Corporate Profile

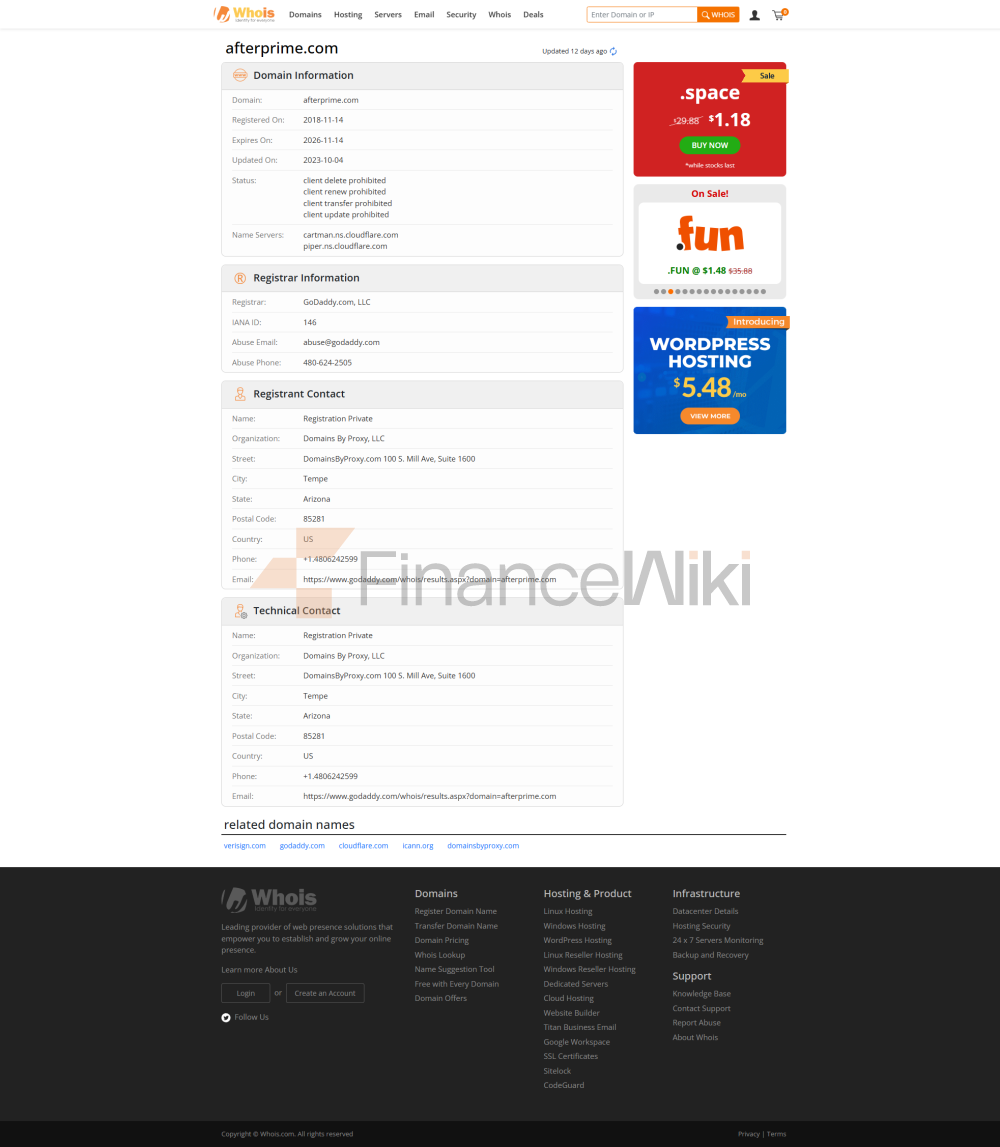

Afterprime Is A Globally Renowned Broker, Established In 2018 And Headquartered In UK . As A Multi-country Regulated Financial Services Provider, Afterprime Is Committed To Providing Traders With Professional Trading Tools And Platform Support. The Company Has A Registered Capital Of XXX (specific Amount Not Mentioned) And Holds A Number Of Regulatory Licenses Such As CySEC, Seychelles FSA And Australian ASIC (cloning License To Be Verified), Covering The Trading Markets In Europe, Asia And Other Regions.

