Corporate Profile

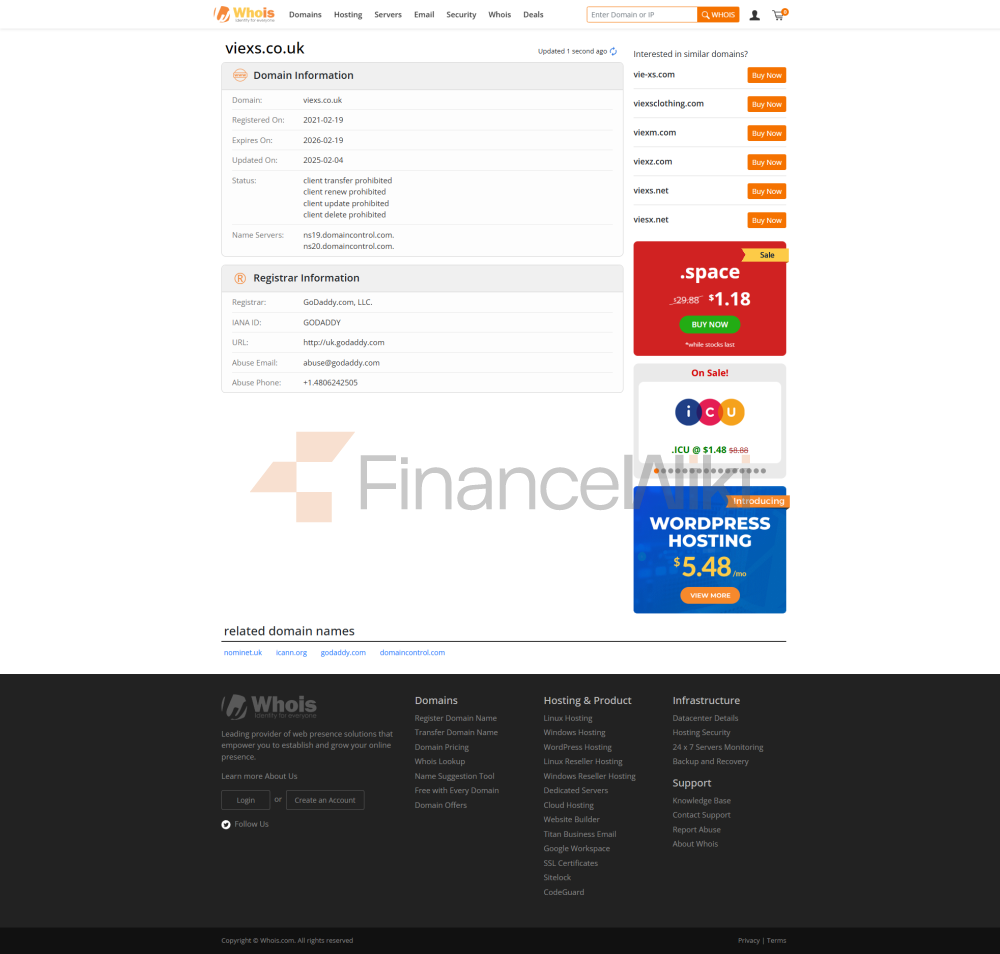

Vision Integrated Exchange Ltd (VIEXS For Short) Was Established In 2019 And Is Headquartered In Wales, UK, With Offices In London. As A Foreign Exchange Dealer Regulated By The UK Financial Conduct Authority (FCA), VIEXS Holds License Number 923324 And Focuses On Providing Foreign Exchange And Contracts For Difference (CFD) Trading Services To Institutional And Professional Traders. The Company's Registered Capital Information Is Not Disclosed, But Its Shareholding Structure And Corporate Structure Comply With UK Regulatory Requirements.

VIEXS's Core Business Covers Financial Products Such As Foreign Exchange And Contracts For Difference, And Mainly Serves Institutional Investors And High Net Worth Traders. Its Technology Platform Relies On FlexTrader , Which Is Known For Its High Performance, Quantitative Analysis Tools And Global Liquidity Connectivity.

Regulatory Information

VIEXS Is A Foreign Exchange Dealer Regulated By The UK Financial Conduct Authority (FCA) With License Number 923324 . The FCA Is A Globally Renowned Financial Regulator, Ensuring That VIEXS Operates In Accordance With Strict Risk Management And Compliance Standards.

VIEXS Compliance Statement Clearly States:

- The Company Strictly Complies With The Relevant Regulations Of The FCA, Including The Segregated Deposit Of Client Funds, Transparent Fee Structure And Risk Management Requirements.

- The Company Does Not Accept Clients From Certain Countries (such As The United States) To Avoid Potential Legal Risks.

