Corporate Profile

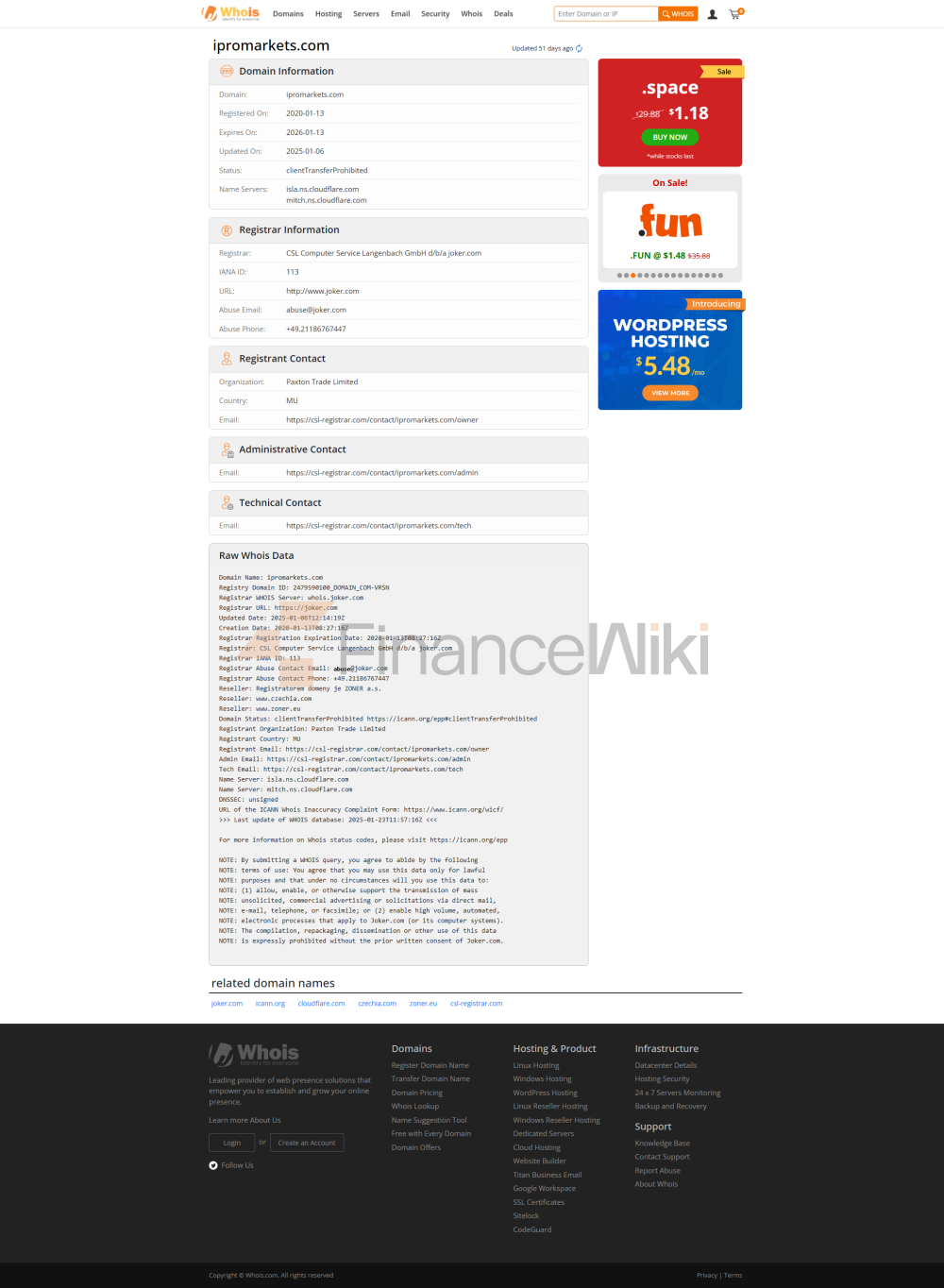

IPromarkets Is An Online Forex Broker Established In 2020 And Registered In Cyprus, Mainly Engaged In Trading Services For Financial Instruments Such As Foreign Exchange, Stocks, Commodities, Indices And Bonds. The Company Claims To Be A Registered Brand Of Trinity Capital LLC And Holds A License From The FS Authority Of Saint Vincent And The Grenadines With Authorization Number 450 LLC 2022 . However, Upon Investigation, It Was Found That The Broker Was Not Officially Authorized Or Regulated By Any National Regulatory Authority, So Its Regulatory Status Was Marked As "unlicensed".

IPromarkets Offers A Diverse Range Of Trading Products And Tools Through Its Platform, Including The MT4 Trading Platform , Which Supports Web, Desktop And Mobile Access. In Addition, The Platform Also Supports A Variety Of Deposit And Withdrawal Methods, Such As Visa, Mastercard, Etc.

Regulatory Information IPromarkets Claims To Be Licensed By The Financial Services Authority Of Saint Vincent And The Grenadines, But The Legality And Validity Of This License Has Not Been Widely Recognized. In Fact, IPromarkets Is Not Authorized By Any Mainstream Financial Regulator, Including The Cyprus Securities And Exchange Commission Or The Financial Conduct Authority Of The United Kingdom.