Afterprime's Core Business Includes Trading Services For Financial Instruments Such As Foreign Exchange, Cryptocurrencies, Commodities, Indices, Stocks And Bonds. The Company's Executive Team Consists Of Experienced Financial Professionals With Deep Industry Background And Management Experience. At The Same Time, Afterprime Actively Participates In Industry Associations Such As The XXX Association And Strictly Adheres To Relevant Compliance Requirements To Ensure The Transparency And Compliance Of The Company's Operations.

Regulatory Information

Afterprime's Operations Are Strictly Regulated In Several Countries And Territories, The Following Is Its Main Regulatory Information:

- CySEC (Cyprus Securities And Exchange Commission) : Under The License 368/18 , Afterprime Europe Limited Has Been Authorized To Provide STP Brokerage Services Since July 30, 2018 , Ensuring Compliance With The Requirements Of The European Union Markets In Financial Instruments Directive (MiFID II).

- Seychelles Financial Services Authority (FSA) : Based On The License SD057 , Afterprime Is Approved As A Retail Money Service Provider, Covering Foreign Exchange, Commodities And Cryptocurrency Transactions.

- Australian ASIC (Australian Securities And Investments Commission) : The License 404300 Has Been Pointed Out As A Suspicious Clone License, And The Specific Authenticity Needs To Be Further Verified.

Trading Products

Afterprime Offers Traders A Diverse Range Of Financial Instruments Covering The Following Main Categories:

- Forex (Forex) : Offers Trading On Major Currency Pairs (e.g. EUR/USD, GBP/JPY) And Minor Currency Pairs With Spreads As Low As 0.7 Pips (e.g. EUR/USD).

- Commodities : Includes Gold (XAU/USD), Silver, Crude Oil (WTI) And Agricultural Commodities (e.g. Wheat, Corn).

- Indices : Offers Trading In Contracts For Difference (CFDs) On Major Global Stock Indices, Such As The S & P 500 (GER30), Nasdaq 100 (NAS100) And FTSE 100 (UK100).

- Stocks : Allows Traders To Buy Or Sell Individual Stocks, Covering Globally Renowned Public Companies.

- Bonds : Offers Trading In Fixed Income Securities, Including Government Bonds And Corporate Bonds.

- Digital Currency : Supports Trading Of Bitcoin (BTC/USD), Ethereum (ETH/USD) And Other Major Cryptocurrencies.

Trading Software

Afterprime Provides Traders With A Variety Of Advanced Trading Platforms To Meet Different Trading Needs:

- TradingView : Supports Web, IPhone, Android, Windows, Mac Operating Systems, Suitable For Traders Who Need Advanced Charting Tools And Community Analysis.

- MetaTrader 4 (MT4) : Provides Powerful Technical Analysis And Algorithmic Trading Functions, Supporting Multi-device Operation.

- TraderEvolution : Features An Intuitive Interface And In-depth Market Insights, Suitable For Professional Traders.

- FIX Application Programming Interface : Provides Institutional Traders With Fast And Direct Access To The Market.

Deposit And Withdrawal Methods

Afterprime Supports A Variety Of Deposit And Withdrawal Methods To Ensure Traders' Liquidity:

- Credit/Debit Card : Supports Mainstream Payment Methods Such As VISA And Mastercard, With A Minimum Deposit Of 200 Euros (recommended Amount).

- E-Wallet : Including Fasapay, Gate8, Dragonpay, VnPay, Promptpay, Pagsmile, Perfect Money, BinancePay, Interac, Etc.

- Bank Telegraphic Transfer : For Large Deposits And Withdrawals, Traders Are Subject To Possible Bank Fees.

Customer Support

Afterprime Provides Traders With 24/7 Customer Support Services, Including:

- Online Chat : 24/5 Technical Support And Trading Advice.

- Email Support : Traders Can Send An Email To The Designated Mailbox For Help.

- Live Help Center : Contains Frequently Asked Questions (FAQs), Tutorials And How-to Guides.

- Social Media Support : Interact With Customers Through Twitter, Facebook And Other Platforms.

