Corporate Profile

Nissan Securities Co., Ltd. Was Established In 1948 And Is A Financial Services Company Headquartered In Japan. The Company Focuses On Providing A Diverse Range Of Financial Services And Products To Individual And Institutional Investors, Including Equities, Derivatives, Fixed Income, Commodities, And Foreign Exchange, Among Others. As An Important Player In Financial Marekt In Japan, Nissan Securities, With Its Extensive Industry Experience And Comprehensive Business Capabilities, Is Committed To Providing Clients With Efficient, Safe And Transparent Trading Solutions.

Regulatory Information

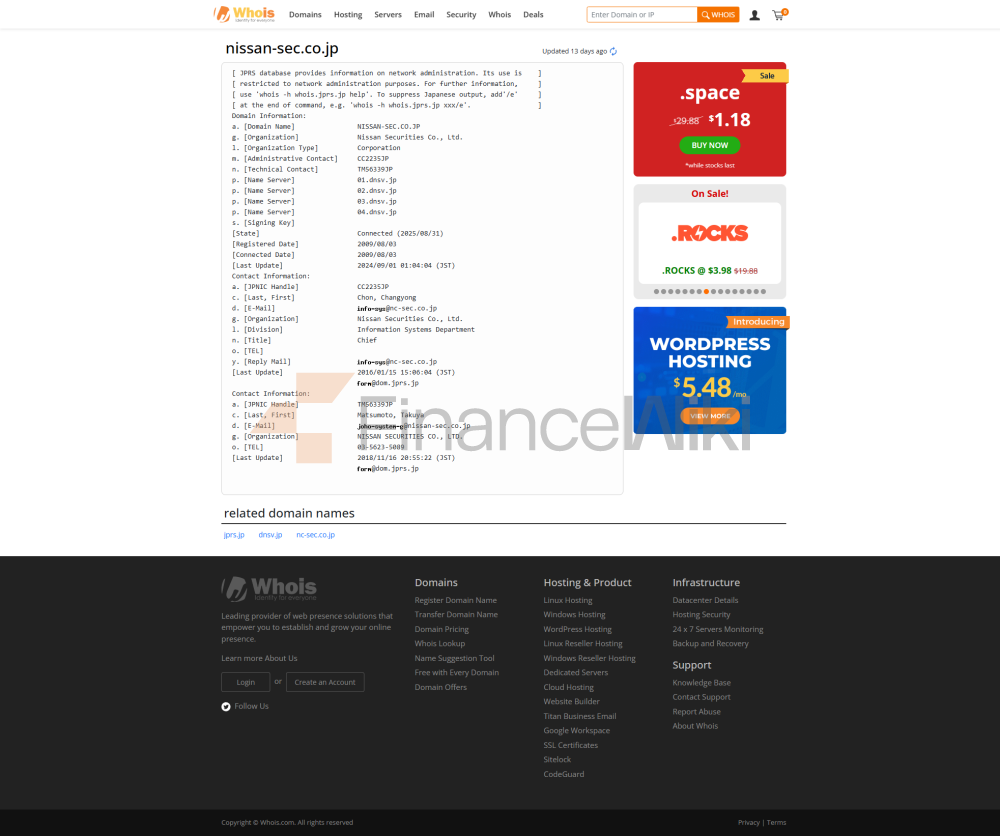

Nissan Securities Co., Ltd. Nissan Securities Is A Financial Instruments Company Registered Under The Japanese Financial Instruments And Exchange Act With Registration Number 131 . The Company Holds A License Issued By The Japanese Financial Services Agency (FSA) With Number 6010001053429 . In Addition, Nissan Securities Is A Member Of The Following Industry Associations: Japan Securities Dealers Association, Japan Commodity Futures Association, Japan Financial Futures Association. The Company's Operations Strictly Follow The Relevant Laws And Regulations Of Japan To Ensure Compliance And Transparency Of Trading Activities.

Trading Products

Nissan Securities Offers Clients A Range Of Financial Products Covering The Following Areas:

- Stocks : Clients Can Trade Stocks Listed On Major Exchanges In Japan And Around The World.

- Derivatives : Including Futures, Options, Swaps And Other Financial Derivatives.

- Fixed Income : Provides Fixed Income Products Such As Government Bonds And Corporate Bonds.

- Commodities : Clients Can Trade Commodities Such As Gold, Crude Oil, And Agricultural Products.

- Forex : Provides Trading Services On 25 Major Currency Pairs, Such As USDJPY, EURJPY And GBPJPY, Etc.

Trading Software

Nissan Securities Supports Multiple Trading Systems And Platforms To Meet The Trading Needs Of Different Clients. The Company Offers The Following ISV/trading Platforms:

- Trading Technologies : Supports High-frequency Trading And Automated Strategies.

- CQG : Provides Real-time Market Data And Trading Capabilities Across Multiple Asset Classes.

- Stellar Trading System : Focuses On Electronic Trading Platforms And Supports Multiple Order Types.

- Bloomberg : Provides Comprehensive Market Data And Analysis Tools.

- Pat_Systems : Supports Forex Trading And Real-time Data Analytics.

In Addition, Nissan Securities Also Provides Native API And System Support To Facilitate Customized Trading For Customers.

