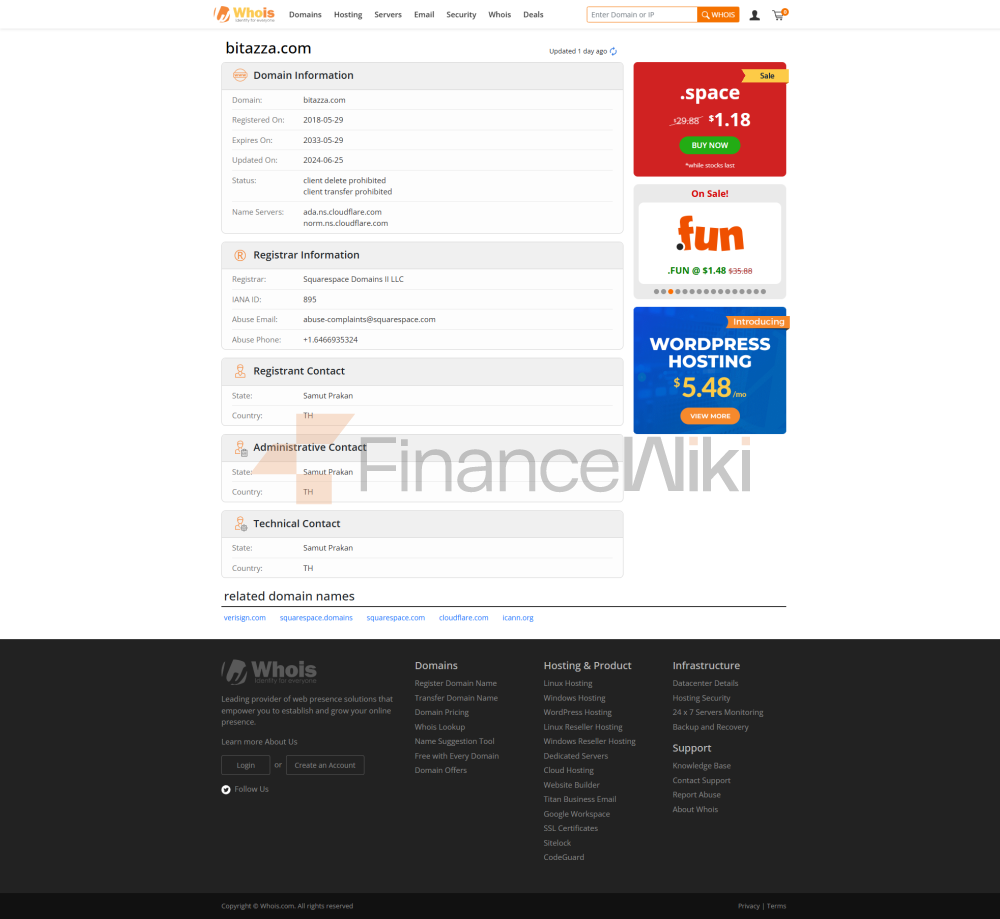

Founded In 2018, Bitazza Is A Centralized Digital Asset Platform That Provides Institutional-grade, Intelligent Routing Of Domestic Orders To Deeply Liquid International Markets. As Part Of The Ecosystem, Bitazza Has Its Own Utility Tokens, Fiat-backed Stablecoins, Visa Cards, And Blockchain-based Payment Solutions.

Bitazza's Trading Platform Supports Instant Fiat Deposits And Withdrawals, Fiat And Cryptocurrency Trading Pairs, And OTC Services Under License From The SEC And The Ministry Of Finance Of Thailand.

Pros And Cons

Bitazza Excels In These Areas:

- Supports More Than 80 Cryptocurrencies, Wider Than Most Exchanges.

- Regulated In Thailand, Ensuring Compliance, Transparent Operations.

- Bitazza Is Easy To Use Even For Beginners. The Website And App Are Well Designed And Easy To Navigate.

- Cryptocurrency Futures Can Be Leveraged Up To 20x For Maximum Potential Gains.

- Offers Bonus Staking Options

- Offers Spot Trading And Futures Trading

Bitazza Lacks These Areas:

- Liquidity Is Limited For Some Of The Smaller Cryptocurrencies It Supports.

- The Higher Recipient Fee Is 0.25%, Slightly Higher Than The Industry Average.

- Liquidity Is A Bit Scarce

- Access May Not Be Possible In Each Country Due To Different Regulations And Regional Restrictions

States

Bitazza Is Regulated By The Securities And Exchange Commission (SEC) And Holds A Digital Currency License. The Securities And Exchange Commission Of Thailand (SEC) Is An Independent National Agency Established Under The Securities And Exchange Act No. 2535 (1992). The SEC Is Responsible For Regulating The Securities And Derivatives Markets In Thailand. The SEC Is Also A Member Of The International Organization Of Securities Commissions (IOSCO) And The Association Of South East Asia Nations (ASEAN) Capital Markets Forum (ACMF), Working With These Organizations To Promote Investor Protection And Market Development In The Asia-Pacific Region.