Banking BasicsPhilippine

National Bank (PNB) is one of the major commercial banks in the Philippines, established in 1916. Headquartered in Manila, Philippines, it is a fully state-owned Philippine bank. The history of PNB can be traced back to the Philippine government's need for control over the financial system in the early 20th century, and since its inception, it has become one of the country's financial pillars. PNB is not publicly listed and is still largely owned by the government, so it can be considered a state-owned bank. As one of the largest banks in the Philippines, PNB has deep roots and a strong presence in the financial industry.

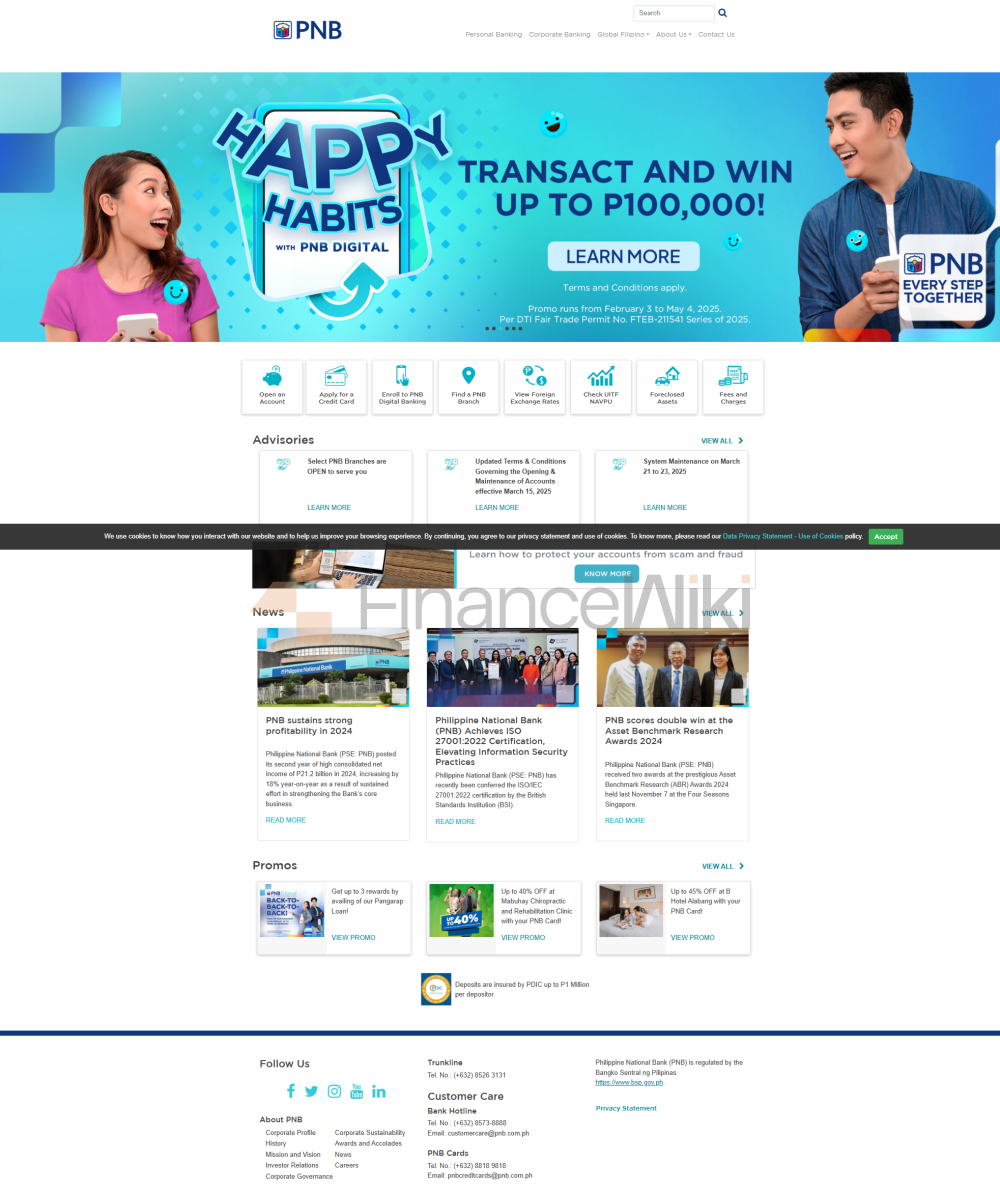

Scope of

ServicesPNB primarily serves the Philippine market and operates more than 600 branches in the Philippines. The bank's network of ATMs nationwide is also extensive, ensuring convenient withdrawals and transactions for customers. Although PNB has a strong offline network and ATM coverage in the Philippines, its influence in the global market is relatively limited, mainly focusing on domestic business and overseas Filipino labor services. PNB, through its overseas branches and partners, is also able to provide banking services to Filipinos abroad.

