Founded In 2024, Capitalcore Is An Online Forex Broker Registered In Saint Vincent And The Grenadines That Offers Leverage Up To 1:2000 And A Demo Account Of $100,000. Additionally, Investors Can Enjoy Competitive Spreads And No Commissions. However, Popular Trading Platforms Like MT4/MT5 Are Not Available At Capitalcore As They Only Offer The Capitalcore Exclusive Web Trading Platform.

Pros

Extremely High Leverage Of 1:2000, Free VPS Service, Up To 40% Deposit Bonus, Popular Payment Methods Available, Proprietary Trading Platform With Web And App Versions, Demo Accounts To Complete Trading Strategies, All Accounts Are No Exchange Fees

Disadvantages

No Valid Regulatory License, No MT4/MT5 Connection, Withdrawal Fees, Restricted Countries Including Afghanistan, Bangladesh, Belarus, Etc.

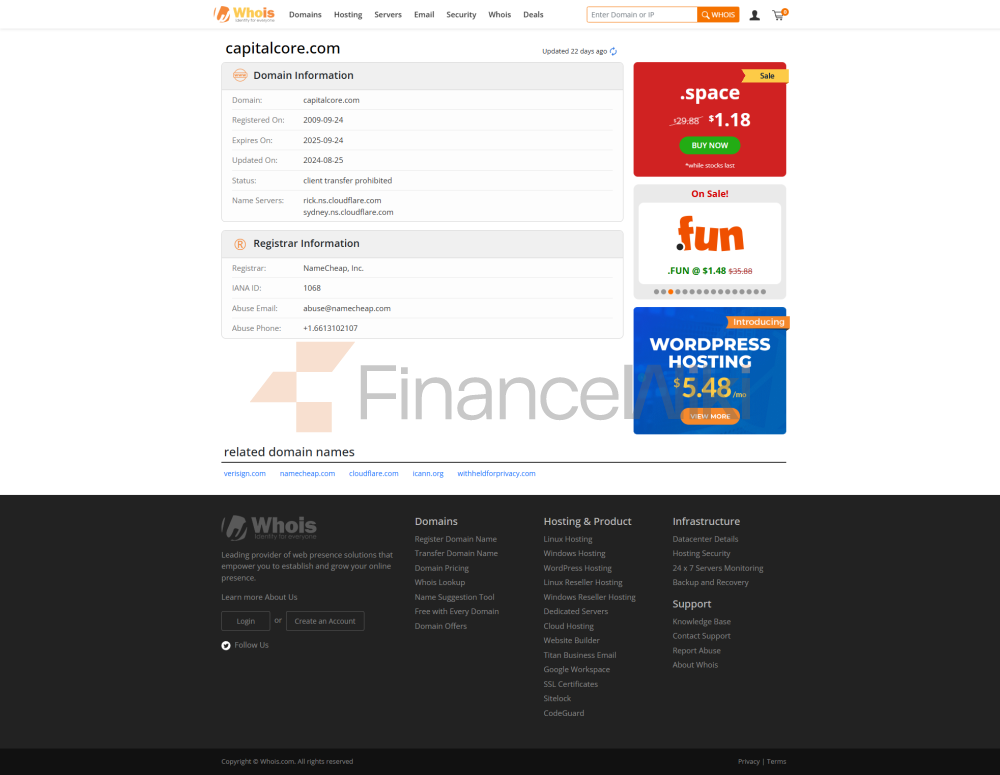

Is Capitalcore Legal?

Trading With A Regulated Broker Is A Critical Step In Protecting Your Money.

Although The Broker Claims To Be Regulated By IFSA On Its Official Website, Verification Shows That It Is Not Overseen By A Tier 1 Regulator In The European Union. IFSA Is Typically Located In Offshore Financial Centres Such As Saint Vincent And The Grenadines And Is Usually Associated With Less Stringent Financial Regulation.

Unlike Well-known Regulators Such As The US Commodity Futures Trading Commission (CFTC), The UK Financial Conduct Authority (FCA) Or The Australian Securities And Investments Commission (ASIC), IFSA Is Generally Considered To Offer A Lower Level Of Investor Protection.

What Can Be Traded On Capitalcore?

