Basic Information

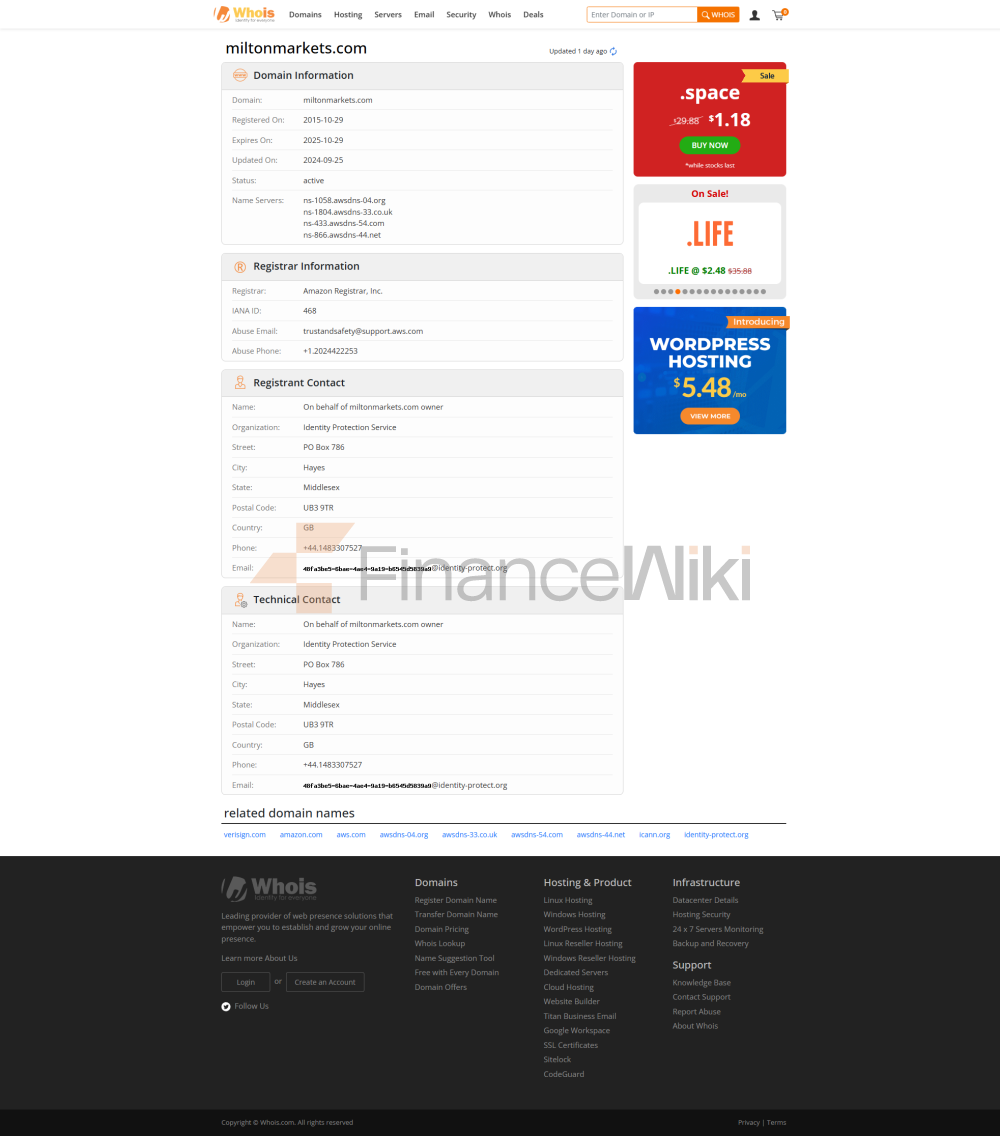

Milton Is A Trading Platform That Offers A Variety Of Services To Traders. Milton Markets Ltd. Is An International Financial Services Provider Officially Registered As An International Business Company (IBC) In Saint Lucia.

