Company Profile

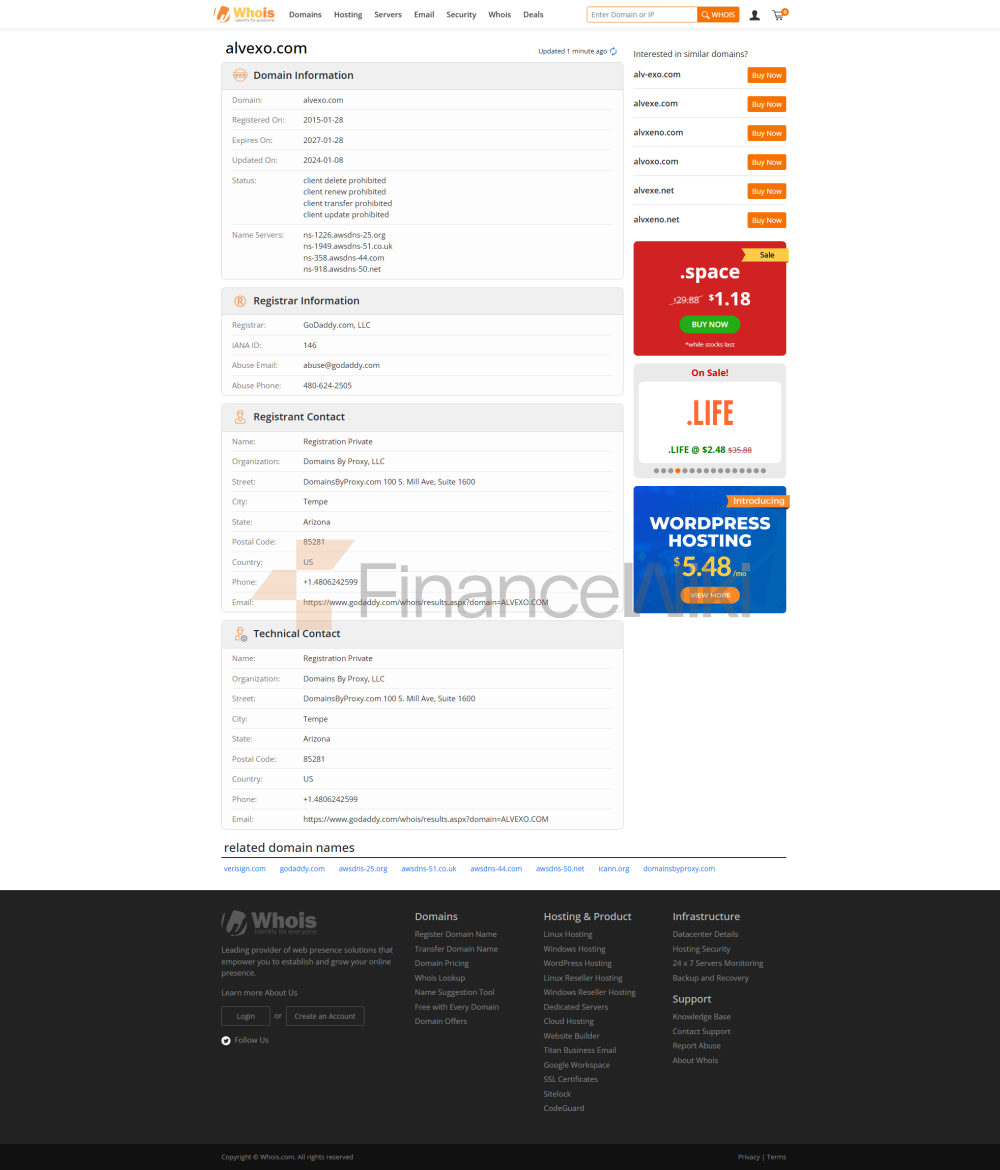

Alvexo Limited Is A Global Investment Brokerage Company Registered In Cyprus, Established In 2014 . The Company Is Headquartered In Nicosia, Cyprus, And Also Has Offices On The Island Of Mahe, Seychelles. As A Highly Regulated Financial Enterprise, Alvexo Is Committed To Providing A Safe And Transparent Financial Trading Environment For Investors Around The World. The Company Has A Registered Capital Of 1.25 Million Euros And Holds A License 236/14 Issued By The Cyprus Securities And Exchange Commission (CySEC) And A License SD030 Issued By The Seychelles Financial Services Authority (SFSA). These Qualifications Ensure Alvexo's Compliance And Reliability In The Global Market.

Regulatory Information Alvexo Operates In Strict Compliance With Financial Regulatory Requirements In Cyprus And The Seychelles. The Company Is Recognized As A Cyprus Investment Company (CIF) Under The Investment Services And Activities And Regulated Markets Act 2007 And Its Amendments. In Addition, Alvexo Is Regulated By The Seychelles Financial Services Authority (SFSA), Ensuring That Its Trading Activities Worldwide Meet High Standards Of Compliance. Alvexo's Regulatory License Numbers Are CySEC: 236/14 And SFSA: SD030 Respectively.

Trading Products Alvexo Offers A Wide Range Of Investment Products Covering The Following Markets:

- Forex : Major Currency Pairs Such As EUR/USD, GBP/USD

- Index : Such As Germany DAX, S & P 500, Etc.

- Precious Metals : Such As Gold (XAU/USD), Silver (XAG/USD) Commodities : Such As Crude Oil (Brent Crude), Natural Gas Contracts For Difference (CFDs) : CFD Trading Based On The Aforementioned Assets

These Products Offer Investors A Diverse Range Of Investment Options.

