Corporate Profile

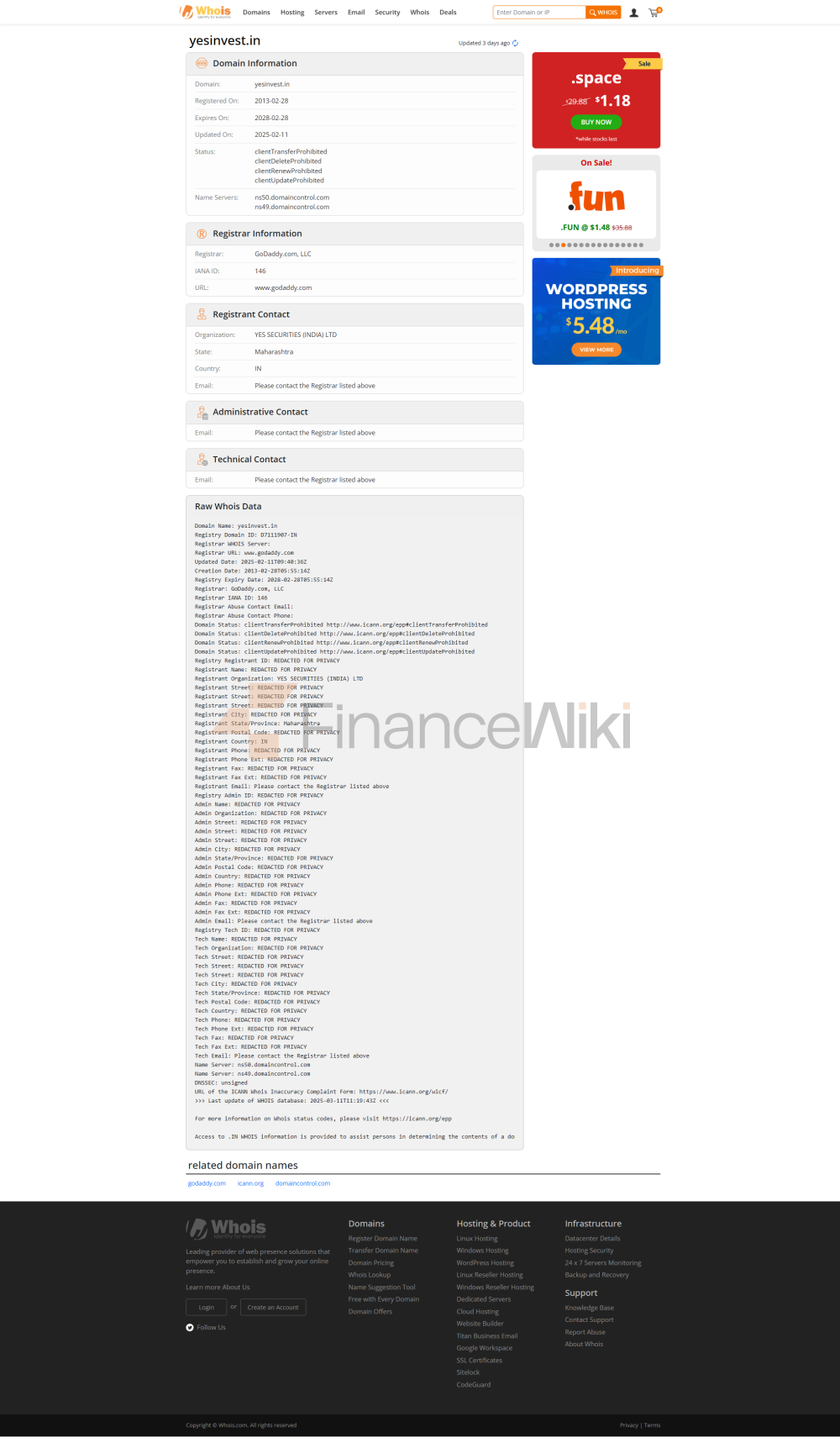

YES Securities (India) Limited (hereinafter Referred To As "YSIL") Was Established In 2013 And Is Headquartered In Mumbai, India With A Representative Office In Dubai. As A Subsidiary Of YES Bank, YSIL Is Dedicated To Providing Comprehensive Financial Services To Retail, High Net Worth (HNI/UHNI) And Institutional Clients. The Company Provides Diversified Services Including Stockbroking, Institutional Sales, Trading Research And Wealth Management Through The Infrastructure And Network Of Its Parent Bank.

YSIL Is Registered As A Stockbroker With The Securities And Exchange Board Of India (SEBI) With Registration Number: INZ000185632. Its Membership Includes The National Stock Exchange Of India (NSE) And The Bombay Stock Exchange (BSE), Ensuring Compliance And Transparency Of Its Transactions On Major Stock Exchanges.

Regulatory Information

YES Securities Strictly Adheres To The Regulations And Laws Of The Financial Regulators Of India. YSIL Is Registered With The Securities And Exchange Board Of India (SEBI) As A Stockbroker With Registration Number INZ000185632 And Holds Membership In The Following Major Stock Exchanges:

- National Stock Exchange Of India (NSE)

- Bombay Stock Exchange (BSE)

YSIL Ensures Compliance In Its Trading And Operational Activities Through These Regulatory Frameworks And Membership.

Trading Products

YES Securities Provides Clients With A Diverse Range Of Financial Instruments And Services, Covering The Following Areas:

-

Mutual Funds :

- Offering Mutual Fund Investments From Multiple Fund Houses, Clients Can Access An End-to-end Digital Investment Experience Through YSIL's Platform.

