Corporate Profile

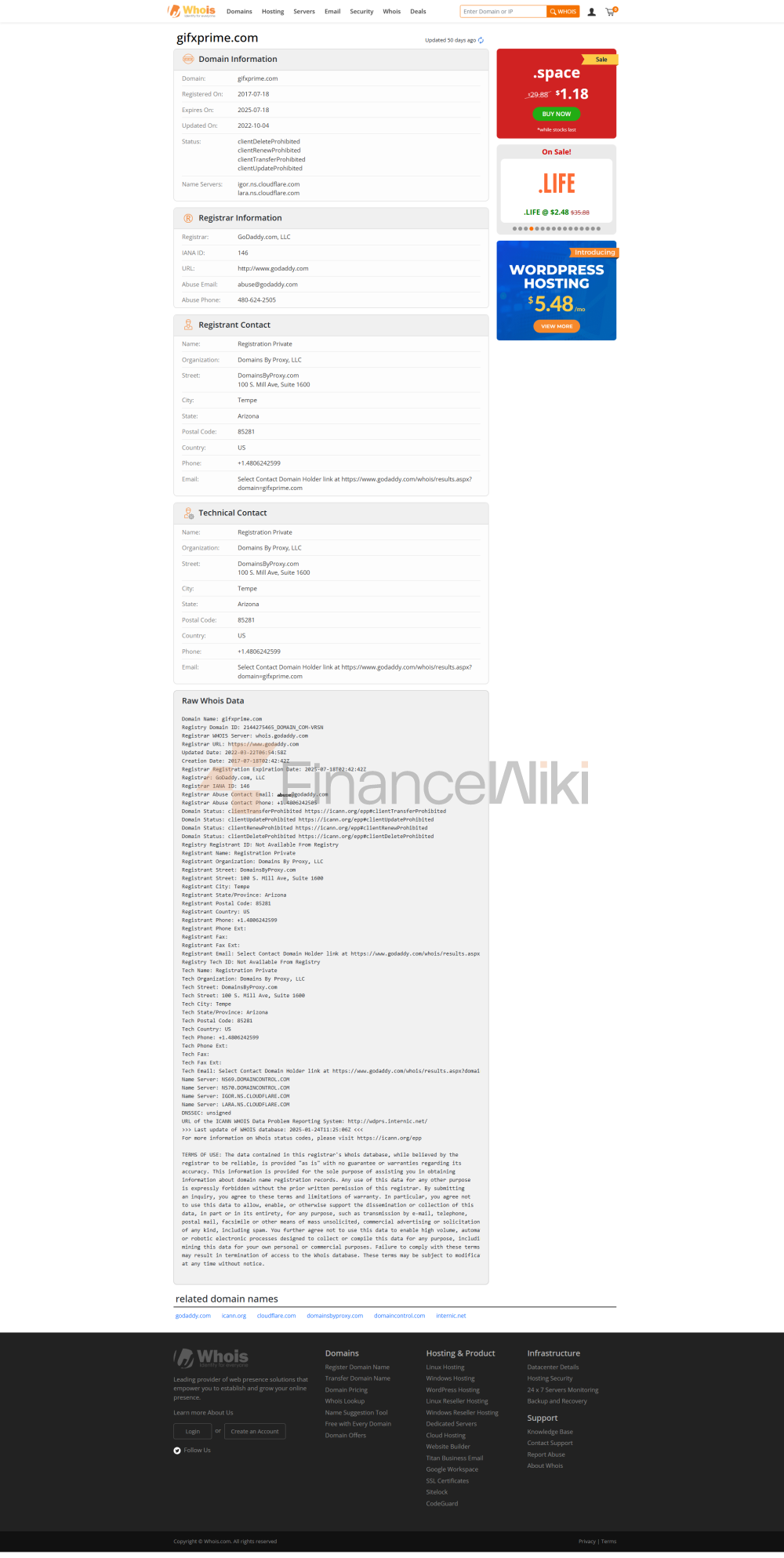

Established In 2013, GIFX PRIME Is A Forex Broker Owned And Operated By GIFX PRIMEinvestment Limited. Registered In Saint Vincent And The Grenadines, The Company Aims To Provide A Diverse Range Of Financial Services And Trading Solutions To Clients Worldwide. Known For Its Comprehensive Trading Tools, Advanced Trading Platform And 24/7 Customer Support, GIFX PRIME Is Committed To Providing A Safe, Transparent Trading Environment For Traders Of All Experience Levels.

Regulatory Information

As A Regulated Forex Broker, GIFX PRIME Operates In Compliance With The Financial Regulations Of Saint Vincent And The Grenadines. The Company Holds The Corresponding Licenses To Ensure The Legality And Compliance Of Its Business Activities. The Following Are The Core Regulatory Qualifications Of GIFX PRIME:

- Regulatory License : GIFX PRIMEinvestment Limited Holds A Financial Services License In Saint Vincent And The Grenadines, Number SVGFSA/202XXX (specific License Number Is Marked). This License Allows The Company To Conduct Business In The Field Of Foreign Exchange, Contracts For Difference (CFD) And Other Financial Derivatives.