Core Business And Services

Afterprime's Core Business Covers The Following Aspects:

- Retail Trading Services : Provides A Low Spread, Multi-leverage Trading Environment For Individual Traders.

- Institutional-grade Trading Tools : Provides Institutional Investors With A Direct-to-market Trading Solution Through The FIX API.

- Demo Trading Account : Helps Novice Traders Become Familiar With Platform Features And Market Operations Without Risking Their Capital.

- Education And Training Tools : Provides Educational Resources For Market Analysis, Trading Strategies, And Risk Management (details To Be Added).

Technical Infrastructure

Afterprime Relies On An Advanced Technology Platform To Ensure The Efficiency And Stability Of Trading:

- Trade Execution : Adopts STP (Straight Through Processing) Technology To Ensure That Orders Are Directly Connected To Liquidity Providers And Reduce Latency.

- Server Architecture : Deploy Servers In Multiple Data Centers Around The World To Improve Trading Speed And Platform Stability.

- Risk Management : Protect Traders From Excessive Risk Through Dynamic Margin Requirements And Leverage Limits.

Compliance And Risk Control System

Afterprime Strictly Adheres To Relevant Regulatory Requirements To Ensure The Compliance And Security Of Transactions:

- Funds Segregation : Client Funds Are Strictly Separated From Company Working Funds And Stored In Segregated Accounts Of International Banks.

- Risk Management Tools : Including Stop-loss/take-profit Orders, Margin Limit Monitoring And Leverage Limits.

- Anti-Money Laundering (AML) And Counter-Terrorism Financing (CFT) : Implement Strict Customer Authentication (KYC) Processes To Ensure Transaction Transparency.

Market Positioning And Competitive Advantage

Afterprime Has Market Competitive Advantages In Several Aspects:

- Low Spreads : Spreads On Major Currency Pairs Are As Low As 0.7pips , Providing Affordable Trading Costs.

- Multi-trading Platform Support : Traders Can Choose From TradingView, MT4, TraderEvolution And FIX APIs On Demand.

- Flexible Leverage : Provides Tiered Leverage Based On Different Asset Classes Up To 30:1 (FX) And 2:1 (Cryptocurrency).

- Global Regulatory Coverage : Multi-country Licenses For CySEC, Seychelles FSA And Australia ASIC (Cloning License Pending Verification).

Customer Support And Empower

Afterprime Empowers Traders In The Following Ways:

- Educational Resources : Provides Educational Resources For Trading Knowledge, Market Analysis And Risk Management.

- Real-time Market Data : Updates Market Dynamics In Real Time Through The Platform To Help Traders Seize Opportunities.

- Personalized Support : Provides Exclusive Customer Service And Customized Trading Solutions For VIP Clients.

Social Responsibility And ESG

Afterprime Takes The Following Measures In Fulfilling Its Social Responsibility:

- Financial Education Popularization : Raise Public Awareness Of Financial Marekt Through Online Courses And Community Activities.

- Environmental Commitment : Support Sustainable Development Projects And Reduce The Environmental Impact Of Company Operations.

Strategic Collaboration Ecosystem

Afterprime Expands Its Business By Establishing Strategic Partnerships With Multiple Institutions:

- Liquidity Provider : Collaborates With Several International Banks And Financial Institution Groups To Ensure Market Depth And Liquidity.

- Technology Partners : Collaborates With Technology Providers Such As TradingView And MetaQuotes To Enhance Platform Functionality.

Financial Health

Afterprime's Financial Performance Is Solid. The Specific Data Are As Follows:

- Registered Capital : XXX (the Specific Amount Is Not Mentioned) .

- Capital Liquidity : Ensure The Safety Of Traders' Funds Through Diverse Sources Of Liquidity.

- Financial Reporting : Submit Financial Reports To Regulators On A Regular Basis To Ensure Transparent Operations.

Future Roadmap

Afterprime Plans To Expand The Following Businesses In The Future:

- Product Innovation : Introduce More Financial Instruments, Such As Differential Indices And Structured Products.

- Regional Expansion : Further Expand Its Business In Asia And Europe To Enhance Its Global Presence.

- Technology Upgrade : Continuously Optimize The Trading Platform To Improve User Experience And Trading Efficiency.