Corporate Profile

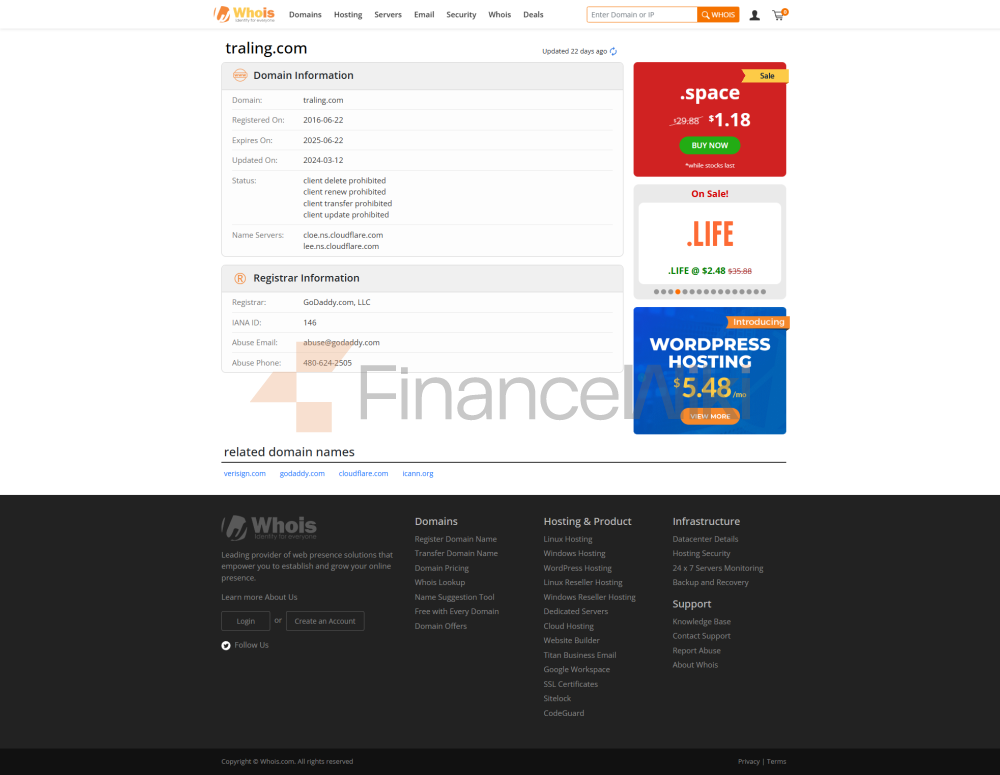

Headquartered In South Africa, Traling Is A Globally Renowned Forex And Commodities Broker Established On June 22, 2016 . As An Institution Dedicated To Serving Traders Worldwide, Traling Has Met Traders' Needs For Flexibility And Accessibility Through Its Robust Online Trading Platform And Diverse Range Of Financial Instruments. However, Traling Has Had Issues With Regulation And Is Currently In An "out Of" State, Which May Have Implications For The Safety Of Traders' Funds And Legitimate Rights And Interests.

Regulatory Information

Traling Is Regulated By The Financial Supervisory Authority Of South Africa (FSCA) Under License Number 53006 . However, Traling's Regulatory Status Is Currently "beyond" , Which Means It May Not Fully Comply With The Regulator's Requirements, Posing Potential Compliance Risks. Traders Should Carefully Assess Their Regulatory Compliance Before Choosing Traling And Consult Relevant Regulatory Information To Avoid Latent Risks.

Trading Products

Traling Offers A Wide Range Of Tradable Assets , Including Forex, Commodities, Stocks, Cryptocurrencies, Metals And Indices . Here Is The Specific Product Information:

- Forex : Offers CFDs On Over 45 Forex Trading Pairs, Covering Major, Minor And Exotic Currencies.

- Commodities : Offers CFDs On Over 20 Popular Commodities, Including Gold, Crude Oil And More.

- Stocks : Offers CFDs On More Than 150 Of The Most Popular Stocks.

- Cryptocurrencies : Offers Trading On Multiple Cryptocurrencies With Tight Spreads.

- Metals : Offers Trading On Precious Metals Such As Gold And Silver.

- Indices : Offers CFDs On Multiple Global Indices Such As Dow Jones, Nasdaq, Etc.

Trading Software

Traling Provides A Proprietary Webtrader Trading Platform That Supports Multi-device Trading, Including Web, Mobile And Desktop Applications . The Platform Provides A User-friendly Trading Interface That Supports Multiple Trading Tools And Analytical Functions. However, Traling Does Not Provide The MetaTrader 4/5 (MT4/MT5) Platform, Which May Be Inconvenient For Traders Who Are Used To Using MT4/MT5.