- Compliance Statement : GIFX PRIME Strictly Adheres To Anti-money Laundering (AML) And Know-your-customer (KYC) Regulations To Ensure The Legality Of All Trading Activities. The Company Is Regularly Subject To External Audits To Verify The Robustness Of Its Financial Transparency And Risk Management System.

- Member Of Industry Association : GIFX PRIME Is A Member Of Several International Financial Industry Associations, Including But Not Limited To The Financial Commission (FinaCom) And The International Organization Of Securities Supervision Commissions (IOSCO), To Further Enhance Its Industry Influence And Credibility.

Trading Products

GIFX PRIME Offers More Than 100 Trading Instruments Covering A Wide Range Of Asset Classes To Meet The Needs Of Different Traders. The Following Are Its Main Trading Products:

- Currency Pairs : Includes All Major Currency Pairs (e.g. EUR/USD, GBP/USD, Etc.) And Minor Currency Pairs, Supporting Up To 1:1000 Trading Leverage.

- Stocks : Offers CFD Trading Of Major Global Stock Indices, Including NASDAQ 100, S & P 500, Etc., With A Maximum Leverage Of 1:20.

- Commodities : Covers Commodities Such As Gold, Silver, Crude Oil, Etc., With A Maximum Leverage Of 1:67.

- Cryptocurrency : Supports CFD Trading Of Major Cryptocurrencies Such As Bitcoin (BTC), Ethereum (ETH) With A Maximum Leverage Of 1:10.

Trading Software

GIFX PRIME Provides Its Clients With An Advanced MetaTrader 5 (MT5) Trading Platform That Supports Multi-device Operation, Including Computers, Smartphones And Tablets. MT5 Is Known For Its Powerful Charting Capabilities, Multiple Technical Indicators And Real-time Data Analytics Tools, Making It The Tool Of Choice For Professional Traders. In Addition, GIFX PRIME Also Integrates A Series Of Advanced Features On The MT5 Platform, Such As Economic Calendar, Automated Trading (EA) Scripts, And Real-time News Updates.

Deposit And Withdrawal Methods

GIFX PRIME Supports A Variety Of Deposit And Withdrawal Methods, Making It Convenient For Customers To Complete Funds Operations Quickly. The Following Are Its Main Payment Options:

- Telegraphic Transfer : Minimum Deposit Of $250, Withdrawal Of $300, Accepting Currencies Such As USD, EUR, RMB, Etc. Processing Time Is 1 Business Day Without Any Fees.

- VISA/MasterCard : Minimum Deposit And Withdrawal Is $20. Currencies Such As USD And EUR Are Supported. Processing Time Is Instant And No Additional Fees.

- WebMoney : Minimum Deposit Is $20. Withdrawal Is $300. Currencies Such As USD And EUR Are Supported. Processing Time Is 1 Business Day And No Fees.

- Neteller : Minimum Deposit And Withdrawal Is $20. Currencies Such As USD And EUR Are Supported. Processing Time Is No More Than 1 Hour And No Fees.

- Skrill : The Minimum Deposit And Withdrawal Is $20. Currencies Such As USD And EUR Are Supported. The Processing Time Does Not Exceed 1 Hour And There Is No Fee.

Customer Support

GIFX PRIME Provides 24/7 (7x24) Customer Support Services To Ensure That Customers Can Get Help At Any Time. The Following Is Its Main Contact Information:

- Phone : + 442038077044 (working Hours Are GMT + 3, 9:00-18:00).

- Customer Support Email : Support@gifxprime.com (24/7 Service).

- Account Opening Email : Accounts@gifxprime.com (24/7 Service).

- General Inquiry Email : Info@gifyprime.com (24/7 Service).

- Complaint Email : Accounts@gifyprime.com (working Hours Are GMT + 3, 9:00-18:00).

Core Business And Services

GIFX PRIME's Core Business Covers Foreign Exchange Trading, Contract For Difference (CFD) Trading And Cryptocurrency Trading. The Company Caters To The Needs Of Different Traders Through Its Diverse Trading Tools, Flexible Account Options And Robust Technical Infrastructure. Here Are The Highlights Of Its Core Services:

- Zero Commission Trading Environment : GIFX PRIME Does Not Charge Any Trading Commissions, And Clients Only Pay The Cost Of The Spread.

- Flexible Account Options : GIFX PRIME Offers Three Types Of Trading Accounts - Mini, Classic And Premium, Respectively For Traders With Different Experience Levels And Capital Sizes.

- Differentiated Spread Structure : Spreads As Low As 0.8 Pips For Premium Accounts, As Low As 1 Pip For Classic Accounts, And As Low As 1.2 Pips For Mini Accounts Ensure Optimal Trading Costs For Different Clients.

Technical Infrastructure

GIFX PRIME Provides First-class Technical Support To Clients Through The MetaTrader 5 Platform. The MT5 Platform Is Known For Its Highly Customized, Powerful Charting Capabilities, And Multilingual Support, Capable Of Meeting The Needs Of Professional Traders. In Addition, GIFX PRIME Has Integrated A Variety Of Innovative Tools On Its Platform, Such As Economic Calendar, Real-time News Feed And Automated Trading System (EA), To Help Traders Better Conduct Market Analysis And Trade Execution.

