Corporate Profile

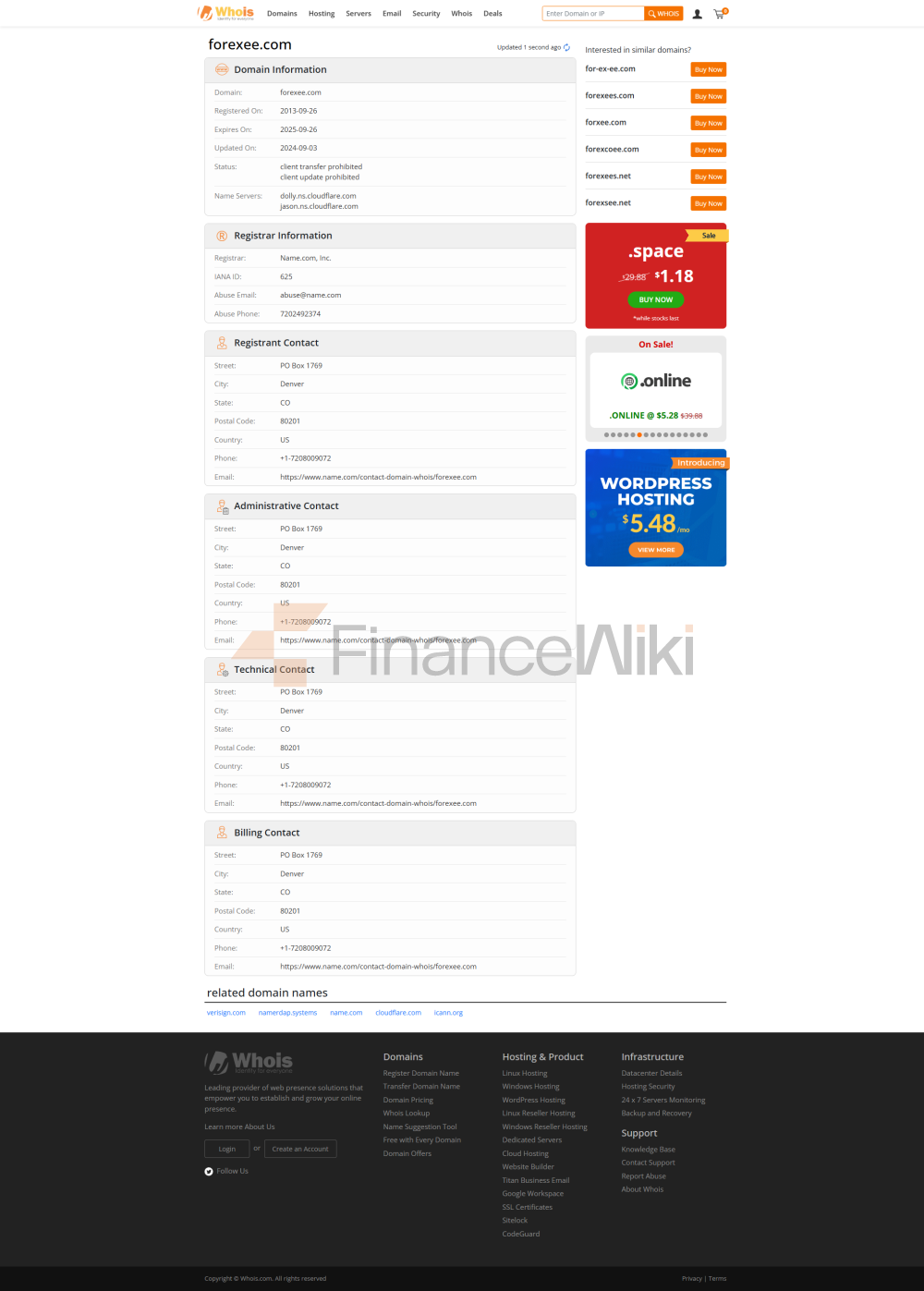

Forex.EE Is A Financial Trading Company Established In 2013 And Headquartered In The United Kingdom. Although The Company Is Registered In Saint Vincent And The Grenadines, Its Operations And Management Team Are Mainly Distributed In Regions Such As The United Kingdom. Forex.EE Provides A Variety Of Financial Trading Services, Including Foreign Exchange, Commodities And Indices, Etc. The Target Customer Group Is Global Traders, Especially Those Looking For Flexible Trading Conditions And Diverse Account Options. As Of 2023, Forex.EE's Market Share And Service Capabilities Have A Certain Influence In The Industry.

Regulatory Information

Forex.EE Is Currently In A Unregulated Status, Which Means That Its Operations Do Not Comply With The Financial Regulatory Requirements Of Certain Countries. Especially For US Traders, Due To The Fact That Forex.EE Is Not Approved By The Relevant US Financial Regulators, It Is Not Possible To Provide Services To US Clients. This Statement Of Compliance Is Based On The Company's Current Regulatory Status And Is Subject To Change In The Future.

Trading Products

Forex.EE Offers Trading Services For 45 Currency Pairs , Gold And Silver. Specifically, The Trading Tools Include:

- Forex : Covers Major And Minor Currency Pairs.

- Commodities : Includes Spot Trading Of Gold And Silver.

- Indices : Offers Index Trading In Some Major Markets.