Capitalcore Specializes In Providing Trading Services For A Wide Range Of Financial Instruments, Including Forex Pairs (EURUSD, USDJPY, GBPUSD, AUDUSD, EURCHF), Commodities, Stocks, Futures Indices And Cryptocurrencies, All Of Which Are Offered As Contracts For Difference (CFDs).

Trading Account Comparison

Capitalcore's Account Types Are Mainly Differentiated Based On Leverage Ratio, Forced Position Squaring Level, Maximum Number Of Open Positions, Maximum Credit Limit, Minimum Deposit And Maximum Lot Size. All Accounts Are Free Accounts And Offer Bonuses. Their Demo Accounts Come With Higher Virtual Balances And Are An Excellent Way To Try Out Different Trading Styles Such As Swing Trading And Day Trading Without Risking Capital.

Selecting The Right Account Is Based On The Following Factors:

Trading Experience

Account Size

Risk Tolerance

Trading Frequency And Volume

Tailored For Novice Traders, The Classic Account Offers Leverage Of Up To 1:2000, Suitable For Traders With Smaller Funds. However, It Is Relatively Low In Terms Of Maximum Number Of Positions And Credit Limits.

The VIP Account Is Designed For Experienced Traders With Sufficient Funds, Offering The Highest Maximum Number Of Positions And Credit Limits, As Well As A Dedicated Client Server. Although It Has Less Leverage Than Classic Accounts, It Offers More Flexibility And Resources To Experienced Traders.

Silver And Gold Accounts Are For Traders With Intermediate Experience And Offer A Balance Between Leverage, Position Limits, And Credit.

Capitalcore Fees

Capitalcore Does Not Charge Commissions Or Overnight Fee Handling Fees. Instead, Costs Are Primarily Derived From Spreads, Which Vary Depending On The Trading Instrument And Account Type.

For Example, The EUR/USD Currency Pair Has A Spread Of 1.5 Pips For Classic And Silver Accounts, 0.6 Pips For Gold Accounts, And 0.4 Pips For VIP Accounts.

Deposit And Withdrawal Reviews

Investors Can Choose From A Variety Of Payment Methods, Such As Popular Cryptocurrencies Such As Ethereum And Bitcoin, Credit Cards Such As MasterCard And Visa, Or E-wallets Such As Perfect Money And PayPal.

The Minimum Deposit Amount Depends On The Method Chosen, Ranging From $10 For Cryptocurrencies And Perfect Money To $50 For MasterCard, Visa, And PayPal.

Withdrawal Requests For All E-wallet Methods Typically Take 1 To 24 Business Hours To Process. Withdrawals Are Not Processed On Non-business Days.

Capitalcore Offers Up To 10% Discount For Traders Who Top Up Using Cryptocurrencies. The Company Reserves The Right To Charge A Withdrawal Fee Of 0 To 10%. This Fee Is Determined Based On Factors Such As The Client's Transaction History, Transaction History And Trading Strategy.

All Withdrawals Can Only Be Paid To Their Source (deposit Source), And Profits Will Be Paid Through Cryptocurrency Or E-wallet.

Payment Method

PayPal Deposit Fee 0% Withdrawal Fee From None To 5% Minimum Deposit 50 Dollars Minimum Withdrawal 1 Dollar

Cryptocurrency, Deposit Fee 0% Withdrawal Fee, Network Fee (Bitcoin Fixed At 20 Dollars) Minimum Deposit 5 Dollars Minimum Withdrawal 5 Dollars

Perfect Money Deposit Fee 1% Withdrawal Fee, Less Than 50 Dollars = 0% Fee, More = 1% Fee, Minimum Deposit 1 Dollar Minimum Withdrawal 1 Dollar

Recommended Program

Capitalcore's IB Rebate Program Offers A Lucrative Opportunity For Introductory Brokers Seeking Additional Income. By Referring Clients To Brokers, IB Earns A Percentage Of The Trading Commissions Generated By The Accounts They Refer.

Commission Rates For Some Popular Trading Instruments:

Forex Trading Pairs (e.g. AUDCAD): $10 Per Standard Lot

Index (e.g. US500 (S & P 500)): $0.10 Per Index Point

Precious Metals (e.g. Gold): $10 Per Ounce

Stocks And Equity (e.g. Adobe): $0.10 Per Share

For The Full Commission Program, See Their Dedicated IB Portal: Https://Capitalcore.com/ibcomission/.