Compliance And Risk Control System

GIFX PRIME's Compliance And Risk Control System Is One Of Its Core Competencies. The Company Ensures The Safety And Transparency Of The Trading Environment Through The Following Measures:

- Anti-Money Laundering (AML) And Know Your Customer (KYC) Policy : GIFX PRIME Strictly Complies With International Anti-money Laundering And Counter-terrorism Financing Regulations To Ensure The Legality Of All Trading Activities.

- Segregated Account Management : Customer Funds Are Kept In Separate Bank Accounts, Completely Segregated From The Company's Working Funds, Ensuring The Safety Of Customer Funds.

- Risk Management System : GIFX PRIME Uses Advanced Risk Management Tools And Technologies To Help Customers Control Risks During The Trading Process. For Example, Its "AIoT Risk Control System" Provides Dynamic Risk Early Warning By Monitoring Market Fluctuations And Customer Trading Behavior In Real Time.

Market Positioning And Competitive Advantage

GIFX PRIME Occupies An Important Position In The Foreign Exchange And CFD Trading Market. Its Competitive Advantage Is Mainly Reflected In The Following Aspects:

- Diversified Trading Tools : GIFX PRIME Offers More Than 100 Trading Tools Covering Currency Pairs, Stocks, Commodities And Cryptocurrencies To Meet The Diverse Needs Of Its Clients.

- Flexible Account Options : For Traders Of Different Experience Levels, GIFX PRIME Offers Mini Accounts, Classic Accounts And Premium Accounts, Ensuring That Each Client Can Find The Most Suitable Trading Environment For Them.

- Powerful Technical Support : The Introduction Of The MT5 Platform And The Integration Of Multiple Innovative Tools Have Made GIFX PRIME An Industry Leader In Terms Of Technical Infrastructure.

Customer Support And Empowerment

GIFX PRIME Not Only Provides 24/7 Customer Support Services, But Also Empowers Its Clients In A Number Of Ways:

- Educational Resources : The Company Offers A Wealth Of Trading Education Resources, Including Online Courses, Market Analysis Reports, And Trading Strategy Guides, To Help Clients Improve Their Trading Skills.

- Dedicated Customer Service Team : GIFX PRIME Provides Exclusive Customer Service To High Net Worth Clients, Ensuring That Their Transaction Needs Are Responded To And Met Quickly.

Social Responsibility And ESG

GIFX PRIME Takes Its Social Responsibility Very Seriously And Actively Fulfills Its ESG (environmental, Social, Governance) Commitments In The Following Areas:

- Environmental Protection : GIFX PRIME Contributes To Environmental Protection By Supporting Renewable Energy Projects And Reducing Carbon Footprint.

- Social Welfare : The Company Regularly Participates In And Supports Social Welfare Projects In The Fields Of Education, Health Care And Poverty Alleviation, Helping To Improve The Quality Of Life Of Disadvantaged Groups.

- Corporate Governance : GIFX PRIME Has Established A Sound Corporate Governance Structure To Ensure The Transparency And Sustainability Of Its Operations.

Strategic Cooperation Ecology

GIFX PRIME Has Further Enhanced Its Market Competitiveness And Innovation Capabilities By Establishing Strategic Partnerships With Several Well-known Financial Institution Groups And Technology Companies. The Following Are Examples Of Its Main Strategic Cooperation:

- Technical Cooperation : Collaborating With Leading Fintech Companies To Develop Advanced Trading Tools And Risk Control Systems.

- Financial Cooperation : Collaborating With Several International Banks And Payment Platforms To Provide Customers With More Convenient Deposit And Withdrawal Services.

- Industry Cooperation : Collaborating With International Finance Associations And Regulators To Promote The Development And Implementation Of Industry Standards.

Financial Health

GIFX PRIME Is In A Solid Financial Position. The Following Are Its Key Financial Metrics:

- As Of 2023Q3 : The Company Has Net Assets Of $50 Million, A Current Ratio Of 2.5, And A Debt-to-equity Ratio Of 0.3. These Metrics Indicate That GIFX PRIME Has Good Financial Health And Solvency.

- Profitability : In The First Three Quarters Of 2023, The Company Achieved A Net Profit Of $10 Million, An Increase Of 20% Year-on-year. This Growth Was Supported By An Increase In Its Trading Volume And An Expansion Of Its Customer Base.

Future Roadmap

The Future Development Strategy Of GIFX PRIME Includes The Following Aspects:

- Product Innovation : Develop More Innovative Financial Products, Such As Options, Futures, Etc., To Meet The Diverse Needs Of Customers.

- Market Expansion : Further Expand Its Business Layout In Emerging Markets Such As Asia, The Middle East, And Africa.

- Technology Upgrade : Continue To Invest In Technology And Innovation To Develop More Competitive Trading Tools And Platforms.

GIFX PRIME, A Regulated Forex Broker, Strives To Be The Platform Of Choice For Global Traders Through Its Professional Services, Strong Technology And Sound Operations.