Forex.EE Does Not Currently Offer Trading In Other Instruments Such As Cryptocurrencies, Stocks, ETFs, Bonds, Mutual Funds, Etc.

Trading Software

Forex.EE Primarily Uses MetaTrader 4 (MT4) As Its Trading Software. MT4 Is A Powerful Trading End Point That Supports Desktop And Mobile Platforms, Providing Traders With A Complete Toolset Including Chart Analysis, Trade Execution, And Order Management. Forex.EE Provides Traders With A Convenient Trading Experience Through MT4.

Deposit And Withdrawal Methods

Forex.EE Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Credit/Debit Card : Visa, MasterCard, Etc.

- Telegraphic Transfer : Bank Transfer.

- E-Wallet : Neteller, Skrill, WebMoney, Payza, FasaPay, Perfect Money, Etc.

- Cryptocurrency : Bitcoin (BTC).

Traders Can Choose The Appropriate Payment Method According To Their Needs. However, It Is Important To Note That The Forex.EE Charges A Monthly Maintenance Fee Of 10 Dollars For Long-term Inactive Accounts And A Fee Of 50 Dollars For Reactivating Accounts.

Customer Support

Forex.EE Customer Support Team Offers Multiple Contact Methods Including Phone, Email, And Live Chat. The Details Are As Follows:

- Phone : + 44 2035198249 (for UK And International Clients).

- Email : Support@forexee.com.

- Address : First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent And The Grenadines.

Although The Customer Support Channels Are Relatively Well Established, Traders Should Carefully Consider Latent Risk When Selecting Services Due To The Unregulated Company.

Core Business And Services

The Core Business Of Forex.EE Is Concentrated In The Field Of Foreign Exchange And Commodity Trading. Its Main Advantages Include:

- Flexible Leverage Ratio : Provide Leverage Options From 1:3 To 1:500 To Meet The Needs Of Different Traders. Low Spreads : Spreads On STP Accounts Are As Low As 0.5 Pips , Providing Traders With More Competitive Trading Conditions.

- Multiple Types Of Accounts : Including STP, Basic ECN, Advanced ECN, Advanced ECN And Crypto Accounts With Minimum Deposits Of 50 Dollars, 200 Dollars, $1,000, $25,000 And $10 Respectively .

In Addition, Forex.EE Also Offers Demo Accounts And Islamic Accounts To Meet The Needs Of Different Customer Groups.

Technical Infrastructure

Forex.EE Uses MT4 As Its Main Trading Platform, Which Is Known For Its High Stability And Powerful Features. Its Technical Infrastructure Also Includes:

- Liquidity Providers : Ensuring Market Depth And Transaction Execution Speed Through Multiple Liquidity Providers.

- Order Execution Type : STP And ECN Modes, Respectively, Provide Traders With Different Order Execution Options.

Although The Technical Infrastructure Is Relatively Complete, There May Be Certain Risks To The Transparency And Fairness Of Its Trading Environment Due To The Unregulated Company.

Compliance And Risk Control System

Forex.EE Is Not Officially Licensed By Any National Financial Regulator, Which Means That There May Be Some Uncertainty About Its Compliance And Risk Management System. Although The Company Claims That Its Trading Environment Is Transparent, Traders Should Carefully Consider Latent Risk In An Unregulated Situation.

Market Positioning And Competitive Advantage

Forex.EE Market Positioning Is Primarily Focused On Serving Traders Seeking Flexible Trading Conditions And Diverse Account Options. Its Competitive Advantages Include:

- Low Spreads : Spreads On STP Accounts Are As Low As 0.5 Pips .

- Flexible Leverage : Up To 1:500 .

- MT4 Platform : Strong Instrument Support For Traders.

However, Its Unregulated Status May Limit Its Market Expansion And Client Trust.

Customer Support And Empower

Forex.EE Provides Traders With Multiple Customer Support Channels And Helps Clients Improve Their Trading Capabilities Through Its Trading Platform And Account Type Design. However, Due To Its Unregulated Nature, The Reliability And Professionalism Of Customer Support May Be Affected To Some Extent.

Social Responsibility And ESG

Forex.EE Does Not Disclose Its Specific Practices And Results In Social Responsibility And ESG (environmental, Social And Governance). As An Unregulated Financial Trading Company, Its Information Disclosure In This Field Is Relatively Limited.

Strategic Cooperation Ecosystem

Forex.EE Has Not Disclosed The Details Of Its Main Strategic Partners Or Ecosystems. Although It Offers A Variety Of Trading Tools And Account Types, Its Cooperation Network And Strategic Layout Within The Industry Are Not Clear Due To Its Unregulated Status.

Financial Health

Forex.EE Has Not Disclosed The Specific Data Of Its Financial Status, Including Information Such As Registered Capital And Management Scale. Due To Its Unregulated Status, There May Be Certain Risks To The Safety Of Traders' Funds And The Financial Stability Of The Company.

Future Roadmap

Forex.EE Has Not Disclosed Its Specific Development Plans For The Future, Including Whether To Seek Regulatory Licenses, Expand Trading Tools Or Optimize Technical Infrastructure. Although Its Current Market Positioning And Competitive Advantages Have Attracted Some Traders, Its Future Development Still Requires Attention To Regulatory Dynamics And Market Changes.