This Lack Of Effective Regulation Makes The Operation Of IPromarkets Highly Risky. According To WikiFX's Score, The Broker's Regulatory Score Is Only 1.36/10 , Further Indicating The Instability Of Its Regulatory Status.

Trading Products IPromarkets Offers Its Clients Four Main Categories Of Trading Tools:

- Index : Covers Major Global Stock Indices Such As The S & P 500, Dow, Nasdaq, Etc.

- Stocks : Provides Trading Of Stocks Including Well-known Companies Such As Apple, Google, Amazon, Etc.

- Bonds : Involves Government Bonds And Corporate Bonds, And The Specific Market Varieties Are Not Yet Clear.

- Cryptocurrency : Provides Trading Services For Mainstream Cryptocurrencies Such As Bitcoin And Ethereum.

Trading Software IPromarkets Provides Clients With Access To The MT4 Trading Platform , Which Is Known For Its Powerful Charting Tools, Technical Indicators, And Customizable Features. MT4 Supports A Variety Of Trading Strategies, Including Manual And Automated Trading (EA Support), And Is Accessible Via The Web, Desktop, And Mobile Devices.

Deposit And Withdrawal Methods IPromarkets Supports A Variety Of Payment Methods, Including Visa, Mastercard, Airtel Monet, MTN, And Tigo Pesa. However, It Is Not Yet Possible To Confirm The Practical Feasibility And Efficiency Of These Payment Methods.

Customer Support IPromarkets Provides Traders With A Variety Of Contact Methods, Including Phone And Email:

- Phone: + 357 25 262652 (English), + 61 870 783 607 (English), + 420 704 917 479 (Vietnamese)

- Email: Support@iPromarkets.com

- WeChat: 420 704 917 479

The Diversity Of Customer Support Channels Can Meet The Needs Of Different Traders To Some Extent, But The Actual Service Quality Needs To Be Further Verified.

Core Business And Services IPromarkets' Core Business Focuses On Providing Traders With A Variety Of Financial Instrument Trading Services. Its Main Services Include:

- Standardized Trading Account : Provide Three Account Types: Standard, VIP And Platinum, With Minimum Deposit Requirements Of $3000, $10,000 And $25,000 Respectively .

- Demo Account : Provide A Free Demo Trading Environment For Novice Traders To Help Them Become Familiar With Trading Platforms And Trading Strategies.

- Technical Analysis Tools : Provides Powerful Technical Analysis Tools Through The MT4 Platform, Including Multi-time Frame Charts, Multiple Technical Indicators, And More.

Technical Infrastructure IPromarkets Relies On The MetaTrader 4 (MT4) Trading Platform As The Core Of Its Technical Infrastructure. MT4 Is Popular Worldwide With Internal Ads For Its Easy-to-use Interface And Powerful Features, But Its Friendliness To Novice Traders Still Needs To Be Improved.

Compliance And Risk Control System Although IPromarkets Claims To Be Licensed By The Saint Vincent And The Grenadines Financial Services Authority, It Lacks An Effective Regulatory Framework And Compliance System. Here Are Some Key Risk Notes:

- Leverage : IPromarkets Does Not Specify The Leverage Multiples It Offers, Which Can Lead Traders To Take Risky Trades Without Understanding The Leverage Risks.

- Spreads And Commissions : IPromarkets Does Not Disclose Its Spread And Commission Structure, Which Could Adversely Affect The Transparency Of Trading Costs.

- Security Of Funds : Since IPromarkets Is Not Overseen By Mainstream Regulators, The Security Of Its Clients' Funds Is At Greater Risk.

Market Positioning And Competitive Advantage IPromarkets Attempts To Attract Traders Through Its Diverse Products And The Technical Advantages Of Its MT4 Platform, But Its High Deposit Requirements And Lack Of Regulatory Qualifications May Have A Negative Impact On Its Market Positioning. Compared With Industry Competitors, IPromarkets' Market Competitiveness Is Relatively Limited.

Customer Support And Empowerment IPromarkets Provides Traders With Multiple Support Channels And Technical Analysis Tools Through The MT4 Platform. However, Its High Deposit Requirements And Lack Of Transparency In The Spread Structure May Limit Its Appeal To Ordinary Traders.

Social Responsibility And ESG At Present, IPromarkets Does Not Mention Its Specific Measures In Social Responsibility, Environmental Protection And Corporate Governance (ESG) In Its Public Information.

Strategic Cooperation Ecology Regarding The Strategic Cooperation Information Of IPromarkets, No Specific Partners Or Strategic Cooperation Projects Have Been Mentioned In The Public Information.

Financial Health Since IPromarkets Does Not Disclose Any Financial Information Such As Revenue, Profit Or Balance Sheet, Etc., Traders Cannot Evaluate The Health Of Their Financial Position.

Future Roadmap The Future Direction Of IPromarkets Is Not Yet Clear, But Its Current Market Positioning And Regulatory Risks Could Have A Significant Impact On Its Future Growth.