Corporate Profile

AMP Futures Is A Platform That Provides Traders With Trading Services For Futures And Other Financial Instruments. Founded 2-5 Years Ago, The Company Is Based In The United States And Offers Traders A Range Of Tradable Assets, Including Futures, Stock Indices, Currencies, Energy, Metals, Financials, Grains, Soft Products, And Meats. Its Distinguishing Feature Is The Availability Of High Leverage, Up To 1:1000, Although This May Vary By Region. Clients Can Choose From A Variety Of Payment Methods On The Platform, Including Bank Transfers, Credit/debit Cards, And Skrill. However, It Should Be Noted That The Platform Has A Regulatory Status Of "suspicious Clones", Which May Raise Concerns About The Safety Of Traders' Funds.

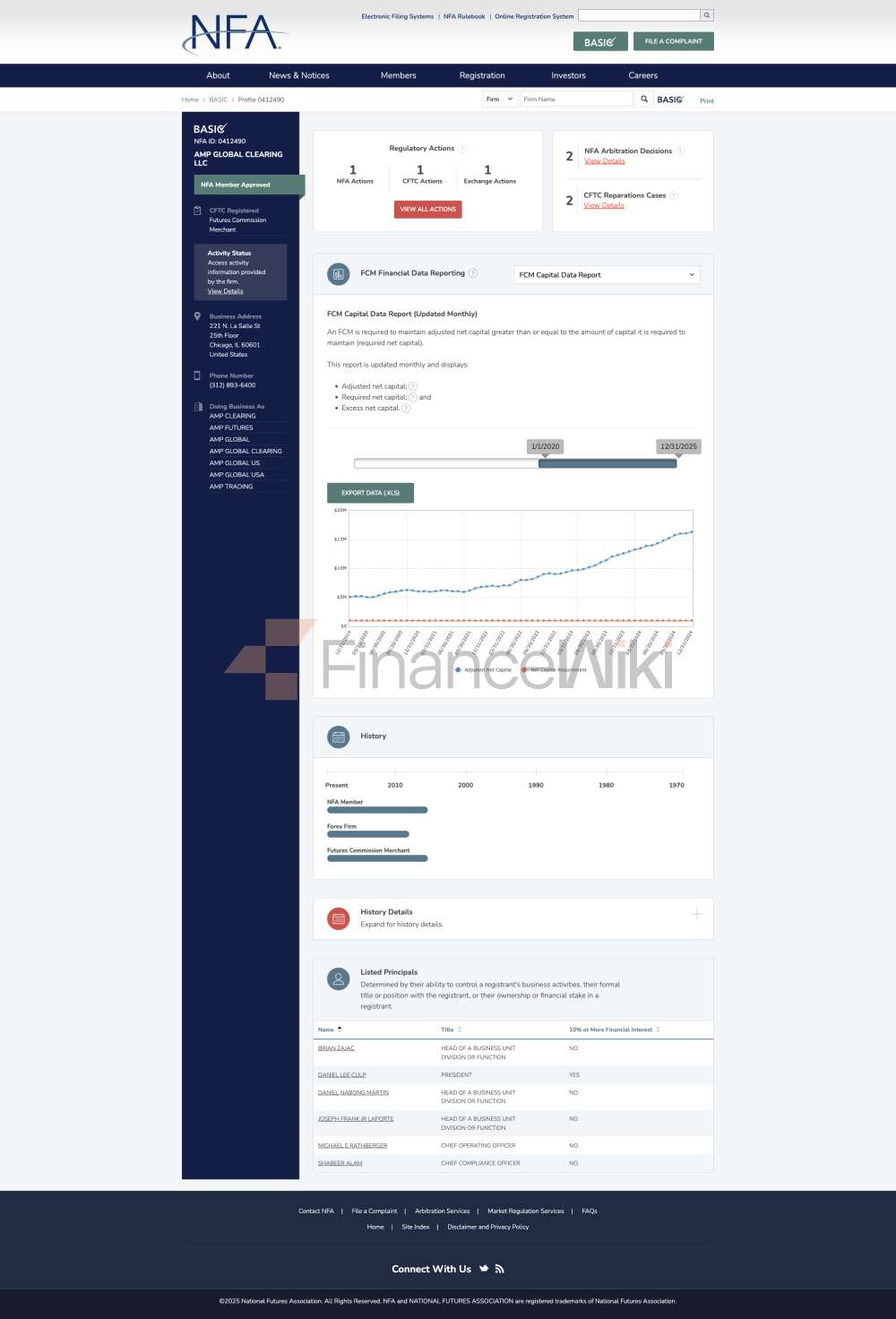

Regulatory Information

AMP Futures Compliance Status In Multiple Jurisdictions Is As Follows:

- United States : AMP Futures Is Regulated By The National Futures Association (NFA) With License Number 0412490. Its US Headquarters Is Located At 221 N. La Salle St, 25th Floor, Chicago, IL 60601, United States.

- Cyprus : Through AMP GLOBAL LTD, AMP Futures Is Regulated By The Cyprus Securities And Exchange Commission (CySEC) With License Number 360/18, Effective As Of June 4, 2018.

