Minimum Deposit Of $100, Suitable For Traders Who Are Ready To Step Up Their Trading Level.

For More Serious Traders, Standard Accounts Require A Minimum Deposit Of $1,000, Offering A Higher Maximum Volume And Order Volume. ECN Accounts Are Geared Towards Professional Traders With A Minimum Deposit Requirement Of $5,000, But Offer The Highest Maximum Volume And Number Of Orders, As Well As The Tightest Spreads.

All Account Types Share Some Common Features, Such As A 70% Margin Call Level, A 50% Stop Loss Level, And A Minimum Trade Volume Of 0.01 Lots. It Is Important To Note That Only ECN Accounts Offer A No-swap (Islamic) Option. The Broker Maintains A No-cut Policy On All Accounts, Which May Disappoint Short-term Traders. However, Providing Account Managers For All Tiers Is A Valuable Addition, Offering Personalized Support To Traders.

Leverage

Rox Capitals Offers Leveraged Trading That Allows Traders To Amplify Their Exposure To Financial Marekts. Leverage Is A Mechanism That Enables Traders To Control Larger Positions With Smaller Capital. It Opens Positions That Exceed The Balance Of A Trader's Account By Borrowing From A Broker.

The Maximum Leverage Offered By Rox Capitals Varies Depending On The Account Type And The Financial Instrument Being Traded. For Micro And Mini Accounts, The Maximum Leverage Is 1:500. The Maximum Leverage Is 1:200 For Standard Account Holders, While ECN Account Members Enjoy A Maximum Leverage Of 1:100. Designed For Advanced Professionals, ECN Accounts Offer Direct Market Access And Offer The Lowest Possible Spreads. Traders Utilizing ECN Accounts Should Be Mindful Of Higher Capital Requirements And Latent Risks Associated With Leverage. When Trading With Leverage, It Is Always Important To Carefully Assess And Manage Risks To Ensure Responsible And Sensible Trading Practices.

Spreads And Commissions

In Rox Capitals, Minimum Spreads Are An Important Consideration When Trading Financial Instruments. It Represents The Minimum Difference Between The Bid And Ask Prices And Reflects The Cost Of Executing A Trade. Minimum Spreads Vary Among Account Types: 2.0 Spreads For Micro Accounts, 1.5 Spreads For Mini Accounts, 1.2 Spreads For Standard Accounts, And Raw Spreads For ECN Accounts. By Considering Minimum Spreads, Traders Can Choose The Account Type That Best Suits Their Trading Needs.

Additionally, For Certain Account Types, Such As ECN Accounts, Rox Capitals Uses A Transparent Commission Structure. Standard Accounts May Have A Commission Fee Structure. For Example, It May Charge A Fixed Commission Fee Of $6 Per Lot Traded. Meanwhile, ECN Accounts Are Designed For Direct Market Access And Offer Minimum Spreads. It Has A Fixed Commission Fee Of $6 Per Lot Traded.

Trading Platform

Rox Capitals Connects Clients With The Trading Market Through Its Trading Platform. Rox Capitals Uses The MetaTrader 5 (MT5) Trading Platform, A Powerful, Comprehensive Platform That Provides A Variety Of Features And Tools To Enhance The Trading Experience. It Enables Traders To Trade A Wide Range Of Financial Instruments, Including Forex, Stocks And Futures, On The Same Platform. With MT5, Traders Can Access Real-time Market Data, Perform Technical Analysis, Execute Trades And Manage Positions Efficiently.

The Platform Is Available On Desktop, Web And Mobile Devices, Ensuring Traders Can Stay Connected And Trade Anytime, Anywhere. With Its User-friendly Interface, Advanced Charting Features And Customizable Features, MT5 Is The First Choice For Both Beginners And Experienced Traders.

Copy Trading

Rox Capitals Enhances Its Trading Platform By Adding Copy Trading Features. This Popular Social Trading Tool Allows Less Experienced Investors To Automatically Copy The Strategies Of Successful Traders. By Providing This Feature, Rox Capitals Makes It Possible For Its Clients To Benefit From The Expertise Of Traders Who Perform Well On The Platform, Diversifying Their Trading Methods Without The Need For Extensive Market Knowledge. This Feature Is Especially Appealing To Novice Traders Who Wish To Learn From Their More Experienced Peers While Still Maintaining Control Over Their Investment Decisions.

Deposits And Withdrawals

Customers Of Rox Capitals Have A Variety Of Deposit And Withdrawal Methods To Choose From. Deposits Can Be Made In A Variety Of Ways Including Local Banks In India, PayU Money, Local Cash, UPI, Mastercard, VISA, PhonePe, Paytm, T Ether TRC-20, T Ether ERC-20, Bitcoin, Binance And Ether. These Payment Options Offer Customers Variety And Convenience To Top Up Their Accounts In Multiple Currencies. Traders Can Start With A Minimum Deposit Of $10 And A Minimum Withdrawal Amount Of $0.10. The Maximum Deposit And Withdrawal Amount Is Both $20,000.