Regulation &

CompliancePNB is regulated by Bangko Sentral ng Pilipinas (BSP) and strictly adheres to the country's financial regulations. As a state-owned bank, PNB must also adhere to financial and compliance standards set by the Philippine government. PNB has joined the Deposit Insurance Scheme to ensure that its customers' deposits are protected in the event of a bank failure. In recent years, PNB has been strengthening its compliance system to adapt to international compliance requirements such as fintech and anti-money laundering.

Financial HealthPNB's

capital adequacy ratio is relatively stable and remains above industry standards, indicating that PNB has strong resilience in the face of market risks. While the Philippine banking sector as a whole is facing non-performing loan problems, PNB's asset quality is effectively managed, and its non-performing loan ratio is lower than the industry average. PNB's liquidity coverage ratio is also in line with regulatory requirements, indicating that it has good short-term capital management capabilities to protect customers' withdrawal needs.

Deposit & Loan

ProductsPNB offers a wide range of deposit products, including demand deposits, time deposits and high-yield savings accounts. Its fixed deposit products offer competitive interest rates and different tenor options to suit the funding needs of different customers. PNB has also launched special products such as large certificates of deposit (CDs) to provide customers with investment opportunities with higher returns.

In terms of loan products, PNB offers a variety of options ranging from home loans, car loans to personal credit loans. Mortgage interest rates vary depending on the loan term and repayment ability, and PNB offers flexible repayment options that allow customers to adjust their repayment plans based on their financial situation. Car loans and lines of credit also have more transparent interest rates and lower application thresholds to help customers meet their daily needs.

List of common fees

PNB's account management fees usually depend on the account type. For the underlying account, the PNB charges a modest annual fee, and some accounts may also charge a monthly fee. Fees for cross-border transfers and ATM withdrawals are relatively standard in the industry, and customers may be charged a fee when using ATMs that are not PNB networks. When applying for a loan, customers will also face certain application and processing fees, especially in the case of a large loan amount, PNB will charge a corresponding handling fee according to the loan amount. It is important to note that PNBs have strict minimum balance limits and may charge maintenance fees if the account balance falls below the specified amount.

Digital Services

ExperiencePNB's mobile banking app has received positive reviews from users on the App Store and Google Play Store. The bank's app supports facial recognition technology to ensure that users can log in to their accounts quickly and securely. The real-time transfer function is widely used, and users can transfer funds anytime and anywhere, which greatly improves the customer experience. In addition, PNB integrates bill management and investment tools to help customers better manage their finances. PNB has also invested in technological innovation, launching AI customer service and robo-advisory services to further improve the service efficiency of customers.

Customer Service Quality

PNB offers 24/7 phone support, ensuring that customers can get timely assistance at all times. Its live chat feature also provides customers with a convenient way to communicate. In addition, PNB is relatively responsive on social media, and customers often get a response within a short period of time when they report problems. For cross-border users, PNB's customer service staff supports multiple languages to meet the international needs of the Filipino population. PNB's complaint handling mechanism is also very mature, with a short average resolution time and high customer satisfaction.

Security

MeasuresPNB provides deposit insurance to its customers, ensuring that their deposits are protected in the event of problems in the bank's operations. In addition, PNB employs advanced anti-fraud technologies, such as real-time transaction monitoring, which greatly reduces the risk of financial crime. The bank has also strengthened the protection of customer data, and all customer transaction information is transmitted through encryption technology to ensure data security. PNB's ISO 27001 certification is further proof of the importance it places on data security.

Featured Services and Differentiated

PNBs have successfully formed differentiated competition in the market by launching diversified services. For the student group, PNB offers fee-free student accounts to encourage young people to develop a saving habit early. For senior customers, PNB provides exclusive financial services to help them plan for retirement. In addition, PNB actively responds to the trend of green finance and has launched a number of environmental protection and socially responsible investment products to meet the needs of customers who pursue sustainable development. For high-net-worth clients, PNB offers customised private banking services to ensure that their wealth management is fully protected.

Market Position &

HonorAs one of the oldest banks in the Philippines, PNB has a strong position in the domestic market. Although its assets in the international market are relatively small compared to the world's top 50 banks, it still has a significant share of the Philippine market and continues to innovate in several areas. PNB has won several industry awards in recent years, including the "Best Digital Bank" award and the "Most Innovative Bank" award, reflecting its leadership in fintech and service innovation.