-

Wealth Basket :

- A Curated Portfolio Of Stocks Or ETFs Designed To Meet Short- And Long-term Investment Objectives, Supporting Rigorous Research And Customized Allocation.

-

Alternates Alpha Plus Fund (AIF) :

- Achieve Stable Risk-adjusted Returns Through A Diversified Trading Strategy In The Derivatives Market.

-

Electronic Will Services :

- Provides Brief Or Detailed Will Creation Services To Ensure Asset Allocation Is In Line With Client Wishes And Reduce Family Disputes.

-

Global Investments :

- Provides Investment And Trading Services To Over 30 Global Markets Through A Platform Supported By SAXO Bank.

Trading Software

YES Securities Provides Clients With Easy-to-use Trading Software That Supports Global Investments And Real-time Portfolio Tracking. Clients Can Access Multiple Global Stock Markets Through A Single Platform And Enjoy Seamless Trading And Efficient Trade Settlement Services.

Deposit And Withdrawal Methods

There Is No Opening Fee For Opening An Account At YES Securities, And Customers Can Manage Their Funds In The Following Ways:

-

Deposit :

- Customers Can Choose To Complete The LRS Form (Form A2) And Submit It To Their Bank To Transfer Funds To The SAXO Bank Account. The Time For Funds To Arrive Is 1-3 Working Days.

- Transfers Can Be Made To Any Bank Account Globally, Including Indian And Non-Indian Banks.

-

Withdrawal :

- Customers Can Initiate A Request Through The Platform's Withdrawal Option, And The Funds Will Be Remitted To Their Indian Bank Account. It Will Take 3-5 Working Days To Arrive.

For Inactive Accounts, Customers Need To Submit KRA/CKYC Forms, PAN Cards, Proof Of Address And Other Documents To Reactivate The Account.

Customer Support

YES Securities Supports Clients Through Multiple Channels, Including:

- Phone : + 91 022 6884 1888

- Email : Customer.service@ysil.in (detailed Inquiries), Escalations@ysil.in/igc@ysil.in (upgrade Inquiries), Dpgrievance@ysil.in (securities Registration Services)

- Social Media : Facebook, Twitter, YouTube, LinkedIn, Telegram And Instagram

Customers Can Access Account Management, Trading Inquiries And Technical Support Through The Above Channels.

Core Business And Services

The Core Business Of YES Securities Includes:

-

Wealth Brokerage :

- Provides Customized Brokerage Services To High Net Worth Clients, Covering Products Such As Stocks, Derivatives, And Mutual Funds.

-

Institutional Equity Sales And Trading :

- Provides In-depth Research And Trade Execution Services To Institutional Investors To Support Their Investment Strategies.

-

Trading Research :

- Provide Clients With Timely Market Analysis And Investment Advice Through A Professional Research Team.

- Provide Wealth Basket And Wills Services To Help Clients Achieve Their Long-term Wealth Goals.

Wealth Management :

Technical Infrastructure

YES Securities Relies On The Parent Bank's Strong Infrastructure And Network To Provide Clients With An Efficient, Safe And Reliable Trading Experience. Its Technology Platform Supports Access To Global Markets And Provides Clients With Cross-market Trading Services Through SAXO Bank.

Compliance And Risk Control System

YES Securities Operates In Strict Accordance With The Regulations Of The Indian Financial Regulator And Ensures The Safety Of Client Funds And Transactions Through A Risk Management System. Its Compliance Statement Makes It Clear That Client Funds Are Independent Of The Company's Operating Funds, Ensuring That Clients' Rights And Interests Are Protected Under All Circumstances.

Market Positioning And Competitive Advantage

YES Securities Is Positioned As The Preferred Brokerage Firm For Global Investors With The Strong Support Of Its Parent Bank And Its Diverse Product Portfolio. Its Competitive Advantages Include:

- Diversified Product Portfolio : Covering Mutual Funds, Wealth Baskets, Global Investments And Derivatives Markets.

- Strong Technical Support : Relying On The Infrastructure Of The Parent Bank To Ensure The Efficiency Of Transaction Execution And Fund Management.

- Customer-centric Service : Enhance The Customer Experience Through Multi-channel Customer Support And Customized Solutions.

Customer Support And Empowerment

YES Securities Supports Customers Through Multiple Channels And Helps Them Achieve Their Investment Goals. Its Customer Support Team Is Available To Provide Real-time Assistance To Customers Via Phone, Email And Social Media Channels.

Social Responsibility And ESG

YES Securities Is Committed To Social Responsibility Through Its Parent Bank's ESG Framework. Its Commitments Include Supporting Sustainable Finance, Reducing Carbon Emissions, And Promoting Fair And Inclusive Financial Practices.

Strategic Collaboration Ecology

YES Securities Has Established Strategic Partnerships With Globally Renowned Financial Institution Groups Such As SAXO Bank To Provide Cross-market Investment Opportunities. These Partnerships Further Enhance Its Competitiveness In The Global Marketplace.

Financial Health

As A Subsidiary Of YES Bank, YES Securities Relies On The Financial Health And Infrastructure Of Its Parent Bank To Ensure Its Own Financial Stability And Operational Continuity.

Future Roadmap

YES Securities Plans To Further Expand Its Global Market Presence And Strengthen Its Technology Infrastructure And Client Server Capabilities In The Future. Its Goal Is To Provide Clients With More Diversified Investment Tools And Services To Support Them In Achieving Their Investment Goals In The Ever-changing Financial Marekt.

The Above Content Is Based On Public Information Collation. The Data Is As Of The Third Quarter Of 2023 And Is For Reference Only.