However, The Platform's Current Status As A "suspicious Clone" Indicates A Possible Lack Of Clear Regulatory Oversight, Which Traders Should Consider With Caution.

Trading Products

AMP Futures Offers A Diverse Range Of Trading Products Covering Multiple Asset Classes:

- Micro E-Mini Futures : Including Micro E-Mini S & P 500 Index, NASDAQ 100, Dow Jones Index, Etc., Reducing Margin Requirements.

- Stock Indices : Such As E-mini S & P 500, E-mini NASDAQ 100, Etc.

- Currency : Covers Major Currencies Such As Australian Dollar, British Pound, Canadian Dollar, Euro, Japanese Yen, Etc.

- Energy : Includes Crude Oil, Small Crude Oil, Natural Gas, Etc.

- Metals : Provides Precious Metals Such As Gold, Silver, Copper, Etc.

- Finance : Involves US Super Bonds, Eurodollar, Three-year US Treasury Bonds, Etc.

- Grains : Corn, Soybeans, Oats, Etc.

- Soft Commodities : Cocoa, Coffee, Cotton And Sugar.

- Meat : Feeding Cattle, Lean Pigs And Live Cattle.

Trading Software

AMP Futures Offers Traders More Than 50 Trading Platform Options, Including:

- Chongqing Series : CQG, CQG Spreader And More.

- Rhythm Series : MultiCharts, Wolffix And More.

- Telex Series : TT Platform, TT-ADL, Etc.

- Quanta And Serra Chart .

- Mobile Platform : CQG Mobile, Trading Navigator, MetaTrader 5 (MT5), Etc.

Traders Can Choose The Platform That Best Suits Their Trading Strategy, Such As MetaTrader 5, Which Offers Powerful Analytical Tools And Multiple Chart Types.

Deposit And Withdrawal Methods

AMP Futures Supports A Variety Of Fund Withdrawal Methods:

- Deposit Methods : Bank Transfer, Credit/Debit Card, Skrill.

- Processing Time :

- Bank Transfer: Usually Takes Several Business Days.

- Credit/Debit Card: Deposits Are Usually Processed Instantly, Withdrawals May Take Several Business Days.

- Skrill: Deposits Are Processed Instantly.

Customer Support

AMP Futures Offers A Comprehensive Customer Support Service:

- Availability : 24/5 Support, Including Weekends.

- Communication Channels :

- Live Chat: Communicate With The Support Team In Real Time Through Its Website.

- Email: For Non-urgent Inquiries.

Core Business And Services

The Core Business Of AMP Futures Includes:

- Integrated Account : Allows Traders To Access All Trading Products In One Account.

- High Leverage : Up To 1:1000, Supports Flexible Fund Management.

- Multiple Payment Methods : Flexible Choice Of Deposit And Withdrawal Methods.

- Educational Resources : Includes A Video Library, Webinars, Support Forums, And Free Tools.

Technical Infrastructure

AMP Futures Has Adopted An Advanced Technical Infrastructure That Ensures The Efficiency And Security Of Trading. Its Trading Platform Supports Multiple Hardware And Software Configurations, Including Desktop And Mobile Applications, And Traders Can Choose The Version That Best Suits Their Needs.

Compliance And Risk Control System

Despite The Regulatory Status Of "dubious Clones", AMP Futures Has Implemented Some Risk Management Measures, Such As Placing Stop-loss Orders To Limit Potential Losses. However, Its Use Of High Leverage Increases Trading Risk, Which Traders Need To Manage Carefully.

Market Positioning And Competitive Advantage

AMP Futures' Strength Lies In Its Diverse Trading Tools And User-friendly Platform, Which Is Particularly Suitable For Traders Who Wish To Trade Equity Indices With Small Capital. However, Its Regulatory Status And Limited Market Analysis Tools May Limit Its Appeal.

Customer Support And Empowerment

AMP Futures Helps Traders Improve Their Skills Through Educational Resources And Multilingual Support. Its Customer Support Team Provides Timely Q & A Services To Help Users Solve Trading-related Problems.

Social Responsibility And ESG

At Present, The Information Provided By Users Does Not Mention AMP Futures' Specific Measures In Social Responsibility And ESG.

Strategic Cooperation Ecology

There Is Currently No Clear Information Indicating That AMP Futures Has A Major Strategic Cooperation.

Financial Health

It Is Difficult To Assess The Financial Position Of AMP Futures Due To The Lack Of Transparent Financial Information.

Future RoadmapNo Detailed Plans For The Future Development Of AMP Futures Are Currently Available.

FAQ

-

Q: What Is The Maximum Leverage Offered? A: AMP Futures Offers Leverage Up To 1:1000.

-

Q: Are There Deposit And Withdrawal Fees? A: Yes, Fees May Be Incurred, Check The Specific Terms.

-

Q: Is Customer Support Available On Weekends? A: Yes, 24/5 Support Is Available.

-

Q: Is A Demo Account Available? A: Yes, A Free Demo Account Is Available.

-

Q: Is The Platform Regulated? A: The Regulatory Status Is "suspicious Clone".