Milestones

2014 Gallant Capital Markets (GCM) Merged With WSM Invest LTD. Obtained An FPS License In New Zealand Through The Merger.

2015 GCM Obtained An FCA License In The UK. GCM Launched The Milton Markets Brand.

2016 Milton Markets Became An Independent Company. Launched Entity In Saint Vincent And The Grenadines.

2017 Milton Markets LTD. Obtained VFSC License In Vanuatu.

2018 Milton Markets Acquired CYSEC Licesne.

2019 Established Milton Global LTD. In Seychelles And Obtained FSA License.

2020 Launch Of Milton Prime Brand Under Milton Global LTD.

2021 Milton Markets Ltd. The SVG Format

2023 Milton Markets Ltd In, Saint Lucia

Advantages Of Milton:

- Support For MT4: Milton Offers A Widely Used MT4 Trading Platform Known For Its Advanced Charting And Analytical Tools. The Platform Provides Traders With A Familiar And Reliable Trading Environment.

- A Range Of Trading Tools: Milton Offers A Wide Range Of Trading Tools Including Currency Pairs, Index CFDs, Energy CFDs And Precious Metals. This Allows Traders To Diversify Their Trading Portfolio And Take Advantage Of Different Market Opportunities.

- No Commission Trading: Milton Does Not Charge Any Commission When Executing Trades, Which Can Help Traders Save On Trading Costs.

- Multi-channel Support: Milton Provides Customer Support Via Phone And Email, Allowing Traders To Contact Them Through Their Preferred Channel. This Accessibility Is Very Beneficial For Traders Who Need Help Or Have Questions.

Disadvantages Of Milton:

- Suspicious FSPR Registration: There Is A Suspicion Of A Clone Of Milton In The FSPR Registration. This May Raise Concerns About The Legitimacy And Reliability Of The Company. Traders Should Exercise Caution And Conduct Thorough Research Before Trading With Milton.

- Website Inaccessible: The Current Inability To Access Milton's Website Has Raised Concerns About Its Online Presence And Availability. Traders May Face Difficulties Accessing Important Information And Managing Their Accounts Online.

- Large Quoted Spreads For EUR/USD Currency Pairs: The Quoted Spreads For EUR/USD Currency Pairs For SMART Accounts Are 1.0 Pips, Which Is Relatively Large. Large Spreads May Affect Trading Costs And May Limit Traders' Profit Potential, Especially For High-frequency Trading Strategies.

Market Tools

Milton Offers A Wide Range Of Trading Tools, Including 46 Currency Pairs. These Currency Pairs Allow Traders To Speculate On Exchange Rate Fluctuations Between Different Currencies. Traders Can Take Advantage Of Major And Minor Currency Pairs Such As EUR/USD, GBP/JPY Or AUD/NZD.

In Addition To Currency Pair Forex Trading, Milton Also Offers Trading Opportunities For Index CFDs. These Contracts Are CFDs Based On Various Stock Market Indices Such As The S & P 500, FTSE 100 Or German DAX30. Traders Can Trade Index CFDs To Gain Exposure To The Overall Movement Of Different Stock Markets Around The World.

In Addition, Milton Offers Energy CFDs That Allow Traders To Speculate On Price Fluctuations Of Various Energy Commodities Such As Crude Oil Or Natural Gas. These CFDs Give Traders The Opportunity To Profit From Price Increases And Decreases In The Energy Market.

Finally, Milton Also Offers Trading Options For Precious Metals. Traders Can Invest In Gold, Silver, Platinum Or Palladium Through Their Platform. In Times Of Economic Uncertainty, Precious Metals Are Often Seen As Safe-haven Assets, And Trading Them Can Diversify A Trader's Portfolio Or Hedge Against Inflation.

Account Types

Milton Offers Two Real Account Types: SMART And FLEX Accounts.

SMART Accounts Are Designed For Traders Who Prefer A Simple And Straightforward Trading Experience. The Minimum Deposit Requirement Is 300 Dollars. FLEX Accounts, On The Other Hand, Are Designed For Traders Who Want More Flexibility And Control In Their Trading Experience. The Minimum Deposit Requirement Is Lower At 100 Dollars.