Deposit And Withdrawal Methods

Customers Can Complete The Deposit And Withdrawal Of Funds In The Following Ways:

- Bank Transfer : Customers Can Complete The Deposit And Withdrawal Of Funds Through Domestic Or International Banks. Electronic Payment : Some Electronic Payment Methods Are Supported To Facilitate Customers To Complete Transactions Quickly.

Customer Support

Nissan Securities Provides Comprehensive Customer Support Services To Its Clients, Including:

- 24/7 Customer Support : Clients Provide 24/7 Online Support To Solve Problems In Trading.

- Market Information : Provides Real-time Market Dynamics And Analytical Reports To Help Clients Make Informed Trading Decisions.

- Investment Education : The Company Regularly Holds Investment Courses And Seminars To Enhance Clients' Investment Knowledge And Skills.

Core Business And Services

Nissan Securities' Core Business Includes The Following:

- Derivatives And Commodities Trading : The Firm Provides Clients With Access To Japanese And Global Markets, Covering Clearing, Execution, And Brokerage Services.

- International Brokerage Services : Nissan Securities Partners With Global Brokerage Firms And FCMs To Provide Services And Products To Its Base Clients.

- Clearing Membership : The Company Is A Clearing Member Of The Jpx Group (OSE, TSE And TOCOM) And The Tokyo Financial Exchange (TFX), While Providing Market Access Services Such As SGX, LME, KRX, ICE, Etc.

Technical Infrastructure

Nissan Securities Uses Advanced Technical Infrastructure To Ensure The Efficiency And Security Of Transactions. The Company Supports The Following Technologies:

- High Frequency Trading System : Provides Institutional Clients With Low-latency Trade Execution.

- Cloud Platform : Supports Large-scale Data Processing And Multi-asset Class Transactions.

- Automated Tools : Provides Order Management System And Risk Management Tools.

Compliance And Risk Control System

Nissan Securities Attaches Great Importance To Compliance And Risk Management And Takes The Following Measures:

- Anti-Money Laundering (AML) Policy : The Company Strictly Enforces Anti-money Laundering Regulations To Ensure The Legitimacy And Transparency Of Transactions.

- Transaction Monitoring System : Monitor Trading Activity In Real Time To Guard Against Market Manipulation And Fraud.

- Risk Management Framework : The Company Has A Professional Risk Management Department Responsible For Assessing And Managing Market, Credit And Operational Risks.

Market Positioning And Competitive Advantage

Nissan Securities' Market Positioning Is A Financial Services Provider Focused On Technological Innovation And Customers. The Company's Competitive Advantages Include:

- Diversified Product Portfolio : Covering Multiple Asset Classes Such As Equities, Derivatives, Commodities And Foreign Exchange.

- Global Market Access : Through Cooperation With Global Exchanges, Customers Can Access The Japanese And International Markets.

- Advanced Technical Support : The Company Adopts High-frequency Trading Systems And Cloud Platforms To Ensure The Efficiency And Security Of Transactions.

- Comprehensive Compliance System : Strict Compliance Management And Risk Control To Ensure The Safety Of Customers' Funds.

Customer Support And Empowering

Nissan Securities Is Committed To Empowering Clients In The Following Ways:

- Personalized Service : Provide Customized Trading Solutions According To Clients' Trading Needs.

- Educational Resources : Provide Investment Courses And Market Analysis To Enhance Clients' Trading Capabilities.

- Risk Management Support : Provide Clients With Threat And Risk Assessment And Management Tools To Help Them Control Trading Risks.

Social Responsibility And ESG

Nissan Securities Is Outstanding In Fulfilling Its Social Responsibility And Actively Participates In The Following Activities:

- Environmental Protection : The Company Is Committed To Reducing Carbon Emissions And Promoting The Development Of Green Finance.

- Social Welfare : Support Public Welfare Projects Such As Education And Medical Care To Give Back To The Society.

- Corporate Governance : The Company Follows High Standards Of Corporate Governance Principles To Ensure Transparent And Fair Management.

Strategic Cooperation Ecology

Nissan Securities Has Established Strategic Partnerships With A Number Of Globally Renowned Institutions, Covering The Following Areas:

- Exchange Cooperation : Established Clearing Memberships With Jpx Group, Tokyo Financial Exchange, Singapore Exchange, Etc.

- Technology Partners : Collaborated With Technology Companies Such As Trading Technologies, CQG, Etc. To Enhance The Trading Experience.

- Brokerage Firm Cooperation : Collaborated With Global Brokerage Firms And FCMs To Provide Clients With Broader Market Access.

Financial Health

As Of The Third Quarter Of 2023, Nissan Securities' Financial Position Is Solid, With A Capital Adequacy Ratio Of 12.5% And A Leverage Ratio Of 9.5% , Which Is Well Below The Industry Average. The Company Has Sufficient Liquidity And Is Able To Cope With Market Fluctuations And Unexpected Risks.

Future Roadmap

In The Future, Nissan Securities Will Work On The Following Development Directions:

- Technical Innovation : Further Optimize The Trading System And Platform To Improve Trading Efficiency.

- Product Expansion : Add More Financial Products To Meet The Diverse Needs Of Customers.

- International Market Expansion : Expand The Global Business Map Through Strategic Cooperation And Market Access.

- Customer Experience Improvement : Continuously Improve Client Server To Provide More Personalized And Convenient Trading Solutions.