Trading Software Alvexo Uses The MetaQuotes MT4 Trading Platform To Provide An Efficient And Stable Trading Environment For Global Investors. The MT4 Platform Supports Desktop, Mobile End And Tablet Operation, And Has Built-in 30 Technical Indicators And 9 Time Frames , Allowing Traders To Customize Their Settings According To Their Own Strategies. In Addition, Alvexo Also Provides The Self-developed Web Trading Platform Alvexo WebTrader , As Well As Mobile Applications, Which Facilitate Traders To Trade Anytime, Anywhere.

Deposit And Withdrawal Methods Alvexo Supports A Variety Of Payment Methods, Including:

- Credit/Debit Cards : VISA, MasterCard

- Electronic Wallets : PayPal, Google Pay, Skrill Bank Transfer

Deposits And Withdrawals Are Free Services, But Some Payment Methods May Be Subject To Small Fees By Third Parties. Alvexo Has A Minimum Deposit Requirement Of €500 For Classic Accounts.

Customer Support Alvexo Provides A 24/7 Multilingual Customer Support Service To Stay In Touch With Customers Through:

- Live Chat

- Phone : + 357 25030482

The Client Server Team Is Committed To Responding Quickly To Customer Inquiries And Providing A Professional, Friendly Service Experience.

Core Business And Services Alvexo's Core Business Includes Foreign Exchange Trading, CFD Trading, Etc. The Company Provides High-quality Trading Services To Global Investors Through Its Advanced Trading Platform And Diverse Trading Products. Alvexo's Customer Base Covers Retail Investors, Institutional Investors And High-frequency Traders To Meet Different Investment Needs. The Company Pays Special Attention To Transparent Pricing And The Latest Execution Services To Ensure That Customers Get A Fair Market Environment In Trading.

Technical Infrastructure Alvexo's Technical Infrastructure Is Characterized By High Security And Stability , Using The Latest Servers And Network Equipment To Ensure Smooth Execution Of Transactions. In Addition, Alvexo Has Developed Its Own AIoT Risk Control System , A Risk Management System Based On Artificial Intelligence And Internet Of Things Technology, To Monitor Market Fluctuations In Real Time And Generate Trading Signals To Help Traders Make More Informed Investment Decisions.

Compliance And Risk Control System Alvexo Has Established A Strict Compliance And Risk Control System To Ensure That The Company Operates Within The Legal Framework And Maximizes The Protection Of Customer Assets. Risk Control Measures Include:

- Multi-level Threat And Risk Assessment

- Real-time Market Monitoring

- Leverage Limit : Dynamically Adjusted According To Client Type, Up To 1:300

These Measures Help Traders Reduce Risk In Complex And Volatile Markets.

Market Positioning And Competitive Advantage Alvexo Is Positioned As The World's Leading Online Broker , And Its Competitive Advantage Is Reflected In The Following Aspects:

- Diversified Product Selection

- Advanced Trading Platform

- Multiple Regulatory Safeguards

- Professional Client Server

In Addition, Alvexo Also Offers Demo Accounts Let Traders Practice Risk-free In A Real Market Environment.

Customer Support And Empowerment In Addition To Basic Trading Services, Alvexo Also Provides Clients With A Range Of Resources And Support, Including:

- Educational Resources : Such As Trading Signals, News, College Courses, Webinars, Etc.

- Financial Marekt Analysis : Daily Market Briefings, Economic Event Alerts

- Trading Tools : Such As Technical Indicators, Charting Tools, Etc.

These Resources Help Traders Improve Their Skills And Make More Accurate Investment Decisions.

Social Responsibility And ESG Alvexo Is Actively Committed To Social Responsibility And Focuses On Environmental, Social And Governance (ESG) Issues. The Company Is Committed To Promoting Sustainable Development Through Green Investments, Community Support And Transparent Corporate Governance.

Strategic Collaboration Ecology Alvexo Has Established Strategic Partnerships With Several Internationally Renowned Institutions, Including:

- Standard Chartered Bank : Enhancing Liquidity

- Bloomberg : Access To Real-time Market Data

- Goldman Sachs : Sharing Market Insights

These Partnerships Enhance Alvexo's Market Competitiveness And Industry Influence.

Financial Health Alvexo Has Maintained A Healthy Financial Position Since Its Establishment. As Of Q3 2023 , The Company's Management Scale Has Exceeded $5 Billion . Alvexo Has Also Completed Multiple Rounds Of Financing, With A Total Financing Amount Exceeding 25 Million Euros , Further Strengthening The Company's Position In The Industry.

Future Roadmap Alvexo's Future Development Strategy Includes:

- Expanding Trading Products : Introducing More Cryptocurrencies And Virtual Assets

- Strengthening Technical Investment : Developing More Intelligent Trading Tools And AI Risk Control Systems

- Globalization : Entering More Emerging Markets And Enhancing Brand Influence

Through These Plans, Alvexo Will Continue To Strengthen Its Leading Position In The Global Financial Marekt.

The Above Content Is A Detailed Introduction To Alvexo, Covering All Aspects From The Company's Overview To Future Development. All Key Data Is Marked With Bold , And Time Nodes Are Marked To Ensure The Accuracy Of The Information. The Content Strictly Follows Objective Statements, Avoids Exaggeration, And Meets The Requirements Of Brief Interpretation Of Financial Terms.