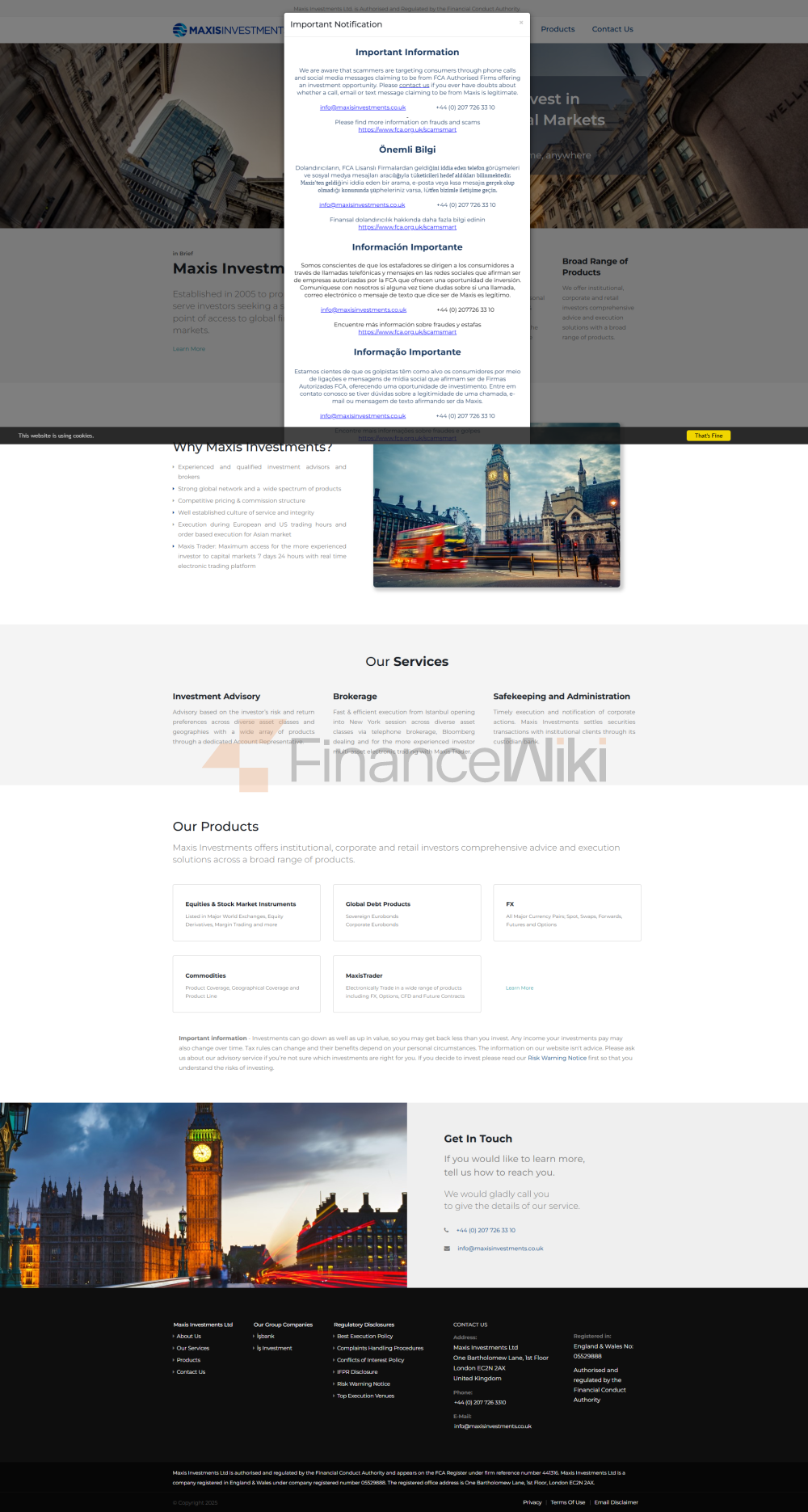

Overview Of Maxis Investments

Maxis Investments Was Established In 2005 And Is Headquartered In The United Kingdom. It Offers A Wide Range Of Traded Assets Including Equities, ETFs, Global Debt Products, Foreign Exchange And Commodities.

The Company Is Regulated By The Financial Conduct Authority (FCA) In The United Kingdom, Providing A Safe And Transparent Trading Environment. Meet The Needs Of Investors With Experienced Advisors And Brokers, Execution During Trading Hours In Europe And The United States, And 24/7 Market Access From Maxis Trader.

Despite Occasional System Failures And Limited Order-based Execution In Asian Markets, Maxis Investments' Strong Global Network And Extensive Product Range Provide Ample Opportunities For Investors Seeking To Navigate The Global Financial Marekt.

Regulatory Status

Maxis Investments Is Regulated In The UK By The Financial Conduct Authority (FCA) And Holds A Straight-through Processing (STP) License (license Number: 441316).

This Regulatory Framework Means Adhering To Strict Standards, Ensuring Transparency, Fairness And Safety In Its Operations.

Advantages:

- Being Regulated By The FCA: Being Regulated By The UK Financial Conduct Authority (FCA) Means Adhering To Strict Standards And Compliance Requirements.

- Experienced And Qualified Advisors And Brokers: Maxis Investments Has A Team Of Experienced And Qualified Advisors And Brokers. These Professionals Have In-depth Knowledge Of Financial Marekts And Are Able To Provide Valuable Insights And Guidance To Investors.

- Strong Global Network And Wide Range Of Products: Maxis Investments Offers A Strong Global Network And A Wide Range Of Financial Products Including Equities, ETFs, Global Debt Products, Forex And Commodities.