Similarly, When It Comes To Withdrawals, Customers Can Take Advantage Of The Same Payment Method To Withdraw Funds. This Ensures That Customers Can Access Their Profits Or Manage Their Account Balance Seamlessly And Efficiently. Deposits Are Instant, While Withdrawals Take Anywhere From 1 Minute To 1 Day To Process. Deposits Are Free, But Withdrawals Are Subject To A 0.5% Processing Fee.

Customer Support

Rox Capitals Prioritizes Customer Support, Providing Customers With Multiple Channels For Assistance. Their Team Of Professionals Provides 24/5 Support With 24/7 Support Via Live Chat And Phone Calls. Customers In India And Pakistan Have Dedicated Contact Numbers, While Global Customers Provide A Global Contact Number. In Addition, Email And Live Chat Support Is Provided To Answer Various Questions Including Customer Support, Documentation For Accounting And New Accounts.

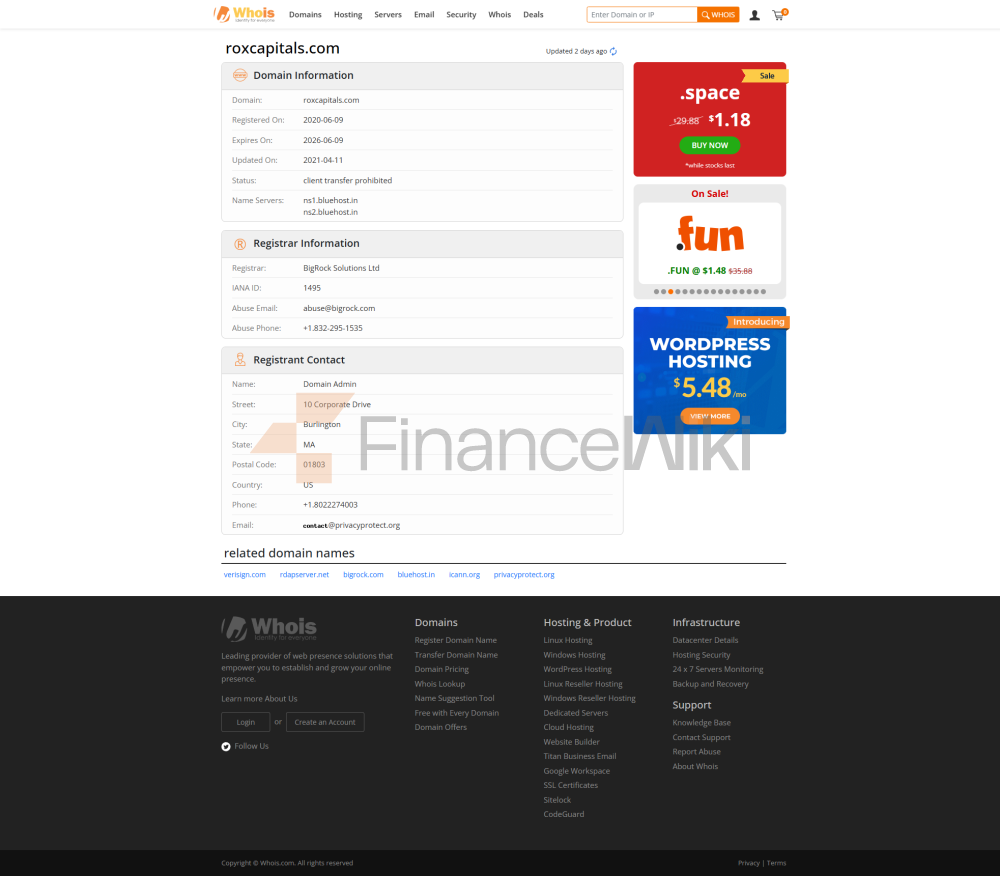

To Ensure Transparency, Rox Capitals Has Shared Their Registration And Office Address, The Company Is Registered In London, UK. They Are Also Associated With The National Futures Association And Comply With Regulatory Standards. However, It Should Be Noted That Rox Capitals Has Regional Restrictions And Does Not Provide Services To Residents Of Certain Countries.

Customers Can Also Connect With Rox Capitals Through Popular Social Media Platforms Such As Facebook, Twitter, LinkedIn, Instagram, YouTube And Telegram, Enabling Them To Stay Up To Date And Participate In Company Updates And Announcements.