Trading Products

VIEXS Offers More Than 70 Currency Pairs , Covering Major Currency Pairs (such As EUR/USD, GBP/USD) And Emerging Currency Pairs (such As USD/ZAR, USD/HKD).

In Addition, The Company Also Offers The Following Trading Products:

- Forex : Supports The T + 0 Trading Mechanism, Allowing Customers To Enter And Exit The Market Multiple Times On The Day Of Trading, Taking Advantage Of Exchange Rate Fluctuations To Earn Spread Gains.

- Contracts For Difference (CFD) : Covers A Variety Of Asset Classes, But The Specific Supported CFD Products Are Not Disclosed.

Trading Software

The Trading Software Of VIEXS Is FlexTrader , Which Is A Platform That Supports Multiple Devices, Including PC Side And Mobile End (web And Mobile Applications).

FlexTrader The Main Advantages Include:

- High Performance : Support For Fast Order Execution And Low Latency Trading.

- Quantitative Analysis Tools : Built-in A Variety Of Technical Indicators And Charting Functions To Meet The Needs Of Professional Traders.

- Global Liquidity Connection : Direct Access To Major Banks, Market Makers And Other Liquidity Providers.

Deposit And Withdrawal Methods

VIEXS's DMA (Direct Market Access) Account Requires A Minimum Deposit Of $10,000 . Deposit And Withdrawal Methods Include A Variety Of Payment Methods (such As Credit Cards, Debit Cards And E-wallets). The Specific Supported Payment Methods Are Not Detailed On The Official Website.

CUSTOMER SUPPORT

VIEXS Provides 5x24 Hours Customer Support Services, Covering A Variety Of Communication Methods Such As Phone, Mail And Online Chat. Clients Can Submit Questions Through Its Official Website Or Contact The Support Team Directly.

CORE BUSINESS AND SERVICES

The Core Business Of VIEXS Is To Provide Liquidity Services To Institutional And Professional Traders. The Company Adopts Direct Market Access (DMA) Model , Which Means That Clients Can Enter The Actual Market Directly To Trade, Rather Than Through The Broker's Internal Spread Model (STP).

Advantages Of The DMA Model :

- Customers Can Directly Obtain The Best Offers In The Market.

- High Transparency And Reduced Information Asymmetry.

In Addition, VIEXS Also Offers Leverage Of Up To 1:50 , But The Company Reminds Customers Of The Risks That Can Come With Excessive Leverage.

Technical Infrastructure

VIEXS 'technical Infrastructure Is Centered On FlexTrader , A Platform Supported By A Globally Renowned Technology Provider That Ensures High Performance And Stability.

Key Features Of FlexTrader :

- Support For Multi-device Operation: Web, PC And Mobile End Are Available.

- Provides Quantitative Analysis Tools: Includes A Variety Of Technical Indicators And Chart Types.

- Global Liquidity Connection: Direct Access To Liquidity Pools Of Major Banks And Market Makers.

Compliance And Risk Control System

VIEXS 'risk Management System Is Based On FCA Compliance Requirements Combined With Its Own Risk Management Model.

Main Risk Control Measures :

- Separate Storage Of Customer Funds : Ensure That Customer Funds Are Managed Separately From The Company's Working Funds To Reduce The Risk Of Bankruptcy.

- Risk Control Tools : Including Stop Loss, Take Profit And Position Limits.

- Transparent Fee Structure : Clear Spread And Commission Collection Standards To Avoid Hidden Fees.

Market Positioning And Competitive Advantage

The Market Positioning Of VIEXS Is Mainly Focused On Providing High-quality Liquidity Services To Institutional Investors And Professional Traders. Its Competitive Advantage Is Reflected In The Following Aspects:

- High-performance Trading Technology : Relying On The FlexTrader Platform, It Provides A Low-latency And High-transparency Trading Experience.

- Direct Market Access Mode : Through The DMA Mode, Customers Can Directly Participate In Global Financial Marekt.

- Broad Currency Pair Support : Covers Major And Emerging Currency Pairs To Meet Diverse Trading Needs.

Future Roadmap

Future Development Plans For VIEXS Include:

- Expanding The Range Of Services : Plans To Add More Financial Products (e.g. Commodities And Stock Indices).

- Optimizing The Technology Platform : Further Enhancing The Performance And User Experience Of FlexTrader.

- Deepening Institutional Cooperation : Establishing Partnerships With More Banks And Liquidity Providers To Expand Market Influence.

VIEXS Aims To Become A Leading Global Forex And CFD Broker, But Its Development Will Strictly Follow The Regulatory Requirements And Market Norms Of The FCA.