- Execution During European And American Trading Sessions: The Ability To Execute Trades During European And American Trading Sessions Is An Important Advantage That Maxis Investments Offers. This Ensures Timely Execution Of Orders And Responds To Market Fluctuations During Key Trading Sessions.

- Maxis Trader 24/7 Market Access: Maxis Trader Is The Trading Interface Of The Platform, Providing 24/7 Access To Global Markets. This Constant Availability Allows Investors To Monitor Their Portfolios, Execute Trades, And React To Market Dynamics At All Times.

Cons:

- Limited Order-based Execution In Asian Markets: One Drawback Of Maxis Investments Is Limited Order-based Execution In Asian Markets.

- Lack Of Transparency In Fees: Maxis Investments Has Been Criticized For Its Lack Of Transparency In Terms Of Fees. Without Clear And Comprehensive Disclosure Of Fees Associated With Trading And Other Services, Investors May Find It Challenging To Accurately Assess The Costs Of Their Investment Activities.

Commodities

- Product Range: Includes Precious Metals, Industrial Metals, Energy And Agricultural Products.

- Geographical Coverage: Includes The London Metal Exchange And The American Commodities Exchange. The Product Line Covers Swaps, Futures, Options And Structured Products Traded On And Over The Counter.

Services

Maxis Investments Offers A Comprehensive Suite Of Services Designed To Meet The Diverse Investment Needs Of Their Clients.

Their Investment Advisory Services Provide Personalized Guidance Based On Individual Risk And Return Preferences, Covering A Wide Range Of Asset Classes And Geographies. Clients Can Receive Assistance From A Dedicated Account Representative To Assist Them In Finding Investment Opportunities.

Through Brokerage Services, Maxis Investments Ensures The Fast And Efficient Execution Of Trades On All Types Of Assets, Utilizing Telephone Brokerage, Bloomberg Trading And Electronic Trading Through Maxis Trader.

In Addition, Their Custody And Management Services Ensure The Timely Execution Of Corporate Actions And The Safe Settlement Of Securities Transactions Through A Trusted Custodian Bank.

How Do I Open An Account?

- Preparation: Collect The Necessary Documents, Including Proof Of Identity (passport, Driver's License), Proof Of Address (utility Bills, Bank Statements) And Any Other Required Information.

- Online Application: Visit The Maxis Investments Website And Find The "Opening An Account" Section. Complete The Online Application Form By Providing Personal Details, Financial Information And Agreeing To The Terms And Conditions.

- Verification: Upload Scanned Copies Or Images Of The Required Documents According To The Instructions Provided. This May Include Proof Of Identity And Address.

- Account Review: After Submitting The Application, The Maxis Investments Team Will Review The Information And Documents Provided. This Process Usually Takes Several Business Days.

- Account Approval: After Successful Review And Verification, Maxis Investments Will Approve The Account. You Will Receive Confirmation Via Email Or Online Portal.

- Deposit Of Funds Into An Account: Once The Account Is Approved, Deposit Funds Into The Newly Opened Account Using The Provided Payment Method (e.g. Bank Transfer, Credit/debit Card Or E-wallet). Once The Funds Are Deposited, You Can Start Trading Through The Maxis Investments Platform.

Trading Platform

MaxisTrader Provides An Electronic Trading Platform That Accommodates A Wide Range Of Financial Products, Including Forex, Options, Contracts For Difference And Futures Contracts.

MaxisTrader Is Designed For Experienced Investors And Provides Unparalleled Access To Capital Markets With 24/7, Real-time Functionality. With MaxisTrader, Investors Can Participate In A Diverse Range Of Trading Activities, Taking Advantage Of Advanced Tools And Features To Make Informed Decisions.

The Platform's Electronic Infrastructure Ensures Timely Execution Of Transactions, Significantly Improving The Efficiency Of Users.

MaxisTrader, With Its 24/7 Availability And Wide Product Selection, Offers A Versatile Trading Environment For Experienced Investors Seeking To Actively Participate In Global Markets.

Deposits And Withdrawals

Maxis Investments Offers Multiple Payment Methods For Deposits And Withdrawals, Ensuring Convenience And Flexibility For Its Customers.

These Methods Include Traditional Options Such As Credit/debit Cards And Bank Transfers, Providing A Simple Trading Experience.

In Addition, Customers Can Use E-wallets For Fast And Secure Transfers, Catering To The Needs Of Those Who Prefer Digital Payment Solutions.

Customer Support

Maxis Investments Offers Easy-to-reach And Responsive Customer Support To Assist Customers With Questions And Concerns.

Individuals Can Contact Their Support Team By Phone On + 44 (0) 207 726 33 10 Or By Email Info@maxisinvestments.co.uk.

In Addition, Maxis Investments Welcomes Enquiries Via Its Address On The Ground Floor Of 1 Bartholomew Lane, EC2N 2AX, London, UK.

Market Instruments

Maxis Investments Offers A Wide Range Of Trading Assets, Giving Investors The Opportunity To Cross Various Financial Marekts. Maxis Investments Focuses On Transparency And Accessibility For Easy Trading Of Stocks, ETFs, Global Debt Products, Foreign Exchange And Commodities.

Equities And Other Stock Market Instruments

- Global Equities: Listed On Major World Exchanges, Including Turkish Stocks.

- Equity Derivatives: Offers Over-the-counter And Exchange Traded Options, As Well As Margin Trading Capabilities.

ETFs

- Offer A Range Of Exchange Traded Funds That Offer Diversified Investment Opportunities.

Global Debt Products

- Sovereign Eurobonds: Offer Stability And Potential Returns Through Government-backed Bonds.

- Corporate Eurobonds: Offer An Investment Pathway To Corporate Bond Securities.

Forex

- Currency Pairs: Offer Trading Of All Major Currency Pairs Through Spot, Swap, Forward And Futures Contracts, As Well As Foreign Exchange Options.