Deposit And Withdrawal Methods

Traling Offers A Variety Of Deposit And Withdrawal Methods, Including Credit/debit Card, Telegraphic Transfer, Cryptocurrency, Gpay, ApplePay, EFT, PIX, WebPay, Gcash, PayMaya, Mobile Money, Sticpay, And Jeton . Deposit Fees Are $0 . For Withdrawals, The Minimum Withdrawal Amount For Traling Is 10 EUR/USD (or Equivalent Currency). However, Traling Does Not Provide Detailed Information On Processing Times And Fees For Deposits And Withdrawals, Which May Have An Impact On Traders' Liquidity.

Customer Support

Traling Offers Multilingual Customer Support Services Including Email, Phone, Live Chat And Communication Through Its Social Media Platforms Such As Facebook, Twitter, Instagram And YouTube. Traders Can Contact Customer Support At:

- Email: Info@traling.com

- Phone: + 44-1919340500

However, Traling Suffers From A Lack Of Transparency And Responsiveness To Customer Support, With Some Traders Reporting Problems With Withdrawal Difficulties.

Core Business & Services

Traling's Core Business Includes Providing A Diverse Range Of Trading Tools And Account Types To Meet The Needs Of Different Traders. Here Are The Details Of Its Core Business:

-

Account Types Traling Offers Five Main Account Types:

- Classic Account : Suitable For Novice Traders And Provides Basic Features.

- Silver Account : Offers More Advanced Trading Tools And Lower Spreads.

- Gold Account : Offers Higher Leverage And Lower Spreads.

- Platinum Account : Offers Priority Client Server And Technical Support.

- VIP Account : Offers Customized Services And The Highest Leverage Ratio ( 1:400 ). In Addition, Traling Offers PAMM Account , Which Allows Traders To Collectively Invest By Aggregating Funds Into The Main Account.

-

Leverage And Spreads Traling Provides Traders With Flexible Leverage Ratios Up To 1:400 . At The Same Time, Traling Has Minimum Spreads As Low As 0 Pips , Which Provides Traders With An Efficient Trading Experience.

Technical Infrastructure

Traling's Technical Infrastructure Is Based On Its Proprietary Webtrader Platform, Which Supports Multi-device Trading, Ensuring Traders Can Easily Access The Market On Any Device. However, As It Does Not Offer A MT4/MT5 Platform, Traling May Lack Flexibility And Customizability In Terms Of Technical Infrastructure.

Compliance And Risk Control System

Traling, While Regulated By The FSCA, Has A Current Regulatory Status Of "Exceeding", Which Indicates That It May Have Issues With Compliance. Traling's Risk Management System Does Not Provide Details, Which May Pose Latent Risks To The Safety Of Traders' Funds.

Market Positioning And Competitive Advantage

Traling's Core Advantage In Market Positioning Is To Provide A Diverse Range Of Trading Tools And Account Types . It Supports A Wide Variety Of Trading Products, Covering Forex, Commodities, Stocks, Cryptocurrencies, Metals And Indices. In Addition, Traling's Minimum Spreads As Low As 0 Pips And Maximum Leverage Of 1:400 Attract A Large Number Of Traders For It. However, Traling's Regulatory Issues And Insufficient Customer Support May Have A Negative Impact On Its Market Positioning.

Customer Support And Empowerment

Traling Provides Multilingual Assistance To Traders Through Its Customer Support Team To Help Them Solve Problems Encountered During The Trading Process. However, Traling's Customer Support Is Inadequate In Terms Of Transparency And Responsiveness, And Some Traders Have Reported Problems With Withdrawal Difficulties. In Addition, Traling Does Not Provide Detailed Information On Withdrawal Processing Times And Fees, Which May Have An Impact On Traders' Liquidity.

Social Responsibility And ESG

Traling's Information On Social Responsibility And ESG Does Not Provide Details. As A Financial Broker, Traling Should Consider Its Responsibilities In Terms Of Environmental Protection, Social Responsibility And Corporate Governance In Order To Enhance Its Corporate Image And Long-term Development.

Strategic Cooperation Ecology

Traling Did Not Provide Details In Terms Of Strategic Cooperation. As A Forex And Commodities Broker, Traling Should Consider Collaborating With Other Institutions Within The Industry In Order To Enhance Its Market Presence And Competitiveness.

Financial Health

No Details Were Provided For Traling's Financial Health Information. As A Financial Institution Group Regulated By The FSCA, Traling Shall Regularly Report Its Financial Position To The Regulator To Ensure Its Financial Health And Compliance.

Future Roadmap For Traling

Details Are Not Provided In The Future Roadmap Information. As A Forex And Commodities Broker, Traling Shall Consider Further Optimization In Terms Of Technical Infrastructure, Customer Support And Market Positioning To Enhance Its Competitiveness And Trader Satisfaction.