Leverage

Milton Offers Different Leverage Options For Its SMART And FLEX Accounts.

For SMART Accounts, The Leverage Options Are 1:1000, 1:500 And 1:200. Each Leverage Option Is Available For A Different Range Of Account Balances. For Account Balances Up To $1,000, Traders Can Enjoy A Maximum Leverage Of 1:1000. For Account Balances Between $1,001 And $10,000, The Maximum Leverage Is 1:500. While For Account Balances Over $10,001, The Maximum Leverage Is 1:200. Leverage Allows Traders To Amplify Their Trading Positions, Potentially Increasing Their Profits.

For FLEX Accounts, The Maximum Leverage Ratio Offered Is 1:500. This Allows Traders To Have The Flexibility To Control Their Trading Positions And Manage Risk More Effectively.

Spreads And Commissions

Milton Offers Different Spreads For Its SMART And FLEX.

For SMART Accounts, The Spread Is Fixed At 1.0 Pips. The Spread Represents The Difference Between The Bid And Ask Prices Of A Currency Pair Or Other Financial Instrument. A Smaller Spread Indicates That The Market Is Tighter And The Trader May Have Lower Transaction Costs.

For FLEX Accounts, On The Other Hand, The Spread Is Slightly Higher At 1.7 Pips. This May Be Due To The Flexibility And Additional Features Offered By FLEX Accounts, Such As The Ability To Control Trading Positions With Higher Leverage.

Furthermore, Milton Does Not Charge Any Commissions. Commissions Are Additional Fees That Some Brokers May Charge For Executing Trades On Behalf Of Their Clients. By Charging No Commissions, Milton Aims To Provide Clients With Transparent And Cost-effective Trading Services.

Trading Platform

Milton Offers Clients The Highly Acclaimed Trading Platform MT4 (MetaTrader 4). Known For Its Advanced Features And User-friendly Interface, The Platform Has Become A Popular Choice For Traders Of All Levels.

The MT4 Trading Platform Provides A Comprehensive Set Of Tools And Resources To Facilitate Efficient And Effective Trading. Traders Can Access A Wide Range Of Financial Marekts, Including Forex, Commodities, Indices And Cryptocurrencies, From One Platform. This Diversity Allows Clients To Explore Different Investment Opportunities And Diversify Their Portfolios.

Deposits And Withdrawals

Milton Offers Its Clients A Variety Of Deposit And Withdrawal Options. Clients Can Choose To Deposit Using Credit Cards (Visa And MasterCard), Bank Telegraphic Transfers And E-wallets Such As Skrill And Neteller.

Deposits Using Credit Cards Are A Common And Convenient Option For Many Traders. By Using Visa Or MasterCard, Customers Can Easily Transfer Funds From Their Credit Card Account To Their Milton Trading Account. This Method Allows For Quick Processing And Immediate Availability Of Funds That Can Be Used For Transactions.

Bank Telegraphic Transfer Is Another Option Offered By Milton. This Method Involves Transferring Funds Directly From A Customer's Bank Account To Their Trading Account. Bank Telegraphic Transfers Are Generally Safe And Secure, Although They May Take Longer To Process Than Other Methods. However, They Are Suitable For Larger Transactions Or Customers Who Prefer Traditional Banking.

Electronic Wallets Like Skrill And Neteller Are Electronic Payment Systems That Provide Secure And Fast Access To Funds. Clients Can Link Their Milton Trading Account With Their Skrill Or Neteller Account And Easily Transfer Funds Between The Two. E-wallets Are Widely Used By Traders Due To Their Convenience, Low Fees And Fast Processing Times.

Client Server

Clients Can Contact Customer Service Using The Information Provided Below:

Tel: 03-4586-4741

Email: Support@miltonmarkets.com

In Addition, Clients Can Also Connect With This Broker Via Social Media Such As Twitter, Facebook And Instagram.